2025 SUT Fiyat Tahmini: Piyasa Trendleri ve Değer Projeksiyonlarına Yönelik Kapsamlı Analiz ve Öngörü

Giriş: SUT'nin Piyasa Konumu ve Yatırım Değeri

SuperTrust (SUT), küresel çapta geliştirilen ve işletilen platformlar için bir ödeme aracı olarak kuruluşundan bu yana önemli ilerlemeler kaydetti. 2025 yılı itibarıyla SUT'nin piyasa değeri 2,16 milyar dolar seviyesine ulaştı; dolaşımdaki arzı yaklaşık 188.403.732 token ve fiyatı 11,465 dolar civarında seyrediyor. Küresel Platform Tokenı olarak anılan bu varlık, doğrudan reklamcılık alanında ve doğal manzara paylaşım platformlarında giderek daha kritik bir rol oynamaktadır.

Bu makalede, SUT'nin 2025-2030 yılları arasındaki fiyat eğilimleri; geçmiş hareketler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik unsurlar kapsamında ayrıntılı şekilde analiz edilerek yatırımcılara profesyonel fiyat öngörüleri ile uygulanabilir yatırım stratejileri sunulacaktır.

I. SUT Fiyat Geçmişi ve Güncel Piyasa Durumu

SUT Tarihsel Fiyat Gelişimi

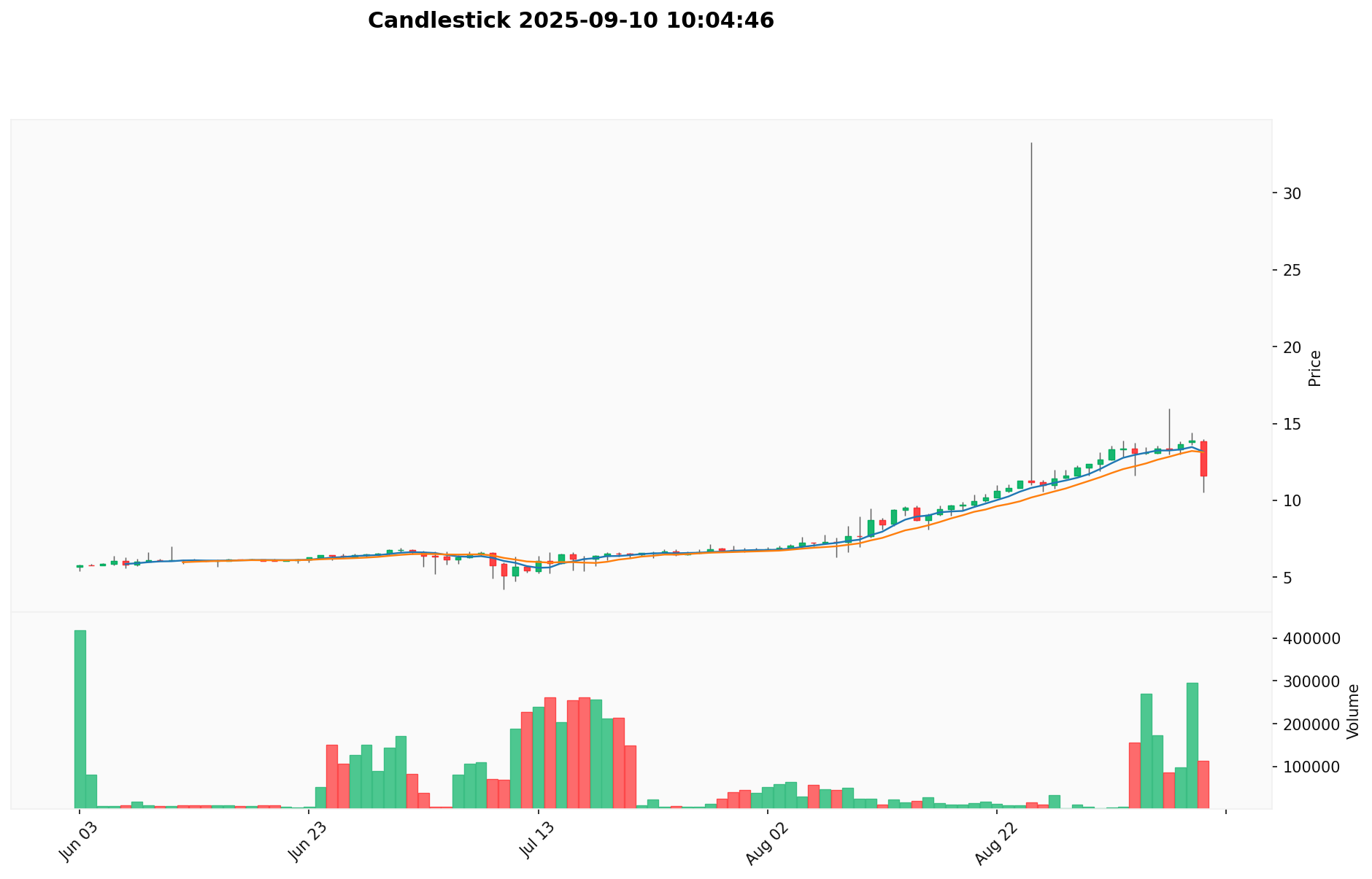

- Nisan 2025: SUT, 3,9 dolar ile tüm zamanların en düşük seviyesini görüp büyük bir yükseliş trendine başladı.

- Ağustos 2025: SUT, 33,3 dolara çıkarak Nisan ayındaki dipten yüzde 753’lük olağanüstü bir artış gösterdi.

- Eylül 2025: Piyasa düzeltmesiyle fiyat, 11,465 dolar civarındaki mevcut seviyelere geriledi.

SUT Güncel Piyasa Durumu

10 Eylül 2025 itibarıyla SUT, 11,465 dolardan işlem görüyor ve son 24 saatte yüzde 10,48 kayıp yaşadı. Token’ın piyasa değeri 2,16 milyar dolara ulaşarak kripto para piyasasında 60. sıraya yerleşti. Son 24 saatteki işlem hacmi 1,41 milyon dolar olarak kaydedildi ve bu da piyasada önemli bir işlem aktivitesine işaret ediyor. Son düzeltmeye rağmen SUT, uzun vadede güçlü bir performans gösterdi: Son 30 günde yüzde 40,53, son bir yılda ise yüzde 407,27 artış kaydetti. Mevcut fiyat, zirve seviyesinden yüzde 65,57 oranında bir geri çekilme anlamına geliyor ve bu, olası bir toparlanma fırsatı sunabilir.

Güncel SUT piyasa fiyatını görmek için tıklayın.

SUT Piyasa Duyarlılığı Göstergesi

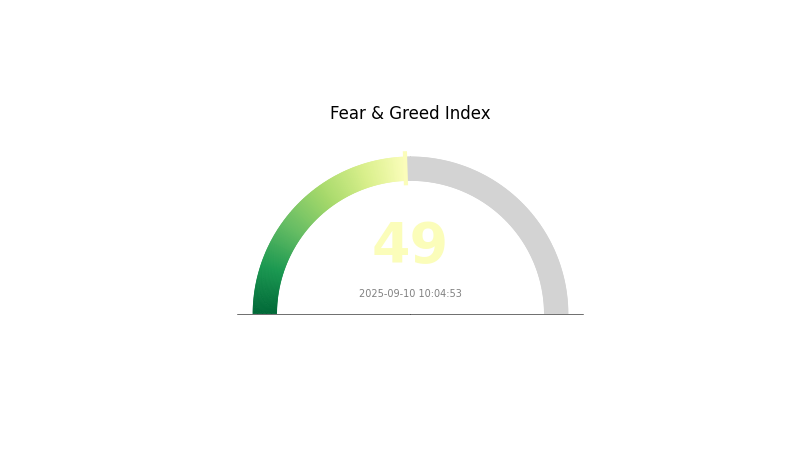

10 Eylül 2025 Korku ve Açgözlülük Endeksi: 49 (Nötr)

Güncel Korku ve Açgözlülük Endeksi için tıklayın.

Bugün kripto para piyasasında duyarlılık dengede seyrediyor. Korku ve Açgözlülük Endeksi’nin 49’da olması, yatırımcıların piyasa koşulları konusunda ne aşırı kötümser ne de aşırı iyimser olduklarını gösteriyor. Yine de ihtiyatlı davranılması önerilir; bu nötr görünüm, hem alıcılar hem de satıcılar için fırsatlar oluşturabilir. İşlem yapan yatırımcıların piyasa eğilimlerini yakından takip etmesi ve yatırım kararı öncesi kapsamlı analiz yapması önem taşır.

SUT Varlık Dağılımı

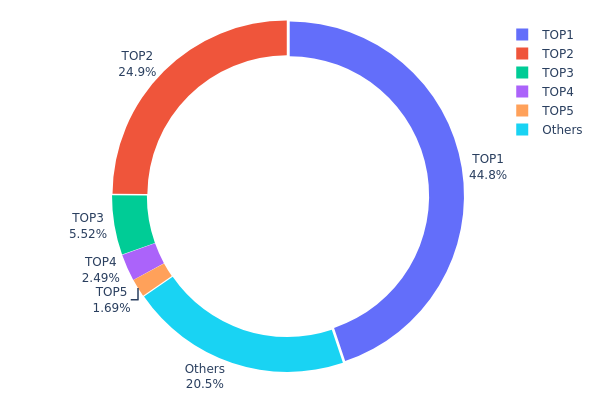

Adres bazlı varlık dağılımı verileri, SUT tokenlarının değişik cüzdanlardaki yoğunlaşmasını gösteriyor. Analiz, SUT’nin yüksek derecede merkezileşmiş bir dağılıma sahip olduğunu ortaya koyuyor: En büyük adres toplam arzın yüzde 44,84’ünü, ikinci en büyük adres ise ilave yüzde 24,91’lik bir bölümü elinde tutuyor. Yani bu iki adres, dolaşımdaki SUT’nin neredeyse yüzde 70’ini kontrol ediyor ve önemli bir sahip konsantrasyonu söz konusu.

Böylesine büyük bir yoğunluk, piyasa stabilitesi ve fiyat manipülasyonu ihtimaline ilişkin kaygılar doğuruyor. Tokenların bu denli az sayıda cüzdanda toplanmış olması, bu büyük yatırımcıların satış ya da transfer kararı almaları halinde piyasada ciddi oynaklık riski oluşturuyor. Ayrıca merkezileşme, token’ın merkeziyetsiz ekosistem iddiasını zayıflatıyor; SUT ekosistemi üzerinde az sayıda aktörün orantısız bir etkisi var.

Bu dağılım yapısı, SUT’nin zincir üstünde istikrarının bu büyük yatırımcıların hareketlerine karşı savunmasız olabileceğini gösteriyor. “Diğerleri” kategorisinin yüzde 20,57 seviyesinde olması, küçük yatırımcılara belirli bir dağılımı işaret etse de genel tablo, sınırlı merkezsizleşme ve kapsayıcı katılım açısından zorluklar olduğunu gösteriyor.

Güncel SUT Varlık Dağılımı için tıklayın.

| Sıra | Adres | Varlık Adedi | Varlık (%) |

|---|---|---|---|

| 1 | 0x987d...c5dd2d | 90.000,00K | 44,84% |

| 2 | 0x0000...00dead | 50.000,00K | 24,91% |

| 3 | 0xaaa4...89cc2c | 11.073,11K | 5,51% |

| 4 | 0x03fd...136597 | 5.000,00K | 2,49% |

| 5 | 0x6973...d84461 | 3.391,00K | 1,68% |

| - | Diğerleri | 41.228,42K | 20,57% |

II. SUT'nin Gelecekteki Fiyatını Belirleyen Temel Faktörler

Arz Mekanizması

- Toplam Arz: SuperTrust (SUT) toplam arzı 188.403.732 adettir.

- Dolaşımdaki Arz: 10 Eylül 2025 itibarıyla dolaşımdaki arz 2.024.492,29 SUT’dir.

- Maksimum Arz: Maksimum arz 238.403.732 SUT olarak belirlenmiştir.

Kurumsal ve Balina Dinamikleri

- Kurumsal Benimseme: SuperTrust; kendine ait bir web sitesine ve sosyal medya hesaplarına sahiptir, bu da belirli bir kurumsal yapı ve benimsenme potansiyeli anlamına gelir.

Makroekonomik Ortam

- Enflasyona Karşı Koruma Özelliği: SUT, diğer dijital varlıklarda olduğu gibi enflasyona karşı potansiyel bir korunma aracı olarak görülebilir.

Teknik Gelişim ve Ekosistem Oluşturma

- Platform: SUT, Polygon platformunda çalışmakta ve bu ekosistemin teknolojik altyapısından faydalanmaktadır.

- Ekosistem Uygulamaları: SuperTrust’ın beyaz kitabı ve GitHub deposu mevcuttur; bu da devam eden teknik gelişimi ve muhtemel ekosistem büyümesini göstermektedir.

Yasal Uyarı: Geçmiş performans, gelecekteki sonuçların garantisi değildir. Yatırım, anapara kaybı riski dahil çeşitli riskler içerir. Yatırım kararlarınızı vermeden önce mutlaka kendi araştırmanızı yapınız.

III. 2025-2030 SUT Fiyat Tahmini

2025 Öngörüsü

- Temkinli tahmin: 6,88 - 11,46 USD

- Nötr tahmin: 11,46 - 11,69 USD

- İyimser tahmin: 11,69 - 11,92 USD (uygun piyasa koşullarında mümkündür)

2027-2028 Öngörüsü

- Piyasa fazı beklentisi: Potansiyel büyüme evresi

- Fiyat aralığı tahmini:

- 2027: 7,52 - 18,25 USD

- 2028: 9,48 - 20,19 USD

- Temel tetikleyiciler: Artan benimsenme, teknolojik ilerlemeler

2030 Uzun Vadeli Beklenti

- Temel senaryo: 13,26 - 21,73 USD (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 21,73 - 23,91 USD (güçlü piyasa performansı durumunda)

- Dönüştürücü senaryo: 23,91 USD üzeri (aşırı olumlu koşullarda)

- 31 Aralık 2030: SUT 21,73 USD (2025 seviyesine göre %89 yükseliş)

| Yıl | Tahmini En Yüksek | Tahmini Ortalama | Tahmini En Düşük | Fiyat Değişimi (%) |

|---|---|---|---|---|

| 2025 | 11,92048 | 11,462 | 6,8772 | 0 |

| 2026 | 12,97728 | 11,69124 | 10,63903 | 1 |

| 2027 | 18,2547 | 12,33426 | 7,5239 | 7 |

| 2028 | 20,18871 | 15,29448 | 9,48258 | 33 |

| 2029 | 25,72532 | 17,7416 | 16,49969 | 54 |

| 2030 | 23,9068 | 21,73346 | 13,25741 | 89 |

IV. SUT İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

SUT Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Yüksek risk toleransına sahip uzun vadeli yatırımcılar

- Uygulama önerileri:

- Piyasa geri çekilmelerinde SUT biriktirin

- Fiyat hedefleri belirleyin ve yatırım planınıza sadık kalın

- Tokenlarınızı güvenli cüzdanlarda ve yedekleyerek saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Kısa ve uzun dönemli fiyat trendlerini izleyin

- RSI: Aşırı alım/aşırı satım bölgelerini tespit edin

- Dalgalı işlem için önemli noktalar:

- Potansiyel kayıpları sınırlamak için zarar durdur emirleri kullanın

- Belirlenmiş direnç seviyelerinden kar alın

SUT Risk Yönetim Modeli

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcı: %1-3

- Agresif yatırımcı: %5-10

- Profesyonel yatırımcı: %10-15

(2) Riskten Korunma Yöntemleri

- Diversifikasyon: Yatırımlarınızı farklı kripto varlıklara dağıtın

- Zarar durdur emirleriyle kayıpları sınırlayın

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan olarak Gate Web3 Cüzdanı önerilir

- Soğuk saklama: Uzun vadeli tutum için donanım cüzdanı

- Güvenlik önlemleri: 2FA etkinleştirme, güçlü parola kullanımı, özel anahtarların çevrimdışı saklanması

V. SUT İçin Potansiyel Riskler ve Zorluklar

SUT Piyasa Riskleri

- Yüksek volatilite: SUT fiyatı ciddi dalgalanmalar gösterebilir

- Sınırlı likidite: Pozisyon açma/kapama esnekliğini kısıtlayabilir

- Piyasa duyarlılığı: Genel kripto piyasası trendlerinden etkilenme

SUT Düzenleyici Riskler

- Bilinmez düzenleyici ortam: SUT'yi etkileyebilecek yeni düzenlemeler olasılığı

- Sınır ötesi uyum: Farklı ülkelerde değişen regülasyonlar

- Platforma özel riskler: MOAD ve NATUREBOOK platformlarına özgü düzenleyici zorluklar

SUT Teknik Riskler

- Akıllı sözleşme açıklıkları: Sömürü veya hata riski

- Ölçeklenebilirlik sorunları: Polygon ağındaki muhtemel sınırlamalar

- Entegrasyon zorlukları: SUT'nin partner platformlara entegrasyonunda riskler

VI. Sonuç ve Eylem Önerileri

SUT Yatırım Değeri Değerlendirmesi

SUT, küresel reklamcılık ve doğal manzara paylaşım platformları için bir yardımcı token olarak potansiyel sunmaktadır. Ancak kısa vadede yüksek oynaklık ve düzenleyici belirsizliklerle karşı karşıya. Uzun vadeli değer, ilgili platformların başarısı ve yaygın kabul görmesiyle şekillenecektir.

SUT Yatırım Tavsiyeleri

✅ Yeni yatırımcılar: Derin araştırma sonrası küçük ve uzun vadeli pozisyonlar açmayı değerlendirin

✅ Deneyimli yatırımcılar: Sıkı risk yönetimiyle ortalama maliyetli alım stratejisi uygulayın

✅ Kurumsal yatırımcılar: SUT’yi, işlevsellik ve benimsenme metriklerine odaklanarak çeşitlendirilmiş kripto portföyünüzde değerlendirin

SUT Alım-Satım Katılım Yöntemleri

- Spot işlemler: SUT alım-satım işlemlerinizi Gate.com üzerinden gerçekleştirebilirsiniz.

- Staking: Varsa staking programlarına katılım

- Platform kullanımı: SUT'yi MOAD ve NATUREBOOK ekosistemlerinde değerlendirin

Kripto para yatırımları çok yüksek risk içerir, bu içerik yatırım tavsiyesi değildir. Yatırımcılar, kararlarını kendi risk profillerine göre dikkatlice vermeli ve profesyonel finansal danışmanlardan destek almalıdır. Kaybetmeyi göze aldığınızdan fazlasını asla yatırmayın.

SSS

SUN'ın 2030 Tahmini Nedir?

SUN'ın 2030 fiyat tahmini, yüzde 27,63 artışla 0,026689 ABD dolarına ulaşması yönünde.

2025'te En İyi Token Fiyat Tahmini Nedir?

Mevcut eğilimlere göre Bitcoin'in, kurumsal benimsenme ve kripto sektöründeki teknolojik ilerlemeler sayesinde 2025'te 150.000 dolara ulaşması bekleniyor.

2030 İçin SOL Fiyat Tahmini Nedir?

Analist tahminlerine göre, Solana’nın 2030 yılı sonunda 1.000-2.000 dolar aralığına ulaşması, 4. çeyrek sonunda ise 1.531 doları hedeflemesi bekleniyor. Bu değerlendirme büyüme ve piyasa konumuna dayanıyor.

Hamster Coin Fiyatları Gelecekte Artar mı?

Evet, Hamster Coin fiyatlarının önemli oranda artması bekleniyor. 2030 yılına kadar yüzde 832,98 yükselişle 0,0₈3073 ABD dolarına ulaşacağı öngörülüyor.

2025 QKC Fiyat Tahmini: QuarkChain Kripto Parası İçin Gelecek Perspektifi ve Piyasa Analizi

2025 LUNC Fiyat Tahmini: Terra Luna Classic’in Çöküş Sonrası Dönemde Potansiyel Toparlanma ve Piyasa Görünümünün Analizi

ICP Kripto: Neden Internet Computer 30 AUD'a Yükselebilir

2025 FET Fiyat Tahmini: Fetch.ai’nin Yerel Token’ı FET İçin Piyasa Eğilimleri ve Gelecek Potansiyeli Analizi

Pi Coin'un GBP cinsinden fiyatını, tahminini ve kar potansiyelini hesaplayın

2025 HBAR Fiyat Tahmini: Hedera Hashgraph, Kripto Piyasasında Yeni Zirvelere Ulaşabilir mi?

Yapay Zekâ ile Sanat Oluşturma: NFT Üretimi İçin En İyi Araçlar

Konsorsiyum Blockchain'i Anlamak: Temel Özellikler ve Avantajlar

Delegated Proof of Stake (DPoS) Kavramının İncelenmesi

Kripto Kopya Ticaretinde En İyi Platformlar: Başlangıç Seviyesine Uygun Alternatifler

Kripto muslukları üzerinden ücretsiz kripto para kazanabileceğiniz en iyi uygulamalar