2025 PYUSD Price Prediction: Analyzing Potential Growth and Market Trends for the Emerging Stablecoin

Introduction: PYUSD's Market Position and Investment Value

PayPal USD (PYUSD), as a stablecoin designed for payment opportunities, has made significant strides since its inception in 2023. As of 2025, PYUSD's market capitalization has reached $3.41 billion, with a circulating supply of approximately 3,408,934,195 tokens, maintaining a price of $1. This asset, often referred to as the "PayPal-backed stablecoin," is playing an increasingly crucial role in digital payments and e-commerce transactions.

This article will comprehensively analyze PYUSD's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. PYUSD Price History Review and Current Market Status

PYUSD Historical Price Evolution

- 2023: PYUSD launched, price stabilized around $1

- 2024: Increased adoption, price maintained stability with minor fluctuations

- 2025: Market expansion, price ranged from $0.9994 to $1.0011

PYUSD Current Market Situation

As of November 14, 2025, PYUSD is trading at $1, maintaining its peg to the US dollar. The 24-hour trading volume stands at $26,218.37, indicating active market participation. PYUSD has shown remarkable stability, with a 24-hour price change of +0.04%. The current market cap is $3,408,934,194.99, ranking PYUSD 40th in the overall cryptocurrency market.

PYUSD has demonstrated resilience, with its all-time high of $1.2 reached on September 12, 2023, and its all-time low of $0.833 on August 22, 2023. The stablecoin has since maintained a tight range around its $1 peg, reflecting its design as a reliable digital representation of the US dollar.

Click to view the current PYUSD market price

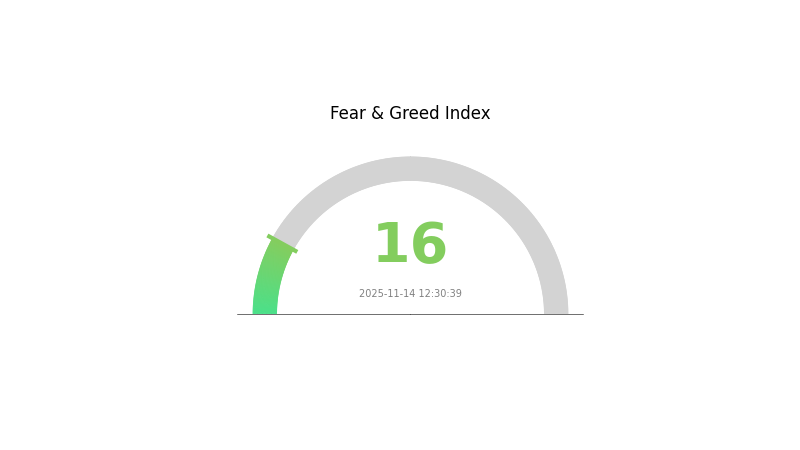

PYUSD Market Sentiment Indicator

2025-11-14 Fear and Greed Index: 16 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is experiencing a period of extreme fear, with the Fear and Greed Index plummeting to 16. This suggests a high level of uncertainty and pessimism among investors. During such times, it's crucial to remain calm and avoid making impulsive decisions. While some see this as a potential buying opportunity, it's important to conduct thorough research and consider your risk tolerance. Gate.com offers a range of tools and resources to help traders navigate these turbulent market conditions.

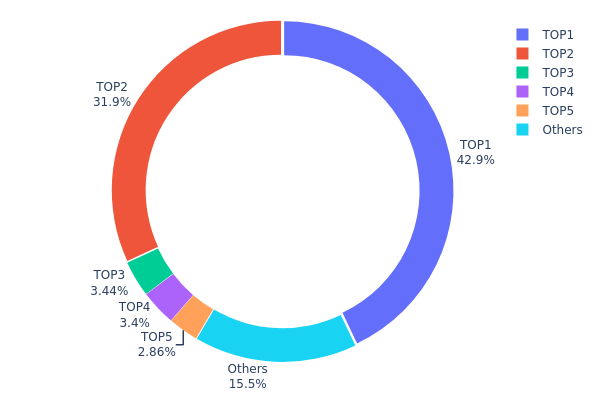

PYUSD Holdings Distribution

The address holdings distribution data for PYUSD reveals a highly concentrated ownership structure. The top two addresses hold a combined 74.78% of the total supply, with 42.91% and 31.87% respectively. This level of concentration raises concerns about potential market manipulation and price volatility.

The top five addresses collectively control 84.46% of PYUSD tokens, leaving only 15.54% distributed among other holders. Such a skewed distribution suggests a low level of decentralization and could pose risks to market stability. Large holders, often referred to as "whales," have the potential to significantly impact the market through their trading activities.

This concentration of holdings may lead to increased price volatility and susceptibility to market manipulation. It also indicates that PYUSD's on-chain structure is currently dominated by a small number of entities, which could affect the token's overall market dynamics and liquidity distribution.

Click to view the current PYUSD Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 9DrvZv...yDWpmo | 441213.08K | 42.91% |

| 2 | 5gUuDF...aUUPE4 | 327701.22K | 31.87% |

| 3 | 5SybwT...yPT8ey | 35338.33K | 3.43% |

| 4 | 5stwKM...vudFde | 34963.50K | 3.40% |

| 5 | 22Wnk8...h7zkBa | 29384.06K | 2.85% |

| - | Others | 159584.87K | 15.54% |

II. Core Factors Affecting PYUSD's Future Price

Supply Mechanism

- Pegged Supply: PYUSD is designed to maintain a 1:1 peg with the US dollar, with supply adjusted based on demand.

- Historical Pattern: As a stablecoin, PYUSD's price has historically remained stable around $1.

- Current Impact: Supply changes are expected to have minimal impact on price due to the pegged nature of the token.

Institutional and Whale Dynamics

- Corporate Adoption: PayPal, as the issuer of PYUSD, is a major corporation utilizing the stablecoin.

- National Policies: Regulatory developments in the US regarding stablecoins may impact PYUSD's adoption and usage.

Macroeconomic Environment

- Monetary Policy Impact: Federal Reserve policies on interest rates and inflation may affect demand for USD-pegged stablecoins like PYUSD.

- Inflation Hedging Properties: As a USD-pegged stablecoin, PYUSD may be viewed as an inflation hedge in certain economic contexts.

Technical Development and Ecosystem Building

- Ecosystem Applications: Integration with PayPal's payment infrastructure and potential expansion to other platforms could increase PYUSD's utility and adoption.

III. PYUSD Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.66 - $0.80

- Neutral forecast: $0.80 - $1.00

- Optimistic forecast: $1.00 - $1.38 (requires strong adoption and market stability)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.66 - $1.85

- 2028: $0.88 - $2.26

- Key catalysts: Wider acceptance of stablecoins, regulatory clarity, and improved blockchain infrastructure

2029-2030 Long-term Outlook

- Base scenario: $1.60 - $2.00 (assuming steady growth and market stability)

- Optimistic scenario: $2.00 - $2.36 (with accelerated adoption and favorable market conditions)

- Transformative scenario: $2.36+ (under extremely favorable conditions and widespread institutional adoption)

- 2030-12-31: PYUSD $1.99893 (projected average price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.37959 | 0.9997 | 0.6598 | 0 |

| 2026 | 1.29671 | 1.18964 | 0.64241 | 18 |

| 2027 | 1.85233 | 1.24318 | 0.65888 | 24 |

| 2028 | 2.25972 | 1.54776 | 0.88222 | 54 |

| 2029 | 2.09411 | 1.90374 | 1.59914 | 90 |

| 2030 | 2.35873 | 1.99893 | 1.91897 | 99 |

IV. PYUSD Professional Investment Strategies and Risk Management

PYUSD Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking stable returns

- Operation suggestions:

- Accumulate PYUSD during market dips

- Set up regular purchase plans

- Store in secure, reputable wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- Relative Strength Index (RSI): Identify overbought or oversold conditions

- Key points for swing trading:

- Monitor market sentiment and news affecting stablecoins

- Set stop-loss orders to manage risk

PYUSD Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 5-10% of portfolio

- Aggressive investors: 15-20% of portfolio

- Professional investors: 25-30% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different stablecoins and assets

- Use of derivatives: Consider options or futures for hedging

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Use two-factor authentication, regularly update passwords

V. Potential Risks and Challenges for PYUSD

PYUSD Market Risks

- Liquidity risk: Potential issues with large-scale redemptions

- Competition: Increased competition from other stablecoins

- Market volatility: Impact on demand during extreme market conditions

PYUSD Regulatory Risks

- Regulatory scrutiny: Potential for increased oversight of stablecoins

- Compliance challenges: Adapting to evolving regulatory requirements

- Cross-border restrictions: Limitations on use in certain jurisdictions

PYUSD Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Centralization concerns: Reliance on Paxos Trust Company

- Integration issues: Challenges with widespread adoption and use

VI. Conclusion and Action Recommendations

PYUSD Investment Value Assessment

PYUSD offers stability and potential for adoption in the PayPal ecosystem, but faces competition and regulatory challenges. It presents a relatively low-risk option within the volatile crypto market.

PYUSD Investment Recommendations

✅ Beginners: Consider small allocations as part of a diversified portfolio ✅ Experienced investors: Use PYUSD for short-term trading or as a stable store of value ✅ Institutional investors: Explore PYUSD for treasury management or as a trading pair

PYUSD Participation Methods

- Direct purchase: Buy PYUSD on Gate.com

- PayPal integration: Utilize PYUSD within the PayPal ecosystem

- DeFi participation: Explore yield-generating opportunities in decentralized finance protocols

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will PayPal USD go up in value?

As a stablecoin, PayPal USD is designed to maintain a steady value of $1. It's unlikely to significantly increase in value beyond this peg.

Is PayPal USD a good crypto?

Yes, PayPal USD (PYUSD) is a promising stablecoin backed by a major financial company. It offers stability, wide acceptance, and potential for growth in the digital payments ecosystem.

Will pi coin reach $100?

It's highly unlikely for Pi coin to reach $100. Given its large supply and current market trends, a more realistic long-term price target might be in the range of $0.01 to $1.

How much is pyusd worth today?

As of November 14, 2025, PYUSD is worth $1.00. PYUSD is a stablecoin pegged to the US dollar, maintaining a consistent value of $1.

Share

Content