2025 USDD Price Prediction: Analyzing Potential Growth and Stability in the Stablecoin Market

Introduction: USDD's Market Position and Investment Value

Decentralized USD (USDD) as a stablecoin issued by Wave Field DAO Reserve, has achieved significant adoption in the cryptocurrency market since its inception in 2022. As of 2025, USDD's market capitalization has reached $425,417,230, with a circulating supply of approximately 425,417,230 tokens, maintaining a price around $1. This asset, known as a "decentralized stablecoin," is playing an increasingly crucial role in providing stability and diverse use cases within the crypto ecosystem.

This article will comprehensively analyze USDD's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. USDD Price History Review and Current Market Status

USDD Historical Price Evolution

- 2022: USDD launched, price fluctuated around $1

- 2023: Reached all-time high of $1.052 on October 24

- 2022: Experienced all-time low of $0.928067 on June 20

USDD Current Market Situation

As of November 15, 2025, USDD is trading at $1, maintaining its peg to the US dollar. The 24-hour trading volume stands at $9,366.45, indicating moderate market activity. USDD's market capitalization is $425,417,230, ranking it 160th among all cryptocurrencies. The circulating supply matches the total supply at 425,417,230 USDD tokens.

Over the past 24 hours, USDD's price has remained stable with 0% change. However, it shows slight negative trends in shorter timeframes, with a -0.043% change in the last hour and -0.014% over the past week. The 30-day performance indicates a -0.15% decline, while the yearly performance shows a positive 0.3% increase.

The current market sentiment for cryptocurrencies is characterized as "Extreme Fear" with a VIX of 10, suggesting a cautious approach among investors.

Click to view the current USDD market price

USDD Market Sentiment Indicator

2025-11-15 Fear and Greed Index: 10 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a period of extreme fear, with the sentiment index plummeting to 10. This indicates a high level of uncertainty and pessimism among investors. During such times, it's crucial to remain calm and avoid making impulsive decisions. While some may see this as a potential buying opportunity, it's important to conduct thorough research and consider your risk tolerance before making any investment choices. Remember, market sentiment can shift rapidly, and it's always wise to diversify your portfolio to mitigate risks.

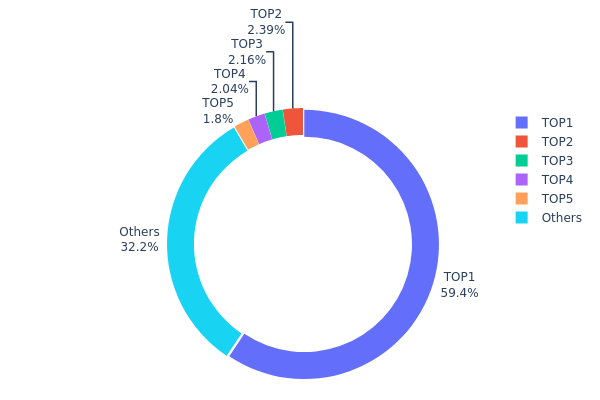

USDD Holdings Distribution

The address holdings distribution data reveals a highly concentrated ownership structure for USDD. The top address holds a staggering 59.40% of the total supply, indicating significant centralization. This single entity's dominant position raises concerns about potential market manipulation and volatility risks.

The subsequent top holders possess considerably smaller stakes, ranging from 2.39% to 1.79%. Collectively, the top 5 addresses control 67.78% of USDD supply, while the remaining 32.22% is distributed among other addresses. This skewed distribution suggests a lack of widespread adoption and limited decentralization in USDD's ecosystem.

Such concentration may lead to increased price volatility and susceptibility to large holder actions. It also implies that USDD's on-chain stability and market dynamics are heavily influenced by a small number of entities, potentially compromising its effectiveness as a stable decentralized asset.

Click to view the current USDD Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | TKFREL...Bh3Mnf | 247277.38K | 59.40% |

| 2 | TX1HRt...sfMXNW | 9956.89K | 2.39% |

| 3 | THqPy1...mwaoKT | 9000.00K | 2.16% |

| 4 | TK5H5F...4TSyom | 8500.00K | 2.04% |

| 5 | TKpurp...1BUnB6 | 7480.00K | 1.79% |

| - | Others | 134053.52K | 32.22% |

II. Key Factors Influencing USDD's Future Price

Macroeconomic Environment

- Inflation Hedging Properties: As a stablecoin, USDD is designed to maintain a stable value, potentially serving as a hedge against inflation in volatile economic conditions.

Technical Development and Ecosystem Building

- Ecosystem Applications: USDD operates within the TRON ecosystem, supporting various DApps and decentralized finance (DeFi) projects on the TRON network.

III. USDD Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.69993 - $0.9999

- Neutral prediction: $0.9999 - $1.09

- Optimistic prediction: $1.09 - $1.16988 (requires increased adoption and market stability)

2027-2028 Outlook

- Market phase expectation: Gradual growth and increased adoption

- Price range forecast:

- 2027: $0.81627 - $1.25842

- 2028: $0.99273 - $1.53096

- Key catalysts: Expansion of use cases, regulatory clarity, and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $1.36351 - $1.4726 (assuming steady market growth and adoption)

- Optimistic scenario: $1.4726 - $1.63458 (assuming widespread integration and favorable market conditions)

- Transformative scenario: $1.63458+ (extreme positive developments in the stablecoin ecosystem)

- 2030-12-31: USDD $1.4726 (47% increase from 2025 levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.16988 | 0.9999 | 0.69993 | 0 |

| 2026 | 1.18253 | 1.08489 | 0.77027 | 8 |

| 2027 | 1.25842 | 1.13371 | 0.81627 | 13 |

| 2028 | 1.53096 | 1.19607 | 0.99273 | 19 |

| 2029 | 1.58168 | 1.36351 | 0.7363 | 36 |

| 2030 | 1.63458 | 1.4726 | 1.075 | 47 |

IV. USDD Professional Investment Strategies and Risk Management

USDD Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking stable returns

- Operational advice:

- Accumulate USDD during market dips

- Set up regular DCA (Dollar-Cost Averaging) plans

- Store in secure cold wallets for long-term holding

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Monitor short-term and long-term MAs for trend identification

- RSI (Relative Strength Index): Use for overbought/oversold signals

- Key Points for Swing Trading:

- Monitor USDD/USD peg stability

- Track overall stablecoin market sentiment

USDD Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 5-10% of portfolio

- Moderate investors: 10-20% of portfolio

- Aggressive investors: 20-30% of portfolio

(2) Risk Hedging Solutions

- Diversification: Allocate across different stablecoins and traditional assets

- Use of stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 wallet

- Cold Storage Solution: Hardware wallets for large holdings

- Security Precautions: Never share private keys, use 2FA, regularly update software

V. Potential Risks and Challenges for USDD

USDD Market Risks

- Depegging: Risk of USDD losing its 1:1 peg with USD

- Liquidity issues: Potential difficulties in large-scale redemptions

- Market confidence: Fluctuations in user trust could impact stability

USDD Regulatory Risks

- Stablecoin regulations: Potential new laws affecting USDD operations

- Cross-border restrictions: Possible limitations on international use

- Compliance requirements: Increased KYC/AML measures may affect accessibility

USDD Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Blockchain congestion: Network issues could affect transaction speed and costs

- Oracle failures: Inaccurate price feeds could disrupt the peg mechanism

VI. Conclusion and Action Recommendations

USDD Investment Value Assessment

USDD offers potential stability in the volatile crypto market, but carries inherent risks associated with algorithmic stablecoins. Long-term value depends on maintaining the peg and building trust, while short-term risks include regulatory uncertainty and market sentiment shifts.

USDD Investment Recommendations

✅ Beginners: Start with small allocations, focus on understanding the mechanics ✅ Experienced Investors: Consider USDD as part of a diversified stablecoin portfolio ✅ Institutional Investors: Conduct thorough due diligence on the backing mechanism and regulatory compliance

USDD Participation Methods

- Exchange Trading: Buy/sell USDD on Gate.com

- DeFi Protocols: Utilize USDD in yield farming and liquidity provision (with caution)

- Direct Minting/Redemption: Engage with the USDD protocol for large-scale transactions (if available)

Cryptocurrency investments carry extremely high risk, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is USDT expected to rise?

No, USDT is not expected to rise significantly. As a stablecoin, it's designed to maintain a value close to $1, providing stability rather than price appreciation.

How much will USDC be worth in 2025?

USDC is expected to maintain its $1 peg in 2025, as it's designed to be a stablecoin. Its value should remain stable at $1, backed by reserves.

What will USDC be worth in 2030?

USDC is expected to maintain its $1 peg in 2030, as it's designed to be a stable cryptocurrency backed by US dollar reserves.

What is the USDT prediction for 2030?

Based on market trends and expert analysis, USDT is predicted to maintain its $1 peg in 2030, with potential for slight fluctuations due to increased adoption and regulatory changes in the crypto space.

Share

Content