2025 TOMI Fiyat Tahmini: Gelişmekte Olan Dijital Varlık İçin Piyasa Analizi ve Gelecek Perspektifi

Giriş: TOMI'nin Piyasadaki Konumu ve Yatırım Değeri

TOMI (TOMI), dijital özgürlüğü artırmayı ve daha merkeziyetsiz bir internet oluşturmayı hedefleyen bir kripto para olarak, kuruluşundan bu yana dikkate değer bir ilerleme kaydetti. 2025 yılı itibarıyla TOMI'nin piyasa değeri 14.737.804 $'a ulaştı; dolaşımdaki arz yaklaşık 47.668.936.138 token ve fiyatı yaklaşık 0,00030917 $ seviyesinde bulunuyor. Sektörde "dijital özgürlük odaklı kripto varlık" olarak tanımlanan bu varlık, dijital çağda insanların iletişim ve işlem alışkanlıklarını yeniden şekillendirmede önemli bir rol üstlenmektedir.

Bu makale, TOMI'nin 2025-2030 dönemi fiyat trendlerini; geçmiş fiyat hareketleri, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler ışığında değerlendirerek, yatırımcılar için profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunacaktır.

I. TOMI Fiyat Geçmişi ve Mevcut Piyasa Durumu

TOMI Tarihsel Fiyat Değişimi

- 2023: TOMI, 6 Haziran'da 6,79266 $ ile tüm zamanların en yüksek seviyesine erişerek fiyat tarihinde önemli bir dönüm noktası yaşamıştır.

- 2025: Piyasada keskin bir düşüş gerçekleşmiş ve TOMI'nin fiyatı 26 Eylül'de 0,00005653 $ ile tüm zamanların en düşük seviyesine inmiştir.

TOMI Güncel Piyasa Durumu

7 Ekim 2025 tarihi itibarıyla TOMI, 0,00030917 $ seviyesinden işlem görmektedir; bu rakam, bir yıl öncesine göre %99,36'lık ciddi bir gerilemeye işaret etmektedir. Token'ın piyasa değeri şu anda 14.737.804,99 $ olup, kripto para sıralamasında 1.242. sırada yer almaktadır.

Son 24 saatte TOMI'nin fiyatı %13,94 gerilemiş, işlem hacmi ise 358.109,49 $ olmuştur. Kısa vadeli bu düşüşe rağmen, son bir saatlik dilimde TOMI %17,36 oranında yukarı yönlü hareket göstermiştir.

Dolaşımdaki arz 47.668.936.138,48581 TOMI, toplam arz 4.281.047.102,4379454 TOMI'dir. Tam seyreltilmiş piyasa değeri 1.323.571,33 $ olup, mevcut piyasa değeri tam seyreltilmiş değerin %100'ünü temsil etmektedir.

Güncel TOMI piyasa fiyatını görmek için tıklayın

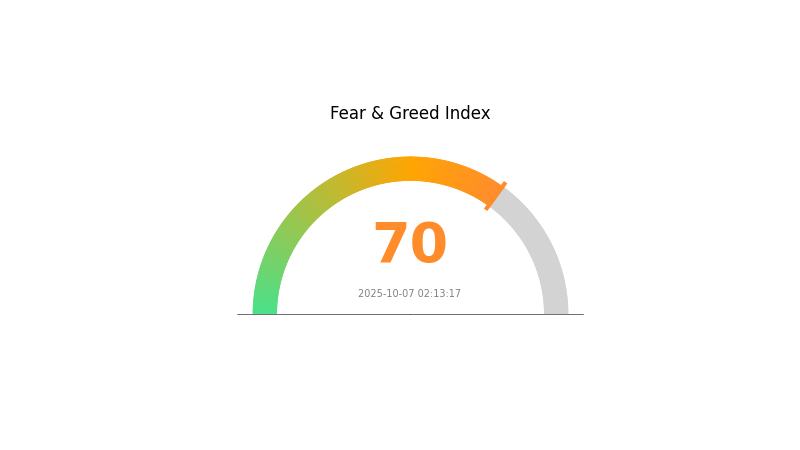

TOMI Piyasa Duyarlılığı Göstergesi

07 Ekim 2025 Korku ve açgözlülük endeksi: 70 (açgözlülük)

Güncel korku ve açgözlülük endeksini görmek için tıklayın

Kripto piyasası şu anda açgözlülük seviyesinde olup, korku ve açgözlülük endeksi 70'e ulaşmıştır. Bu durum, yatırımcıların aşırı iyimser olduğuna ve varlıkların değerinin gereğinden fazla yükseldiğine işaret etmektedir. Kısa vadede yükseliş eğilimi devam edebilir, ancak piyasalarda bu tür aşırı açgözlülük dönemlerinin ardından genellikle düzeltme hareketleri gözlenmektedir. Portföy çeşitlendirmesi yapılması ve stop-loss emirleri kullanılması risk yönetimi açısından önerilmektedir. Güncel piyasa koşulları yakından izlenmelidir.

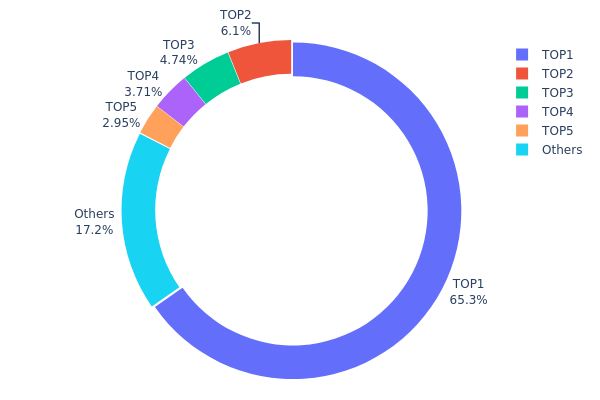

TOMI Varlık Dağılımı

TOMI adres varlık dağılımı verileri, son derece yoğunlaşmış bir sahiplik yapısı göstermektedir. En büyük adres, toplam arzın %65,30'unu yani 31.137.994,19K TOMI tokenini elinde bulundurmaktadır. Bu konsantrasyon, merkezileşme ve piyasa manipülasyonu riskleri açısından önemli endişeler oluşturmaktadır.

Sonraki dört en büyük adres ise toplam arzın %17,47'sini elinde tutmakta olup, ilk 5 adresin payı %82,77'ye ulaşmaktadır. Geri kalan %17,23 ise diğer tüm cüzdanlara dağılmıştır. Bu dengesiz dağılım, TOMI piyasasının büyük sahiplerin ani alım/satım hamlelerine karşı kırılgan olabileceğini, bunun da fiyat oynaklığı ve küçük yatırımcılar için likidite riskini artırabileceğini göstermektedir.

Varlık yoğunlaşması, TOMI'nin yönetişim süreçlerini ve karar mekanizmalarını da etkileyebilir; bu durum merkeziyetsizlik ilkesinin zayıflamasına yol açabilir. TOMI'nin piyasa dinamikleri ve uzun vadeli istikrarı değerlendirilirken bu unsurların dikkate alınması önerilir.

Güncel TOMI Varlık Dağılımını görmek için tıklayın

| En Büyük | Adres | Miktar | Pay (%) |

|---|---|---|---|

| 1 | 0xf42a...36f173 | 31.137.994,19K | 65,30% |

| 2 | 0x75e8...1dcb88 | 2.906.564,89K | 6,09% |

| 3 | 0x6d0d...d9062d | 2.261.279,49K | 4,74% |

| 4 | 0xd4d2...9153b1 | 1.767.180,20K | 3,70% |

| 5 | 0x0000...e08a90 | 1.405.343,91K | 2,94% |

| - | Diğerleri | 8.201.297,13K | 17,23% |

TOMI'nin Gelecekteki Fiyatını Etkileyecek Ana Faktörler

Arz Mekanizması

- Piyasa Koşulları: TOMI'nin değeri; piyasa koşulları, yatırımcı duyarlılığı, düzenleyici gelişmeler ve teknolojik yenilikler gibi çeşitli faktörlere bağlı olarak önemli dalgalanmalara maruz kalabilir.

Kurumsal ve Balina Dinamikleri

- Yatırımcı Duyarlılığı: Yatırımcı duyarlılığı, TOMI'nin fiyat hareketlerinde belirleyici rol oynamaktadır. Trader ve yatırımcılar, alım-satım veya tutma kararlarını vermeden önce token değerini yakından izler.

Makroekonomik Ortam

- Düzenleyici Gelişmeler: Düzenleyici ortamda yaşanacak değişiklikler, TOMI'nin fiyat hareketine yön verebilir.

Teknik Gelişim ve Ekosistem Oluşumu

- Teknolojik Gelişmeler: TOMI projesinde devam eden teknolojik ilerlemeler fiyat performansını etkileyebilir.

- Ekosistem Uygulamaları: Temel DApp'lerin ve ekosistem projelerinin geliştirilmesi ve benimsenmesi TOMI'nin piyasa değerini şekillendirebilir.

Yatırımcıların, TOMI ile ilgili son gelişmeleri ve proje planlarını takip ederek yüksek oynaklığa sahip piyasada daha bilinçli kararlar almaları önerilmektedir.

III. 2025-2030 İçin TOMI Fiyat Tahmini

2025 Öngörüsü

- Temkinli tahmin: 0,00022 $ - 0,00028 $

- Tarafsız tahmin: 0,00028 $ - 0,00034 $

- İyimser tahmin: 0,00034 $ - 0,00039 $ (olumlu piyasa duyarlılığı ve proje gelişmeleriyle)

2027-2028 Öngörüsü

- Piyasa fazı: Benimsenmenin artacağı büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 0,00029 $ - 0,00051 $

- 2028: 0,00030 $ - 0,00062 $

- Temel katalizörler: Teknolojik gelişmeler, piyasa kabulünün genişlemesi ve olası iş birlikleri

2029-2030 Uzun Vadeli Öngörü

- Temel senaryo: 0,00054 $ - 0,00062 $ (istikrarlı piyasa büyümesi ve proje gelişimiyle)

- İyimser senaryo: 0,00062 $ - 0,00077 $ (güçlü piyasa performansı ve önemli proje başarılarıyla)

- Dönüştürücü senaryo: 0,00077 $ - 0,00085 $ (çığır açıcı yenilikler ve kitlesel benimsenmeyle)

- 2030-31-12: TOMI 0,00077 $ (iyimser öngörüye göre olası zirve)

| Yıl | Tahmini En Yüksek | Tahmini Ortalama | Tahmini En Düşük | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,00039 | 0,00028 | 0,00022 | -3 |

| 2026 | 0,00049 | 0,00034 | 0,00032 | 15 |

| 2027 | 0,00051 | 0,00041 | 0,00029 | 41 |

| 2028 | 0,00062 | 0,00046 | 0,0003 | 56 |

| 2029 | 0,00069 | 0,00054 | 0,0003 | 84 |

| 2030 | 0,00077 | 0,00062 | 0,00039 | 109 |

IV. TOMI İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

TOMI Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcılar: Dijital özgürlük vizyonuna inanan, uzun vadeli yatırımcılar

- Öneriler:

- TOMI'ye düzenli ve kademeli alımlarla yatırım yapılması

- Piyasa dalgalanmalarında pozisyonun korunması

- Varlıkların güvenli bir donanım cüzdanında saklanması

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Kısa ve uzun vadeli trend takibi

- RSI: Aşırı alım ve aşırı satım bölgelerinin tespiti

- Dalgalı işlem için ana noktalar:

- Net giriş ve çıkış seviyelerinin belirlenmesi

- Risk yönetimi için stop-loss emirleri kullanılması

TOMI Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: %1-2

- Agresif yatırımcılar: %5-10

- Profesyonel yatırımcılar: %10-15

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Birden fazla kripto para arasında yatırımın dağıtılması

- Opsiyon stratejileri: Düşüş riskine karşı satım opsiyonu kullanılması

(3) Güvenli Saklama Yöntemleri

- Donanım cüzdanı tavsiyesi: Gate Web3 Wallet

- Soğuk cüzdan çözümü: Çevrimdışı kağıt cüzdan

- Güvenlik önlemleri: İki faktörlü doğrulama kullanılması, halka açık Wi-Fi ile işlem yapılmaması

V. TOMI İçin Potansiyel Riskler ve Zorluklar

TOMI Piyasa Riskleri

- Yüksek oynaklık: Kripto piyasalarında aşırı fiyat dalgalanması yaygındır

- Likidite riski: Düşük işlem hacmi, pozisyondan çıkışı zorlaştırabilir

- Rekabet: Diğer mesajlaşma/ödeme platformları pazar payı kazanabilir

TOMI Düzenleme Riskleri

- Belirsiz düzenleme ortamı: Olumsuz düzenlemelerle karşılaşılabilir

- Sınır ötesi uyum: Birden fazla yargı bölgesinde uyum zorlukları

- Gizlilik endişeleri: Artan veri koruma ve kullanıcı gizliliği denetimi

TOMI Teknik Riskler

- Akıllı kontrat açıkları: Sömürü ya da hata riski

- Ölçeklenebilirlik: Ağ tıkanıklığı sorunları yaşanabilir

- Siber güvenlik tehditleri: Ağda saldırı veya hack riski

VI. Sonuç ve Eylem Önerileri

TOMI Yatırım Değeri Değerlendirmesi

TOMI, dijital özgürlük ve merkeziyetsiz iletişim alanında uzun vadeli potansiyele sahip olmakla birlikte, kısa vadede yüksek oynaklık ve benimseme zorlukları ile karşı karşıyadır. Projenin mesajlaşma ve kripto ödeme entegrasyonu yenilikçi bir kullanım sunarken, yatırımcıların yüksek risk faktörünü dikkate alması gerekmektedir.

TOMI Yatırım Tavsiyeleri

Yeni başlayanlar için piyasayı öğrenmeye yönelik küçük ve ulaşılabilir yatırımlar önerilmektedir. Deneyimli yatırımcılar, stratejik giriş noktaları ile dengeli bir portföy oluşturabilir. Kurumsal yatırımcıların ise kapsamlı araştırma yapmaları ve OTC alternatiflerini değerlendirmeleri tavsiye edilmektedir.

TOMI İşlem Katılım Yöntemleri

- Spot alım-satım: TOMI, Gate.com spot piyasasında alınıp satılabilir

- Staking: Uygunsa staking programlarına katılım sağlanabilir

- DeFi entegrasyonu: Merkeziyetsiz finans seçenekleri araştırılabilir

Kripto para yatırımları çok yüksek risk içermektedir. Bu makale yatırım tavsiyesi niteliği taşımamaktadır. Yatırımcıların, kendi risk toleransları kapsamında hareket etmeleri ve profesyonel finansal danışmanlara başvurmaları gerekmektedir. Yatırım yapılacak tutarın, kaybı göze alınabilecek seviyede olması önemlidir.

SSS

Toncoin'in 100 $ seviyesine ulaşma potansiyeli nedir?

Toncoin'in büyüme potansiyeli bulunmakla birlikte, mevcut fiyat eğilimleri ve piyasa koşulları kapsamında kısa vadede 100 $ seviyesine ulaşması olası gözükmemektedir. Uzun vadeli büyüme potansiyeli ise mevcuttur.

1000x getiri öngörülen kripto para projeleri hangileridir?

Hiçbir kripto para 1000x getiri garantisi sunmamaktadır; ancak Bullzilla (BZIL) gibi yeni projeler, mevcut piyasa döngüsünde yüksek getiri potansiyeli barındırabilir.

TOMI coin hakkında teknik bilgiler nelerdir?

TOMI, daha özgür bir internet için sohbet ve cüzdan uygulaması sunan bir platformdur. Gizli ve açık gruplar, kolaylaştırılmış kripto gönderimi ve içerik üreticileri için öncelikli gelir araçları ile öne çıkmaktadır.

2025 yılında Tomarket token'ın tahmini değeri nedir?

Piyasa analizlerine göre Tomarket token'ın 2025 yılında 0,065515 $ ile 0,067891 $ arasında olması, ortalama fiyatının ise 0,066703 $ seviyesinde gerçekleşmesi beklenmektedir.

2025 FTT Fiyat Tahmini: Dijital Varlık Ekosisteminde Piyasa Trendleri ile Potansiyel Büyüme Faktörlerinin Analizi

2025 HT Fiyat Tahmini: Huobi Token için piyasa trendleri ve olası büyüme faktörlerinin analizi

2025 MTL Fiyat Tahmini: Metal Token’ın Gelecekteki Büyüme Eğilimleri ve Piyasa Potansiyeli Analizi

2025 CHEQ Fiyat Tahmini: Cheqd Network Token için Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

2025 VICE Fiyat Tahmini: Dijital medya devi için piyasa trendleri ve potansiyel büyüme faktörlerinin analizi

2025 CRTS Fiyat Tahmini: Değişen Kripto Para Ekosisteminde CRTS Token’larının Piyasa Eğilimleri ve Gelecek Değerlemesi Analizi

2024'te İzlenmesi Gereken Başlıca Merkeziyetsiz Finans Platformları

Dijital Varlık Alım Satımı İçin En İyi Platformlar - Kapsamlı Rehber

Yönlendirilmiş Asiklik Grafikler (DAG) Hakkında Her Şey: Kapsamlı Bir Kılavuz

Özel Anahtarları Anlamak: Kriptonuzu Güvende Tutmak İçin Temel İpuçları

Yeni Başlayanlara Yönelik En İyi DeFi Girişimleri