2025 CERE Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

Giriş: CERE'nin Piyasa Konumu ve Yatırım Değeri

Cere Network (CERE), merkeziyetsiz veri bulutu (DDC) platformu olarak faaliyete geçtiği günden bu yana kayda değer bir ivme kazandı. 2025 yılı itibarıyla CERE'nin piyasa değeri 3.661.464 $'a ulaşırken, dolaşımdaki arz yaklaşık 6.637.897.251 token ve fiyatı 0,0005516 $ seviyesinde dengeleniyor. "Kurumsal-blokzincir köprüsü" olarak anılan bu varlık, büyük şirketler ile hızla büyüyen merkeziyetsiz ekosistemler arasında kritik bir bağlantı noktası haline geliyor.

Bu makalede, 2025-2030 döneminde CERE fiyat eğilimleri; tarihsel desenler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler çerçevesinde analiz edilerek, yatırımcılara profesyonel fiyat projeksiyonları ve uygulanabilir yatırım stratejileri sunulacaktır.

I. CERE Fiyat Geçmişi ve Güncel Piyasa Görünümü

CERE Tarihsel Fiyat Seyri

- 2021: 8 Kasım'da CERE, 0,47126 $ ile tüm zamanların en yüksek seviyesine ulaşarak proje adına önemli bir aşama kaydetti.

- 2022-2024: Kripto para piyasasındaki uzun süreli ayı dönemi, CERE fiyatında belirgin bir gerilemeye yol açtı.

- 2025: 11 Ekim'de CERE, 0,00051279 $ ile tüm zamanların en düşük seviyesini gördü ve piyasa koşullarının zorluğunu yansıttı.

CERE Mevcut Piyasa Durumu

13 Ekim 2025 itibarıyla CERE, 0,0005516 $ seviyesinden işlem görüyor ve son 24 saatte %4,15 artış gösterdi. Ancak uzun vadede, token ciddi değer kaybı yaşadı; son bir haftada %25,03, son bir ayda %38,46 oranında düşüş kaydetti. Güncel piyasa değeri 3.661.464 $ olup, CERE küresel kripto para sıralamasında 1.962. sırada yer alıyor. 24 saatlik işlem hacmi ise 19.571 $ ile piyasanın orta düzeyde aktif olduğunu gösteriyor. Son kısa vadeli yükselişe rağmen, CERE halen tüm zamanların zirvesinin %99,88 altında işlem görüyor; bu da tepe seviyeden bu yana yaşanan ciddi düşüşü ortaya koyuyor.

Güncel CERE piyasa fiyatını görmek için tıklayın

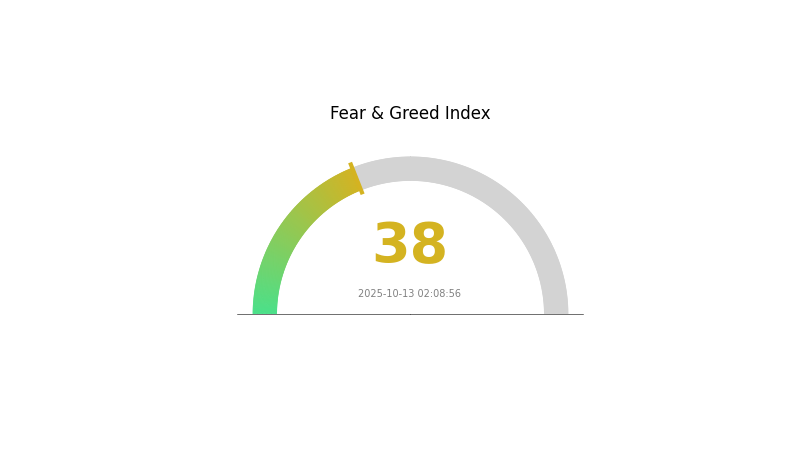

CERE Piyasa Duyarlılığı Endeksi

13 Ekim 2025 Korku ve Açgözlülük Endeksi: 38 (Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto para piyasasında şu anda korku hakim; Korku ve Açgözlülük Endeksi 38 seviyesinde. Bu, yatırımcılar arasında temkinli bir yaklaşımın öne çıktığını ve karşıt stratejiye sahip yatırımcılar için potansiyel bir alım fırsatı anlamına gelebilir. Ancak yatırım kararları öncesinde kapsamlı araştırma yapmak ve çok yönlü değerlendirme şarttır. Piyasadaki korku ortamı, düzenleme endişeleri, makroekonomik belirsizlikler veya son dönemdeki dalgalanmalardan kaynaklanıyor olabilir. Her koşulda, çeşitlendirme ve risk yönetimi kripto piyasasında başarılı bir yol haritası için temel önemdedir.

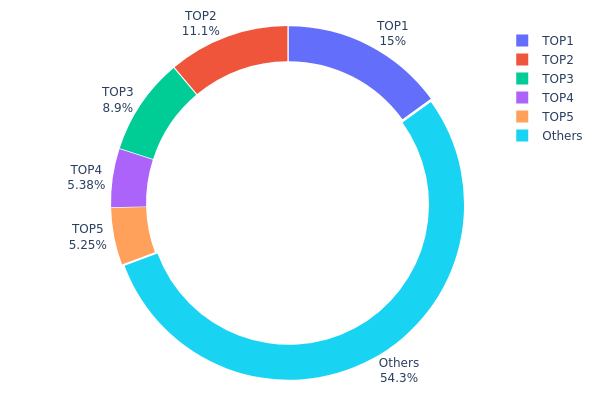

CERE Token Dağılımı

Adres bazında token dağılımı, CERE sahipliğinin piyasa üzerindeki etkisini anlamada önemli bir gösterge sunar. Analize göre, en büyük sahiplerde yüksek bir yoğunlaşma söz konusu; ilk 5 adres toplam arzın %45,7’sini elinde bulundururken, en büyük adres %15,04’üne sahip. Bu yoğunlaşma, piyasada az sayıda aktörün önemli bir rol üstlenebileceğini gösteriyor.

Bu seviyedeki yoğunlaşma, volatiliteyi artırabilir ve fiyat manipülasyon riskini yükseltebilir. Büyük sahipler, büyük işlem emirleriyle fiyat üzerinde etkili olabilir. Ancak, tokenların %54’ünden fazlasının geri kalan adreslere yayılmış olması, belirli ölçüde merkeziyetsizlik ve risk dağılımı anlamına gelir.

Mevcut dağılım, başlıca paydaşların ciddi ağırlık taşıdığı, ancak küçük yatırımcılar arasında da geniş bir token tabanının bulunduğu bir piyasa yapısı sunar. Bu denge, hem piyasa istikrarının korunması hem de CERE ekosisteminin büyüme ve benimsenme potansiyeli için kritik bir faktördür.

Güncel CERE Token Dağılımı için tıklayın

| İlk | Adres | Miktar | Pay (%) |

|---|---|---|---|

| 1 | 0x10e2...132335 | 1.504.733,24K | 15,04% |

| 2 | 0x218f...6d640f | 1.114.007,54K | 11,14% |

| 3 | 0x15b3...04cd34 | 890.271,06K | 8,90% |

| 4 | 0xac7f...c5bae7 | 537.500,00K | 5,37% |

| 5 | 0x8fe0...5b6f88 | 525.195,22K | 5,25% |

| - | Diğerleri | 5.428.292,94K | 54,3% |

II. CERE'nin Gelecekteki Fiyatını Etkileyen Temel Unsurlar

Arz Mekanizması

- Piyasa Oynaklığı: İşlem platformlarının tepki süresi, piyasa koşulları, sistem performansı veya başka faktörlere bağlı olarak değişebilir. Piyasa dalgalanmaları, hesap erişimi ve işlem yürütme süreçlerini etkileyebilir.

Makroekonomik Koşullar

-

Para Politikası Etkisi: Uluslararası enerji fiyatlarındaki dalgalanma ve küresel ekonomik ortam, CERE'nin gelecekteki fiyatı üzerinde belirleyici rol oynar.

-

Enflasyona Karşı Koruma Özellikleri: Düşük emisyon teknolojilerine yatırımlar ve bunların getirileri, enflasyonist ortamda CERE'nin fiyat performansına etki edebilir.

-

Jeopolitik Faktörler: Petrol, doğalgaz ve gıda fiyatlarındaki değişim gibi uluslararası gelişmeler, CERE fiyat beklentilerinde önemli belirsizlikler yaratabilir.

Teknolojik Gelişmeler ve Ekosistem Oluşumu

-

İklimle İlgili Finansal Açıklamalar: Finansal kuruluşların iklim risklerini açıklama zorunluluğu, CERE'nin piyasa algısını ve fiyatını etkileyebilir.

-

Ekosistem Uygulamaları: İklim dostu yatırım ve yeşil finans çerçevesinin gelişimi, CERE'nin benimsenmesini ve değerini artırabilir.

III. 2025-2030 Dönemi CERE Fiyat Tahmini

2025 Görünümü

- İhtiyatlı tahmin: 0,00034 $ - 0,00045 $

- Tarafsız tahmin: 0,00045 $ - 0,00065 $

- İyimser tahmin: 0,00065 $ - 0,00074 $ (olumlu piyasa koşulları ve proje gelişmesi gerektirir)

2027-2028 Görünümü

- Piyasa aşaması beklentisi: Daha fazla benimsenmeyle büyüme evresine geçiş

- Fiyat aralığı tahmini:

- 2027: 0,00073 $ - 0,00096 $

- 2028: 0,00053 $ - 0,00092 $

- Başlıca katalizörler: Teknolojide ilerleme, ekosistemin genişlemesi ve CERE token kullanımının artması

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,00090 $ - 0,00107 $ (istikrarlı piyasa büyümesi ve proje gelişimi varsayımıyla)

- İyimser senaryo: 0,00107 $ - 0,00125 $ (güçlü piyasa performansı ve yaygın benimsenme varsayımıyla)

- Dönüştürücü senaryo: 0,00125 $ - 0,00150 $ (çığır açan inovasyonlar ve kitlesel benimseme varsayımıyla)

- 2030-12-31: CERE 0,00112 $ (yıl sonu konsolidasyonu öncesi olası zirve)

| Yıl | En Yüksek Tahmini Fiyat | Ortalama Tahmini Fiyat | En Düşük Tahmini Fiyat | Getiri (%) |

|---|---|---|---|---|

| 2025 | 0,00074 | 0,00055 | 0,00034 | 0 |

| 2026 | 0,00094 | 0,00065 | 0,00062 | 17 |

| 2027 | 0,00096 | 0,00079 | 0,00073 | 43 |

| 2028 | 0,00092 | 0,00087 | 0,00053 | 58 |

| 2029 | 0,00125 | 0,0009 | 0,00072 | 62 |

| 2030 | 0,00112 | 0,00107 | 0,00076 | 94 |

IV. CERE Profesyonel Yatırım Stratejisi ve Risk Yönetimi

CERE Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Uygun olanlar: Risk toleransı yüksek ve uzun vadeli vizyona sahip yatırımcılar

- Operasyon önerileri:

- Piyasa gerilemelerinde CERE token biriktirin

- 3-5 yıl hedefli tutma süresi belirleyin

- Tokenları güvenli donanım cüzdanında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve dönüş noktalarını saptayın

- RSI: Aşırı alım/aşırı satım durumlarını takip edin

- Dalgalı al-sat için önemli noktalar:

- Risk yönetimi için sıkı zarar durdur emirleri koyun

- Belirlenen direnç seviyelerinde kar alın

CERE Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Saldırgan yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Yatırımı farklı kripto varlıklara yaymak

- Opsiyon stratejileri: Düşüş riskine karşı opsiyon kullanımı değerlendirilmelidir

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk depolama: Uzun vadeli tutum için donanım cüzdanı kullanın

- Güvenlik için: İki faktörlü kimlik doğrulama etkinleştirilmeli, güçlü şifreler kullanılmalı

V. CERE İçin Potansiyel Riskler ve Zorluklar

CERE Piyasa Riskleri

- Yüksek volatilite: CERE fiyatı önemli dalgalanmalara açık

- Düşük likidite: Büyük işlemlerde zorluk yaşanabilir

- Rekabet: Diğer merkeziyetsiz veri platformları CERE'nin pazar payını etkileyebilir

CERE Regülasyon Riskleri

- Belirsiz düzenlemeler: Yeni kripto düzenlemeleri CERE üzerinde etkili olabilir

- Sınır ötesi uyum: Farklı ülke yasalarına uyum gerekliliği

- Vergi etkileri: Kripto varlıkların vergilendirilmesindeki değişkenlik

CERE Teknik Riskleri

- Akıllı sözleşme açıkları: CERE protokolünde olası güvenlik açıkları

- Ölçeklenebilirlik sorunları: Ağ büyüdükçe performans sorunları oluşabilir

- Birlikte çalışabilirlik riskleri: Zincirler arası uyumlulukta zorluklar

VI. Sonuç ve Eylem Önerileri

CERE Yatırım Değeri Değerlendirmesi

CERE, merkeziyetsiz veri bulutu platformu olarak uzun vadede yüksek potansiyel sunar; ancak piyasa oynaklığı ve düzenleyici belirsizlikler kısa vadede risk teşkil eder.

CERE Yatırım Önerileri

✅ Yeni başlayanlar: Zaman içinde düzenli ve küçük alımlar ile pozisyon oluşturmayı düşünebilir ✅ Deneyimli yatırımcılar: Tutma ve aktif alım-satım stratejilerini dengeli şekilde uygulamalı ✅ Kurumsal yatırımcılar: Kapsamlı inceleme yapmalı, CERE’yi çeşitlendirilmiş kripto portföyünde değerlendirmeli

CERE Alım-Satım Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden CERE token alıp satabilirsiniz

- Staking: Uygun ise staking programlarına katılım sağlanabilir

- DeFi entegrasyonu: CERE token ile merkeziyetsiz finans imkanlarını değerlendirin

Kripto para yatırımları son derece yüksek risk içerir ve bu makale yatırım tavsiyesi değildir. Yatırım kararlarınızı kendi risk profilinize göre dikkatlice almalı ve profesyonel finans danışmanlarına danışmalısınız. Kaybetmeyi göze alabileceğinizden fazlasını asla yatırmayınız.

SSS

Cere token kaç para?

13 Ekim 2025 itibarıyla Cere token yaklaşık 0,00086 $ değerindedir ve Eylül ayına göre hafif bir düşüş göstermektedir.

Constellation kripto 2025’te ne kadar olur?

Piyasa analizlerine göre Constellation kripto, 2025’te 0,02917 $ – 0,0675 $ aralığına ulaşabilir ve büyüme potansiyeli taşımaktadır.

Cere Crypto’nun işlevi nedir?

Cere Network, blokzincirler arası güvenli veri iş birliği ve birlikte çalışabilirlik sağlayan merkeziyetsiz bir platformdur; kesintisiz veri paylaşımını gizlilik ve güvenlikten ödün vermeden mümkün kılar.

En yüksek fiyat tahminine sahip kripto hangisi?

2025’te en yüksek fiyat tahmini Bitcoin’e aittir; öngörüler 122.937 $ seviyesindedir. Chainlink ise 59,67 $ ile dikkat çeken bir yükselişle ikinci sıradadır.

2025 COTI Fiyat Tahmini: Gelişen kripto para ekosisteminde piyasa trendleri ve geleceğe yönelik potansiyelin değerlendirilmesi

2025 ROSE Fiyat Tahmini: Oasis Network’in yerel token’ı için piyasa trendleri ve olası büyümenin analizi

2025 CELO Fiyat Tahmini: Boğa Koşusu mu, Ayı Piyasası mı? CELO'nun Gelecekteki Değerini Belirleyen Temel Faktörlerin Analizi

2025 NEWT Fiyat Tahmini: Gelişen DeFi Ekosisteminde Newt Finance İçin Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

2025 RADAR Fiyat Tahmini: Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

2025 REACT Fiyat Tahmini: Merkeziyetsiz Finans Ekosisteminde Büyüme Potansiyelinin Analizi

NFT Nadirliği Anlamak: Puanlama Sistemleri Rehberi

Blokzincirde Proof-of-Work Konsensüs Mekanizmasını Anlamak

Satoshi'den Bitcoin'e Dönüşümün Anlaşılması: Kolay Anlatım

Web3'te Hashing Kavramı: Kapsamlı Bir Blockchain Rehberi

Ethereum Gas Ücretlerini Anlamak: Tam Kapsamlı Rehber