2025 PYUSD Fiyat Tahmini: Stablecoin Dalgalı Kripto Piyasasında Dolar Sabitini Korumayı Sürdürebilecek mi?

Giriş: PYUSD'nin Piyasadaki Konumu ve Yatırım Potansiyeli

PayPal USD (PYUSD), ödeme alanında fırsatlar yaratmak amacıyla tasarlanmış bir stablecoin olarak, 2023 yılındaki çıkışından bu yana kayda değer bir gelişim göstermiştir. 2025 yılı itibarıyla PYUSD'nin piyasa değeri 2,64 milyar dolara ulaşırken, yaklaşık 2.641.474.136 token dolaşımda bulunuyor ve fiyatı 0,9992 dolar civarında seyrediyor. "PayPal destekli stablecoin" olarak bilinen bu dijital varlık, dijital ödemeler ve finansal işlemlerde giderek büyüyen bir rol üstlenmektedir.

Bu makalede, PYUSD'nin 2025-2030 yılları arasındaki fiyat hareketleri, geçmiş veriler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik etkenler incelenerek yatırımcılara profesyonel tahminler ve uygulanabilir yatırım stratejileri sunulacaktır.

I. PYUSD Fiyat Geçmişi ve Güncel Piyasa Durumu

PYUSD Tarihsel Fiyat Gelişimi

- 2023: PYUSD piyasaya sürüldü, fiyatı 1 dolar civarında sabit kaldı

- 2024: Benimsenme arttı, fiyat küçük dalgalanmalarla genel olarak stabil seyretti

- 2025: Piyasa oynaklığı görüldü, son 24 saatte fiyat 0,9984 ila 0,9997 dolar arasında değişti

PYUSD Güncel Piyasa Durumu

15 Ekim 2025 itibarıyla PYUSD, 0,9992 dolardan işlem görüyor ve ABD dolarına sabitliğini koruyor. 24 saatlik işlem hacmi 6.952,66 dolar olup, piyasa aktivitesinin orta düzeyde olduğunu gösteriyor. PYUSD'nin piyasa değeri 2.639.360.956 dolar ve kripto para sıralamasında 51. sırada yer alıyor. Dolaşımdaki arz 2.641.474.136 PYUSD, toplam arz ise 967.614.865 token. Stablecoin, son 24 saatteki %0,03 fiyat değişimiyle mevcut piyasa koşullarında istikrarını sürdürüyor.

Güncel PYUSD piyasa fiyatını görmek için tıklayın

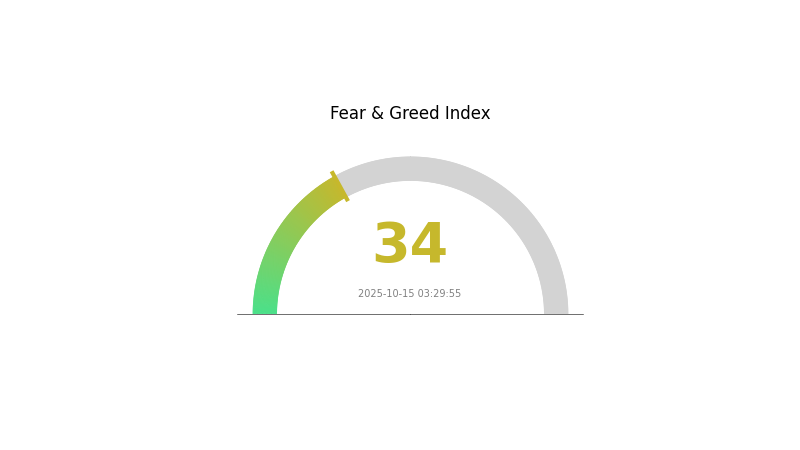

PYUSD Piyasa Duyarlılık Endeksi

2025-10-15 Korku ve Açgözlülük Endeksi: 34 (Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında şu anda korku hakim; Korku ve Açgözlülük Endeksi 34 seviyesinde. Bu, yatırımcıların temkinli davrandığını ve bunun son piyasa dalgalanmaları veya düzenleyici belirsizliklerden kaynaklanabileceğini gösteriyor. Böyle bir dönemde, tecrübeli yatırımcılar genellikle düşük fiyatlardan varlık toplama fırsatı arar. Ancak yatırım kararı almadan önce kapsamlı araştırma yapmalı ve dikkatli olunmalıdır. Piyasa gelişmelerini izleyerek PYUSD ekosistemindeki yeniliklerden haberdar kalın.

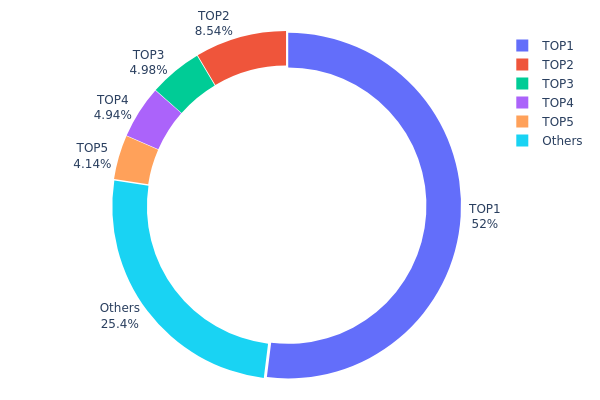

PYUSD Varlık Dağılımı

PYUSD adres varlık dağılımı verileri, piyasada yüksek merkezileşme olduğunu gösteriyor. En üstteki adres, toplam arzın %51,97'sini elinde bulunduruyor ve bu ciddi bir merkezileşmeye işaret ediyor. Sonraki dört büyük adres toplamda %22,58'lik paya sahipken, kalan adresler %25,45'lik paya sahip.

Bu dağılım yapısı, piyasa manipülasyonu ve fiyat oynaklığı riskleri doğuruyor. Arzın yarısından fazlası tek bir varlıkta olduğunda, bu adresin büyük ölçekli hareketleri piyasada önemli dalgalanmalara yol açabilir. İlk beş adres toplamda PYUSD'nin %74,55'ini kontrol ediyor ve bu da koordineli hareket riskini artırıyor.

Böyle bir merkezileşme, PYUSD'nin merkeziyetsizliğinin düşük olduğunu gösterir. Bu yapı piyasa istikrarı ve likiditeyi etkileyebilir; büyük sahipler fiyat dinamiklerinde ciddi rol oynayabilir. Yatırımcılar ve traderlar, PYUSD ile ilgili işlemlerde bu yoğunlaşmanın farkında olmalı.

Güncel PYUSD Varlık Dağılımını görmek için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 9DrvZv...yDWpmo | 367.799,53K | 51,97% |

| 2 | 4AK83V...bjdV3m | 60.452,62K | 8,54% |

| 3 | 5SybwT...yPT8ey | 35.225,89K | 4,97% |

| 4 | 5stwKM...vudFde | 34.963,50K | 4,94% |

| 5 | 22Wnk8...h7zkBa | 29.276,99K | 4,13% |

| - | Diğerleri | 179.992,69K | 25,45% |

II. PYUSD'nin Gelecek Fiyatını Etkileyen Temel Unsurlar

Arz Mekanizması

- Piyasa Talebi: PYUSD'nin finansal sistemlere daha yoğun entegrasyonu ve artan kullanım oranı, arz-talep dengesini doğrudan etkileyecek.

- Tarihsel Eğilim: Stablecoin olarak PYUSD'nin fiyatı sabit kalsa da piyasa değeri ve benimsenme oranı yükseliş trendinde.

- Mevcut Etki: PYUSD'nin Solana gibi ağlara açılması, erişilebilirliğini ve kullanım senaryolarını artırarak arz-talep üzerinde yeni etkiler yaratıyor.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Benimseme: PayPal'ın desteği ve PYUSD'nin ödeme ekosistemine entegrasyonu, kurumsal yatırımlar için sağlam bir zemin oluşturuyor.

- Ulusal Politikalar: Stablecoin'lere yönelik kamu politikaları ve düzenleyici yaklaşımlar, PYUSD'nin gelecekteki gelişiminde belirleyici olacak.

Makroekonomik Ortam

- Para Politikası Etkisi: Merkez bankası kararları, özellikle FED'in adımları, kripto piyasası ve PYUSD üzerinde doğrudan etki oluşturacak.

- Jeopolitik Etkenler: Küresel ekonomik koşullar ve uluslararası ilişkiler, dijital dolar alternatiflerine olan talebi şekillendirebilir.

Teknolojik Gelişim ve Ekosistem Oluşumu

- Ağ Genişlemesi: PYUSD'nin Solana gibi farklı blockchain ağlarına entegrasyonu, çok yönlü ve yeni kullanım alanları sunuyor.

- Ekosistem Uygulamaları: PYUSD ile çalışan DApp ve finansal servislerin gelişimi, ekosistemin büyümesini ve benimsenmesini hızlandıracak.

III. 2025-2030 PYUSD Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,89928 - 0,9992 dolar

- Tarafsız tahmin: 0,9992 - 1,12 dolar

- İyimser tahmin: 1,12 - 1,249 dolar (stablecoin benimsenmesinin artması durumunda)

2027-2028 Görünümü

- Piyasa fazı beklentisi: Büyüme ve konsolidasyon dönemi

- Fiyat aralığı tahmini:

- 2027: 0,66727 - 1,42266 dolar

- 2028: 0,79109 - 1,58218 dolar

- Temel katalizörler: DeFi'de geniş kabul, geleneksel finans ile entegrasyon

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 1,4615 - 1,53458 dolar (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 1,60765 - 2,28652 dolar (kurumsal benimsenmede artış ile)

- Dönüştürücü senaryo: 2,28652+ dolar (düzenleyici netlik ve yaygın kullanım ile)

- 2030-12-31: PYUSD 1,53458 dolar (%53 artış, 2025'e göre)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Artış Oranı |

|---|---|---|---|---|

| 2025 | 1,249 | 0,9992 | 0,89928 | 0 |

| 2026 | 1,39388 | 1,1241 | 0,86556 | 12 |

| 2027 | 1,42266 | 1,25899 | 0,66727 | 26 |

| 2028 | 1,58218 | 1,34083 | 0,79109 | 34 |

| 2029 | 1,60765 | 1,4615 | 1,27151 | 46 |

| 2030 | 2,28652 | 1,53458 | 1,39646 | 53 |

IV. Profesyonel PYUSD Yatırım Stratejileri ve Risk Yönetimi

PYUSD Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için uygun: İstikrarlı getiri arayan temkinli yatırımcılar

- İşlem önerileri:

- Piyasa geri çekilmelerinde PYUSD biriktirin

- Düzenli alım programı oluşturun

- Çok faktörlü doğrulama ile güvenli cüzdanlarda saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Kısa ve uzun vadeli trendleri takip edin

- RSI (Göreli Güç Endeksi): Aşırı alım veya aşırı satım noktalarını belirleyin

- Dalgalı işlemde dikkat edilmesi gerekenler:

- Net giriş ve çıkış noktaları belirleyin

- Risk yönetimi için zarar-durdur emirleri kullanın

PYUSD Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcılar: %5-10

- Agresif yatırımcılar: %15-20

- Profesyonel yatırımcılar: %25-30

(2) Riskten Korunma Yöntemleri

- Diversifikasyon: Yatırımlarınızı farklı stablecoin ve varlıklara dağıtın

- Zarar-durdur emirleri: Olası kayıpları sınırlandırmak için uygulayın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 cüzdanı

- Soğuk depolama: Büyük varlıklar için donanım cüzdanları

- Güvenlik önlemleri: İki faktörlü doğrulamayı açın, güçlü parolalar kullanın

V. PYUSD'nin Potansiyel Riskleri ve Zorlukları

PYUSD Piyasa Riskleri

- Likidite riski: Büyük çaplı geri alımlarda yaşanabilecek sorunlar

- Rekabet: Diğer stablecoin’lerle artan rekabet

- Piyasa duyarlılığı: Kripto piyasasındaki genel duygu değişiklikleri

PYUSD Düzenleyici Riskler

- Düzenleyici inceleme: Stablecoin’lerin daha yoğun denetlenmesi

- Uyum gereklilikleri: Yasal standartlarda olası değişiklikler

- Sınır ötesi kısıtlamalar: Farklı ülkelerde değişen düzenlemeler

PYUSD Teknik Riskler

- Akıllı sözleşme açıkları: Temel kodda olası zafiyetler

- Blokzincir yoğunluğu: Ağda aşırı işlem aktivitesi nedeniyle gecikmeler

- Entegrasyon sorunları: Yeni platformlara geçişte yaşanabilecek güçlükler

VI. Sonuç ve Eylem Önerileri

PYUSD Yatırım Potansiyeli Değerlendirmesi

PYUSD, güvenilir bir şirket desteğiyle istikrar ve düzenli getiri potansiyeli sunar. Ancak gelişen stablecoin piyasasında, yatırımcıların düzenleyici ve piyasa risklerini göz önünde bulundurması gerekir.

PYUSD Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Piyasayı anlamak için küçük ve düzenli alımlar yapın

✅ Deneyimli yatırımcılar: PYUSD’yi çeşitlendirilmiş stablecoin portföyüne dahil edin

✅ Kurumsal yatırımcılar: Hazine yönetimi ve düşük riskli kripto varlıklar için PYUSD’yi değerlendirin

PYUSD İşlem Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden PYUSD alıp satın

- Getiri ürünleri: PYUSD'yi faiz getiren platformlarda değerlendirin

- Ödeme çözümleri: PYUSD ile sınır ötesi işlemleri keşfedin

Kripto para yatırımları son derece yüksek risk taşır. Bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarına göre dikkatli karar vermeli ve profesyonel finansal danışmanlara danışmalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

Sıkça Sorulan Sorular

PayPal USD değer kazanacak mı?

Evet, PayPal USD’nin değerinin artması öngörülüyor; 2030’da 2,1 dolara ulaşabilir. Bu da mevcut fiyatına göre %112,00 potansiyel getiri anlamına gelir.

Pyusd bugün ne kadar?

15 Ekim 2025 itibarıyla Pyusd 0,9998 dolar değerindedir. 24 saatlik işlem hacmi 274.400.692 dolardır. Fiyat anlık olarak güncellenmektedir.

PayPal hissesi için 2030 fiyat tahmini nedir?

PayPal hissesi, 2030’da piyasa analizlerine göre 14,13 ile 24,75 dolar arasında fiyatlanabilir.

Pyusd’yi USD’ye çevirebilir miyim?

Evet, PYUSD’yi USD’ye çevirebilirsiniz. Dönüşüm oranı genellikle 1:1’dir; 1 PYUSD, 1 ABD dolarına eşittir. Dönüşüm işlemi hızlı ve kolaydır.

PayPal USD (PYUSD) iyi bir yatırım olur mu?: Dijital para dünyasında PayPal'ın stablecoin'inin potansiyelini ve risklerini değerlendiriyoruz

Worldwide USD (WUSD) iyi bir yatırım mı?: Yeni bir stablecoin’in riskleri ve potansiyelinin analizi

USDe Fiyat Tahmini: 2025 Ethena Stabilcoin Pazar Analizi ve Yatırım Stratejisi

Elon Musk'un İlk Milyonunu Nasıl Kazandı: Bir Milyarder Yapan İlk Girişimler

Gate Launchpad: Plasma XPL Proje Yatırım Stratejisi ve Kar Analizi

World Liberty Financial USD (USD1) iyi bir yatırım mı?: Bu kripto paranın riskleri ve potansiyel getirileri üzerine bir analiz

Blokzincir teknolojisinde işlem düğümlerinin işleyişini anlamak

Web3 varlığınızı ENS alan adlarıyla güçlendirin

Tekne Meraklıları için Önde Gelen Yacht Club NFT Koleksiyonları

Blockchain Oracle’ı Anlamak: Kapsamlı Bir Rehber

Nostr'a Yakından Bakış: Merkeziyetsiz Sosyal Medyanın Geleceği