2025 USDC Price Prediction: Stability Amidst Market Volatility or Potential De-pegging Risks?

Introduction: USDC's Market Position and Investment Value

USD Coin (USDC) has established itself as a leading fully collateralized stablecoin pegged to the US dollar since its inception in 2018. As of 2025, USDC's market capitalization has reached $75.57 billion, with a circulating supply of approximately 75.56 billion coins, maintaining a price of $1. This asset, often referred to as the "digital dollar," is playing an increasingly crucial role in the cryptocurrency ecosystem and decentralized finance (DeFi) applications.

This article will provide a comprehensive analysis of USDC's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. USDC Price History Review and Current Market Status

USDC Historical Price Evolution

- 2018: USDC launched, price remained stable around $1

- 2020: Increased adoption during DeFi boom, maintaining $1 peg

- 2023: Brief de-peg to $0.877647 on March 11, quickly recovered to $1

USDC Current Market Situation

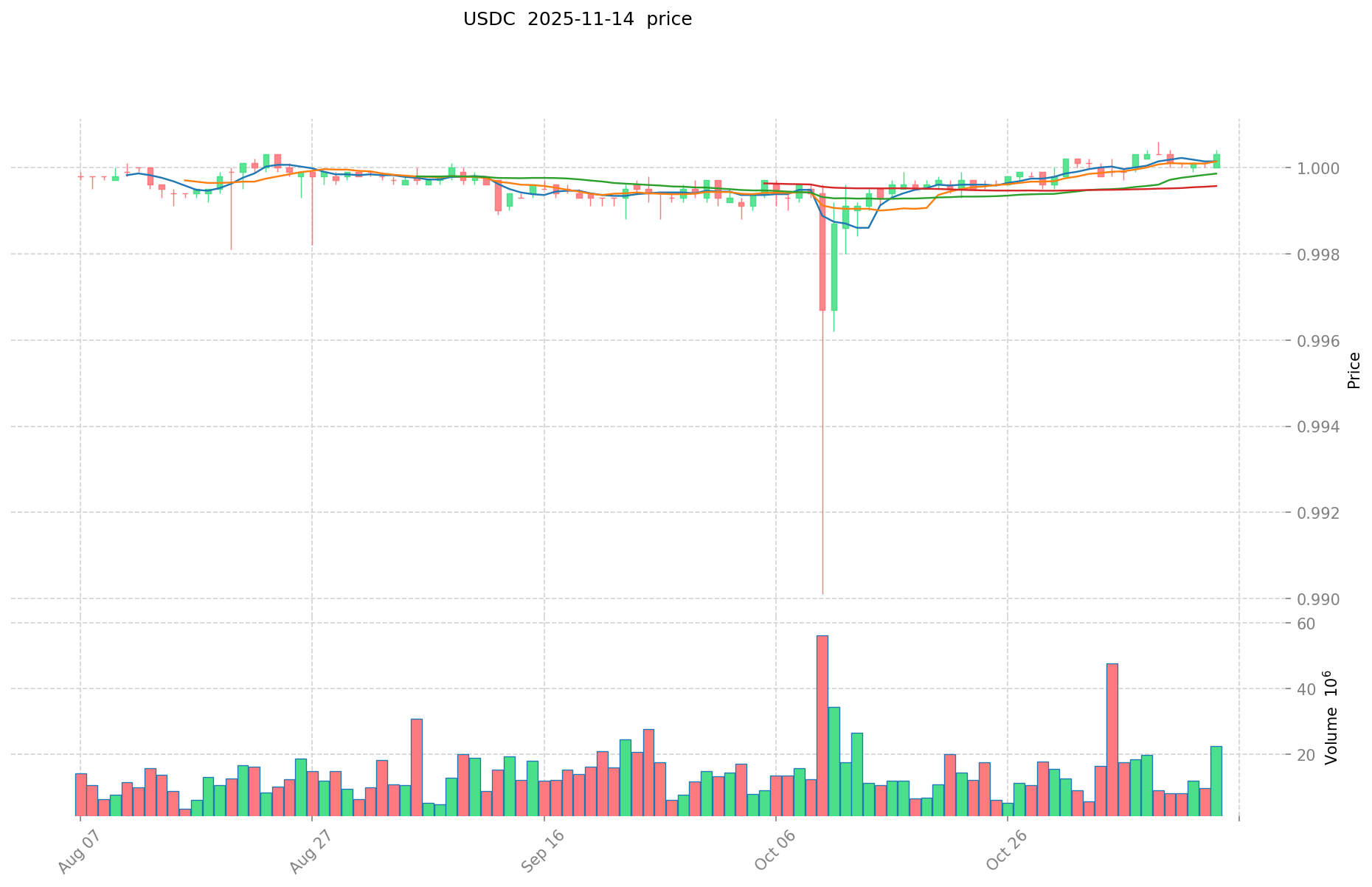

As of November 14, 2025, USDC is trading at $1.00, maintaining its peg to the US dollar. The 24-hour trading volume stands at $12,723,810.71. USDC has a market capitalization of $75,562,914,516.51, ranking 7th in the global cryptocurrency market with a 2.17% market share. The circulating supply is 75,562,914,516.51 USDC, which is 99.99% of the total supply of 75,573,720,295.81 USDC. Over the past year, USDC has shown minimal price fluctuation, with a slight increase of 0.13%.

Click to view the current USDC market price

USDC Market Sentiment Indicator

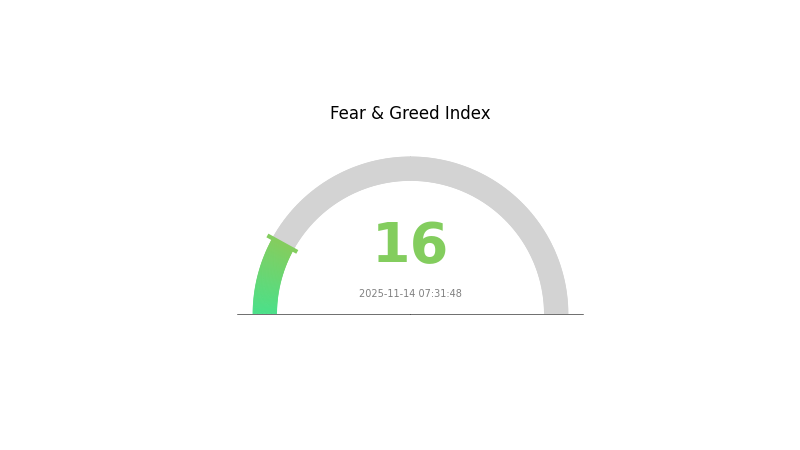

2025-11-14 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is gripped by extreme fear, with the sentiment index plummeting to 16. This level of pessimism often precedes potential buying opportunities, as Warren Buffett famously advised: "Be fearful when others are greedy, and greedy when others are fearful." However, investors should exercise caution and conduct thorough research before making any decisions. Gate.com offers a range of tools and resources to help traders navigate these uncertain market conditions.

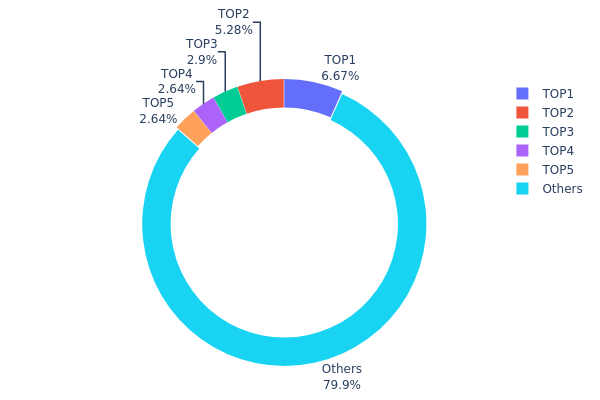

USDC Holdings Distribution

The address holdings distribution data provides insight into the concentration of USDC holdings across different addresses. Analysis of this data reveals that the top 5 addresses collectively hold 20.11% of the total USDC supply, with the largest address controlling 6.67%. This distribution suggests a moderate level of concentration, albeit not to an alarming degree.

The majority of USDC (79.89%) is dispersed among numerous smaller holders, indicating a relatively decentralized structure. This distribution pattern contributes to market stability by reducing the potential for single-entity market manipulation. However, the presence of several large holders still poses some risk of price volatility if these entities were to make significant moves.

Overall, the current USDC address distribution reflects a balance between institutional involvement and wider adoption. The presence of large holders suggests institutional interest, while the substantial "Others" category indicates broad market participation, enhancing the stablecoin's resilience and liquidity across the ecosystem.

Click to view the current USDC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x3730...fd7341 | 3534488.91K | 6.67% |

| 2 | 0x38aa...f9b200 | 2795903.03K | 5.27% |

| 3 | 0xd9b2...fcce40 | 1534325.55K | 2.89% |

| 4 | 0xad35...329ef5 | 1400000.00K | 2.64% |

| 5 | 0xe194...6929b6 | 1400000.00K | 2.64% |

| - | Others | 42311847.62K | 79.89% |

II. Key Factors Affecting USDC's Future Price

Supply Mechanism

- Minting and Redemption: USDC is minted when users deposit USD and redeemed when users withdraw USD, maintaining a 1:1 peg.

- Historical Pattern: Supply changes have historically had minimal impact on USDC price due to its stable coin nature.

- Current Impact: Changes in supply are expected to have limited effect on price as long as the peg is maintained.

Institutional and Whale Dynamics

- Institutional Holdings: Major financial institutions and crypto companies hold USDC as a stable asset.

- Corporate Adoption: Payment processors and e-commerce platforms increasingly accept USDC for transactions.

- National Policies: Regulatory clarity in some jurisdictions has encouraged USDC adoption for cross-border payments.

Macroeconomic Environment

- Monetary Policy Impact: Central bank interest rate decisions may affect demand for stable coins like USDC.

- Inflation Hedge Properties: USDC serves as a digital dollar, potentially attracting users in high-inflation economies.

- Geopolitical Factors: Global economic uncertainties may drive increased usage of USDC as a stable digital asset.

Technical Development and Ecosystem Building

- Cross-Chain Integration: USDC has expanded to multiple blockchains, increasing its utility and accessibility.

- Smart Contract Enhancements: Improved security features and auditing processes for USDC smart contracts.

- Ecosystem Applications: USDC is widely used in DeFi protocols, lending platforms, and decentralized exchanges.

III. USDC Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.99 - $1.00

- Neutral prediction: $1.00

- Optimistic prediction: $1.00 - $1.01 (requires increased adoption and regulatory clarity)

2027-2028 Outlook

- Market phase expectation: Stable growth with potential for wider adoption

- Price range forecast:

- 2027: $0.99 - $1.01

- 2028: $0.99 - $1.01

- Key catalysts: Increased institutional adoption, integration with traditional finance systems

2029-2030 Long-term Outlook

- Base scenario: $0.99 - $1.01 (assuming continued stability and regulatory compliance)

- Optimistic scenario: $1.00 - $1.02 (assuming widespread global adoption and integration with CBDCs)

- Transformative scenario: $1.00 - $1.03 (assuming USDC becomes a dominant global digital currency)

- 2030-12-31: USDC $1.01 (slight premium due to high demand and trust)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1 | 1 | 1 | 0 |

| 2026 | 1 | 1 | 1 | 0 |

| 2027 | 1 | 1 | 1 | 0 |

| 2028 | 1 | 1 | 1 | 0 |

| 2029 | 1 | 1 | 1 | 0 |

| 2030 | 1 | 1 | 1 | 0 |

IV. Professional Investment Strategies and Risk Management for USDC

USDC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking stability

- Operational suggestions:

- Allocate a portion of portfolio to USDC as a stable asset

- Use USDC for dollar-cost averaging into other cryptocurrencies

- Store USDC in secure hardware wallets or reputable exchanges

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term price movements

- Volume indicators: Assess market liquidity and interest

- Key points for swing trading:

- Observe USDC/crypto trading pairs for arbitrage opportunities

- Monitor stablecoin market cap dominance for sentiment shifts

USDC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 5-10% of crypto portfolio

- Moderate investors: 15-25% of crypto portfolio

- Aggressive investors: 30-40% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread holdings across multiple stablecoins

- Collateral: Use USDC as collateral for low-risk yield farming

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for large holdings

- Security precautions: Enable 2FA, use unique passwords, regular audits

V. Potential Risks and Challenges for USDC

USDC Market Risks

- Competitive pressure: Emergence of new stablecoins or CBDCs

- Liquidity risk: Potential large-scale redemptions during market stress

- De-pegging risk: Temporary loss of 1:1 USD peg due to market volatility

USDC Regulatory Risks

- Increased scrutiny: Potential new regulations on stablecoin issuers

- Compliance requirements: Changes in KYC/AML policies affecting users

- Cross-border restrictions: Limitations on USDC use in certain jurisdictions

USDC Technical Risks

- Smart contract vulnerabilities: Potential exploits in the token contract

- Centralization risks: Reliance on Circle's infrastructure and reserves

- Blockchain congestion: High gas fees or slow transactions on Ethereum

VI. Conclusion and Action Recommendations

USDC Investment Value Assessment

USDC offers stable value proposition with low volatility, but faces regulatory and competitive challenges. It remains a cornerstone of the crypto ecosystem with strong adoption and utility.

USDC Investment Recommendations

✅ Beginners: Use USDC as an entry point to crypto, focusing on education and small allocations ✅ Experienced investors: Utilize USDC for portfolio stabilization and as a trading pair ✅ Institutional investors: Leverage USDC for treasury management and efficient cross-border transactions

USDC Participation Methods

- Direct purchase: Buy USDC on Gate.com

- Yield farming: Participate in DeFi protocols offering USDC liquidity pools

- Payment usage: Utilize USDC for fast and low-cost international transfers

Cryptocurrency investments carry extremely high risks. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance. It is recommended to consult a professional financial advisor. Never invest more than you can afford to lose.

FAQ

How high will USDC go?

USDC is designed to maintain a stable value of $1. It's not expected to significantly increase in price beyond this peg.

Is USDC a good investment?

USDC is a stable investment, maintaining a 1:1 peg with USD. It offers low volatility and high liquidity, making it suitable for preserving value and as a trading pair in crypto markets.

Will USDC always be $1?

No, USDC aims to maintain a $1 peg but can fluctuate slightly due to market conditions. It's generally stable but not guaranteed to always be exactly $1.

What is the prediction for USDC in 2030?

USDC is expected to maintain its $1 peg in 2030, with increased adoption in global payments and DeFi, potentially reaching a market cap of $500 billion.

Share

Content