2025 RADAR Fiyat Tahmini: Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

Giriş: RADAR'ın Piyasadaki Konumu ve Yatırım Potansiyeli

DappRadar (RADAR), tüm protokoller ve dikeylerde merkeziyetsiz uygulamaları izleyen ve sıralayan dünyanın lider Dapp mağazası olarak, DeFi ve Web3 ekosisteminin şekillenmesinde kuruluşundan bu yana giderek daha önemli bir rol üstleniyor. 2025 yılı itibarıyla RADAR'ın piyasa değeri $2.243.090’a yükseldi; dolaşımda yaklaşık 1.525.808.338 token bulunmakta ve fiyatı $0,0014701 civarında seyretmektedir. “Dapp Analytics Pioneer” olarak anılan bu varlık, merkeziyetsiz uygulama ekosistemi için analiz ve içgörü sunma noktasında kritik bir konumda yer alıyor.

Bu makalede RADAR’ın 2025-2030 dönemindeki fiyat performansı, tarihsel eğilimler, piyasa arz ve talebi, ekosistem gelişimi ve makroekonomik koşullar bir arada analiz edilerek yatırımcılara profesyonel fiyat öngörüleri ve uygulanabilir yatırım stratejileri aktarılacaktır.

I. RADAR Fiyat Geçmişinin İncelenmesi ve Güncel Piyasa Durumu

RADAR Tarihsel Fiyat Gelişim Seyri

- 2023: 23 Şubat'ta $0,031 ile tüm zamanların en yüksek seviyesi görüldü; RADAR açısından önemli bir kilometre taşı

- 2025: Piyasa gerilemesiyle 10 Ekim'de $0,0009016 ile tüm zamanların en düşük seviyesine ulaşıldı

RADAR Güncel Piyasa Durumu

15 Ekim 2025 itibarıyla RADAR, $0,0014701 seviyesinden işlem görüyor ve 24 saatlik işlem hacmi $15.904,63. Son 24 saatte token %7,95 oranında değer kaybetti. RADAR’ın piyasa değeri $2.243.090,84 ve kripto para piyasasında 2.294. sırada yer alıyor.

Mevcut fiyat, tüm zamanların en yüksek seviyesinden %95,26 aşağıda; en düşük seviyesinden ise %63,06 yukarıda. Dolaşımdaki token miktarı 1.525.808.338,019161 RADAR olup toplam 10.000.000.000 token arzının %15,26’sını oluşturuyor.

RADAR, farklı vadelerde negatif performans sergiledi; son bir haftada %21,49, son 30 günde %17,14 değer kaybetti. Yıllık performans ise %69,12 oranında ciddi bir düşüşe işaret ediyor.

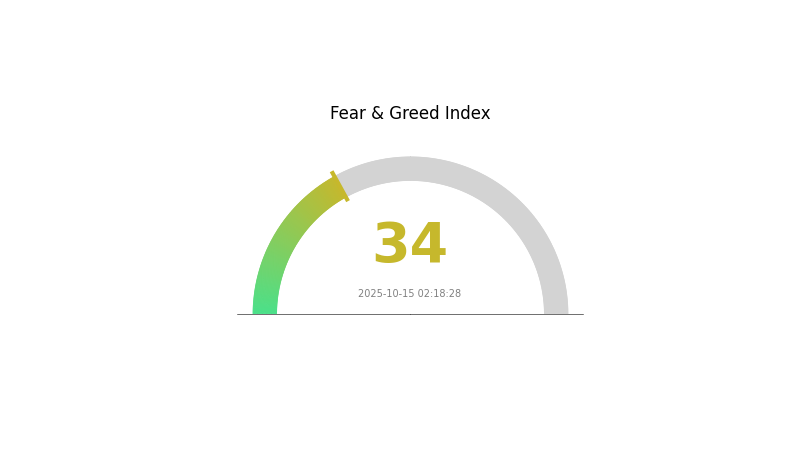

Kripto piyasasında duyarlılık şu anda “Korku” bölgesinde; VIX endeksi 34 düzeyinde ve yatırımcıların temkinli davrandığı gözleniyor.

Güncel RADAR piyasa fiyatı için tıklayın

RADAR Piyasa Duyarlılık Endeksi

15 Ekim 2025 Korku ve Açgözlülük Endeksi: 34 (Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasası temkinli bir havada; Korku ve Açgözlülük Endeksi 34 seviyesinde ve piyasa korku durumunda. Yatırımcılar temkinli hareket ediyor ve fırsatları gözden kaçırabiliyor. Tarihsel olarak, korku genellikle piyasa toparlanmalarından önceki dönemi işaret eder. Tecrübeli yatırımcılar bu dönemde araştırma yapıp olası giriş noktalarına hazırlık yapmalı ve risk yönetimini ön planda tutmalı. Piyasa duyarlılığı hızla değişebileceğinden güncel kalmak ve stratejiyi buna göre uyarlamak önemlidir.

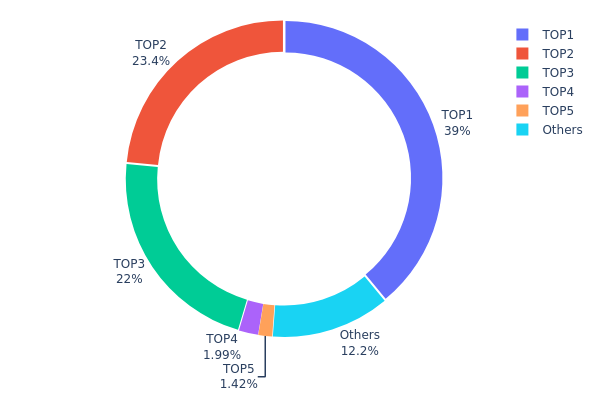

RADAR Varlık Dağılımı

RADAR adres varlık dağılımı verileri, oldukça yoğun ve merkezi bir sahiplik yapısını gösteriyor. İlk üç adres toplam arzın %84,36’sını elinde bulunduruyor; en büyük sahip ise %38,97 oranında tokena sahip. Bu seviye, olası piyasa manipülasyonu ve volatilite riskleri açısından endişe yaratıyor.

Böyle bir yoğun sahiplik, büyük adreslerden birinin yüklü miktarda token satması veya transfer etmesi halinde ciddi fiyat dalgalanmaları doğurabilir. Düşük merkeziyetsizlik, projenin yönetimini ve karar alma süreçlerini etkileyebilir. Az sayıda adresin çoğunluğu kontrol etmesi, RADAR ekosisteminin istikrarı ve adil işleyişi açısından tehdit oluşturabilir.

Tokenlerin %12,23’ü diğer adreslerde bulunuyor; bu oran, küçük yatırımcılar arasında yaygın bir dağılım olmadığını gösteriyor. Bu sahiplik yapısı, yeni yatırımcıların ilgisini azaltabilir ve RADAR projesinin uzun vadeli sürdürülebilirliği için zorluklar oluşturabilir.

Güncel RADAR Varlık Dağılımı için tıklayın

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x1117...40d911 | 3.897.803,06K | 38,97% |

| 2 | 0xe7dd...8778df | 2.343.333,83K | 23,43% |

| 3 | 0xfb22...55b6b9 | 2.196.942,23K | 21,96% |

| 4 | 0x5903...ffdf96 | 199.421,23K | 1,99% |

| 5 | 0xa023...fc947e | 142.130,65K | 1,42% |

| - | Others | 1.220.369,00K | 12,23% |

II. RADAR'ın Gelecekteki Fiyatını Etkileyecek Temel Unsurlar

Makroekonomik Ortam

- Para Politikası Etkisi: ABD Merkez Bankası’nın politikaları RADAR fiyatı üzerinde belirleyici olacak. Son PPI verileri yıllık %3,3 artış gösterdi ve bu, para politikalarını etkileyebilir.

- Enflasyona Karşı Koruma Potansiyeli: RADAR, enflasyona karşı koruma açısından potansiyel göstermekte; çekirdek PPI %3,7’ye yükselerek çok yıllık zirveye ulaştı.

- Jeopolitik Etkenler: Rusya-Ukrayna savaşının sürmesi ve ABD ile Rusya’daki siyasi güç dengesi, global piyasaları ve RADAR’ı etkileyen kritik faktörler arasında.

Teknolojik Gelişim ve Ekosistem İnşası

- Tedarik Zinciri Değişimleri: Sektörde bölgesel tedarik zincirlerine geçiş eğilimi RADAR’ın üretim maliyeti ve erişilebilirliğine etki edebilir.

- Yerli Teknoloji Gelişimi: Temel teknolojilerde kendine yeterlilik artırılmaya çalışılıyor; bu, RADAR’ın teknolojik ilerlemesi ve rekabetçiliği açısından önemli.

III. RADAR 2025-2030 Fiyat Öngörüleri

2025 Görünümü

- Temkinli tahmin: $0,00097 - $0,00147

- Tarafsız tahmin: $0,00147 - $0,00177

- İyimser tahmin: $0,00177 - $0,00207 (pozitif piyasa duyarlılığı şartıyla)

2027-2028 Görünümü

- Piyasa aşaması beklentisi: Olumlu büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: $0,0012 - $0,0022

- 2028: $0,00112 - $0,0026

- Temel katalizörler: Artan kullanım ve teknolojik gelişmeler

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: $0,00238 - $0,00269 (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: $0,00269 - $0,00301 (güçlü piyasa performansı varsayımıyla)

- Dönüştürücü senaryo: $0,003 - $0,00301 (yaygın benimseme ve olumlu piyasa şartları ile)

- 2030-12-31: RADAR $0,00301 (muhtemel zirve fiyat)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0,00207 | 0,00147 | 0,00097 | 0 |

| 2026 | 0,00243 | 0,00177 | 0,0017 | 20 |

| 2027 | 0,0022 | 0,0021 | 0,0012 | 42 |

| 2028 | 0,0026 | 0,00215 | 0,00112 | 46 |

| 2029 | 0,003 | 0,00238 | 0,00202 | 61 |

| 2030 | 0,00301 | 0,00269 | 0,00199 | 82 |

IV. RADAR Profesyonel Yatırım Stratejileri ve Risk Yönetimi

RADAR Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcılar: Uzun vadeli bakanlar ve DApp ekosistemine inananlar

- Uygulama önerileri:

- Piyasa düşüşlerinde RADAR token biriktirin

- Yönetim ve ödül için tokenlerinizi stake edin

- Tokenleri güvenli, saklama gerektirmeyen cüzdanlarda muhafaza edin

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Kısa ve uzun vadeli eğilimleri izleyin

- RSI: Aşırı alım/aşırı satım noktalarını tespit edin

- Dalgalı al-sat için kritik noktalar:

- Destek ve direnç seviyelerine göre net giriş-çıkış noktaları belirleyin

- DappRadar ekosistemindeki gelişmeleri fiyat katalizörleri açısından takip edin

RADAR Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: %5-10’u

- Profesyonel yatırımcılar: En fazla %15’i

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: DApp bağlantılı farklı tokenlerde pozisyon açmak

- Zarar durdur emirleri: Potansiyel kayıpları sınırlamak için kullanın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk saklama: Uzun vadeli varlıklar için donanım cüzdanı

- Güvenlik önlemleri: İki aşamalı doğrulama, güçlü şifre ve düzenli güncelleme kullanın

V. RADAR’da Potansiyel Riskler ve Zorluklar

RADAR Piyasa Riskleri

- Yüksek volatilite: RADAR fiyatında keskin dalgalanmalar görülebilir

- Sınırlı likidite: Büyük hacimli işlemlerde zorluk yaşanabilir

- Rekabet: Diğer DApp analiz platformları RADAR’ın payını azaltabilir

RADAR Düzenleyici Riskler

- Belirsiz regülasyonlar: Kripto düzenlemelerinde ani değişiklikler olabilir

- Token sınıflandırması: RADAR’ın menkul kıymet olarak görülme riski

- Sınır ötesi kısıtlamalar: Bazı ülkelerde RADAR ticareti sınırlandırılabilir

RADAR Teknik Riskler

- Akıllı kontrat açıkları: Token sözleşmesinde güvenlik zaafları oluşabilir

- Ölçeklenebilirlik sorunları: DappRadar büyüdükçe performans zayıflayabilir

- Blokzincirler arası uyumluluk: Çoklu zincirde DApp takibi zorlaşabilir

VI. Sonuç ve Eylem Önerileri

RADAR Yatırım Potansiyeli Değerlendirmesi

RADAR, hızla büyüyen DApp ekosistemine yatırım yapmak için eşsiz bir fırsat sunar. DApp’lerin yaygınlaşması ile uzun vadeli potansiyeli yüksek olsa da, kısa vadede volatilite ve düzenleyici riskler göz ardı edilmemelidir.

RADAR Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayın ve DApp ekosistemini öğrenmeye odaklanın ✅ Tecrübeli yatırımcılar: Kripto portföyünüzün bir bölümünü RADAR’a ayırıp diğer DApp bağlantılı yatırımlarla dengeleyin ✅ Kurumsal yatırımcılar: Kapsamlı araştırma yapıp RADAR’ı çeşitlendirilmiş DApp ve blokzincir analitik portföyüne dahil etmeyi değerlendirin

RADAR İşlem Katılım Yöntemleri

- Spot işlem: Gate.com üzerinde RADAR token alım-satımı

- Stake etme: RADAR stake programlarına katılarak ödül elde etmek

- DApp kullanımı: Tokenin ekosistem içindeki işlevini yakından gözlemlemek için DappRadar platformunda aktif olmak

Kripto para yatırımları son derece yüksek risk taşır, bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarını gözeterek dikkatli karar vermeli ve profesyonel finans danışmanlarına danışmalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayınız.

Sıkça Sorulan Sorular

2030’da RAD kripto için fiyat tahmini nedir?

Piyasa analizlerine göre 2030’da RAD’ın $3,28 ile $3,97 arasında, ortalama $3,62 düzeyinde olması bekleniyor.

RADAR kripto nedir?

RADAR, DappRadar platformunun yardımcı ve yönetim token’ıdır; PRO üyelikler ve geliştirici ödülleri için kullanılır, geliştiricilerin platform üzerindeki görünürlüğünü artırır.

En yüksek fiyat tahmini hangi kripto parada?

2025 yılı itibarıyla, Ethereum piyasa trendleri ve teknolojik gelişmeler ışığında büyük kripto paralar arasında en yüksek fiyat tahminine sahiptir.

Dare hisse fiyatı 2025 tahmini nedir?

Mevcut öngörülere göre Dare hissesi 2025’te $2,49 ile $2,96 aralığında olacak.

2025 COTI Fiyat Tahmini: Gelişen kripto para ekosisteminde piyasa trendleri ve geleceğe yönelik potansiyelin değerlendirilmesi

2025 ROSE Fiyat Tahmini: Oasis Network’in yerel token’ı için piyasa trendleri ve olası büyümenin analizi

2025 CELO Fiyat Tahmini: Boğa Koşusu mu, Ayı Piyasası mı? CELO'nun Gelecekteki Değerini Belirleyen Temel Faktörlerin Analizi

2025 NEWT Fiyat Tahmini: Gelişen DeFi Ekosisteminde Newt Finance İçin Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

2025 CERE Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

2025 REACT Fiyat Tahmini: Merkeziyetsiz Finans Ekosisteminde Büyüme Potansiyelinin Analizi

Kripto piyasasına yeni adım atanlar için Gate ETF Kaldıraçlı Tokenlar Ticaret Rehberi: Düşük başlangıç seviyeli, yüksek getirili araçların detaylı açıklaması

SEC, Ondo Finance hakkındaki soruşturmayı sonlandırdı: Bu durum DeFi token geliştirme süreçleri ve kripto uyumluluğu açısından ne ifade ediyor?

20 Hafta Önce Ne Kadar Süre Geçti?

USDT’nin Düzenleyici Olarak Tanınması: Stablecoin’ler ADGM’de Uyumluluğu Nasıl Sağlar

Sanal Visa Kartınızı Nasıl Nakit Paraya Çevirirsiniz