2025 ELF Fiyat Tahmini: aelf için Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

Giriş: ELF’in Piyasadaki Konumu ve Yatırım Değeri

aelf (ELF), yapay zeka ile güçlendirilmiş bir Layer 1 blokzincir ağı olarak 2017’den bu yana önemli aşamalar kaydetmiş ve 2020’de ana ağını başarıyla devreye almıştır. 2025 itibarıyla aelf’in piyasa değeri 112.167.002 $’a ulaşmış; dolaşımdaki arzı yaklaşık 795.510.657 token ve fiyatı 0,141 $ bandında seyretmektedir. “Asya’nın blokzincir dönüşümünde öncü” olarak anılan bu varlık, Web3 ve yapay zeka teknolojilerinin benimsenmesinde giderek daha belirleyici bir rol üstlenmektedir.

Bu makalede, 2025-2030 döneminde aelf’in fiyat hareketleri; geçmiş veriler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler ışığında profesyonel analiz ile öngörülerek, yatırımcılara uzman fiyat tahminleri ve pratik yatırım stratejileri sunulacaktır.

I. ELF Fiyat Geçmişi ve Güncel Piyasa Durumu

ELF Tarihsel Fiyat Seyri

- 2017: Proje Coindesk konferansında tanıtıldı, fon toplama süreci başarıyla tamamlandı

- 2018: Testnet başlatıldı, 9 Ocak’ta fiyat 2,6 $ ile tüm zamanların zirvesine ulaştı

- 2020: Ana ağ devreye alındı, 13 Mart’ta fiyat 0,03545756 $ ile en düşük seviyeyi gördü

ELF Güncel Piyasa Görünümü

20 Ekim 2025 tarihi itibarıyla ELF, 0,141 $ seviyesinden işlem görmekte olup kripto para piyasasında 384. sıradadır. Son 24 saatte %0,07’lik artış kaydeden token’ın işlem hacmi 26.167,62 $’dır. ELF’in piyasa değeri şu anda 112.167.002,68 $ seviyesinde olup, toplam kripto piyasasının %0,0036’sını oluşturmaktadır.

ELF, farklı dönemlerde dalgalı bir performans sergilemiştir. Son 24 saatte hafif bir yükseliş yaşanırken, uzun vadede ciddi kayıplar söz konusudur. Token, son bir haftada %10,25, son bir ayda ise %27,27 oranında değer kaybetmiştir. Yıllık bazda ise en yüksek düşüş %63,7 ile gerçekleşmiştir.

Güncel fiyat, 9 Ocak 2018’deki 2,6 $ ile belirlenen tüm zamanların en yüksek seviyesinin oldukça altındadır. Ancak, 13 Mart 2020’deki 0,03545756 $’lık en düşük seviyesinin ise üstündedir. Dolaşımdaki ELF arzı 795.510.657,3274444 token ile maksimum arzın %79,55’ine (1.000.000.000 token) karşılık gelmektedir.

Güncel ELF piyasa fiyatını görüntülemek için tıklayın

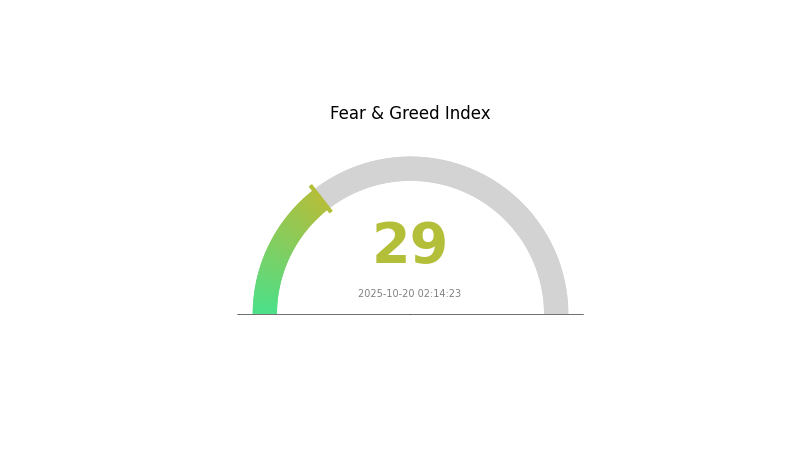

ELF Piyasa Duyarlılığı Göstergesi

20 Ekim 2025 Korku ve Açgözlülük Endeksi: 29 (Korku)

Güncel Korku & Açgözlülük Endeksini görmek için tıklayın

Kripto piyasasında şu anda korku hakim ve Korku ve Açgözlülük Endeksi 29 seviyesinde bulunuyor. Bu durum, yatırımcıların temkinli ve belirsizlik içinde olduğuna işaret etmektedir. Böyle zamanlarda dikkatli olmak ve ani kararlar almaktan kaçınmak gerekir. Korku ortamı, uzun vadeli yatırımcılar için alım fırsatı sunabilir; ancak mutlaka detaylı araştırma yapılmalı ve riskler titizlikle yönetilmelidir. Piyasa duyarlılığının ani değişebileceğini unutmayın; güncel kalın ve stratejinizi buna göre ayarlayın.

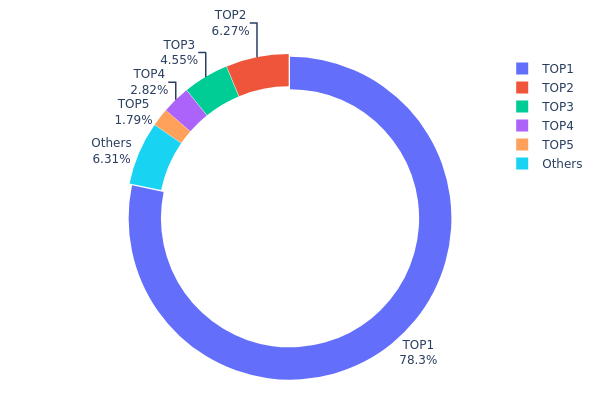

ELF Varlık Dağılımı

ELF’in adres bazındaki varlık dağılımı, çok yüksek oranda merkezileşmiş bir sahiplik yapısı göstermektedir. En büyük adres, toplam arzın %78,26’sını yani 688.746.710 ELF tokeni elinde bulunduruyor. Bu derece yoğunlaşma, merkezileşme ve piyasa manipülasyonu risklerini artırmaktadır.

İkinci en büyük adres %6,26, üçüncü adres ise %4,54 oranında paya sahiptir. İlk beş adres toplamda ELF arzının %93,67’sini kontrol ederken, kalan %6,33’lük bölüm ise diğer adreslere dağılmıştır. Bu dengesiz yapı, ELF ekosisteminde yaygın benimsenmenin ve merkeziyetsizliğin sınırlı olduğunu göstermektedir.

Bu kadar yoğun bir sahiplik dağılımı, fiyat dalgalanmasını artırabilir ve birkaç büyük yatırımcının yönlendireceği ani hareketlere karşı piyasayı hassas hale getirebilir. Ayrıca, yönetişim gücünün de az sayıda elde toplanması, ağın merkeziyetsiz yönetimini tehlikeye atabilir.

Güncel ELF Varlık Dağılımını görüntüleyin

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...aedead | 688746,71K | 78,26% |

| 2 | 0xce03...11da7a | 55155,20K | 6,26% |

| 3 | 0xffe7...250749 | 40000,00K | 4,54% |

| 4 | 0x28c6...f21d60 | 24819,52K | 2,82% |

| 5 | 0x7b35...b2c15d | 15786,08K | 1,79% |

| - | Others | 55492,50K | 6,33% |

II. ELF’in Gelecekteki Fiyatını Belirleyecek Temel Unsurlar

Teknik Gelişim ve Ekosistem Oluşumu

-

Ana Ağ Yükseltmesi: aelf blokzincirinde planlanan kapsamlı ana ağ yükseltmesi, ölçeklenebilirlik ve işlem hızı açısından önemli iyileştirmeler getirecek. Bu yükseltme, ekosisteme daha fazla geliştirici ve kullanıcı çekebilir.

-

Çapraz Zincir Uyumluluğu: aelf, farklı blokzincirler arasında kesintisiz varlık transferi ve iletişim sağlamak için çapraz zincir kabiliyetlerini güçlendiriyor. Bu gelişme, ELF tokeninin kullanım alanını ve benimsenmesini artırabilir.

-

Ekosistem Uygulamaları: aelf platformunda DeFi protokolleri ve NFT pazar yerleri dahil olmak üzere çeşitli merkeziyetsiz uygulamalar geliştiriliyor. Bu projelerin büyümesi, ELF’e olan talebi artırarak fiyatı olumlu etkileyebilir.

III. 2025-2030 Dönemi için ELF Fiyat Tahmini

2025 Görünümü

- İhtiyatlı tahmin: 0,13076 $ - 0,14060 $

- Tarafsız tahmin: 0,14060 $ - 0,14622 $

- İyimser tahmin: 0,14622 $ - 0,15000 $ (güçlü piyasa ivmesiyle)

2026-2027 Görünümü

- Piyasa döngüsü beklentisi: Dalgalı ancak genel olarak yukarı yönlü seyir

- Fiyat aralığı tahmini:

- 2026: 0,08318 $ - 0,16923 $

- 2027: 0,09692 $ - 0,17039 $

- Temel katalizörler: Artan benimseme, teknolojik gelişmeler, piyasa duyarlılığı

2028-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,16335 $ - 0,21912 $ (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,21912 $ - 0,24760 $ (güçlü piyasa performansı varsayımıyla)

- Dönüştürücü senaryo: 0,24760 $ - 0,30000 $ (çığır açıcı gelişmeler ve yaygın benimseme varsayımıyla)

- 31 Aralık 2030: ELF 0,24760 $ (mevcut öngörülere göre potansiyel zirve)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0,14622 | 0,1406 | 0,13076 | 0 |

| 2026 | 0,16923 | 0,14341 | 0,08318 | 1 |

| 2027 | 0,17039 | 0,15632 | 0,09692 | 10 |

| 2028 | 0,23686 | 0,16335 | 0,08821 | 15 |

| 2029 | 0,23813 | 0,20011 | 0,12807 | 41 |

| 2030 | 0,2476 | 0,21912 | 0,20159 | 55 |

IV. ELF için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

ELF Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Uygun profiller: Uzun vadeli bakış açısına ve risk toleransına sahip yatırımcılar

- İşlem önerileri:

- Piyasa düşüşlerinde ELF alımına yönelin

- Kısmi kar realizasyonu için hedef fiyatlar belirleyin

- Uzun vadeli saklama için güvenli donanım cüzdanlarını tercih edin

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve olası dönüş seviyelerini tespit etmek için kullanılır

- RSI (Göreceli Güç Endeksi): Aşırı alım ve aşırı satım koşullarını değerlendirmek için kullanılır

- Dalgalı ticaret için temel noktalar:

- Fiyat hareketlerinin teyidi için işlem hacmini izleyin

- Zarar durdur emirleri ile aşağı yönlü riskleri yönetin

ELF Risk Yönetim Çerçevesi

(1) Varlık Dağılımı Esasları

- Ihtiyatlı yatırımcılar: Kripto portföyünün %1-3’ü

- Aggresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Yatırımlarınızı birden fazla kripto varlığa yayarak riski azaltın

- Zarar durdur emirleri: Potansiyel kayıpları sınırlandırmak için uygulayın

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk saklama: Uzun vadeli tutumlar için donanım cüzdanlarını kullanın

- Güvenlik önlemleri: İki faktörlü doğrulamayı etkinleştirin, güçlü şifreler kullanın

V. ELF İçin Potansiyel Riskler ve Zorluklar

ELF Piyasa Riskleri

- Aşırı oynaklık: Kripto piyasalarında sık rastlanan yüksek fiyat dalgalanmaları

- Likitide sorunu: Büyük işlemlerde önemli fiyat kaymalarının yaşanabilmesi

- Piyasa duyarlılığı: Haberler ve sosyal medyanın tetiklediği ani yön değişiklikleri

ELF Regülasyon Riskleri

- Düzenleyici belirsizlik: ELF’in operasyonlarını etkileyebilecek yeni mevzuat riskleri

- Uyum zorlukları: Küresel regülasyonlardaki değişimlere ayak uydurma gerekliliği

- Sınır ötesi kısıtlamalar: Uluslararası işlemler ve iş ortaklıklarında yaşanabilecek engeller

ELF Teknik Riskleri

- Akıllı sözleşme açıkları: Blokzincir kodunda istismar potansiyeli

- Ölçeklenebilirlik zorlukları: Yüksek talep dönemlerinde ağın tıkanması riski

- Teknolojik geri kalma: Daha yeni blokzincir teknolojilerinin gerisinde kalma riski

VI. Sonuç ve Eylem Tavsiyeleri

ELF Yatırım Değeri Analizi

ELF, yüksek risk ve yüksek getiri potansiyeline sahip bir yatırım imkanı sunmaktadır. Uzun vadeli değerini, yapay zeka destekli blokzincir altyapısı ve modüler Layer 2 çözümlerinden almaktadır. Kısa vadede ise piyasa oynaklığı ve regülasyon belirsizlikleri önemli riskler oluşturmaktadır.

ELF Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük ve düzenli yatırımlarla kademeli pozisyon oluşturmayı değerlendirmeli ✅ Deneyimli yatırımcılar: Ortalama maliyet yöntemi uygulayıp net kar hedefleri belirlemeli ✅ Kurumsal yatırımcılar: Derinlemesine analiz yapıp büyük işlemler için OTC piyasasını değerlendirmeli

ELF İşlem Katılım Yolları

- Spot alım-satım: Gate.com spot piyasasında ELF alım-satımı yapabilirsiniz

- Staking: Mümkünse ELF staking programlarına katılabilirsiniz

- DeFi entegrasyonu: aelf ekosistemindeki merkeziyetsiz finans seçeneklerini keşfedebilirsiniz

Kripto para yatırımları çok yüksek risk taşır ve bu makale yatırım tavsiyesi içermez. Yatırımcılar, kendi risk profillerine göre dikkatli hareket etmeli ve profesyonel finansal danışmanlarla görüşmelidir. Kaybetmeyi göze alabileceğinizden fazlasını asla yatırmayın.

SSS

ELF hissesi ne kadar yükselebilir?

ELF, Web3’teki artan benimseme ve piyasa büyümesiyle 2026’da 5-7 $ aralığına ulaşabilir.

Elf Labs’a yatırım yapılır mı?

Evet, Elf Labs inovatif blokzincir çözümleri ve artan benimsenme ile 2025’te Web3’te güçlü büyüme potansiyeli sunmaktadır.

ELF için hedef fiyat nedir?

Piyasa analizi ve uzman görüşlerine göre, 2025 için ELF hedef fiyatı Web3 büyümesini yansıtarak yaklaşık 2,50 $ – 3,00 $ aralığındadır.

ELF aşırı değerli mi?

Hayır, ELF aşırı değerli değil. Mevcut fiyatı, Web3 ekosistemindeki büyüyen benimsenme ve potansiyeli yansıtıyor. ELF’in özgün özellikleri ve iş ortaklıkları, daha fazla büyüme alanı olduğunu gösteriyor.

2025 SUI Fiyat Tahmini: Sui Network Token’ın Olası Büyümesi ve Piyasa Trendlerinin Analizi

Layer3 (L3) Yatırım İçin Uygun mu?: Yükselen Blockchain Protokolünün Olası Getirileri ve Risklerinin Değerlendirilmesi

2025 TIA Fiyat Tahmini: Celestia'nın Yerel Token'ı İçin Piyasa Eğilimleri ve Uzman Öngörülerinin Analizi

Astar Token (ASTR) iyi bir yatırım mı?: Bu Polkadot parachain projesinin potansiyeli ve risklerinin analizi

Kaia (KAIA) iyi bir yatırım mı?: Bu Yükselen Kriptoparanın Potansiyeli ve Risklerinin Analizi

Dropee Günlük Kombinasyonu 12 Aralık 2025

Tomarket Günlük Kombinasyonu 12 Aralık 2025

SEI Airdrop Ödülleri’ne Katılım ve Talep Etme Kılavuzu

Kripto para birimlerinde algoritmik alım satım için etkili stratejiler

Stock-to-Flow Model ile Bitcoin'in Değerlemesini Anlamak