2025 BTC Fiyat Tahmini: Kurumsal Benimsenme ve Halving Döngüsünün Bitcoin’in 150.000 Dolara Ulaşmasındaki Rolü

Giriş: BTC'nin Piyasadaki Konumu ve Yatırım Potansiyeli

Kripto para piyasasının öncüsü ve lideri olan Bitcoin (BTC), 2009’daki çıkışından bu yana sektör adına çarpıcı bir başarıya imza attı. 2025 itibarıyla Bitcoin’in piyasa değeri 2,25 trilyon dolar seviyesine ulaşmış; dolaşımda yaklaşık 19.918.246 adet BTC var ve fiyatı 113.025 dolar civarında seyrediyor. “Dijital altın” olarak tanımlanan bu varlık, finans, yatırım ve dijital ödeme ekosistemlerinde giderek daha belirleyici bir rol oynuyor.

Bu makalede, Bitcoin’in 2025’ten 2030’a kadar olan fiyat hareketleri; geçmiş dönem fiyatlamaları, piyasa arz-talep dengesi, ekosistem gelişmeleri ve makroekonomik dinamikler ışığında kapsamlı biçimde incelenecek, yatırımcılara uzman fiyat öngörüleri ve uygulanabilir yatırım stratejileri önerilecektir.

I. BTC Fiyat Geçmişi ve Güncel Piyasa Durumu

BTC Fiyatlarının Tarihsel Seyri

- 2009: Bitcoin piyasaya sürüldü, fiyatı ölçülemez derecede düşük

- 2013: İlk büyük boğa dönemi, fiyat 1.000 dolara ulaştı

- 2017: Büyük boğa piyasası, fiyat 20.000 dolara zirve yaptı

- 2020: COVID-19 krizinde fiyat 3.800 dolara indi, ardından 29.000 dolara yükseldi

- 2021: Tüm zamanların zirvesi: 69.000 dolar

BTC Güncel Piyasa Görünümü

9 Eylül 2025 tarihinde Bitcoin (BTC) 113.025 dolardan işlem görüyor ve son 24 saatte %1,73 artış kaydetti. Bu fiyat, 14 Ağustos 2025’te ulaşılmış olan 124.128 dolarlık tüm zamanların en yüksek seviyesine oldukça yakın. BTC’nin piyasa değerinin 2.251.259.754.150 dolar olması, toplam kripto para piyasasının %54,18’inin BTC tarafından domine edildiğini gösteriyor.

24 saatlik işlem hacmi 1.170.492.702 dolar olup, piyasanın ciddi bir işlem yoğunluğuna sahip olduğunu yansıtıyor. Fiyat hareketlerinde son bir haftada %2,42 artış ve son bir yılda ise %105,95 oranında yükseliş gözlemlendi.

Dolaşımdaki BTC arzı 19.918.246 adetle toplam arzın (%21.000.000) %94,85’ine ulaşmış durumda; bu kıtlık özelliği, Bitcoin’in değer teklifinde temel rol oynuyor.

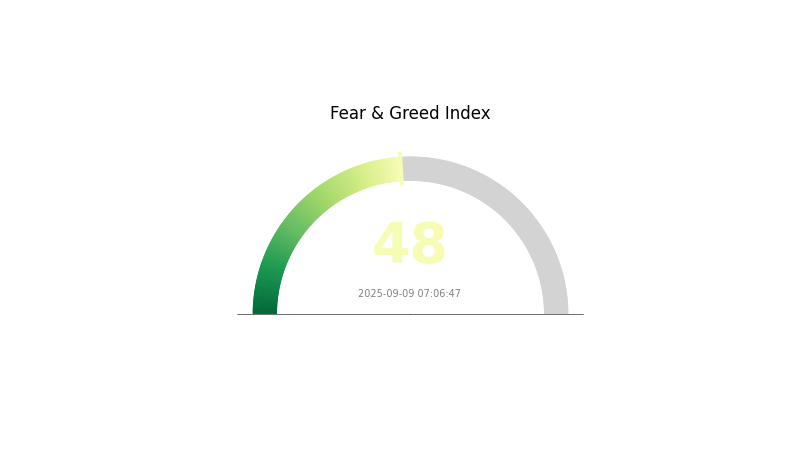

VIX Endeksi’nin 48 değerinde olması, piyasa katılımcılarının genel görüşünde nötr bir hava olduğunu gösteriyor.

Güncel BTC piyasa fiyatını görmek için tıklayın

BTC Piyasa Duyarlılığı Göstergesi

2025-09-09 Korku ve Açgözlülük Endeksi: 48 (Nötr)

Kripto piyasasında duyarlılık dengede; Korku ve Açgözlülük Endeksi’nin 48 ile nötr bölgede olması yatırımcıların yön arayışında olduğunu gösteriyor. Bu dönemin ardından piyasanın ani bir hareketle yeni bir yön bulması mümkün. Yatırımcıların başlıca göstergeleri ve piyasa haberlerini sürekli takip ederek, böyle geçiş dönemlerinde dikkatli olması gerekir. Riskin etkin yönetimi ve portföy çeşitlendirmesi, bu tür belirsizlik ortamlarında başarının vazgeçilmez unsurlarıdır.

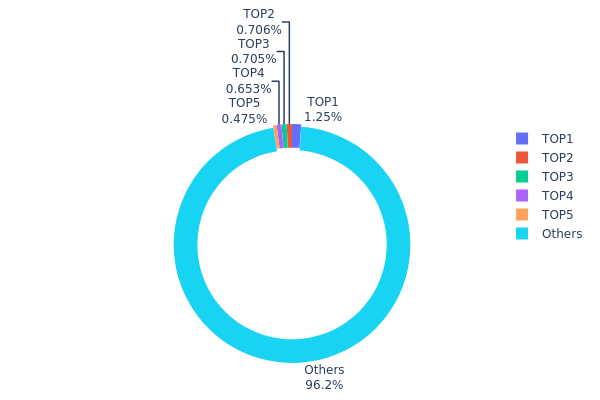

BTC Varlık Dağılımı Tablosu

Bitcoin adreslerinde varlıkların dağılımı, BTC sahipliğinin merkezileşme derecesiyle ilgili önemli içgörüler sunar. Analiz edildiğinde, en büyük ilk 5 adres toplam Bitcoin arzının yaklaşık %3,79’unu tutarken; en büyük adres 248.600 BTC’ye (%1,25) sahip, diğer üst adresler ise %0,48 ile %0,71 arasında değişen paylara sahiptir.

Söz konusu dağılım, sahipliğin büyük oranda merkeziyetsiz olduğunu gösterir; BTC’nin %96,21’i çok sayıda adrese dağılmış durumdadır. En büyük adreslerde aşırı yoğunlaşmanın olmaması, ağın sağlıklı dağılımına işaret eder ve büyük oyuncuların piyasa üzerinde tek başına etkili olma riskini düşürür. Bu yapı, Bitcoin’in merkeziyetsizlik ilkesine katkı sağlarken, fiyat hareketlerinin birkaç büyük aktörden ziyade geniş piyasa dinamikleriyle şekilleneceği anlamına gelir.

Üst adresler elinde önemli miktarda BTC bulunduruyor olsa da, piyasa üzerinde mutlak bir hakimiyetleri yok. Bu dengeli dağılım, Bitcoin’in merkeziyetsiz yapı felsefesini destekler ve piyasa istikrarını artırır.

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 34xp4v...4Twseo | 248.600 | 1,25% |

| 2 | bc1ql4...8859v2 | 140.570 | 0,71% |

| 3 | 3M219K...DjxRP6 | 140.400 | 0,70% |

| 4 | bc1qgd...jwvw97 | 130.010 | 0,65% |

| 5 | bc1qaz...uxwczt | 94.640 | 0,48% |

| - | Diğerleri | 19.163.930 | 96,21% |

II. Gelecek Dönemlerde BTC Fiyatını Belirleyecek Temel Etkenler

Arz Mekanizması

- Halving: Her yaklaşık 4 yılda bir Bitcoin’in arzı yarıya iner ve yeni BTC üretimi azalır.

- Tarihsel Kalıp: Geçmiş halving sonrası yıllarda Bitcoin fiyatında yüksek artışlar görülmüştür.

- Güncel Etki: 2024’teki halving, kıtlık etkisi yaratacak ve fiyatın yukarı yönlü hareketini tetikleyebilir.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Sahiplik: Büyük kurumların ve ETF fonlarının portföylerinde Bitcoin’in payı hızla artıyor.

- Kurumsal Benimseme: MicroStrategy gibi şirketler bilançolarında Bitcoin’e yer verdi.

- Devlet Politikası: El Salvador gibi ülkeler Bitcoin’i yasal ödeme aracı ilan etti.

Makroekonomik Çerçeve

- Para Politikası Etkisi: ABD Merkez Bankası’nın faiz kararları ve genel para politikası, Bitcoin fiyatını doğrudan etkiliyor.

- Enflasyon Kalkanı Özelliği: Bitcoin, altın gibi enflasyona karşı koruma olarak görülmeye başlandı.

- Jeopolitik Unsurlar: Küresel belirsizlikler ve jeopolitik riskler, Bitcoin’e olan talebi güvenli liman arayışında artırıyor.

Teknolojik Yenilikler ve Ekosistemde Genişleme

- Lightning Network: Bitcoin ağının ölçeklenebilirliği ve işlem hızını artırmak üzere geliştirilmiş Layer 2 çözümü.

- Taproot Yükseltmesi: Ağda gizlilik ve akıllı sözleşme yeteneklerini büyük ölçüde geliştiriyor.

- Ekosistem Uygulamaları: Bitcoin tabanlı DeFi uygulamaları hızla büyüyor; kredi ve getiri çiftçiliği platformları öne çıkıyor.

III. 2025-2030 Dönemi İçin BTC Fiyat Öngörüleri

2025 Öngörüleri

- Temkinli senaryo: 103.995 – 110.000 dolar

- Orta/baseline senaryo: 110.000 – 115.000 dolar

- İyimser senaryo: 115.000 – 120.951 dolar (kurumsal benimsenmede süreklilik gerekli)

2027-2028 Öngörüleri

- Piyasa Döngüsü Beklentisi: Yükseliş trendine açık potansiyel boğa piyasası

- Fiyat aralığı tahminleri:

- 2027: 125.968 – 159.733 dolar

- 2028: 83.983 – 179.550 dolar

- Ana katalizörler: Halving etkisi, küresel ekonomik gelişmeler, regülasyon netliği

2029-2030 Uzun Vadeli Öngörüler

- Temel senaryo: 160.000 – 170.000 dolar (istikrarlı benimseme ve regülasyon kabulüyle)

- İyimser senaryo: 170.000 – 180.000 dolar (yaygın kurumsal entegrasyon)

- Dönüştürücü senaryo: 180.000 – 183.257 dolar (ölçeklenebilirlik ve gerçek dünya uygulamalarında çığır açıcı gelişmeler)

- 2030-31-12: BTC 172.716 dolar (büyük büyüme döneminden sonra fiyat istikrarı)

| Yıl | En Yüksek Tahmin | Ortalama Tahmin | En Düşük Tahmin | Yıllık Değişim (%) |

|---|---|---|---|---|

| 2025 | 120.951,62 | 113.038,90 | 103.995,79 | 0 |

| 2026 | 142.734,22 | 116.995,26 | 76.046,92 | 3 |

| 2027 | 159.733,63 | 129.864,74 | 125.968,80 | 14 |

| 2028 | 179.550,99 | 144.799,19 | 83.983,53 | 28 |

| 2029 | 183.257,85 | 162.175,09 | 116.766,06 | 43 |

| 2030 | 179.625,13 | 172.716,47 | 94.994,06 | 52 |

IV. BTC'de Profesyonel Yatırım Stratejileri ve Risk Yönetimi

BTC Yatırım Metodolojisi

(1) Uzun Vadeli Tutma

- Kimler için uygun: Uzun vadeli bakış açısına sahip, düşük risk tercih eden yatırımcılar

- Strateji önerileri:

- Dolar-maliyet ortalaması (DCA) ile fiyat dalgalanmasını azaltmak

- En az bir tam piyasa döngüsü (ortalama 4 yıl) boyunca pozisyonu korumak

- Varlıkları soğuk cüzdanlarda saklayarak güvenliği artırmak

(2) Aktif Alım-Satım Stratejisi

- Başlıca teknik analiz araçları:

- Hareketli Ortalamalar (MA): Trend takibi ve dönüş sinyalleri

- Relative Strength Index (RSI): Aşırı alım/aşırı satım koşullarını izleme

- Dalgalı trendlerde dikkat etmeniz gerekenler:

- Teknik göstergelere dayalı net giriş/çıkış noktaları belirleyin

- Risk kontrolü için stop-loss emirleri uygulayın

BTC Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Tavsiyeleri

- Temkinli yatırımcılar: %1-5 oranında BTC

- Orta düzey risk toleransı: %5-10

- Agresif yaklaşım: %10-20

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Farklı varlık sınıflarına yayılmış yatırım

- Opsiyon işlemleri: Put opsiyonu ile aşağı yönlü riskten korunma

(3) Güvenli Saklama Çözümleri

- Donanım cüzdanı: Gate Web3 Wallet tavsiye edilir

- Çoklu imza cüzdanı: Özel anahtarları güvenilir paydaşlara dağıtmak

- Güvenlik önlemleri: Güçlü şifre seçimi, iki faktörlü doğrulama, düzenli yazılım güncellemeleri

V. BTC'de Karşılaşılabilecek Riskler ve Zorluklar

BTC Piyasa Riskleri

- Volatilite: Ani fiyat dalgalanmaları ciddi kayıplara yol açabilir

- Likidite riski: Düşük likidite dönemlerinde büyük işlemler fiyatı dalgalandırabilir

- Korelasyon riski: BTC'nin geleneksel piyasalarla korelasyonu, portföy çeşitlendirme avantajını azaltabilir

BTC Düzenleyici Riskleri

- Devlet müdahaleleri: Bazı ülkelerde olası yasaklar veya ağır düzenlemeler

- Vergilendirme: Yeni vergi uygulamaları kârlılığı doğrudan etkileyebilir

- AML/KYC gereksinimleri: Daha katı mevzuat mahremiyet ve kullanım kolaylığını azaltabilir

BTC Teknik Riskleri

- %51 saldırısı: Ağın kontrolünün ele geçirilmesi potansiyeli

- Ölçeklenebilirlik sorunları: Ağda yüksek yoğunluk sırasında işlem gecikmeleri

- Kuantum bilgisayar tehdidi: Gelecekteki gelişmeler kriptografik güvenliği tehdit edebilir

VI. Sonuç ve Eylem Önerileri

BTC Yatırım Potansiyeli ve Değeri

Bitcoin; kısa vadede yüksek volatiliteye ve ciddi risklere sahip olmakla birlikte uzun vadede büyük değer potansiyeli sunar. Dijital altın ve enflasyon kalkanı rolünü sürdürürken, regülasyon ve teknolojiyle ilgili tehditler varlığını korumaktadır.

BTC Yatırım Tavsiyeleri

✅ Yeni başlayanlar: DCA yaklaşımıyla küçük ve düzenli yatırım tercih edin

✅ Tecrübeli yatırımcılar: Uzun vadeli tutma ile aktif taktiksel işlemleri harmanlayarak portföy çeşitlendirin

✅ Kurumsal yatırımcılar: Bitcoin’i alternatif varlık portföyünüzün bir bileşeni olarak değerlendirin

BTC ile Katılım Yöntemleri

- Spot alım-satım: Gate.com gibi düzenli borsalardan doğrudan BTC alımı

- Bitcoin ETF’leri: Mevzuata uygun finansal ürünler aracılığıyla dolaylı yatırım (uygunluk durumunda)

- Bitcoin madenciliği: Ağın güvenliğine katkıda bulunarak BTC ödülü kazanmak (yüksek sermaye gerektirir)

Kripto para yatırımlarında çok yüksek riskler bulunmaktadır; bu metin yatırım tavsiyesi niteliği taşımaz. Yatırımcılar kendi risk profilini dikkate alarak ve profesyonel finansal danışmanlarla görüşerek karar vermelidir. Kaybetmeyi göze alamayacağınız miktarda yatırım yapmayınız.

Sıkça Sorulan Sorular

2025’te 1 Bitcoin’in fiyatı ne olacak?

Uzman analizlerine göre, ETF yatırımlarındaki artış ve kurumsal benimsemenin hızlanması ile birlikte 2025’te 1 Bitcoin’in fiyatı 125.000 – 200.000 dolar aralığında beklenmektedir.

2030’da Bitcoin’in değeri ne olabilir?

Bitcoin’in ağı büyüdükçe, fiyatı 2030’a kadar 1 milyon doları görebilir. Piyasa şartları ve benimseme oranı bu tahmini doğrudan etkilemektedir.

Bitcoin 1 milyon dolara çıkabilir mi?

Teorik olarak mümkün olsa da, böylesi bir fiyatın gerçekleşmesi global çapta geniş bir benimseme gerektirir. Dünya nüfusunun %20-40’ı Bitcoin’e geçiş yapmadığı sürece bu senaryo oldukça spekülatif kabul edilir.

Bitcoin’in gerçekçi fiyatı ne kadar yükselebilir?

Bitcoin’in potansiyeli geniş; uzman tahminlerine göre benimseme ve piyasa koşullarına bağlı şekilde 1 milyon ila 10 milyon dolarlık zirvelere ulaşabilir.

2025 BTC Fiyat Tahmini: Boğa Koşusu mu, Ayı Piyasası mı? Kripto Paraların Gelecekteki Yönünü Analiz Etmek

2025 yılı BTC fiyat tahmini: Dijital altının 200.000 ABD Doları seviyesini aşma potansiyeline ilişkin teknik ve makro analiz

Bitcoin Fiyat Tahmini 2030

2025 yılı BTC fiyat tahmini: Bitcoin boğa piyasası döngüsünde ulaşılacak yeni zirveler ve küresel makroekonomik etkilerin kapsamlı analizi

Bitcoin Haberleri 2025: En Son Trendler ve Benimseme Güncellemeleri

2025 BTC Fiyat Tahmini: Bitcoin’i Yeni Zirvelere Taşıyabilecek Makroekonomik Faktörlerin ve Piyasa Döngülerinin Analizi

Günlük Analizler: MemeFi Ödülleri, Token Listelemeleri ve Fiyat Stratejileri

Yeni başlayanlar için önde gelen uluslararası token yatırım platformlarını keşfetmek

NFT Mint Etme Sürecinin Temelleri: Kendi NFT'lerinizi Mint Etmek İçin Kapsamlı Bir Rehber

ZK Rollup'ların İşleyişi: Web3 Ekosisteminde Sıfır Bilgi Teknolojisinin Kapsamlı Analizi

En İyi NFT Sanatçılarını Keşfedin