2025 STRIKE Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

Giriş: STRIKE'ın Piyasadaki Konumu ve Yatırım Potansiyeli

StrikeBit AI (STRIKE), Modüler Aracı Protokolü (MAP) olarak kullanıcıların ölçeklenebilir iş birliği için akıllı çoklu ajan sistemleri inşa etmesine, geliştirmesine ve birleştirmesine olanak tanımaktadır. 2025 yılı itibarıyla STRIKE'ın piyasa değeri 2.875.630 ABD dolarına ulaşırken, dolaşımdaki arzı yaklaşık 209.900.000 token ve fiyatı yaklaşık 0,0137 ABD doları seviyesindedir. “İş birliği zekasının itici gücü” olarak tanımlanan bu varlık, ölçeklenebilir ajan tabanlı sistemler alanında giderek artan bir öneme sahiptir.

Bu makalede, STRIKE'ın 2025-2030 dönemindeki fiyat eğilimleri; tarihsel desenler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik göstergeler ile birlikte detaylı şekilde analiz edilecek ve yatırımcılara profesyonel fiyat tahminleri ile uygulanabilir yatırım stratejileri sunulacaktır.

I. STRIKE Fiyat Geçmişi ve Mevcut Piyasa Durumu

STRIKE'ın Tarihsel Fiyat Gelişimi

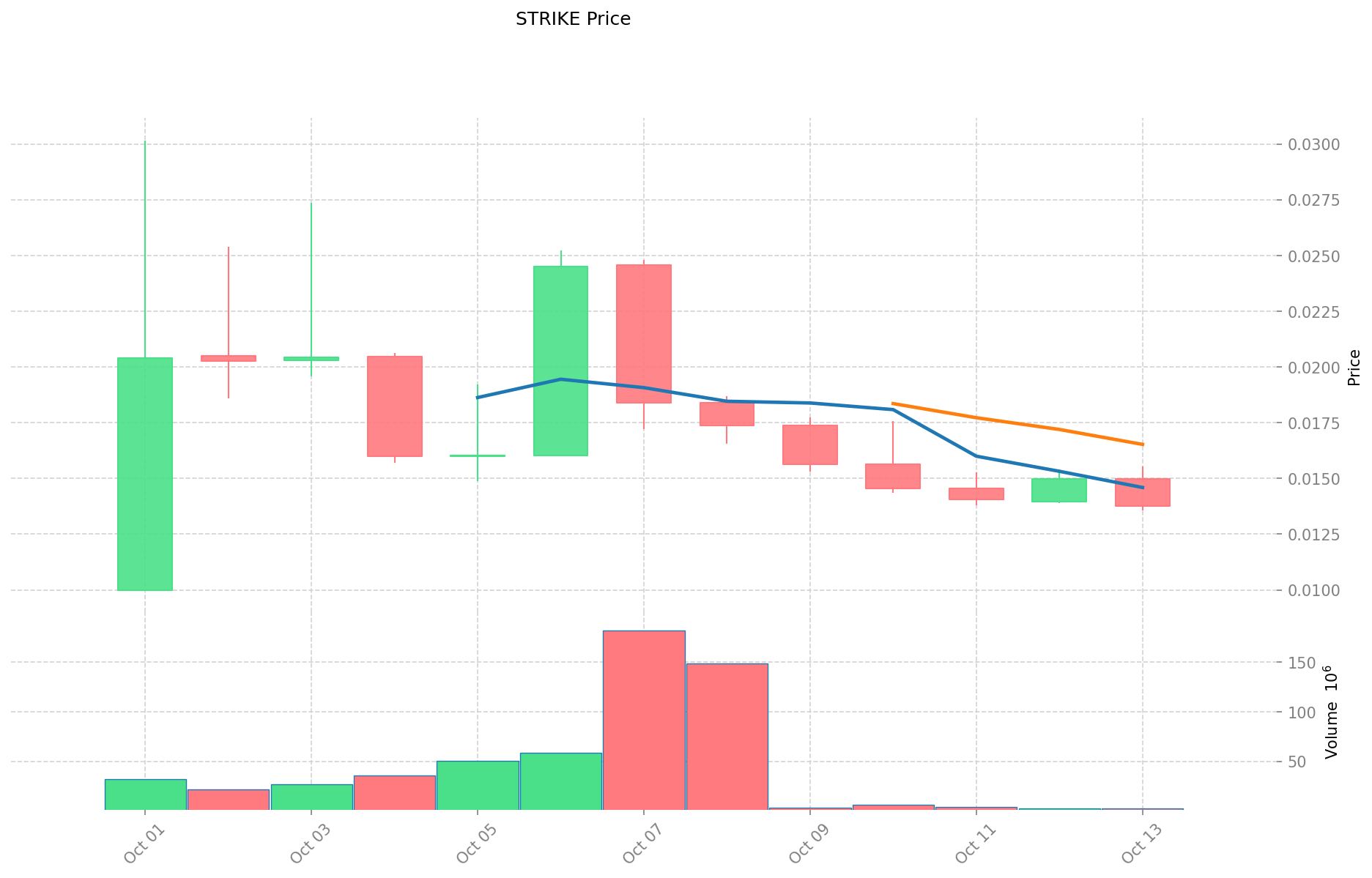

- 2025: Proje başlatıldı, fiyat 1 Ekim'de tüm zamanların zirvesi olan 0,03015 ABD dolarına ulaştı

- 2025: Piyasa düzeltmesiyle fiyat 1 Ekim'de tüm zamanların en düşük seviyesi olan 0,01 ABD dolarına geriledi

STRIKE Güncel Piyasa Görünümü

14 Ekim 2025 itibarıyla STRIKE, 0,0137 ABD doları fiyatla işlem görmektedir ve bu, tarihi zirvesinden %54,56 düşüşe işaret etmektedir. Token son dönemde kayda değer bir volatilite göstermiştir:

- 1 saat: +%0,22

- 24 saat: -%7,79

- 7 gün: -%36,08

- 30 gün: -%64,21

STRIKE'ın piyasa değeri şu an 2.875.630 ABD doları olup, kripto para piyasasında 2.121. sırada yer almaktadır. Dolaşımdaki arzı 209.900.000 STRIKE olup, bu rakam maksimum arzın %10,5'ine denk gelmektedir (2.000.000.000 token).

Son 24 saatteki işlem hacmi 41.319,55 ABD doları ile piyasanın orta seviyede aktif olduğuna işaret etmektedir. STRIKE için mevcut piyasa hissiyatı, çoklu zaman dilimlerinde yaşanan ciddi fiyat düşüşleriyle net bir şekilde ayı yönündedir.

Güncel STRIKE piyasa fiyatını görüntüleyin

STRIKE Piyasa Duyarlılığı Göstergesi

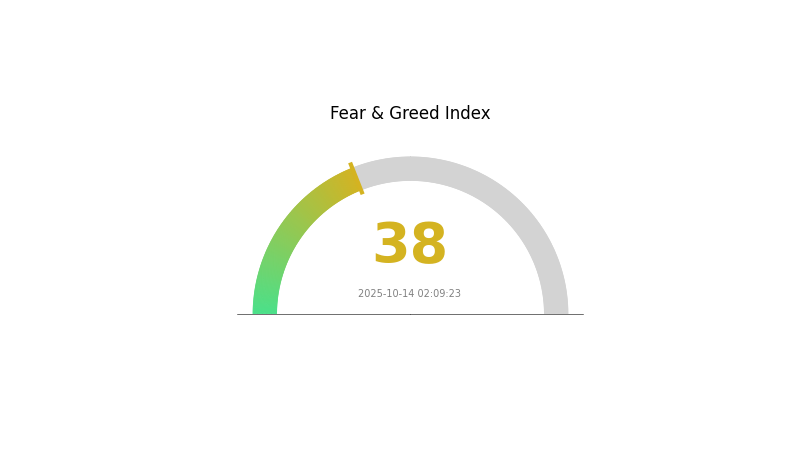

14 Ekim 2025 Korku ve Açgözlülük Endeksi: 38 (Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında duyarlılık, Korku ve Açgözlülük Endeksi'nin 38 seviyesinde kalmasıyla temkinli olarak devam etmektedir ve bu da piyasada korku havasına işaret etmektedir. Yatırımcıların çekingen olduğu ve potansiyel alım fırsatlarını kolladığı görülmektedir. Ancak piyasa duyarlılığının hızla değişebileceği unutulmamalıdır. Yatırımcılar, güncel gelişmeleri takip etmeli, risklerini etkin şekilde yönetmeli ve portföylerini çeşitlendirmeye özen göstermelidir. Kripto piyasasının oynak ortamında ilerlemek için kapsamlı araştırma ve uzun vadeli bakış açısı her zamankinden daha önemlidir.

STRIKE Varlık Dağılımı

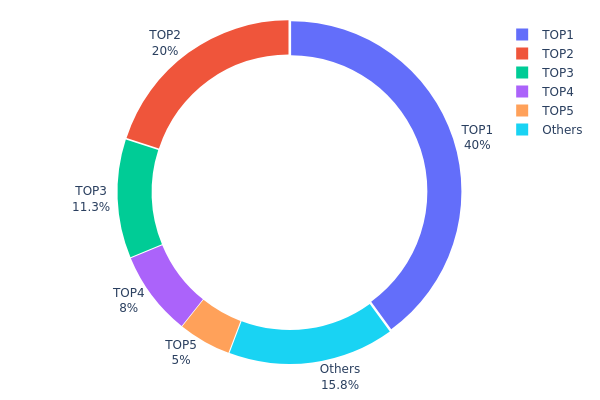

STRIKE'ın adres bazlı varlık dağılımı, oldukça yoğunlaşmış bir sahiplik yapısı sergilemektedir. En büyük adres, toplam arzın %40'ını tutarken; ilk 5 adres, tüm STRIKE tokenların %84,25'ini elinde bulundurmaktadır. Bu seviye, token'ın merkeziyetsizliği ve piyasa güvenliği açısından önemli riskler barındırmaktadır.

Böylesine yoğun bir dağılım, STRIKE'ın piyasa dinamikleri üzerinde büyük etki yaratabilir. Az sayıda adresin büyük payı kontrol etmesi, fiyat manipülasyonu ve yüksek volatilite riskini artırmaktadır. “Balina” diye adlandırılan büyük sahipler, işlemleriyle piyasada ciddi dalgalanmalara neden olabilir. Ayrıca, bu yoğunluk token'ın yönetişim ve karar alma süreçlerinin dar bir paydaş grubunun etkisiyle şekillenebileceğine işaret etmektedir.

Mevcut dağılım yapısı, STRIKE için düşük merkeziyetsizlik seviyesini göstermektedir. Büyük sahiplerin uzun vadeli çıkarlarının olması, belirli bir istikrar sunsa da; genel piyasa katılımcıları için risk doğurmakta ve adil dağılıma önem veren yeni yatırımcıları uzaklaştırabilmektedir.

Güncel STRIKE varlık dağılımını inceleyin

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x3153...89821e | 800.000,00K | 40,00% |

| 2 | 0xa463...f3371e | 400.000,00K | 20,00% |

| 3 | 0x3362...5f032f | 225.000,00K | 11,25% |

| 4 | 0xc3d4...994150 | 160.000,00K | 8,00% |

| 5 | 0x198f...e634ef | 100.000,00K | 5,00% |

| - | Diğerleri | 315.000,00K | 15,75% |

II. STRIKE'ın Gelecekteki Fiyatını Etkileyen Temel Etkenler

Arz Mekanizması

- Token Yakımı: STRIKE, dolaşımdaki arzı azaltmak için token yakma mekanizması uygular.

- Tarihsel Etki: Geçmişteki yakımlar, arzın azalması nedeniyle fiyat üzerinde genellikle olumlu etki yaratmıştır.

- Güncel Etki: Aktif token yakımları, toplam arzın azalması yoluyla STRIKE fiyatını desteklemeye devam edecektir.

Kurumsal ve Balina Etkileri

- Kurumsal Varlıklar: STRIKE, birçok kripto yatırım fonunun portföyüne girmiş olup, kurumsal talepte artış gözlenmektedir.

Makroekonomik Koşullar

- Enflasyon Koruması: STRIKE, bazı dönemlerde fiyatı ile enflasyon oranları arasında pozitif korelasyon göstererek enflasyona karşı koruma potansiyeline işaret etmiştir.

Teknik Gelişim ve Ekosistem Oluşumu

- Layer 2 Entegrasyonu: STRIKE, ölçeklenebilirliği artırmak ve işlem maliyetlerini düşürmek için Layer 2 çözümlerine entegre olmayı hedeflemektedir.

- Çapraz Zincir Uyumluluğu: Geliştirici ekip, STRIKE'ın farklı blockchain ağlarında kullanımını artıracak çapraz zincir yeteneklerini güçlendirmektedir.

- Ekosistem Uygulamaları: Birçok DeFi protokolü ve merkeziyetsiz borsa, STRIKE entegrasyonu ile ekosistemde kullanım alanlarını genişletmiştir.

III. 2025-2030 STRIKE Fiyat Tahminleri

2025 Öngörüsü

- Ihtiyatlı tahmin: 0,00699 - 0,01370 ABD doları

- Tarafsız tahmin: 0,01370 - 0,01459 ABD doları

- İyimser tahmin: 0,01459 - 0,01548 ABD doları (olumlu piyasa ve proje gelişmeleriyle)

2027-2028 Öngörüsü

- Piyasa aşaması: Artan benimseme ile büyüme evresi

- Fiyat aralığı tahmini:

- 2027: 0,01411 - 0,02008 ABD doları

- 2028: 0,01126 - 0,01985 ABD doları

- Temel katalizörler: Teknolojik ilerleme, yeni ortaklıklar ve piyasa genişlemesi

2029-2030 Uzun Vadeli Öngörü

- Temel senaryo: 0,01947 - 0,02404 ABD doları (istikrarlı piyasa büyümesiyle)

- İyimser senaryo: 0,02404 - 0,02861 ABD doları (güçlü proje ve piyasa koşullarıyla)

- Dönüştürücü senaryo: 0,02861 - 0,03000 ABD doları (çığır açan yenilikler ve yaygın kullanım ile)

- 31 Aralık 2030: STRIKE 0,02861 ABD doları (dönemin olası zirve fiyatı)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0,01548 | 0,0137 | 0,00699 | 0 |

| 2026 | 0,02159 | 0,01459 | 0,01386 | 6 |

| 2027 | 0,02008 | 0,01809 | 0,01411 | 32 |

| 2028 | 0,01985 | 0,01909 | 0,01126 | 39 |

| 2029 | 0,02862 | 0,01947 | 0,01733 | 42 |

| 2030 | 0,02861 | 0,02404 | 0,02068 | 75 |

IV. STRIKE İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

STRIKE Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Uygun olanlar: Yüksek risk toleransına sahip, uzun vadeli yatırımcılar

- Öneriler:

- Piyasa düşüşlerinde STRIKE biriktirin

- Fiyat hedefleri koyup portföyünüzü düzenli olarak gözden geçirin

- Tokenları güvenli donanım cüzdanında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve olası giriş/çıkış noktalarını belirler

- Göreli Güç Endeksi (RSI): Aşırı alım/aşırı satım seviyelerini izler

- Dalgalı işlemde kritik noktalar:

- Risk yönetimi için kesin stop-loss emirleri kullanın

- Önceden belirlenen seviyelerde kâr alın

STRIKE Risk Yönetim Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: %1-3

- Agresif yatırımcılar: %5-10

- Profesyonel yatırımcılar: %10-15

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Yatırımları farklı kripto paralara bölün

- Stop-loss emirleri: Kaybı sınırlamak için kullanın

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan önerisi: Gate web3 cüzdanı

- Soğuk depolama: Uzun vadeli saklama için donanım cüzdanları

- Güvenlik: İki faktörlü doğrulama etkinleştirin, güçlü şifreler seçin

V. STRIKE İçin Olası Riskler ve Zorluklar

STRIKE Piyasa Riskleri

- Yüksek oynaklık: Kripto piyasasında yaygın, ciddi fiyat dalgalanmaları

- Piyasa duyarlılığı: Haber ve trendlere bağlı ani değişiklikler

- Likitide riski: Sınırlı işlem hacmi, büyük işlemlerin yapılmasını zorlaştırabilir

STRIKE Düzenleyici Riskler

- Düzenleyici belirsizlik: Tokenın kullanımını etkileyebilecek yeni düzenlemeler

- Sınır ötesi uyum: Farklı ülkelerde değişen yasal statü

- Vergi etkileri: Değişen vergi mevzuatı yatırım getirilerini etkileyebilir

STRIKE Teknik Riskler

- Akıllı sözleşme açıkları: Temel kodda potansiyel istismarlar

- Ağ tıkanıklığı: BSC ağında yoğunluk işlem süreçlerini etkileyebilir

- Teknolojik eskime: Daha yenilikçi rakiplerin gerisinde kalma riski

VI. Sonuç ve Eylem Önerileri

STRIKE Yatırım Değeri Analizi

STRIKE, modüler aracı protokolleri alanında hem yüksek riskli hem de yüksek potansiyele sahip bir seçenektir. Ölçeklenebilir iş birliğine yönelik yenilikçi teknolojiler sunarken, kripto piyasasındaki dalgalanma ve düzenleyici belirsizlikler göz önünde bulundurulmalıdır.

STRIKE Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Sadece kaybetmeyi göze alabileceğiniz küçük keşif yatırımları yapın

✅ Deneyimli yatırımcılar: Sıkı risk yönetimiyle ortalama maliyetli alım stratejisi uygulayın

✅ Kurumsal yatırımcılar: Kapsamlı analiz ve çeşitlendirilmiş portföy çerçevesinde değerlendirin

STRIKE İşlem Katılımı Yöntemleri

- Spot alım-satım: Gate.com üzerinden STRIKE token alın

- Stake etme: Mevcutsa stake programlarına katılarak pasif gelir elde edin

- DeFi entegrasyonu: STRIKE token ile merkeziyetsiz finans fırsatlarını keşfedin

Kripto para yatırımları yüksek risk içerir. Bu makale yatırım tavsiyesi değildir. Yatırımcılar, risk toleranslarına göre karar vermeli ve profesyonel finansal danışmanlara başvurmalıdır. Kaybetmeyi göze alabileceğinizden fazlasını asla yatırmayın.

SSS

Prediction strike market nedir?

Prediction strike market, kullanıcıların opsiyon sözleşmeleriyle kripto para fiyatlarının gelecekteki hareketleri üzerine alım-satım yaptığı merkeziyetsiz bir platformdur.

Gelecekteki strike fiyatı nedir?

STRIKE'ın gelecekteki fiyatının, artan benimseme ve merkeziyetsiz finans çözümlerine olan talep ile 2026 yılında 50 ABD dolarına ulaşması beklenmektedir.

Strike fiyatım ne olmalı?

Strike fiyatınızı, risk toleransınız ve piyasa analiziniz doğrultusunda belirlemelisiniz. Genel olarak, yükseliş stratejisi için mevcut piyasa fiyatının %10-20 üzerinde bir seviye hedeflenebilir.

Daha yüksek bir strike fiyatı avantajlı mı?

Her durumda değil. Daha yüksek bir strike fiyatı, daha fazla potansiyel kazanç anlamına gelebilir; fakat beraberinde daha yüksek risk getirir. Sonuç, piyasa koşullarına ve işlem stratejinize bağlıdır.

QFS Kripto Açıklandı: Kuantum Finans Sistemi Dijital Varlıklar İçin Ne Anlama Geliyor

Moni nedir? Bir Rehber

Zincir üstü veriler, COAI’nin hızlı büyümesini ve yatırım potansiyelini nasıl gözler önüne seriyor?

2025 0G Fiyat Tahmini: Uzay Keşiflerinde Zero Gravity Technology'nin Gelecekteki Değerine Yönelik Öngörüler

2025 VELVET Fiyat Tahmini: Dijital Varlığın Büyüme Potansiyeli ve Piyasa Faktörlerinin Analizi

2025 CLANKER Fiyat Tahmini: Piyasa Eğilimlerinin Analizi ve Gelecekteki Değer Potansiyeli

Testnet ortamında, kolayca erişilebilen musluk ile ücretsiz MATIC token talep edin

Blockchain Düğümlerinin İşleyişini Anlamak

Flash Kredileri Anlamak: DeFi'de Teminatsız Borçlanma Üzerine Kapsamlı Bir Rehber

MetaMask ile ERC20 Token Yönetimi: Bir Rehber

Dijital Varlıkların Güvenli Saklanması: Kripto Saklama Çözümlerinde En İyi Uygulamalar