2025 SUI Fiyat Tahmini: Sui Network Token’ın Olası Büyümesi ve Piyasa Trendlerinin Analizi

Giriş: SUI'nin Piyasadaki Konumu ve Yatırım Değeri

Ölçeklenebilirlik ve verimlilik için tasarlanmış önde gelen bir Katman 1 blokzincir olan Sui (SUI), 2023'teki çıkışından bu yana önemli aşamalar kaydetti. 2025 itibarıyla Sui'nin piyasa değeri 10,28 milyar dolar seviyesine ulaşırken, dolaşımdaki arzı yaklaşık 3,63 milyar token ve fiyatı 2,84 dolar civarında seyrediyor. Genellikle “Yeni Nesil Web3 Altyapısı” olarak tanımlanan bu varlık, merkeziyetsiz uygulama ve deneyimlere destek sunmada giderek daha önemli bir rol üstleniyor.

Bu makalede, Sui'nin 2025-2030 yılları arasındaki fiyat eğilimleri detaylı şekilde analiz edilmekte; tarihsel desenler, piyasa arz ve talebi, ekosistem gelişimi ve makroekonomik faktörler bir araya getirilerek profesyonel fiyat tahminleri ve yatırımcılara yönelik pratik stratejiler sunulmaktadır.

I. SUI Fiyat Geçmişi ve Mevcut Durumu

SUI Tarihsel Fiyat Gelişimi

- 2023: SUI, 0,1 dolardan piyasaya çıktı; fiyat bir ayda 1,91 dolara yükseldi

- 2024: Ekosistem büyümesiyle 6 Ocak'ta tüm zamanların zirvesi olan 5,3674 dolara ulaştı

- 2025: Piyasa düzeltmesiyle fiyat 15 Ekim'de 2,8357 dolara geriledi

SUI Güncel Piyasa Durumu

15 Ekim 2025 itibarıyla SUI, 2,8357 dolardan işlem görüyor ve piyasa değeri bakımından 21. sırada. Token son bir saatte %1,17 artış, son 24 saatte ise %1,62 düşüş yaşadı. SUI'nin piyasa değeri 10,28 milyar dolar, dolaşımdaki arzı 3,63 milyar, toplam arzı ise 10 milyar. Token şu anda 6 Ocak 2025'te kaydedilen 5,3674 dolarlık zirvesinin %47,17 altında işlem görüyor. 24 saatlik işlem hacmi ise 28,45 milyon dolar seviyesinde ve bu, piyasada orta düzeyde aktiviteye işaret ediyor. Son fiyat düşüşüne rağmen SUI, son bir yılda %26,56’lık artış göstererek kısa vadeli dalgalanmalara rağmen uzun vadeli büyüme potansiyeli sergiliyor.

Güncel SUI piyasa fiyatını görmek için tıklayın

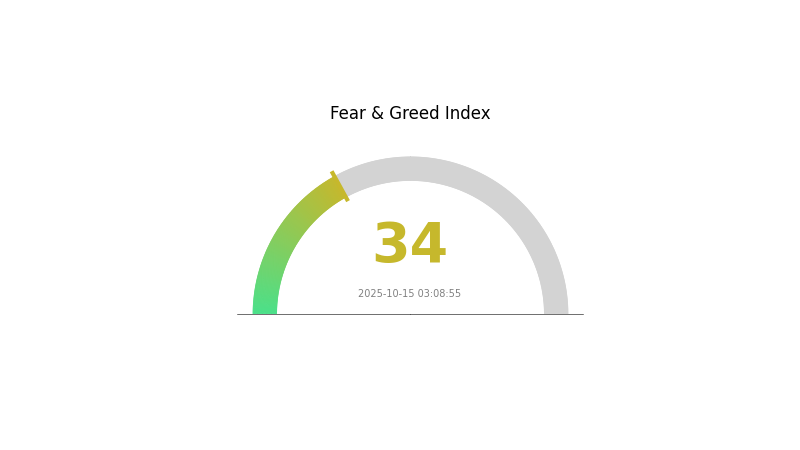

SUI Piyasa Duyarlılığı Göstergesi

2025-10-15 Korku ve Açgözlülük Endeksi: 34 (Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında şu anda korku hakim ve Korku ve Açgözlülük Endeksi 34 seviyesinde. Bu, yatırımcıların temkinli davrandığını ve cesur pozisyonlar almaktan kaçındığını gösteriyor. Böyle dönemlerde bazı yatırımcılar, varlıkları daha düşük fiyatlardan toplama fırsatı olarak görebilir. Ancak, yatırım kararları öncesinde detaylı araştırma yapmak ve kişisel risk toleransınızı dikkate almak büyük önem taşır. Unutulmamalıdır ki, kripto piyasasında duyarlılık hızlıca değişebilir.

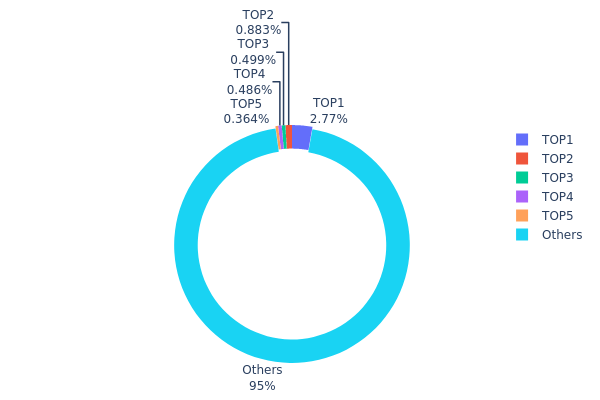

SUI Varlık Dağılımı

Adres bazındaki varlık dağılımı verileri, SUI tokenlerinin adresler arasında ne kadar merkeziyetsiz dağıldığını gösterir. Analizler, SUI’de oldukça merkeziyetsiz bir dağılım olduğunu ortaya koymaktadır. En büyük adres toplam arzın sadece %2,77’sini elinde tutarken, sonraki dört adresin her biri %1’in altında paya sahiptir. İlk 5 adres birlikte toplam arzın yaklaşık %5’ini elinde bulundururken, kalan %95 diğer adresler arasında dağılmıştır.

Bu dağılım yapısı, SUI sahipliğinde sağlıklı bir merkeziyetsizlik olduğunu gösteriyor. Birkaç adreste yoğunlaşmanın olmaması, piyasa manipülasyonu riskini azaltır ve fiyat istikrarını destekler. Ayrıca, geniş bir kullanıcı tabanına ve SUI ekosisteminin yaygın benimsenmesine işaret eder. En büyük adresler önemli miktarlara sahip olsa da, piyasaya etkileri sınırlı düzeydedir; bu da genel piyasa yapısı ve likidite açısından olumludur.

Mevcut adres dağılımı, SUI'nin zincir üstü yapısının sağlam ve istikrarlı olduğunu gösteriyor. Bu merkeziyetsiz yapı, blokzincir prensipleriyle uyumlu olup, SUI ekosisteminde uzun vadeli sürdürülebilirlik ve düşük volatiliteye katkı sağlayabilir.

Güncel SUI Varlık Dağılımı için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xac5b...13c33c | 277091,92K | 2,77% |

| 2 | 0x1561...45fc76 | 88329,24K | 0,88% |

| 3 | 0x60dd...b0984d | 49855,27K | 0,50% |

| 4 | 0x7ab9...c71cec | 48630,25K | 0,49% |

| 5 | 0xdad8...554b5a | 36355,92K | 0,36% |

| - | Diğerleri | 9499737,39K | 95% |

II. SUI'nin Gelecekteki Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Ağ Yükseltmeleri: Sui Network'ün teknolojik gelişmeleri ve ağ optimizasyonları, SUI tokenlerinin değer kazanmasında belirleyici olacaktır.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Benimseme: Sui Network'te merkeziyetsiz uygulamaların geliştirilmesi ve devreye alınması, SUI'nin benimsenme oranı ve talebini doğrudan etkileyecektir.

Makroekonomik Ortam

- Düzenleme Etkisi: Kripto para ve blokzincir teknolojisine yönelik küresel düzenlemelerdeki değişiklikler, Sui Network'ün işleyişini ve SUI'nin piyasa performansını etkileyebilir.

Teknolojik Gelişme ve Ekosistem Oluşumu

- Ekosistem Büyümesi: Sui Network ekosisteminin büyümesi ve merkeziyetsiz uygulamaların geliştirilip devreye alınması, SUI'nin benimsenme oranı ve talebine doğrudan etki edecektir.

- Ortaklıklar ve Entegrasyonlar: Diğer blokzincir projeleri ve teknoloji platformlarıyla yapılan iş birlikleri, Sui'nin görünürlüğünü ve kullanımını artıracaktır.

- Ekosistem Uygulamaları: Yüksek performanslı blokzincir platformlarına olan piyasa talebi, SUI'nin benimsenmesi ve değerini doğrudan etkiler.

III. 2025-2030 SUI Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 2,00 - 2,50 dolar

- Tarafsız tahmin: 2,50 - 3,00 dolar

- İyimser tahmin: 3,00 - 3,33 dolar (geniş çaplı kripto piyasa toparlanması gerektirir)

2027-2028 Görünümü

- Piyasa döngüsü beklentisi: Artan benimsenmeyle yükseliş trendi potansiyeli

- Fiyat aralığı tahmini:

- 2027: 2,95 - 4,07 dolar

- 2028: 2,53 - 4,22 dolar

- Başlıca katalizörler: Ekosistem genişlemesi, teknolojik yükseltmeler, kurumsal ilginin artması

2030 Uzun Vadeli Görünüm

- Temel senaryo: 3,33 - 4,69 dolar (istikrarlı benimsenme ve gelişim varsayımıyla)

- İyimser senaryo: 4,69 - 6,00 dolar (ekosistemin belirgin şekilde büyümesi ve ana akım entegrasyonla)

- Dönüştürücü senaryo: 6,00 - 6,90 dolar (çığır açıcı uygulamalar ve kitlesel benimseme ile)

- 2030-12-31: SUI 6,89674 dolar (yeni zirvelere ulaşma potansiyeliyle)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Getiri (%) |

|---|---|---|---|---|

| 2025 | 3,3322 | 2,8239 | 2,00497 | 0 |

| 2026 | 4,12459 | 3,07805 | 2,61634 | 8 |

| 2027 | 4,06949 | 3,60132 | 2,95308 | 26 |

| 2028 | 4,21895 | 3,83541 | 2,53137 | 35 |

| 2029 | 5,35614 | 4,02718 | 3,4231 | 42 |

| 2030 | 6,89674 | 4,69166 | 3,33108 | 65 |

IV. SUI İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

SUI Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Uygun olanlar: Uzun vadeli yatırımcılar ve Sui ekosistemine inananlar

- İşlem önerileri:

- Piyasa düşüşlerinde SUI biriktirin

- Kısmi kar realizasyonu için fiyat hedefleri belirleyin

- SUI’yi güvenli, kendi gözetiminizdeki cüzdanlarda saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve olası dönüş noktalarını tespit etmek için kullanılır

- RSI (Göreceli Güç Endeksi): Aşırı alım/aşırı satım durumlarını göstermek için kullanılır

- Kısa vadeli al-sat için önemli noktalar:

- Fiyat hareketlerinin teyidi için işlem hacmini izleyin

- Risk yönetimi için zararı durdur emirleri kullanın

SUI Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Planları

- Diversifikasyon: Yatırımlarınızı birden fazla Katman 1 projeye dağıtın

- Zararı durdur emirleri: Olası kayıpları sınırlamak için uygulayın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk saklama çözümü: Uzun vadeli tutum için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama etkinleştirin, güçlü şifreler kullanın

V. SUI İçin Potansiyel Riskler ve Zorluklar

SUI Piyasa Riskleri

- Volatilite: Kripto piyasasında doğal fiyat dalgalanmaları

- Rekabet: Yeni Katman 1 çözümleri SUI'nin pazar payını etkileyebilir

- Likidite: Aşırı piyasa koşullarında potansiyel sorunlar

SUI Düzenleyici Riskler

- Düzenleyici belirsizlik: Küresel kripto düzenlemelerindeki değişimler

- Uyum zorlukları: Yeni yasalara uyumda karşılaşılabilecek engeller

- Coğrafi kısıtlamalar: Bazı bölgelerde olası sınırlandırmalar

SUI Teknik Riskler

- Ağ güvenliği: Blokzincirdeki olası açıklar

- Ölçeklenebilirlik sorunları: Benimsenme arttıkça ortaya çıkabilecek sıkıntılar

- Akıllı sözleşme riskleri: Merkeziyetsiz uygulamalarda hata veya istismar olasılığı

VI. Sonuç ve Eylem Önerileri

SUI Yatırım Değeri Değerlendirmesi

SUI, ölçeklenebilir bir Katman 1 çözümü olarak uzun vadede umut vaat eder; ancak kısa vadeli volatilite ve piyasa riskleri dikkatle değerlendirilmelidir.

SUI Yatırım Önerileri

✅ Yeni başlayanlar: Pozisyon oluşturmak için küçük, düzenli yatırımlarla başlayın ✅ Deneyimli yatırımcılar: Uzun vadeli tutum ile aktif alım-satımı birleştiren dengeli bir yaklaşım seçin ✅ Kurumsal yatırımcılar: Stratejik iş birlikleri ve ekosistem yatırımlarını değerlendirin

SUI Alım-Satım Katılım Yöntemleri

- Spot işlem: Gate.com üzerinden SUI tokenleri alıp tutabilirsiniz

- Staking: SUI stake programlarına katılarak pasif gelir sağlayabilirsiniz

- DeFi katılımı: Sui tabanlı merkeziyetsiz finans protokollerinde işlem yapabilirsiniz

Kripto para yatırımları oldukça yüksek risk içerir ve bu makale yatırım tavsiyesi değildir. Yatırımcılar kararlarını kendi risk toleranslarına göre dikkatlice vermeli ve profesyonel finansal danışmanlara başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

SSS

Sui, 2025’te ne kadar yükselebilir?

Sui, 2025’te yeni bir zirve olan 6,25 dolara ulaşabilir; yıl sonunda ortalama fiyatı ise 5,05 dolar olabilir.

Sui 100 dolara ulaşabilir mi?

Evet, Sui uzun vadede büyümesini sürdürür ve Web3 ekosisteminde yaygın şekilde benimsenirse 100 dolara ulaşma potansiyeline sahiptir.

Sui 50 dolara ulaşabilir mi?

Evet, artan benimsenme, teknolojik gelişmeler ve olumlu piyasa koşulları ile Sui gelecekte 50 dolara ulaşabilir.

Sui kripto paranın bir geleceği var mı?

Evet, Sui kripto paranın geleceği parlak. Ekosistemi özellikle DeFi, NFT ve oyun alanlarında hızla genişliyor. Ağın büyümesi ve performansı, uzun vadeli başarı için güçlü bir potansiyel sunuyor.

Layer3 (L3) Yatırım İçin Uygun mu?: Yükselen Blockchain Protokolünün Olası Getirileri ve Risklerinin Değerlendirilmesi

2025 ELF Fiyat Tahmini: aelf için Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

2025 TIA Fiyat Tahmini: Celestia'nın Yerel Token'ı İçin Piyasa Eğilimleri ve Uzman Öngörülerinin Analizi

Astar Token (ASTR) iyi bir yatırım mı?: Bu Polkadot parachain projesinin potansiyeli ve risklerinin analizi

Kaia (KAIA) iyi bir yatırım mı?: Bu Yükselen Kriptoparanın Potansiyeli ve Risklerinin Analizi

Bitcoin Stok-Akış Modelinin Mantığını Kavramak

Sürekli Swap Sözleşmeleri Üzerinde Uzmanlaşmak: Traderlar İçin Kapsamlı Rehber

Linea Network’ı Keşfetmek: Ethereum’un Layer 2 Gelişmelerine Yönelik Temel Rehberiniz

Varlıklarınızı Polygon Ağı’na kesintisiz şekilde bağlayın

Blockchain Hash Fonksiyonlarının Mantığını Kavramak: Mekanizmalar ve Kullanım Alanları