2025 UNI Fiyat Tahmini: Uniswap’ın Yerel Token’ı İçin Potansiyel Büyüme ve Karşılaşabileceği Zorlukların Analizi

Giriş: UNI'nin Piyasa Konumu ve Yatırım Değeri

Uniswap (UNI), Ethereum blokzinciri üzerinde hayata geçirilen ilk otomatik piyasa yapıcı protokol olarak 2020’deki çıkışından bu yana önemli başarılara imza atmıştır. 2025 yılı itibarıyla Uniswap'ın piyasa değeri 4,09 milyar dolar seviyesine ulaşmış, dolaşımdaki arzı yaklaşık 600.483.074 tokene yükselmiş ve fiyatı 6,809 dolar civarında seyretmektedir. “DeFi öncüsü” olarak anılan bu varlık, merkeziyetsiz finans ve otomatik piyasa yapıcı teknolojilerde gitgide daha önemli bir rol üstlenmektedir.

Bu makalede, Uniswap’ın 2025-2030 yılları arasında göstereceği fiyat eğilimleri; geçmiş performans, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik etkenler kapsamında profesyonel fiyat tahminleri ile yatırımcılara yönelik stratejik öneriler sunulacaktır.

I. UNI Fiyat Geçmişi ve Güncel Piyasa Durumu

UNI'nin Tarihsel Fiyat Seyri

- 2020: UNI piyasaya sürüldü, fiyatı 1,03 $ ile (tüm zamanların en düşük seviyesi) başladı

- 2021: Boğa piyasası zirvesi, fiyatı 44,92 $ ile rekor kırdı

- 2022-2024: Kripto kışı ve toparlanma süreci, fiyat 3 $ ile 10 $ arasında dalgalandı

UNI Güncel Piyasa Görünümü

15 Ekim 2025 itibarıyla UNI, 6,809 $ seviyesinden işlem görüyor ve piyasa değeriyle 37. sırada yer alıyor. Son 24 saatte %1,58 değer kaybeden UNI'nin işlem hacmi 8.292.278 $’dır. UNI’nin toplam piyasa değeri 4.088.689.248 $ olup, kripto piyasasının %0,16’sını oluşturmaktadır.

UNI, çeşitli zaman dilimlerinde aşağıdaki performansı sergilemiştir:

- 1 saatlik değişim: +%0,27

- 7 günlük değişim: -%13

- 30 günlük değişim: -%27,75

- 1 yıllık değişim: -%16,22

Mevcut fiyatı, 3 Mayıs 2021’de ulaşılan 44,92 $’lık rekorun oldukça altındadır. Buna karşın, 17 Eylül 2020’deki 1,03 $’lık taban seviyenin ise oldukça üstündedir.

UNI'nin dolaşımdaki arzı 600.483.073,71 token olup, toplam 1 milyar arzın %60,05’ine denk gelmektedir. Tam seyreltilmiş piyasa değeri ise 6.809.000.000 $’dır.

Güncel UNI piyasa fiyatını görüntülemek için tıklayın

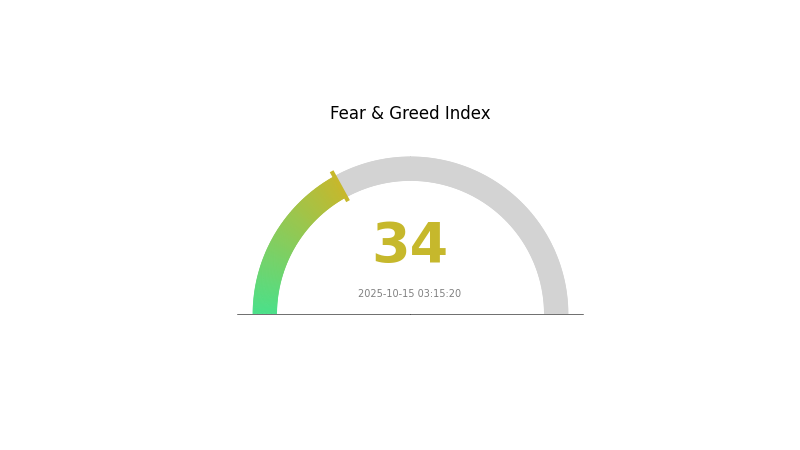

UNI Piyasa Duyarlılık Göstergesi

15 Ekim 2025 Korku ve Açgözlülük Endeksi: 34 (Korku)

Güncel Korku & Açgözlülük Endeksini görüntülemek için tıklayın

Kripto piyasasında şu anda korku hâkim; Korku ve Açgözlülük Endeksi 34’te seyrediyor. Bu, yatırımcıların temkinli hareket ettiğini ve piyasada düşük değerleme ihtimalinin arttığını gösteriyor. Böyle dönemlerde bazı yatırımcılar birikim fırsatı olarak görürken, bazıları daha fazla düşüş riskine karşı tedbirli kalmayı tercih edebilir. Her zaman olduğu gibi, volatil kripto piyasasında yatırım kararı almadan önce detaylı araştırma yapmak ve kendi risk toleransınızı değerlendirmek önemlidir.

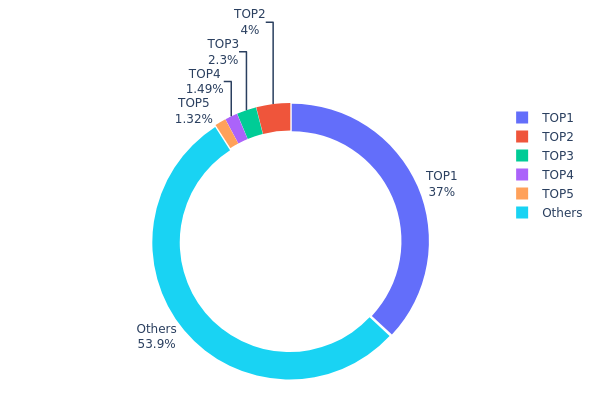

UNI Varlık Dağılımı

UNI adres dağılımı verileri, tokenlerin büyük bölümünün az sayıda üst düzey adreste yoğunlaştığını ortaya koyuyor. En büyük sahip, toplam arzın %36,96’sını elinde tutuyor; bu oran, tek bir adres için oldukça yüksek. Takip eden dört büyük adresin toplam payı ise %9,08. Bu derece yoğunlaşma, piyasa manipülasyonu ve merkezileşme risklerini gündeme getiriyor.

Bununla birlikte, UNI tokenlerinin %53,96’sı çok sayıda farklı adrese dağılmış durumda. Bu, piyasada belirli bir merkeziyetsizlik seviyesinin bulunduğu anlamına geliyor. Ancak en büyük adresin ağırlığı, piyasanın genel dinamiğini ve fiyat hareketlerini hâlâ önemli ölçüde etkileyebilir.

Mevcut dağılım, UNI’nin geniş çaplı benimsenmeye ulaştığını gösterse de, önemli bir merkezileşme riskinin sürdüğüne işaret ediyor. Büyük sahiplerin hareketleri, volatiliteyi artırabilir. Yatırımcılar, UNI’nin piyasa davranışını ve uzun vadeli beklentilerini analiz ederken bu yoğunlaşma riskini göz önünde bulundurmalıdır.

Güncel UNI Varlık Dağılımını görüntülemek için tıklayın

| Üst | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x1a9c...be35bc | 369.669,47K | 36,96% |

| 2 | 0xf977...41acec | 39.992,81K | 3,99% |

| 3 | 0x61cb...2096eb | 23.047,48K | 2,30% |

| 4 | 0x5069...680f7e | 14.880,12K | 1,48% |

| 5 | 0x611f...dfb09d | 13.160,92K | 1,31% |

| - | Diğerleri | 539.249,19K | 53,96% |

II. UNI'nin Gelecekteki Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Likidite Sağlama: UNI fiyatı, Uniswap havuzlarında bulunan likidite miktarından doğrudan etkilenir. Yüksek likidite fiyatlarda istikrar sağlarken, düşük likidite volatiliteyi artırabilir.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Varlıklar: Kurumsal yatırımcıların UNI’ye ilgisinin artması, tokenin piyasa konumu ve fiyat istikrarı üzerinde etkili olabilir.

Makroekonomik Ortam

- Enflasyona Karşı Koruma: DeFi token’ı olarak UNI, enflasyona karşı bir koruma aracı olarak görülebilir ve bu, ekonomik koşullara bağlı olarak performansını etkileyebilir.

Teknolojik Gelişmeler ve Ekosistem Güçlenmesi

- Uniswap V4 Güncellemesi: Yaklaşan Uniswap V4 güncellemesi, platformun işlev ve verimliliğini artırarak UNI’nin değerini yukarı çekebilir.

- DeFi Pazarının Büyümesi: DeFi piyasasının istikrarlı büyümesi, Uniswap’a daha geniş kullanım alanları ve gelişim potansiyeli sunarak UNI hacmi ve kullanıcı sayısında artışa yol açabilir.

- Ekosistem Uygulamaları: Uniswap ekosistemini oluşturan çeşitli DApp’ler ve projeler, UNI'nin toplam değer önerisine katkı sağlamaktadır.

III. 2025-2030 Arası UNI Fiyat Tahmini

2025 Beklentisi

- Ihtiyatlı tahmin: 6,46 $ - 6,80 $

- Tarafsız tahmin: 6,80 $ - 7,82 $

- İyimser tahmin: 7,82 $ - 8,84 $ (piyasanın olumlu seyretmesi halinde)

2027-2028 Beklentisi

- Piyasa aşaması: Artan volatiliteyle birlikte potansiyel büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 5,93 $ - 9,86 $

- 2028: 7,42 $ - 12,70 $

- Temel katalizörler: DeFi ekosisteminin büyümesi, UNI token faydasının artması

2029-2030 Uzun Vadeli Beklenti

- Temel senaryo: 9,63 $ - 11,30 $ (istikrarlı piyasa büyümesiyle)

- İyimser senaryo: 11,30 $ - 13,11 $ (DeFi benimsemesinin hızlanması durumunda)

- Dönüştürücü senaryo: 13,11 $ üzeri (UNI ekosisteminde kayda değer atılımlarla)

- 31 Aralık 2030: UNI 11,30 $ (2025’e göre %66 artış)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 8,8465 | 6,805 | 6,46475 | 0 |

| 2026 | 8,21704 | 7,82575 | 7,51272 | 14 |

| 2027 | 9,86631 | 8,02139 | 5,93583 | 17 |

| 2028 | 12,70027 | 8,94385 | 7,4234 | 31 |

| 2029 | 11,79605 | 10,82206 | 9,63164 | 58 |

| 2030 | 13,11851 | 11,30906 | 10,06506 | 66 |

IV. UNI için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

UNI Yatırım Stratejisi

(1) Uzun Vadeli Tutma Yaklaşımı

- Kimler için uygun: Uzun vadeli yatırımcılar ve DeFi’ye ilgi duyanlar

- İşlem önerileri:

- Piyasa düşüşlerinde UNI biriktirin

- Dalgalanmalara karşı en az 1-2 yıl tutun

- Tokenlerinizi güvenli, kendi anahtarınızda saklanan bir cüzdanda koruyun

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: 50 ve 200 günlük ortalamalarla trend tespiti

- RSI (Göreceli Güç Endeksi): Aşırı alım/satım takibi

- Dalgalı al-sat için önemli noktalar:

- Kayıpları sınırlamak amacıyla zarar-durdur emri koyun

- Karı belirli seviyelerde realize edin

UNI Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Ihtiyatlı yatırımcılar: Kripto portföyünün %1-3’ü

- Daha agresif yatırımcılar: %5-10 arası

- Profesyoneller: En fazla %15

(2) Riskten Korunma Yöntemleri

- Diversifikasyon: Farklı DeFi protokollerine dağıtım

- Opsiyon işlemleri: Satım opsiyonuyla aşağı yönlü riske karşı koruma

(3) Güvenli Saklama Önerileri

- Sıcak cüzdan: Gate Web3 cüzdanı

- Soğuk depolama: Uzun vadeli için donanım cüzdanı

- Güvenlik: İki faktörlü doğrulama ve benzersiz şifre kullanımı

V. UNI için Olası Riskler ve Zorluklar

UNI Piyasa Riskleri

- Yüksek volatilite: Kripto piyasalarında sık görülen sert fiyat dalgalanmaları

- Rekabet: Yeni DEX platformları Uniswap’ın pazar payını tehdit edebilir

- Likidite riski: Piyasa baskısı sırasında likidite azalabilir

UNI Düzenleyici Riskleri

- Belirsiz regülasyon ortamı: DeFi’ye ilişkin daha sıkı düzenlemeler olabilir

- SEC incelemesi: UNI’nin menkul kıymet olarak değerlendirilme olasılığı

- Küresel regülasyon farklılıkları: Ülkelere göre değişen DeFi yaklaşımı

UNI Teknik Riskleri

- Akıllı sözleşme açıkları: İstismar veya hata riski

- Ölçeklenebilirlik sorunları: Ethereum ağındaki tıkanıklık performansı etkileyebilir

- Güncelleme riski: Protokol yükseltmeleri veya geçişlerinde yaşanabilecek aksaklıklar

VI. Sonuç ve Eylem Önerileri

UNI Yatırım Değeri Analizi

Uniswap (UNI), önde gelen DEX protokollerinden biri olarak uzun vadede güçlü bir değer sunar; ancak kısa vadede piyasa volatilitesi, regülasyon belirsizliği ve teknik zorluklar nedeniyle risk barındırır.

UNI Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük miktarlarla başlayın, DeFi’yi öğrenmeye odaklanın ✅ Deneyimli yatırımcılar: Maliyet ortalaması ve aktif portföy yönetimine yönelin ✅ Kurumsal yatırımcılar: UNI’yi çeşitlendirilmiş bir DeFi portföyünün parçası olarak değerlendirin

UNI İşlem Katılım Yöntemleri

- Spot alım-satım: UNI tokenlerini Gate.com’da alıp tutmak

- Likidite sağlama: Uniswap havuzlarında likiditeye katılmak

- DeFi entegrasyonu: UNI stake etme ve yönetişim süreçlerinde yer alma

Kripto para yatırımları yüksek risk içerir ve bu makalede yer alan bilgiler yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarına göre dikkatli hareket etmeli ve profesyonel danışmanlardan destek almalıdır. Kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

SSS

Uniswap 100 $’ı görecek mi?

Mevcut piyasa eğilimleri ve Uniswap’ın büyümesine bakıldığında, 100 $ seviyesine ulaşması mümkün olsa da garanti değildir. Sonuç, genel kripto piyasası koşulları ve Uniswap’ın inovasyon kabiliyetine bağlıdır.

Uniswap 2025’te ne kadar olabilir?

Piyasa eğilimlerine göre, 2025’te Uniswap’a yapılan 1.000 $’lık yatırımın değeri, DeFi sektöründeki büyümeye bağlı olarak 800 $ ile 1.800 $ arasında değişebilir.

UNI coin’in geleceği nasıl?

UNI coin’in geleceği parlak görünüyor. Uzman tahminleri, 2025’te 28,5 $, 2026’da 50 $ ve uzun vadede 75,5 $ seviyelerine çıkabileceğini öngörüyor; bu da güçlü bir büyüme potansiyeline işaret ediyor.

Uniswap yükselişini sürdürecek mi?

Uniswap’ın yükseliş trendinin devam edeceği ve 2030 yılına dek yaklaşık 75,5 $’a ulaşacağı öngörülüyor. Güncel analizler ve tarihsel veriler, önümüzdeki yıllarda istikrarlı büyüme potansiyeline işaret ediyor.

2025 PUFFER Fiyat Tahmini: Bu yükselen kripto para biriminin gelecekteki büyüme potansiyeli ve piyasa dinamiklerinin değerlendirilmesi

Fluid (FLUID) iyi bir yatırım mı?: Bu gelişmekte olan kripto paranın potansiyeli ve riskleri üzerine kapsamlı analiz

2025 FERC Fiyat Tahmini: Enerji Sektöründe Düzenleyici Değişiklikler ve Piyasa Dinamiklerinde Yön Bulmak

THE ve ETH: Kripto Para Ekosisteminin İki Devi Karşılaştırılıyor

2025 EUL Fiyat Tahmini: Euler Finance’ın Token’ı İçin Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

ETHS ve UNI: DeFi Ekosisteminde Ethereum ile Uniswap Performansının Karşılaştırılması

Dropee Günlük Kombinasyonu 11 Aralık 2025

Tomarket Günlük Kombinasyonu 11 Aralık 2025

Merkeziyetsiz Finans'ta Geçici Kayıp Nedir?

Kripto Parada Çifte Harcama: Önleme Stratejileri

Kripto Ticaretinde Wyckoff Yönteminin Anlaşılması