2025 USDC Fiyat Tahmini: Stablecoin İstikrarı ve Piyasa Trendlerinin Analizi

Giriş: USDC'nin Piyasa Konumu ve Yatırım Değeri

ABD dolarına endeksli ve tamamen teminatlandırılmış bir stablecoin olan USD Coin (USDC), 2018’deki lansmanından bu yana önemli başarılar elde etti. 2025 itibarıyla USDC’nin piyasa değeri 76,24 milyar dolara ulaşırken, dolaşımdaki arzı yaklaşık 76,24 milyar seviyesinde gerçekleşti ve fiyatı 1 dolar civarında istikrarını korudu. “Güvenilir dijital dolar” olarak anılan bu varlık, merkeziyetsiz finans ve sınır ötesi ödemeler alanlarında giderek daha önemli bir rol üstleniyor.

Bu makalede, USDC’nin 2025-2030 yılları arasındaki fiyat eğilimleri; tarihsel veriler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik ortam birlikte değerlendirilerek detaylı biçimde analiz edilmekte, yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulmaktadır.

I. USDC Fiyat Geçmişi ve Güncel Piyasa Durumu

USDC Tarihsel Fiyat Seyri

- 2018: USDC piyasaya sürüldü, fiyatı yaklaşık 1 dolar seviyesinde istikrarını korudu

- 2020: DeFi yükselişiyle hızlı benimsenme, 1 dolar sabitini sürdürdü

- 2023: Bankacılık krizi nedeniyle kısa süreli 0,87 dolara kadar de-peg, hızla toparlandı

USDC Güncel Piyasa Görünümü

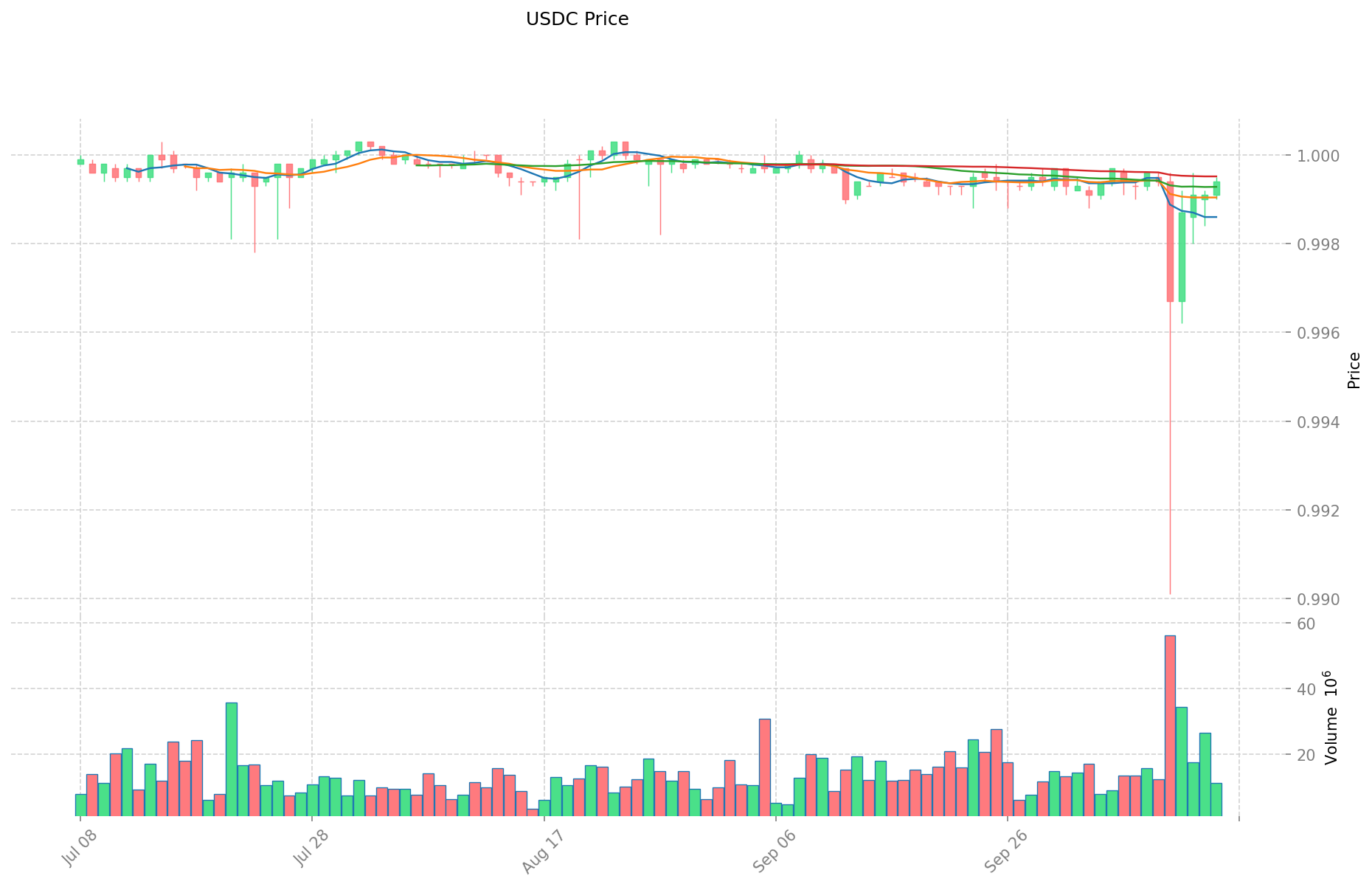

15 Ekim 2025 itibarıyla USDC, tam olarak 1,00 dolardan işlem görüyor ve ABD dolarına endeksini sürdürüyor. 24 saatlik işlem hacmi 10.359.191 dolar seviyesinde olup, piyasada istikrarlı bir işlem hacmi gözleniyor. USDC’nin piyasa değeri 76.235.149.356 dolar ile tüm kripto paralar arasında yedinci sırada ve %1,86’lık bir piyasa payına sahip. 76.235.149.356 USDC’lik dolaşımdaki arz, toplam arza oldukça yakın; bu da yüksek likidite ve yoğun kullanım anlamına geliyor. Küçük dalgalanmalara rağmen USDC, istikrarlı bir seyir izledi; 24 saatte +%0,05, 7 günde ise +%0,01 fiyat değişimi gerçekleşti.

Güncel USDC piyasa fiyatını görmek için tıklayın

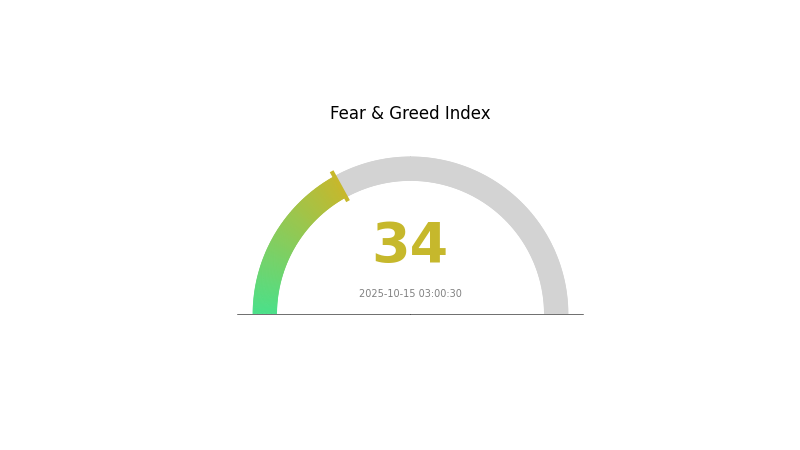

USDC Piyasa Duyarlılığı Göstergesi

2025-10-15 Korku ve Açgözlülük Endeksi: 34 (Korku)

Güncel Korku & Açgözlülük Endeksini görmek için tıklayın

Kripto piyasasında duyarlılık endeksi 34 seviyesinde ve piyasa “korku” halinde. Bu durum, yatırımcıların temkinli olduğu ve fırsatları kaçırabilecekleri anlamına geliyor. Böyle dönemlerde, deneyimli trader’lar sıklıkla “başkaları açgözlü olduğunda kork, başkaları korktuğunda açgözlü ol” ilkesini izleyerek birikim yapmayı tercih ediyor. Ancak, bu oynak piyasada yatırım kararı öncesi kapsamlı araştırma yapmak ve riskleri dikkatle yönetmek şart.

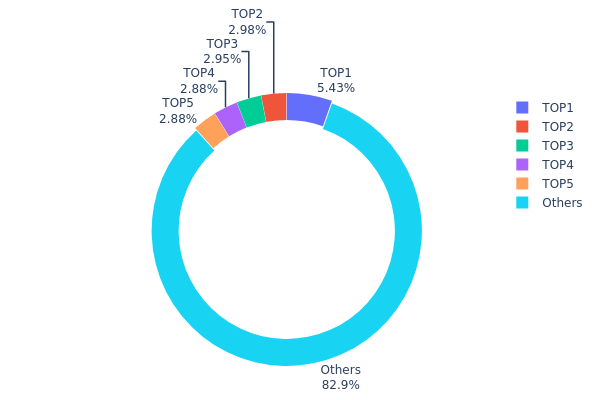

USDC Varlık Dağılımı

Adres bazında varlık dağılımı, USDC sahipliğinin adresler arasında ne ölçüde yoğunlaştığını gösterir. Analizlere göre, en büyük 5 adres USDC arzının yaklaşık %17,07’sini elinde bulunduruyor ve en büyük adresin payı %5,42. Bu yapı, arzda tek bir adresin piyasayı domine etmediği, orta seviyede bir yoğunlaşmaya işaret ediyor.

Mevcut dağılım, USDC için dengeli bir piyasa yapısı olduğunu gösteriyor. En büyük sahiplerde bir miktar yoğunlaşma olsa da, bu seviye piyasa manipülasyonu veya aşırı fiyat oynaklığı riski oluşturacak düzeyde değil. USDC’nin %82,93’ünün ilk 5 adres dışında tutulması, geniş bir kullanıcı ve yatırımcı tabanını işaret ediyor ve bu da piyasa istikrarı ile likiditeyi destekliyor.

Genel tablo, USDC varlıklarında orta düzeyde merkeziyetsizliğe işaret ediyor. Büyük adreslerin varlığı, küçük adreslerde tutulan önemli orandaki USDC ile dengelenmiş durumda ve bu da stablecoin’in zincir üzerinde yapısal istikrarı ile tek noktalı risklere karşı dayanıklılığını güçlendiriyor.

Güncel USDC Varlık Dağılımını görmek için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x3730...fd7341 | 2.641.726,56K | 5,42% |

| 2 | 0x2d4d...7d7bb4 | 1.450.472,21K | 2,97% |

| 3 | 0x98c2...e16f5c | 1.436.019,73K | 2,94% |

| 4 | 0xad35...329ef5 | 1.400.000,00K | 2,87% |

| 5 | 0xe194...6929b6 | 1.400.000,00K | 2,87% |

| - | Diğerleri | 40.351.788,93K | 82,93% |

2. USDC'nin Gelecekteki Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Dolaşım Artışı: USDC'nin arzı, stablecoin ekosisteminin genel büyüklüğü ve pazar payına bağlı olarak şekilleniyor.

- Tarihsel Desen: USDC dolaşımındaki artışlar, fiyat istikrarı ile doğrudan bağlantılı.

- Güncel Etki: Dolaşım büyüdükçe, USDC'nin fiyat istikrarını koruyup pazar payını artırması bekleniyor.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Varlıklar: Büyük kurumlar, USDC’yi işlemler ve rezervler için giderek artan oranda kullanıyor.

- Kurumsal Benimseme: MoneyGram ve Mastercard gibi şirketler, ödeme sistemlerinde USDC entegrasyonunu başlattı.

- Ulusal Politikalar: Fransa’nın Circle’a elektronik para kuruluşu (EMI) lisansı vermesi gibi düzenleyici gelişmeler, USDC’nin benimsenmesini olumlu etkiliyor.

Makroekonomik Ortam

- Para Politikası Etkisi: Özellikle ABD Merkez Bankası’nın politikaları, USDC’nin dolar endeksli bir varlık olarak cazibesini belirliyor.

- Enflasyona Karşı Koruma: USDC, ABD dolarına endeksli olması sayesinde enflasyon dönemlerinde güvenli liman olma özelliğine sahip.

- Jeopolitik Faktörler: Uluslararası gerginlikler ve ekonomik belirsizlikler, USDC gibi istikrarlı dijital varlıklara ilgiyi artırıyor.

Teknolojik Gelişim ve Ekosistem Oluşturma

- Çapraz Zincir Uyumluluğu: USDC’nin çoklu blockchain ağlarında yaygınlaşması, erişim ve kullanım alanını çoğaltıyor.

- Circle Payment Network (CPN): Bu altyapı, küresel fon hareketliliğini kolaylaştırıyor ve USDC’nin sınır ötesi işlemlerde daha yaygın kullanılmasını sağlayabilir.

- Ekosistem Uygulamaları: USDC, DeFi’de önemli bir rol üstleniyor; 30 Kasım 2024 itibarıyla stablecoin işlem hacminin %69’u USDC üzerinden gerçekleşiyor.

III. 2025-2030 USDC Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,99 - 1,00 dolar

- Tarafsız tahmin: 1,00 dolar

- İyimser tahmin: 1,00 - 1,01 dolar (benimsenme ve düzenleyici netlik ile)

2027-2028 Görünümü

- Piyasa beklentisi: İstikrarlı büyüme ve daha geniş kullanım

- Fiyat aralığı tahmini:

- 2027: 0,99 - 1,01 dolar

- 2028: 0,99 - 1,01 dolar

- Temel katalizörler: USDC'nin sınır ötesi işlemler ve DeFi uygulamalarında yayılması

2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,99 - 1,01 dolar (istikrar ve regülasyon devam ederse)

- İyimser senaryo: 1,00 - 1,02 dolar (küresel benimseme ve geleneksel finansla entegrasyon)

- Dönüştürücü senaryo: 1,00 - 1,03 dolar (USDC küresel baskın stablecoin olursa)

- 2030-12-31: USDC 1,00 dolar (stabil dijital dolar olarak endeksini sürdürüyor)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Fiyat Değişimi |

|---|---|---|---|---|

| 2025 | 1 | 1 | 1 | 0 |

| 2026 | 1 | 1 | 1 | 0 |

| 2027 | 1 | 1 | 1 | 0 |

| 2028 | 1 | 1 | 1 | 0 |

| 2029 | 1 | 1 | 1 | 0 |

| 2030 | 1 | 1 | 1 | 0 |

IV. USDC Profesyonel Yatırım Stratejileri ve Risk Yönetimi

USDC Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için uygun: İstikrar arayan temkinli yatırımcılar

- Operasyon önerileri:

- Fiat varlıkların bir kısmını portföy çeşitlendirmesi için USDC'ye aktarın

- Güvenilir DeFi platformlarında düşük riskli getiri için USDC kullanın

- Uzun vadeli saklama için USDC’yi donanım cüzdanında koruyun

(2) Aktif Alım Satım Stratejisi

- Teknik analiz araçları:

- Hareketli ortalamalar: Fiyatın dolar endeksine göre kısa vadeli dalgalanmalarını izleyin

- Hacim: Likiditeyi değerlendirmek için işlem hacmini takip edin

- Swing trading için önemli noktalar:

- 1 dolarlık endeksten küçük sapmalardan faydalanın

- Piyasa duyarlılığını ve regülasyon haberlerini izleyin

USDC Risk Yönetim Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Portföyün %5-10’u

- Orta riskli yatırımcılar: Portföyün %10-20’si

- Agresif yatırımcılar: Portföyün %20-30’u

(2) Riskten Korunma Yöntemleri

- Diversifikasyon: Birikimleri birden fazla stablecoin’e yaymak

- Teminat: USDC’yi DeFi platformlarında düşük riskli borç verme için teminat olarak kullanmak

(3) Güvenli Saklama Yöntemleri

- Donanım cüzdan önerisi: Gate Web3 Wallet

- Yazılım cüzdanı: Artan güvenlik için çoklu imzalı cüzdanlar

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama, güçlü şifreler, cüzdan yazılımını düzenli güncelleyin

V. USDC'yi Bekleyen Olası Riskler ve Zorluklar

USDC Piyasa Riskleri

- Likidite riski: Aşırı piyasa koşullarında olası sorunlar

- Rekabet: Yeni stablecoin’ler veya CBDC’lerin ortaya çıkışı

- Endeks kaybı: Piyasa oynaklığı ile geçici dolar endeksinden sapmalar

USDC Regülasyon Riskleri

- Artan denetim: Stablecoin’lere yönelik yeni regülasyon olasılığı

- Uyum maliyetleri: Daha sıkı KYC/AML gereklilikleri operasyonları etkileyebilir

- Hukuki riskler: Stablecoin ihraççılarına karşı olası yasal işlemler

USDC Teknik Riskler

- Akıllı sözleşme açıkları: Token sözleşmesinde olası güvenlik açıkları

- Merkeziyet riski: Circle ve Coinbase’e bağımlılık

- Blokzincir tıkanıklığı: Ağ yoğunluğunda yüksek ücretler veya gecikmeler

VI. Sonuç ve Öneriler

USDC Yatırım Değeri Değerlendirmesi

USDC, güçlü teminat ve şeffaflık ile dijital dolar maruziyeti için istikrarlı, regüle edilmiş bir seçenek sunar. Ancak yatırımcıların stablecoin piyasasına özgü regülasyon ve piyasa risklerinin farkında olması gerekir.

USDC Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Stablecoin’leri ve kripto piyasasını anlamak için USDC’yi giriş noktası olarak kullanın

✅ Deneyimli yatırımcılar: Portföyü dengelemek ve DeFi fırsatlarından yararlanmak için USDC’yi değerlendirin

✅ Kurumsal yatırımcılar: Hazine yönetimi ve sınır ötesi işlemler için USDC’yi göz önünde bulundurun

USDC Alım Satım Katılım Yöntemleri

- Spot alım satım: Gate.com üzerinden doğrudan USDC al/sat

- DeFi entegrasyonu: Getiri için USDC’yi merkeziyetsiz finans protokollerinde kullanmak

- Ödeme çözümü: Hızlı ve düşük maliyetli uluslararası transferler için USDC kullanmak

Kripto para yatırımları son derece yüksek risk taşır. Bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk profillerine göre özenli karar vermeli ve profesyonel finansal danışmanlara başvurmalıdır. Kaybetmeyi göze alabileceğinizden fazlasını asla yatırmayın.

SSS

USDC iyi bir yatırım mı?

USDC, istikrar ve enflasyona karşı koruma amaçlı tercih edilebilir. ABD dolarına endeksli stablecoin olarak istikrarlı değer sunar ve dalgalı piyasalarda serveti koruyabilir.

USDC her zaman 1 dolar olacak mı?

USDC, rezervlerle desteklenerek 1 dolarlık endeksini korumayı hedefler. Ancak piyasa hareketleri nedeniyle zaman zaman küçük sapmalar görülebilir.

USDC değer kaybedebilir mi?

Evet, USDC piyasa talebine bağlı olarak geçici olarak değer kaybedebilir; fakat ABD dolarına endeksli olduğu için genellikle hızlıca istikrar kazanır.

2030 için USD tahmini nedir?

Mevcut eğilimlere göre, 2030 yılında USD’nin Euro karşısında yaklaşık 0,892298 olması bekleniyor. Bu, önümüzdeki beş yıl içinde USD’de hafif bir değer kaybı öngörmektedir.

USDC Ne Kadar Sıklıkla Faiz Öder? Bilmeniz Gereken Her Şey

2025 USDP Fiyat Tahmini: Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

GUSD nasıl alınır: Stablecoin yatırımı için yeni bir seçenek

USDC faizi nasıl işler?

USDCoin (USDC) iyi bir yatırım mı?: Stablecoin yatırımının avantajlarını ve dezavantajlarını değerlendirmek

2025 USDC Fiyat Tahmini: Piyasa Dalgalanmaları Karşısında İstikrar mı, Yoksa Sabitlikten Sapma Riski mi?

ZK Rollup'ların İşleyişi: Web3 Ekosisteminde Sıfır Bilgi Teknolojisinin Kapsamlı Analizi

En İyi NFT Sanatçılarını Keşfedin

Kripto para karıştırma süreçlerinde gizliliğin korunmasına yönelik nihai rehber

Ordinals NFT'lerinin İşleyişi ve Sağladığı Avantajlar: Kapsamlı Bir Rehber

Yaygın Cüzdan Dolandırıcılıklarını Tespit Edin ve Önleyin