2025 SATS Fiyat Tahmini: Bitcoin Benimsenmesindeki Hızlı Artışla Birlikte Yükseliş Eğilimi

Giriş: SATS’in Piyasa Konumu ve Yatırım Değeri

SATS (SATS), bir BRC-20 tokenı olarak piyasaya sürüldüğünden beri kripto para ekosisteminde giderek daha önemli bir konuma gelmiştir. 2025 yılı itibarıyla SATS’in piyasa değeri 50.211.000 dolar, dolaşımdaki arzı 2.100.000.000.000.000 token ve fiyatı yaklaşık 0,00000002391 dolar seviyesindedir. Sıkça “satoshi birimleri” olarak anılan bu varlık, Bitcoin tabanlı token piyasasında hızla ilgi görmektedir.

Bu makalede, 2025’ten 2030’a kadar SATS’in fiyat eğilimleri; geçmiş performans, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler dikkate alınarak profesyonel fiyat tahminleri ve yatırımcılara yönelik stratejiler kapsamlı bir şekilde analiz edilecektir.

I. SATS Fiyat Geçmişi ve Mevcut Piyasa Durumu

SATS Fiyatının Tarihsel Seyri

- 2023: SATS, 15 Aralık’ta 0,000000941 dolar ile tüm zamanların en yüksek seviyesine ulaşarak fiyat tarihinde önemli bir dönüm noktası kaydetti.

- 2024: Token, yıl boyunca düşüş trendine girerek zirveden uzaklaştı.

- 2025: SATS, 10 Ekim’de 0,00000000638 dolar ile en düşük seviyesine gerileyerek piyasa düzeltmesi yaşadı.

SATS’in Mevcut Piyasa Durumu

24 Ekim 2025 tarihi itibarıyla SATS, 0,00000002391 dolardan işlem görmekte ve son 24 saatte %7,54 artış göstermiştir. Token’ın piyasa değeri 50.211.000 dolar olup kripto para piyasasında 615. sırada yer almaktadır. Toplam arzı 2.100.000.000.000.000 token olan SATS’in tamamı dolaşımdadır.

Mevcut fiyat, tüm zamanların en yüksek seviyesinden önemli oranda düşük olsa da, SATS son bir yılda %90,75 değer kaybetmiştir. Ancak son 24 saatteki yükseliş kısa vadeli toparlanma işareti olabilir. Token’ın son 24 saatteki işlem hacmi 994.228,59 dolar olup, orta düzeyde piyasa aktivitesi göstermektedir.

SATS, farklı zaman dilimlerinde karmaşık bir performans sergilemiştir. Son bir saatte %0,04 artış, son 24 saatte %7,54 yükseliş görülürken; haftalık bazda %3,08, aylık bazda ise %29,88 düşüş yaşanmıştır. Bu oynaklık, kripto para piyasasındaki mevcut belirsizliği yansıtmaktadır.

Güncel SATS piyasa fiyatını görmek için tıklayın

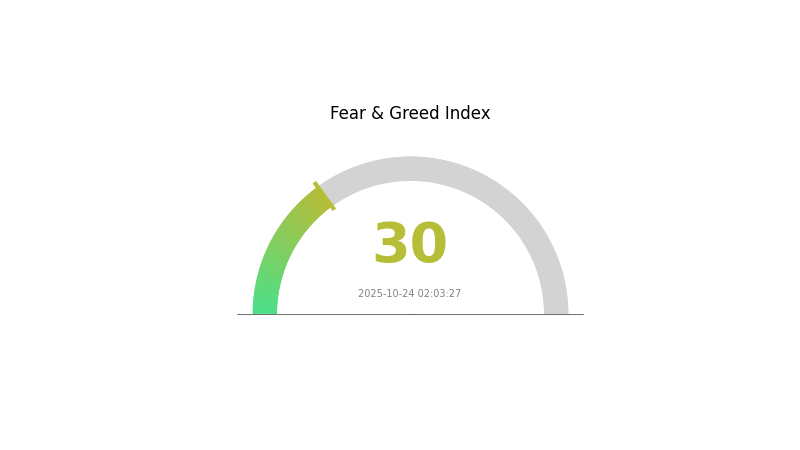

SATS Piyasa Duyarlılığı Göstergesi

24 Ekim 2025 Korku ve Açgözlülük Endeksi: 30 (Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasası şu anda korku evresinde ve duyarlılık endeksi 30 seviyesinde. Bu, yatırımcılar arasında temkinli bir atmosfer olduğunu gösteriyor. Böyle zamanlarda, yatırım kararı almadan önce dikkatli olmak ve kapsamlı araştırma yapmak gerekir. Korku ortamı, uzun vadeli yatırımcılar için potansiyel alım fırsatları sunabilir; ancak piyasaya dengeli yaklaşmak ve kararları duygusal değil, rasyonel verilere dayandırmak önemlidir. Bilgili hareket edin, portföyünüzü çeşitlendirerek riskleri azaltın.

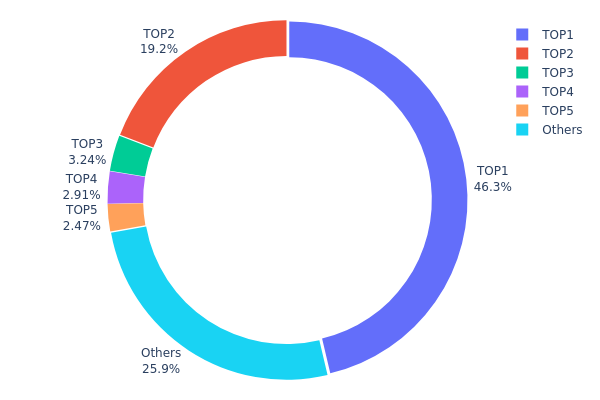

SATS Varlık Dağılımı

SATS için adres varlık dağılımı verileri, sahiplikte yüksek bir yoğunlaşma olduğunu gösteriyor. En büyük adres toplam arzın %46,30’unu elinde tutarken, ikinci en büyük adres %19,18’lik paya sahip. Sadece bu iki adres, tüm SATS tokenlarının %65’inden fazlasını elinde bulunduruyor. İlk beş adresin toplamda %74,09’luk payı bulunurken, kalan %25,91’lik kısım diğer sahipler arasında dağılmış durumda.

Böyle bir yoğunlaşma, piyasa merkezileşmesi ve olası fiyat manipülasyonu risklerini artırır. Tokenların büyük kısmının az sayıda adreste bulunması, fiyat oynaklığını ciddi şekilde etkileyebilecek büyük alım veya satışların riskini yükseltir. Yoğun sahiplik yapısı, merkeziyetsizlik derecesinin düşük olduğunu göstererek token’ın değer algısı ve piyasa istikrarını olumsuz etkileyebilir.

Öte yandan, bu büyük adreslerin bazıları borsa veya saklama hizmeti sağlayıcısı olabilir ve bireysel yatırımcıları temsil etmeyebilir. Yine de mevcut dağılım, dikkatli olunması gerektiğini ve büyük sahiplerin hareketlerinin piyasaya etkisinin izlenmesinin önemini ortaya koymaktadır.

Güncel SATS Varlık Dağılımı için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | bc1p8w...a8p0k6 | 972.376.769.384,04K | 46,30% |

| 2 | bc1qgg...l9t85q | 402.841.653.528,67K | 19,18% |

| 3 | bc1qn2...fmmrq2 | 68.084.860.391,69K | 3,24% |

| 4 | 16G1xY...Vp9Wxh | 61.139.053.666,79K | 2,91% |

| 5 | bc1qm6...nmyzcx | 51.815.312.914,98K | 2,46% |

| - | Diğerleri | 543.742.350.113,83K | 25,91% |

II. SATS’in Gelecek Fiyatını Etkileyen Temel Unsurlar

Kurumsal ve Büyük Yatırımcı Hareketleri

- Kurumsal Varlıklar: NBIM (Norveç Varlık Fonu), Bitcoin ile ilişkili varlıklarını 2025’in ikinci çeyreğinde %83 artırarak 6.200 BTC’den 11.400 BTC’ye yükseltti.

- Şirket Benimsemesi: H100 Group, Bitcoin varlıklarını 102,19 BTC artırarak toplamda 911,29 BTC’ye ulaştı.

Makroekonomik Ortam

- Para Politikası Etkisi: FOMC tutanaklarında, ABD Merkez Bankası yetkilileri enflasyon kaygılarını korurken, zayıf istihdam verilerine rağmen faiz oranını %4,25-%4,5 aralığında tuttu.

- Jeopolitik Faktörler: SEC, Bitcoin ve Ethereum ETF’lerini de içeren birçok kripto ETF başvurusunun kararını sonbahara erteledi.

Teknik Gelişim ve Ekosistem Oluşumu

- Taproot Assets Protokolü: Bitcoin ağında gaz ücreti olmadan varlık oluşturma ve transferini sağlarken, Lightning Network ile entegrasyon sayesinde düşük maliyetli işlem imkanı sunar.

- Ekosistem Uygulamaları: Bitcoin üzerinde Ordinals, BRC-20 tokenlar, RGB, Runes Protocol ve TROLL gibi çeşitli protokol ve uygulamaların geliştirilmesi.

III. SATS Fiyat Tahmini (2025-2030)

2025 Görünümü

- Temkinli tahmin: 0,00045-0,00050 dolar

- Tarafsız tahmin: 0,00050-0,00055 dolar

- İyimser tahmin: 0,00055-0,00060 dolar (daha fazla kurumsal benimseme gerektirir)

2027-2028 Görünümü

- Piyasa evresi beklentisi: Olası boğa dönemi

- Fiyat aralığı tahminleri:

- 2027: 0,00064-0,00070 dolar

- 2028: 0,00078-0,00086 dolar

- Temel katalizörler: Bitcoin yarılanması, küresel ekonomik belirsizliğin artması

2029-2030 Uzun Vadeli Tahmin

- Temel senaryo: 0,00096-0,00118 dolar (istikrarlı benimseme ve net düzenleyici ortam varsayılırsa)

- İyimser senaryo: 0,00118-0,00130 dolar (yaygın kurumsal kabul varsayılırsa)

- Dönüştürücü senaryo: 0,00130-0,00150 dolar (SATS’in yaygın bir ödeme aracı olması durumunda)

- 31 Aralık 2030: SATS 0,00137 dolar (projeksiyonlara göre potansiyel zirve)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0 | 0 | 0 | 0 |

| 2026 | 0 | 0 | 0 | 6 |

| 2027 | 0 | 0 | 0 | 28 |

| 2028 | 0 | 0 | 0 | 57 |

| 2029 | 0 | 0 | 0 | 92 |

| 2030 | 0 | 0 | 0 | 137 |

IV. SATS için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

SATS Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı tipi: Uzun vadeli bakış açısına sahip, risk toleransı yüksek yatırımcılar

- İşlem önerileri:

- Piyasa düşüşlerinde SATS biriktirin

- Uzun vadeli fiyat hedefleri belirleyin, plana sadık kalın

- SATS’i güvenli donanım cüzdanında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Kısa ve uzun vadeli trendleri izleyin

- Göreceli Güç Endeksi (RSI): Aşırı alım ve aşırı satım bölgelerini tespit edin

- Dalgalı işlemlerde dikkat edilmesi gerekenler:

- Açık giriş-çıkış noktaları belirleyin

- Risk yönetimi için zarar durdur emirleri kullanın

SATS Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcılar: %1-3

- Agresif yatırımcılar: %5-10

- Profesyonel yatırımcılar: %10-15

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Yatırımları birden fazla kripto para arasında dağıtın

- Zarar durdur emirleri: Olası kayıpları sınırlamak için otomatik satış emirleri kullanın

(3) Güvenli Saklama Yöntemleri

- Donanım cüzdanı önerisi: Gate Web3 Wallet

- Soğuk saklama çözümü: Uzun vadeli tutumlar için kağıt cüzdan

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama ve güvenli yedekleme uygulayın

V. SATS için Potansiyel Riskler ve Zorluklar

SATS Piyasa Riskleri

- Yüksek volatilite: SATS fiyatında büyük dalgalanmalar yaşanabilir

- Sınırlı likidite: Büyük hacimli işlemlerde zorluklar oluşabilir

- Piyasa duyarlılığı: Genel kripto para piyasası trendlerine karşı hassasiyet

SATS Düzenleyici Riskler

- Belirsiz düzenleyici ortam: BRC-20 tokenlarını etkileyebilecek yeni düzenlemeler ihtimali

- Hukuki statü: Birçok ülkede SATS için net yasal çerçeve bulunmaması

- Vergi etkileri: Değişen vergi politikaları SATS sahiplerini etkileyebilir

SATS Teknik Riskleri

- Akıllı kontrat açıkları: BRC-20 protokolünde henüz tespit edilmemiş hatalar olabilir

- Ağ tıkanıklığı: Bitcoin ağındaki sorunlar SATS işlemlerini etkileyebilir

- Teknolojik eskime: Daha gelişmiş token standartlarının ortaya çıkması

VI. Sonuç ve Eylem Önerileri

SATS’in Yatırım Değeri Değerlendirmesi

SATS, Bitcoin ağı üzerinde bir BRC-20 tokenı olarak benzersiz bir yatırım fırsatı sunar. Uzun vadede dijital varlık olarak değer kazanma potansiyeli olsa da, piyasa oynaklığı ve düzenleyici belirsizlikler nedeniyle kısa vadede yüksek risk barındırır.

SATS Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayın, önceliği eğitime verin ✅ Deneyimli yatırımcılar: Portföyün küçük bir kısmını ayırın, sıkı risk yönetimi uygulayın ✅ Kurumsal yatırımcılar: Detaylı inceleme ile SATS’i çeşitlendirilmiş kripto stratejisinin bir parçası olarak değerlendirin

SATS Alım-Satım Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden SATS alıp satabilirsiniz

- Dolar maliyeti ortalaması: Düzenli alımlarla zaman içinde SATS biriktirin

- Limit emirleri: Belirlenen fiyatlarla pozisyon açıp kapamak için gelişmiş emir türlerinden faydalanın

Kripto para yatırımları son derece yüksek risk taşır ve bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarına göre dikkatli karar vermeli ve profesyonel finans danışmanlarından destek almalıdır. Kaybetmeyi göze alabileceğinizden fazlasını asla yatırım olarak kullanmayın.

SSS

SATS coin 1 dolara ulaşır mı?

Hayır, SATS coin’in 1 dolar seviyesine ulaşması beklenmemektedir. Mevcut tahminlere göre en yüksek fiyat 0,017442 dolar olup, 1 dolarlık hedefin oldukça altındadır.

SATS iyi bir yatırım mı?

Evet, SATS 2025 için umut vadeden bir yatırım olarak görülüyor. Tahmini fiyatı 0,0000000252 dolar olup, gelişen kripto piyasasında büyüme potansiyeli sunmaktadır.

2030’da bir satoshi ne kadar değerli olacak?

Piyasa trendlerine göre, bir satoshi’nin 2030’da yaklaşık 1,4932 dolar değerinde olması öngörülüyor; %27,63 büyüme oranı varsayılmıştır.

2025 için SATS’in hedef fiyatı nedir?

Mevcut analiz ve piyasa trendlerine göre 2025’te SATS’in hedef fiyatı 70,84 ila 84,10 dolar arasında tahmin edilmektedir.

2025 SATS Fiyat Tahmini: Bitcoin’in En Küçük Birimi $1 Değerine Ulaşır mı?

2025 yılı BTC fiyat tahmini: Dijital altının 200.000 ABD Doları seviyesini aşma potansiyeline ilişkin teknik ve makro analiz

Bitcoin Fiyat Tahmini 2030

2025 yılı BTC fiyat tahmini: Bitcoin boğa piyasası döngüsünde ulaşılacak yeni zirveler ve küresel makroekonomik etkilerin kapsamlı analizi

2025 BTC Fiyat Tahmini: Bitcoin’i Yeni Zirvelere Taşıyabilecek Makroekonomik Faktörlerin ve Piyasa Döngülerinin Analizi

2025 BTC Fiyat Tahmini: Kurumsal Benimsenme ve Halving Döngüsünün Bitcoin’in 150.000 Dolara Ulaşmasındaki Rolü

ENS Alan Adları ile Web3 Kimlik Yönetimi

Farcaster Protokolünü Keşfetmek: Kripto Ağlarında Yeni Bir Dönem

ETH Dağıtımlarına Güvenli Şekilde Katılmak: Temel İpuçları

Curve Protokolü Hakkında Bilgi: Merkeziyetsiz Platformlarda Stablecoin Ticaretinin İncelenmesi

Kripto Para White Paper'larını Anlamak: Yatırımcılar İçin Kapsamlı Bir Rehber