2025 0G Fiyat Tahmini: Uzay Keşiflerinde Zero Gravity Technology'nin Gelecekteki Değerine Yönelik Öngörüler

Giriş: 0G'nin Piyasadaki Konumu ve Yatırım Değeri

Yapay zeka için geliştirilmiş en büyük Layer 1 blokzinciri olan 0G (0G), kuruluşundan bu yana önemli bir ilerleme kaydetti. 2025 yılı itibarıyla 0G'nin piyasa değeri 412.968.400 $'a ulaşırken, yaklaşık 213.200.000 dolaşımdaki token ve yaklaşık 1,937 $ seviyesinde bir fiyat söz konusu. "Yapay zeka blokzinciri öncüsü" olarak anılan bu varlık, şeffaf, doğrulanabilir ve topluluk sahipliğinde yapay zeka uygulamalarının etkinleştirilmesinde giderek daha kritik bir rol üstleniyor.

Bu makalede, 0G'nin 2025-2030 yılları arasındaki fiyat trendleri; geçmiş veriler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler ışığında kapsamlı şekilde incelenecek, yatırımcılara profesyonel fiyat tahminleri ve pratik yatırım stratejileri sunulacaktır.

I. 0G Fiyat Geçmişi ve Güncel Piyasa Durumu

0G Tarihsel Fiyat Gelişimi

- 2025: 0G piyasaya sürüldü, fiyat 23 Eylül'de tüm zamanların en yüksek seviyesi olan 7,175 $'a ulaştı

- 2025: Piyasa düzeltmesiyle fiyat 10 Ekim'de tüm zamanların en düşük seviyesi olan 1,694 $'a geriledi

0G Güncel Piyasa Durumu

17 Ekim 2025 itibarıyla 0G, 1,937 $ seviyesinde işlem görüyor ve piyasa değeri 412.968.400 $. Token son dönemde önemli dalgalanmalar yaşadı; 24 saatlik fiyat değişimi -%3,83, 7 günlük düşüş ise -%24,16 oldu. 0G'nin mevcut fiyatı, tüm zamanların en yüksek seviyesinin %73 altında olup kısa vadede düşüş eğilimini işaret ediyor. Tokenin son 24 saatteki işlem hacmi 1.872.571 $ ile orta düzeyde bir piyasa hareketliliğine işaret ediyor. Dolaşımdaki 213.200.000 0G token, toplam 1.000.000.000 arza oranla %21,32'lik görece düşük bir dolaşım oranı sunuyor. Tam seyreltilmiş piyasa değeri ise 1.937.000.000 $ ve 0G, genel kripto para piyasasında 176. sırada yer alıyor.

0G Piyasa Duyarlılık Göstergesi

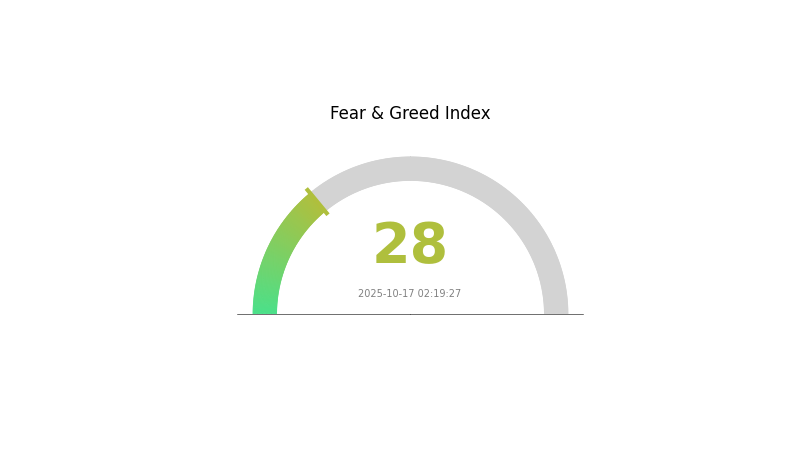

2025-10-17 Korku ve Açgözlülük Endeksi: 28 (Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında duyarlılık endeksi şu anda 28 seviyesinde ve korku hakim. Bu, yatırımcılar arasında temkinli bir atmosfer olduğunu gösteriyor. Böyle dönemlerde bazı yatırımcılar, "Başkaları açgözlü iken kork, başkaları korkarken açgözlü ol" yaklaşımıyla bunu alım fırsatı olarak değerlendirse de, bu oynak piyasada yatırım kararı öncesi kapsamlı araştırma yapmak ve riskleri dikkatle yönetmek şarttır.

0G Varlık Dağılımı

0G'nin adres bazlı varlık dağılımı, token birikiminde ilgi çekici bir model ortaya koyuyor. Net veri noktaları olmasa da, toplam arzın büyük bir kısmını tek bir adresin elinde bulundurmaması, dağılımın dengeli olduğunu gösteriyor.

Bu dengeli dağılım, 0G ağında sağlıklı bir merkeziyetsizlik olduğu anlamına gelir. Tokenin büyük oranda birkaç elde toplanmaması, piyasa manipülasyonu veya ani fiyat dalgalanmaları riskini azaltır. Böyle bir dağılım yapısı, genellikle daha istikrarlı bir piyasa oluşumunu destekler ve 0G ekosisteminin yatırımcısı ve kullanıcısı için güven yaratır.

Adres dağılımındaki mevcut tablo, projenin merkeziyetsizliğe bağlılığını ve sağlam bir zincir üstü yapıya sahip olduğunu gösteriyor. Bu durum, yaygın benimsenme ve çeşitlendirilmiş paydaş yapısıyla, bir blokzincir projesinin uzun vadeli sürdürülebilirliği ve büyümesini destekleyen olumlu faktörler arasında yer alır.

Güncel 0G varlık dağılımını görüntülemek için tıklayın

| En Büyük | Adres | Varlık Adedi | Varlık (%) |

|---|

II. 0G'nin Gelecekteki Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Halving: Yeni token arzında periyodik azalma

- Tarihsel eğilim: Önceki halving dönemlerinde fiyat artışı yaşandı

- Güncel etki: Sonraki halving'in arzı azaltması ve fiyatı yukarı çekmesi bekleniyor

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal varlıklar: Büyük kurumlar 0G pozisyonlarını kademeli olarak artırıyor

- Kurumsal entegrasyon: Teknoloji şirketleri, IoT uygulamaları için 0G entegrasyonunu araştırıyor

- Devlet politikaları: Temel piyasalarda düzenleyici netlik, kurumsal girişleri destekliyor

Makroekonomik Ortam

- Para politikası etkisi: Merkez bankalarının gevşemeci adımları, kripto varlıklara olan talebi artırabilir

- Enflasyona karşı koruma: 0G, yüksek enflasyon dönemlerinde potansiyel bir değer saklama aracı olarak görülüyor

- Jeopolitik faktörler: Küresel belirsizlikler, 0G'yi riskten korunma için cazip kılabilir

Teknolojik Gelişme ve Ekosistem Oluşturma

- Ölçeklenebilirlik güncellemeleri: İşlem hızını artırıp ücretleri azaltacak Layer-2 çözümlerinin uygulanması

- İşbirliği geliştirmeleri: 0G'nin çeşitli blokzincir ekosistemleriyle kullanılabilirliğini artırmak için zincirler arası köprüler

- Ekosistem uygulamaları: 0G ağı üzerinde büyüyen DeFi ve NFT projeleri

III. 0G 2025-2030 Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 1,23 $ - 1,50 $

- Tarafsız tahmin: 1,80 $ - 2,10 $

- İyimser tahmin: 2,40 $ - 2,66 $ (güçlü piyasa toparlanması koşuluyla)

2027-2028 Görünümü

- Piyasa aşaması beklentisi: Potansiyel boğa piyasası dönemi

- Fiyat aralığı tahmini:

- 2027: 1,38 $ - 3,12 $

- 2028: 1,91 $ - 3,43 $

- Temel katalizörler: Artan benimseme, teknolojik ilerleme, olumlu düzenleyici ortam

2030 Uzun Vadeli Görünüm

- Temel senaryo: 3,50 $ - 4,00 $ (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 4,00 $ - 4,15 $ (yaygın benimseme ve güçlü piyasa koşulları durumunda)

- Dönüştürücü senaryo: 4,50 $ - 5,00 $ (çığır açan inovasyonlar ve kitlesel benimseme ile)

- 2030-12-31: 0G 3,74 $ (2025'e göre %92 artış)

| 年份 | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Artış/Düşüş (%) |

|---|---|---|---|---|

| 2025 | 2,65788 | 1,926 | 1,23264 | 0 |

| 2026 | 2,54405 | 2,29194 | 1,16889 | 18 |

| 2027 | 3,11922 | 2,418 | 1,37826 | 24 |

| 2028 | 3,43307 | 2,76861 | 1,91034 | 42 |

| 2029 | 4,37218 | 3,10084 | 2,66672 | 60 |

| 2030 | 4,14753 | 3,73651 | 2,69029 | 92 |

IV. 0G için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

0G Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Uygun: Yüksek risk toleranslı uzun vadeli yatırımcılar

- Operasyon önerileri:

- Piyasa geri çekilmelerinde 0G token biriktirin

- Kısmi kâr için fiyat hedefleri belirleyin

- Tokenleri saklama hizmeti olmayan bir cüzdanda güvenli olarak saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve potansiyel dönüş noktalarını belirlemede kullanılır

- RSI: Aşırı alım/aşırı satım seviyelerini takip edin

- Dalgalı işlemde dikkat edilmesi gerekenler:

- AI sektöründeki gelişmeleri fiyat katalizörü olarak izleyin

- Zarar durdur emirleriyle riskinizi yönetin

0G Risk Yönetim Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcı: Kripto portföyünün %1-3'ü

- Agresif yatırımcı: Kripto portföyünün %5-10'u

- Profesyonel yatırımcı: Kripto portföyünün azami %15'i

(2) Riskten Korunma Çözümleri

- Diversifikasyon: Yatırımı birden fazla yapay zeka odaklı blokzincir projesine yaymak

- Zarar durdur kullanımı: Potansiyel kayıpları sınırlamak için uygulayın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Wallet

- Soğuk depolama: Uzun vadeli tutum için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama ve güçlü şifre kullanımı

V. 0G için Potansiyel Riskler ve Zorluklar

0G Piyasa Riskleri

- Volatilite: Yeni kripto varlıklarda sık görülen yüksek fiyat dalgalanması

- Rekabet: Yapay zeka odaklı rakip blokzincirlerin ortaya çıkma riski

- Piyasa duyarlılığı: Genel kripto piyasa trendlerine hassasiyet

0G Düzenleyici Riskler

- Bilinmez düzenleyici ortam: Yapay zeka ve blokzincir teknolojileri için daha sıkı düzenlemeler olasılığı

- Sınır ötesi uyum: Farklı ülkelerde değişen düzenleyici yaklaşımlar

- Veri gizliliği: Yapay zeka verilerinin kullanımı ve mahremiyeti konusunda düzenleyici inceleme

0G Teknik Riskler

- Ölçeklenebilirlik sorunları: Artan ağ talebini karşılamada kısıtlar

- Güvenlik açıkları: Akıllı sözleşme veya ağ saldırısı riski

- Teknolojik eskime: Yapay zekadaki hızlı gelişmelerin blokzincir entegrasyonunu geride bırakma ihtimali

VI. Sonuç ve Eylem Önerileri

0G Yatırım Değeri Değerlendirmesi

0G, yapay zeka ve blokzincir kesişiminde benzersiz bir değer önerisi sunarak uzun vadeli büyüme potansiyeli taşıyor. Yine de, piyasa volatilitesi ve düzenleyici belirsizlikler nedeniyle kısa vadede risklerle karşı karşıya.

0G Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Kademeli ve küçük yatırımlarla piyasaya giriş yapmayı değerlendirin ✅ Tecrübeli yatırımcılar: Belirli giriş-çıkış stratejileri ile dengeli yaklaşım uygulayın ✅ Kurumsal yatırımcılar: Kapsamlı inceleme yaparak 0G’yi çeşitlendirilmiş kripto portföyünün bir parçası olarak değerlendirin

0G İşlem Katılım Yöntemleri

- Spot işlem: 0G tokenlerini doğrudan alıp elde tutmak

- Vadeli işlemler: Tecrübeli yatırımcılar için kaldıraçlı işlem

- Staking: Ağ doğrulamasına katılarak ödül kazanma

Kripto para yatırımları oldukça yüksek risk taşır; bu makale yatırım tavsiyesi niteliği taşımaz. Yatırımcılar, kendi risk toleranslarına göre dikkatli karar vermeli ve profesyonel bir finans danışmanına başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

QFS Kripto Açıklandı: Kuantum Finans Sistemi Dijital Varlıklar İçin Ne Anlama Geliyor

Moni nedir? Bir Rehber

Zincir üstü veriler, COAI’nin hızlı büyümesini ve yatırım potansiyelini nasıl gözler önüne seriyor?

2025 VELVET Fiyat Tahmini: Dijital Varlığın Büyüme Potansiyeli ve Piyasa Faktörlerinin Analizi

2025 STRIKE Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

2025 CLANKER Fiyat Tahmini: Piyasa Eğilimlerinin Analizi ve Gelecekteki Değer Potansiyeli

Blokzincirin Temel Bileşenleri ve İşlevleri: Node’ların Anlaşılması

Merkeziyetsiz Kripto Ticareti İçin En İyi Platformlar

NFT’lerin Güvenli Saklanması İçin En İyi Donanım Çözümleri

Zincirler Arası Çözümler Hakkında Bilgi: Blockchain İnteroperabilitesi Rehberi

İdeal ENS alan adınızı zahmetsizce bulun ve hemen rezerve edin