2025 CRTS Fiyat Tahmini: Değişen Kripto Para Ekosisteminde CRTS Token’larının Piyasa Eğilimleri ve Gelecek Değerlemesi Analizi

Giriş: CRTS'nin Piyasadaki Konumu ve Yatırım Değeri

Cratos (CRTS), gerçek zamanlı canlı oylama platformları için geliştirilen oyla-kazan (v2e) kripto para birimi olarak, 2021’deki çıkışından bu yana kayda değer ilerlemeler göstermektedir. 2025 yılı itibarıyla Cratos’un piyasa değeri 11.238.403 ABD doları, dolaşımdaki arzı yaklaşık 63.529.696.688 token ve fiyatı yaklaşık 0,0001769 ABD dolarıdır. “Demokrasi tokenı” olarak anılan bu varlık, mobil oylama uygulamalarında vatandaş katılımını artırmada her geçen gün daha önemli bir rol oynamaktadır.

Bu makalede, Cratos’un 2025-2030 yılları arasındaki fiyat eğilimleri kapsamlı şekilde analiz edilerek tarihsel desenler, piyasa arz ve talep dengesi, ekosistem gelişimi ve makroekonomik etkenler bir arada değerlendirilerek profesyonel fiyat tahminleri ve yatırımcılar için uygulanabilir yatırım stratejileri sunulacaktır.

I. CRTS Fiyat Geçmişi ve Güncel Piyasa Durumu

CRTS Tarihsel Fiyat Gelişimi

- 2021: İlk çıkış, fiyat 24 Aralık’ta 0,00747511 ABD doları ile zirve yaptı

- 2022: Piyasa gerilemesi, fiyat 3 Aralık’ta 0,00013742 ABD doları ile dip seviyeye indi

- 2025: Kademeli toparlanma, fiyat 0,0001769 ABD doları civarında dalgalanıyor

CRTS Güncel Piyasa Durumu

8 Ekim 2025 itibarıyla CRTS 0,0001769 ABD doları seviyesinden işlem görmektedir. Son 24 saatte token %3,86 oranında değer kaybederken, son 30 günde %7,48 düşüş gösterdi. Bununla birlikte, son bir haftada %0,33’lük hafif bir toparlanma yaşandı. Güncel piyasa değeri 11.238.403 ABD doları olup, CRTS küresel kripto para piyasasında 1.359. sırada yer almaktadır. Dolaşımdaki 63.529.696.688 CRTS tokenı, toplam arzın %63,53’ünü temsil etmekte ve projenin tam seyreltilmiş değeri 17.690.000 ABD dolarıdır. Son 24 saatteki işlem hacmi 23.837,61 ABD doları olarak gerçekleşmiş, bu da orta seviyede piyasa hareketliliğine işaret etmektedir.

Güncel CRTS piyasa fiyatını görmek için tıklayın

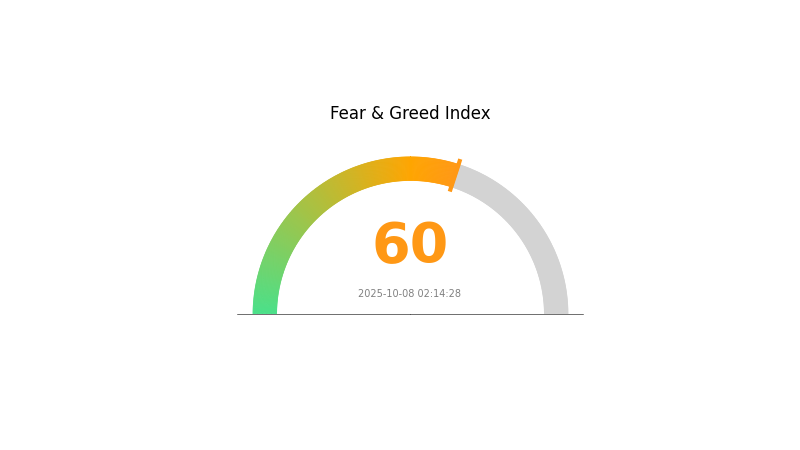

CRTS Korku ve Açgözlülük Endeksi

08 Ekim 2025 Korku ve Açgözlülük Endeksi: 60 (Açgözlülük)

Güncel Korku ve Açgözlülük Endeksi için tıklayın

Kripto para piyasasında açgözlülük hakim; Korku ve Açgözlülük Endeksi 60 seviyesine ulaşmış durumda. Bu, yatırımcıların piyasanın potansiyeline daha iyimser yaklaştığını gösteriyor. Ancak aşırı açgözlülük, aşırı değerlenmeye ve olası piyasa düzeltmelerine yol açabilir. Yatırımcılar, riskleri azaltmak için portföylerini çeşitlendirmeli ve temkinli hareket etmelidir. Volatil kripto piyasasında yatırım kararları alırken kapsamlı araştırma ve risk yönetimi her zaman kritik önem taşır.

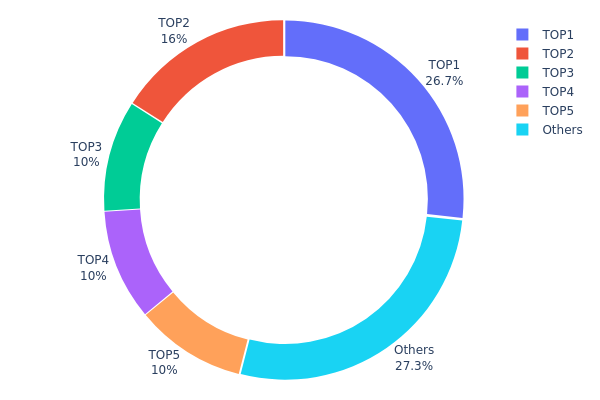

CRTS Varlık Dağılımı

Adres varlık dağılımı verileri, CRTS tokenlarının cüzdanlar arasında nasıl yoğunlaştığına dair önemli bilgiler sunar. Analiz, en büyük 5 adresin toplam arzın %72,71’ini kontrol ettiğini ve en büyük sahibi olan bir adresin tüm CRTS tokenlarının %26,71’ine tek başına sahip olduğunu, diğer dört adresin ise arzın her biri %10-16’sını bulundurduğunu gösteriyor.

Böyle bir yoğunlaşma, piyasa merkezileşmesi ve olası fiyat manipülasyonu konusunda endişeleri artırır. Tokenların büyük bir kısmının az sayıda adreste toplanması, büyük ölçekli satışlar veya koordineli hareketlerle CRTS fiyatı ve likiditesi üzerinde ciddi etkiye yol açabilir. Bu durum, blokzincir projelerinin merkeziyetsizlik ilkeleriyle de çelişir.

Bununla birlikte, tokenların %27,29’u diğer adresler arasında dağıtılmıştır ve bu durum, daha geniş piyasa katılımı olduğuna işaret eder. Fakat genel yapı, piyasanın volatiliteye ve büyük token sahiplerinin hareketlerine karşı hassas olabileceğini göstermektedir.

Güncel CRTS Varlık Dağılımı için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xa82b...be993b | 26.711.766,31K | 26,71% |

| 2 | 0xe891...eb5bbb | 16.000.000,00K | 16,00% |

| 3 | 0x61ad...ae0a46 | 10.000.000,00K | 10,00% |

| 4 | 0xdfa3...9fc360 | 10.000.000,00K | 10,00% |

| 5 | 0x7454...5c275f | 10.000.000,00K | 10,00% |

| - | Diğerleri | 27.288.233,69K | 27,29% |

II. CRTS’nin Gelecekteki Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Piyasa Arz ve Talebi: Arz ve talep dinamikleri, CRTS fiyatında belirleyici rol oynar.

- Tarihsel Desen: Sınırlı arz ve talep artışı fiyatı yükseltirken, satıcıların fazlalığı ani fiyat düşüşlerine neden olabilir.

- Güncel Etki: Arz ve talebin etkileşimi; toplam arz, yeni token üretim oranı ve ani alım-satım dalgalarını tetikleyen piyasa olayları gibi faktörlerden etkilenir.

Kurumsal ve Whale Dinamikleri

- Kurumsal Benimseme: CRTS’nin büyük şirketlerce benimsenmesi fiyat üzerinde ciddi etki yaratabilir.

- Ulusal Politikalar: Kripto para ile ilgili devlet politikaları CRTS fiyatını doğrudan etkileyebilir.

Makroekonomik Ortam

- Para Politikası Etkisi: Büyük merkez bankalarının kararları CRTS fiyatını etkileyebilir.

- Enflasyona Karşı Koruma Özellikleri: CRTS, enflasyonist ortamlarda performansına göre fiyatında değişiklik gösterebilir.

- Jeopolitik Etkenler: Uluslararası gelişmeler CRTS fiyatında dalgalanmalara neden olabilir.

Teknolojik Gelişim ve Ekosistem Oluşumu

- Blockchain Protokol Güncellemeleri: Protokol yükseltmeleri verimliliği artırarak CRTS fiyatını olumlu yönde etkileyebilir.

- Ekosistem Uygulamaları: Yeni DApp ve ekosistem projelerinin geliştirilmesi CRTS fiyatını destekleyebilir.

III. CRTS Fiyat Tahmini: 2025-2030

2025 Görünümü

- Temkinli tahmin: 0,00015 - 0,00018 ABD doları

- Tarafsız tahmin: 0,00018 - 0,00022 ABD doları

- İyimser tahmin: 0,00022 - 0,00026 ABD doları (olumlu piyasa duyarlılığı ve proje gelişmeleriyle)

2026-2027 Görünümü

- Piyasa fazı beklentisi: Benimsemenin artmasıyla potansiyel büyüme dönemi

- Fiyat aralığı tahmini:

- 2026: 0,00013 - 0,00032 ABD doları

- 2027: 0,00020 - 0,00032 ABD doları

- Önemli katalizörler: Proje kilometre taşları, piyasa toparlanması ve CRTS’nin kullanım alanının genişlemesi

2028-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,00029 - 0,00037 ABD doları (istikrarlı piyasa büyümesi ve proje gelişimi varsayımıyla)

- İyimser senaryo: 0,00037 - 0,00042 ABD doları (güçlü piyasa performansı ve yaygın benimsemeyle)

- Dönüştürücü senaryo: 0,00042 - 0,00049 ABD doları (çığır açan gelişmeler ve genel kabul ile)

- 31 Aralık 2030: CRTS 0,00049 ABD doları (bu dönemin potansiyel zirve değeri)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Yüzdesi |

|---|---|---|---|---|

| 2025 | 0,00026 | 0,00018 | 0,00015 | 0 |

| 2026 | 0,00032 | 0,00022 | 0,00013 | 23 |

| 2027 | 0,00032 | 0,00027 | 0,0002 | 50 |

| 2028 | 0,00042 | 0,00029 | 0,00025 | 65 |

| 2029 | 0,00039 | 0,00036 | 0,00026 | 102 |

| 2030 | 0,00049 | 0,00037 | 0,00031 | 110 |

IV. CRTS Profesyonel Yatırım Stratejileri ve Risk Yönetimi

CRTS Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı tipi: Uzun vadeli değer odaklı yatırımcılar

- Operasyon önerileri:

- Piyasa düşüşlerinde CRTS tokenı biriktirin

- Fiyat hedefleri belirleyip düzenli aralıklarla gözden geçirin

- Tokenları güvenli cüzdanlarda muhafaza edin

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve potansiyel giriş/çıkış noktalarını tespit etmek için kullanılır

- RSI (Göreli Güç Endeksi): Aşırı alım/aşırı satım durumlarını izleyin

- Dalgalı alım-satımda dikkat edilmesi gerekenler:

- Cratos platformundaki oylama aktivitesini takip edin

- Kripto para piyasasında genel duyarlılığı izleyin

CRTS Risk Yönetim Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcılar: %1-3

- Agresif yatırımcılar: %5-10

- Profesyonel yatırımcılar: %10-15

(2) Riskten Korunma Planları

- Portföyü çeşitlendirme: Yatırımları birden fazla kripto varlık arasında dağıtın

- Zarar durdur emirleri: Olası kayıpları sınırlandırmak için kullanın

(3) Güvenli Saklama Çözümleri

- Donanım cüzdanı tavsiyesi: Gate Web3 Wallet

- Yazılım cüzdanı alternatifi: Resmi Cratos cüzdanı (varsa)

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama ve güçlü parola kullanımı

V. CRTS için Potansiyel Riskler ve Zorluklar

CRTS Piyasa Riskleri

- Volatilite: Kripto piyasaları yüksek derecede dalgalanma gösterir

- Likidite: Düşük işlem hacmi fiyat istikrarını olumsuz etkileyebilir

- Rekabet: Oylama odaklı yeni tokenlar piyasaya çıkabilir

CRTS Düzenleyici Riskler

- Belirsiz düzenlemeler: Kripto paralar için düzenleyici ortam ülkeden ülkeye değişir

- Uyumluluk sorunları: Oy ver, kazan modelinde yasal zorluklar yaşanabilir

- Vergi etkileri: Kripto kazançlarına yönelik vergi mevzuatı sürekli değişmektedir

CRTS Teknik Riskler

- Akıllı kontrat açıkları: Güvenlik zafiyeti veya hata riski

- Ölçeklenebilirlik: Artan kullanıcı aktivitesine yanıt verme kapasitesi

- Ağ tıkanıklığı: Ethereum ağının işlem sınırları transferleri etkileyebilir

VI. Sonuç ve Eylem Önerileri

CRTS Yatırım Değeri Değerlendirmesi

Cratos (CRTS) oyla-kazan alanında özgün bir değer önerisi sunarken, kısa vadede yüksek volatilite ve düzenleyici belirsizliklerle karşı karşıyadır. Uzun vadeli potansiyeli ise kullanıcı benimsemesi ve platformun gelişimine bağlıdır.

CRTS Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük miktarlarda işlem yaparak platformu öğrenmeye odaklanın ✅ Deneyimli yatırımcılar: Maliyet ortalaması yöntemi uygulayın, oylama trendlerini izleyin ✅ Kurumsal yatırımcılar: Ayrıntılı inceleme ve düzenleyici durum analizi gerçekleştirin

CRTS Alım-Satım Katılım Yöntemleri

- Spot işlemler: Gate.com ve diğer desteklenen borsalarda mevcut

- Staking: Cratos platformu sunuyorsa staking programlarına katılım

- Yönetişim: Oylama faaliyetlerine katılarak CRTS tokenı kazanma

Kripto para yatırımları son derece yüksek risk içerir ve bu makale yatırım tavsiyesi olarak değerlendirilmemelidir. Yatırımcılar kararlarını kendi risk tercihlerine göre dikkatlice vermeli, profesyonel finans danışmanlarına başvurmalıdır. Kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

SSS

Sıkça Sorulan Sorular

TRX için 2025 fiyat tahmini nedir?

TRX’in, 2025 Ekim ayında 0,37 ABD doları üzerinde başarılı bir yükseliş yaşaması durumunda 0,40-0,42 ABD doları seviyelerine ulaşacağı öngörülmektedir.

CRTS tokenı ne kadar?

Ekim 2025 itibarıyla CRTS tokenı fiyatı 0,0001756 ABD dolarıdır. Son 24 saat içinde 0,000167 ile 0,000188 ABD doları aralığında işlem görmüştür.

Trac için 2030 fiyat tahmini nedir?

Mevcut piyasa analizine göre, Trac’in 2030 yılı için tahmini fiyatı 0,623463 ABD dolarıdır; bu tahmin %27,63 büyüme oranına dayanmaktadır.

En yüksek fiyat tahmini yapılan kripto para hangisidir?

2025 yılında en yüksek fiyat tahmini Bitcoin (BTC) için yapılmıştır. BTC, istikrarlı trendiyle yatırımcılar arasında en çok tercih edilen kripto para olmaya devam etmektedir.

2025 FTT Fiyat Tahmini: Dijital Varlık Ekosisteminde Piyasa Trendleri ile Potansiyel Büyüme Faktörlerinin Analizi

2025 HT Fiyat Tahmini: Huobi Token için piyasa trendleri ve olası büyüme faktörlerinin analizi

2025 MTL Fiyat Tahmini: Metal Token’ın Gelecekteki Büyüme Eğilimleri ve Piyasa Potansiyeli Analizi

2025 CHEQ Fiyat Tahmini: Cheqd Network Token için Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

2025 VICE Fiyat Tahmini: Dijital medya devi için piyasa trendleri ve potansiyel büyüme faktörlerinin analizi

2025 TOMI Fiyat Tahmini: Gelişmekte Olan Dijital Varlık İçin Piyasa Analizi ve Gelecek Perspektifi

Dropee Günlük Kombinasyonu 12 Aralık 2025

Tomarket Günlük Kombinasyonu 12 Aralık 2025

SEI Airdrop Ödülleri’ne Katılım ve Talep Etme Kılavuzu

Kripto para birimlerinde algoritmik alım satım için etkili stratejiler

Stock-to-Flow Model ile Bitcoin'in Değerlemesini Anlamak