2025 PPrice Tahmini: Kripto Para Varlıklarında Piyasa Eğilimleri ve Gelecek Değerleme Analizi

Giriş: P'nin Piyasa Konumu ve Yatırım Değeri

Kullanıcı odaklı bir Web3 keşif ve büyüme platformu olan PoP Planet (P), kuruluşundan bu yana önemli başarılar elde etti. 2025 yılı itibarıyla PoP Planet'ın piyasa değeri 11.729.200 $'a ulaşırken, yaklaşık 140.000.000 token dolaşımda bulunuyor ve fiyatı 0,08378 $ civarında seyrediyor. "Kullanıcılar ile Web3 uygulamaları arasında köprü" olarak tanımlanan bu varlık, blokzincir kullanıcılarının keşfi ve geliştirici kitlesinin büyümesinde giderek daha kritik bir rol oynuyor.

Bu makalede, PoP Planet'ın 2025-2030 dönemindeki fiyat hareketleri kapsamlı biçimde analiz edilecek; geçmiş fiyat verileri, arz-talep dengesi, ekosistem gelişimi ve makroekonomik etkenler bir araya getirilerek yatırımcılara profesyonel fiyat tahminleri ve pratik yatırım stratejileri sunulacak.

I. P Fiyat Geçmişi ve Mevcut Piyasa Durumu

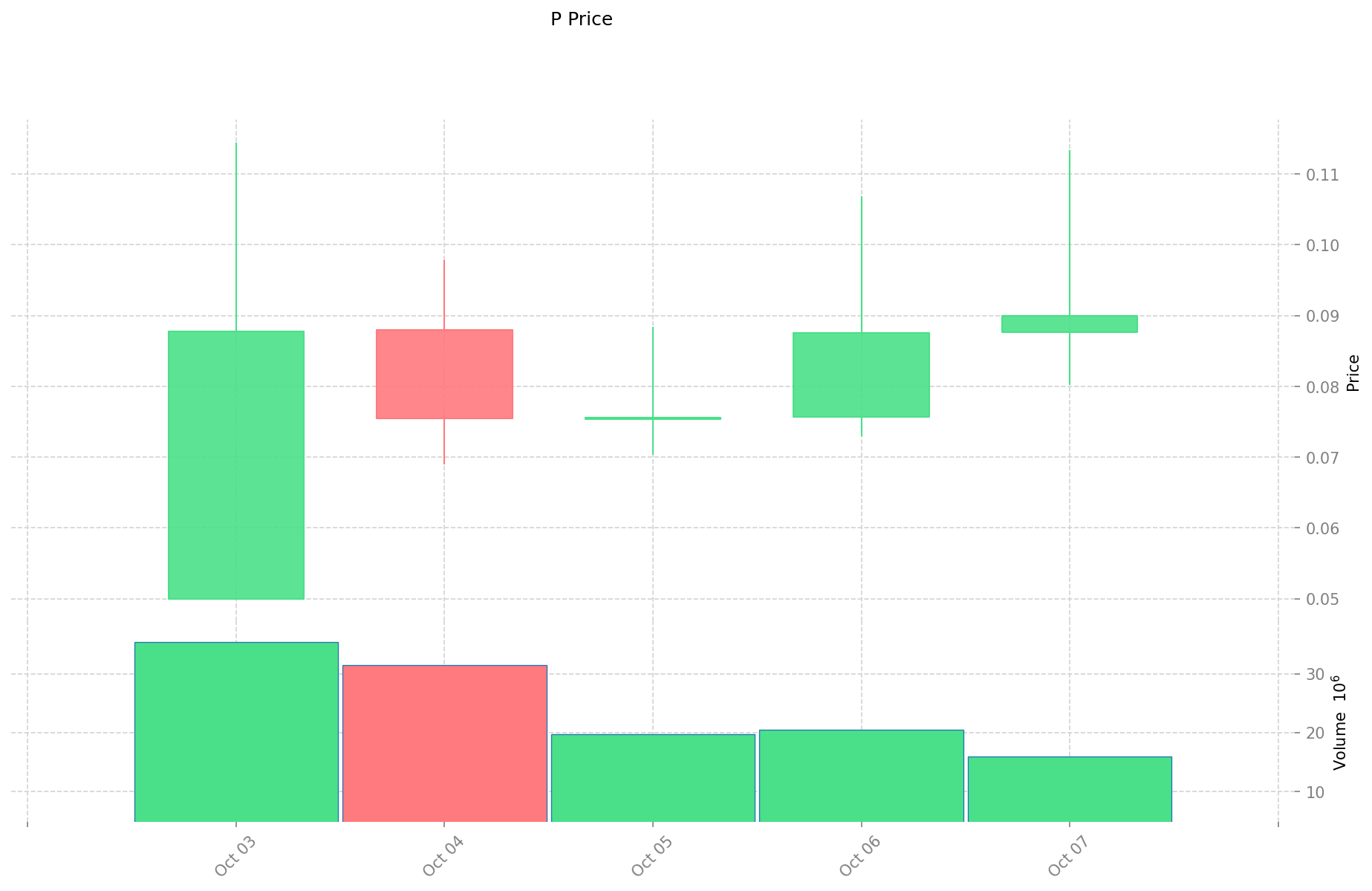

P'nin Tarihsel Fiyat Seyri

- 2025: 3 Ekim’de ilk piyasaya çıkış, fiyat tüm zamanların en yüksek seviyesi olan 0,11443 $'a ulaştı

- 2025: Piyasa dalgalanmaları, fiyat tüm zamanların en düşük seviyesi olan 0,05 $'a geriledi

- 2025: Son toparlanma, 8 Ekim itibarıyla mevcut fiyat 0,08378 $

P'nin Güncel Piyasa Durumu

P token şu anda 0,08378 $ seviyesinden işlem görüyor ve son 24 saatte %11,1 oranında değer kaybetti. Token yüksek volatilite gösterdi; 24 saatlik fiyat aralığı 0,0802 $ ile 0,1134 $ arasında değişti. Son düşüşe rağmen P, 11.729.200 $ piyasa değeriyle toplam kripto para piyasasında 1.340. sırada yer alıyor. Son 24 saatteki işlem hacmi 1.468.385,799039 $ olup, aktif piyasa hareketliliğine işaret etmektedir. Dolaşımdaki 140.000.000 P token, toplam 1.000.000.000 token arzının %14’ünü oluşturuyor. Tam seyreltilmiş piyasa değeri ise 83.780.000,000000 $ olup, tüm token arzının dolaşıma girmesi halinde büyüme potansiyeline işaret ediyor.

Güncel P piyasa fiyatını görüntüleyin

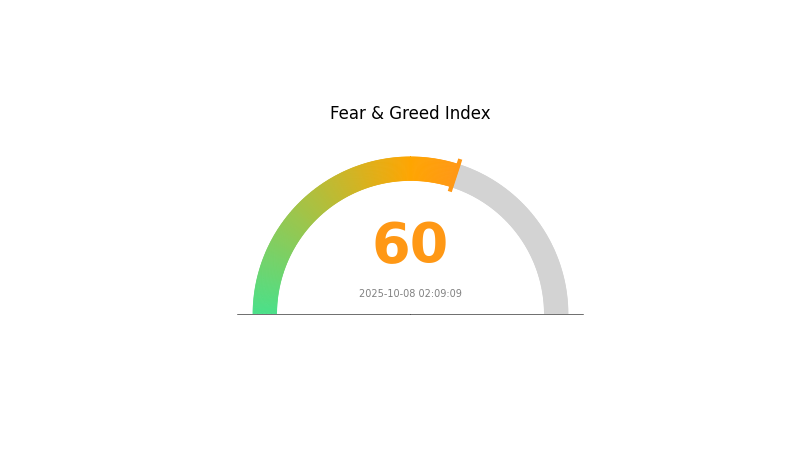

P Piyasa Duyarlılık Göstergesi

2025-10-08 Korku ve Açgözlülük Endeksi: 60 (Açgözlülük)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında Korku ve Açgözlülük Endeksi'nin 60 olması, "Açgözlülük" duygusunun hâkim olduğunu gösteriyor. Yatırımcılar daha iyimser ve yükseliş odaklı olsa da, aşırı açgözlülük piyasanın fazla değerlenmesine ve düzeltmelere yol açabilir. Portföyü çeşitlendirmek ve zarar-durdur emirleriyle kazançları korumak önemlidir. Kripto piyasasında başarılı olmak için kapsamlı araştırma ve etkili risk yönetimi her zaman gereklidir.

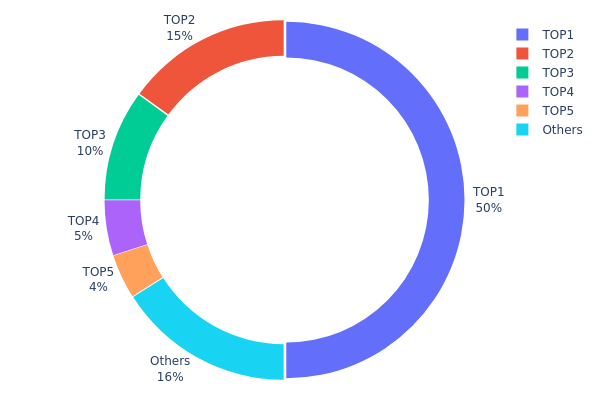

P Varlık Dağılımı

Adres bazlı varlık dağılımı, P tokenlerinde yoğunlaşmış bir sahiplik yapısı olduğunu gösteriyor. En büyük adres toplam arzın %50’sini, ilk 5 adres ise toplam tokenlerin %83,99’unu elinde bulunduruyor. Bu oran, merkezileşme ve olası piyasa manipülasyonu riskini artırıyor.

Böylesi bir dağılım, piyasa dinamikleri üzerinde ciddi etkiler oluşturabilir. Tek bir varlık arzın yarısını kontrol ettiğinde, fiyat oynaklığı ve manipülasyon riski yükselir. Büyük sahipler, büyük alım veya satış işlemleriyle fiyatı etkileyebilir. Ayrıca bu yoğunlaşma, likidite riski ve adil piyasa koşulları konusundaki endişeler nedeniyle bazı yatırımcıları caydırabilir.

Bu dağılım, P'nin merkeziyetsizlik düzeyinin düşük olduğunu gösteriyor ve kripto ekosisteminde algılanan değer ile benimsenme üzerinde etkili olabilir. Yeni projelerde bir miktar yoğunlaşma yaygın olsa da, bu seviyede bir sahiplik yapısı, daha dağıtık ve sağlam token ekonomisi arayanlar için risk teşkil eder.

Güncel P varlık dağılımını görüntüleyin

| Top | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x4fa4...2eb89e | 500.000,00K | 50,00% |

| 2 | 0x17de...c302eb | 150.000,00K | 15,00% |

| 3 | 0xf7c4...b34cf5 | 100.000,00K | 10,00% |

| 4 | 0xbcc4...5ab633 | 50.000,00K | 5,00% |

| 5 | 0xd29b...22d1e1 | 39.987,50K | 3,99% |

| - | Diğerleri | 160.012,50K | 16,01% |

II. P'nin Gelecek Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Petrol Fiyatı Etkisi: Ham petrol fiyatı, P'nin fiyat trendini belirleyen ana faktördür. Petrol ve türevleri, endüstriyel sektörlerin tüm aşamalarında önemli rol oynar.

- Tarihsel Seyir: Petrol fiyatlarındaki değişim, P'nin fiyat hareketleriyle yüksek korelasyon gösterir.

- Mevcut Etki: Güncel petrol fiyatlarındaki trendlerin, P'nin arz ve talep dengesine büyük etkisi olması bekleniyor.

Kurumsal ve Büyük Sahip Dinamikleri

- Kurumsal Benimseme: Sektörler arası büyük şirketler P'yi daha fazla kullanmaya başladı, bu da talep ve fiyatı artırabilir.

- Ulusal Politikalar: Devlet politikaları ve düzenlemeleri P'nin benimsenmesi ve değeri üzerinde etkili olabilir.

Makroekonomik Ortam

- Para Politikası Etkisi: Merkez bankası politikaları, özellikle faiz oranları ve parasal genişleme, P'nin fiyatını etkileyebilir.

- Enflasyona Karşı Koruma Özellikleri: P'nin enflasyonist ortamlardaki performansı, yatırımcılar için giderek daha önemli hale gelmektedir.

- Jeopolitik Faktörler: Uluslararası gerilimler ve küresel ekonomik değişimler, P'nin güvenli liman varlığı olarak algılanmasını etkileyebilir.

Teknolojik Gelişim ve Ekosistem İnşası

- Emtia Fiyat Endeksi: Uluslararası emtia fiyat vadeli işlemler endeksi, P'nin fiyat hareketleriyle yüksek korelasyon göstererek gelecekteki trendlerin tahmininde önem taşır.

- Ekonomik Politika: Hem yerel hem de uluslararası ekonomik politika değişimleri, P'ye yönelik piyasa beklentilerinin şekillenmesinde kritik rol oynar.

III. P'nin 2025-2030 Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,07159 $ - 0,08324 $

- Tarafsız tahmin: 0,08324 $ - 0,08615 $

- İyimser tahmin: 0,08615 $ - 0,08907 $ (pozitif piyasa duyarlılığı gerektirir)

2027-2028 Görünümü

- Piyasa evresi beklentisi: Kademeli büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 0,07616 $ - 0,11519 $

- 2028: 0,07469 $ - 0,15253 $

- Önemli katalizörler: Benimsenmenin artışı ve teknolojik ilerlemeler

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,12886 $ - 0,15270 $ (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,15270 $ - 0,17654 $ (güçlü piyasa performansı varsayımıyla)

- Dönüştürücü senaryo: 0,17654 $ - 0,20462 $ (olağanüstü piyasa koşulları varsayımıyla)

- 2030-12-31: P 0,20462 $ (potansiyel maksimum fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Artış/Düşüş Oranı |

|---|---|---|---|---|

| 2025 | 0,08907 | 0,08324 | 0,07159 | 0 |

| 2026 | 0,10425 | 0,08615 | 0,04738 | 2 |

| 2027 | 0,11519 | 0,0952 | 0,07616 | 13 |

| 2028 | 0,15253 | 0,1052 | 0,07469 | 25 |

| 2029 | 0,17654 | 0,12886 | 0,09536 | 53 |

| 2030 | 0,20462 | 0,1527 | 0,113 | 82 |

IV. P için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

P Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı: Sabırlı ve yüksek risk toleranslı kişiler

- Uygulama önerileri:

- P tokenlerini piyasa düşüşlerinde biriktirin

- Belirlediğiniz fiyat hedeflerine sadık kalın

- Tokenleri güvenli donanım cüzdanlarında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve destek/direnç belirlemede kullanılır

- RSI (Göreceli Güç Endeksi): Aşırı alım/aşırı satım sinyali verir

- Dalgalı işlem için ipuçları:

- Piyasa duyarlılığı ve haberleri dikkatle takip edin

- Zarar-durdur emirleriyle olası kayıpları sınırlayın

P Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcı: Kripto portföyünün %1-3’ü

- Agresif yatırımcı: Kripto portföyünün %5-10’u

- Profesyonel yatırımcı: Kripto portföyünün %15’ine kadar

(2) Riskten Kaçınma Çözümleri

- Çeşitlendirme: Birden fazla kripto varlığa yatırım yapın

- Zarar-durdur emirleri: Potansiyel kayıpları sınırlamak için kullanın

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk saklama: Uzun vadeli tutumlar için donanım cüzdanları

- Güvenlik önlemleri: İki faktörlü doğrulama ve güçlü şifre kullanımı

V. P için Potansiyel Riskler ve Zorluklar

P Piyasa Riskleri

- Yüksek volatilite: Fiyatı ciddi dalgalanmalara açık

- Düşük likidite: Büyük işlemlerde zorluk yaşanabilir

- Piyasa duyarlılığı: Yatırımcı psikolojisindeki ani değişimlerden etkilenebilir

P Düzenleyici Riskler

- Belirsiz düzenlemeler: Yeni yasa ve mevzuat riski

- Sınır ötesi uyumluluk: Uluslararası düzenlemelere adaptasyon zorluğu

- Vergilendirme etkileri: Değişen vergi uygulamaları yatırımcıları etkileyebilir

P Teknik Riskler

- Akıllı sözleşme açıkları: Temel kodda istismar riski

- Ağ yoğunluğu: İşlem hızı ve maliyetlerinde olumsuzluk

- Ölçeklenebilirlik zorlukları: Artan kullanıcıyla başa çıkmada sınırlamalar

VI. Sonuç ve Eylem Önerileri

P Yatırım Değeri Değerlendirmesi

P, Web3 kullanıcı keşfi ve büyümesi için yenilikçi bir çözüm sunuyor; ancak ciddi rekabet ve mevzuat belirsizlikleriyle karşı karşıya. Uzun vadeli potansiyel mevcut, fakat kısa vadede volatilite yüksek.

P Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Piyasayı tanımak için küçük ve düzenli yatırımlarla başlayın ✅ Deneyimli yatırımcılar: Portföyün bir bölümünü ayırıp, piyasa gelişmelerini takip edin ✅ Kurumsal yatırımcılar: Detaylı inceleme yaparak P'yi çeşitlendirilmiş kripto stratejisinin bir parçası olarak değerlendirin

P İşlem Katılım Yöntemleri

- Spot işlem: Gate.com üzerinden P token alıp satın

- Staking: Uygun ise staking programlarına katılın

- DeFi entegrasyonu: P token içeren merkeziyetsiz finans çözümlerini araştırın

Kripto para yatırımları son derece yüksek risk içerir, bu makale yatırım tavsiyesi niteliği taşımaz. Yatırımcılar, kendi risk toleranslarına göre dikkatli karar vermeli ve profesyonel finansal danışmanlardan destek almalıdır. Asla kaybedebileceğinizden fazla yatırım yapmayın.

SSS

Pi Coin 100 $'a ulaşır mı?

Pi Coin’in yakın dönemde 100 $'a ulaşması oldukça düşük ihtimaldir. Mevcut piyasa projeksiyonları ve uzman görüşleri, bu fiyat hedefinin Pi Coin için gerçekçi olmadığını gösteriyor.

2030'da Pi'nin değeri ne olur?

2030 yılında Pi Coin’in 6,00 $ seviyesine ulaşacağı ve ortalama fiyatının 4,50 $ olacağı tahmin ediliyor. Bu öngörüler, benimsenme ve ekosistem gelişimine bağlıdır.

Pi piyasaya çıktığında ne kadar olacak?

Pi Network’ün lansmanında 2025 için piyasa trendleri ve uzman analizlerine göre değeri 500 $ ile 520 $ arasında öngörülmektedir.

PROP hissesi için 2025 tahmini nedir?

Analistlere göre, PROP hissesinin 2025 yılında ortalama fiyatı 190 $ olacak; tahminler 133 $ ile 200 $ arasında değişmektedir.

2025 SUT Fiyat Tahmini: Piyasa Trendleri ve Değer Projeksiyonlarına Yönelik Kapsamlı Analiz ve Öngörü

2025 XCN Fiyat Tahmini: XCN Token, Yarılanma Sonrası Boğa Piyasasında Yeni Zirvelere Ulaşabilir mi?

2025 AWE Fiyat Tahmini: Piyasa Trendleri ve Gelecek Büyüme Potansiyelinin Kapsamlı Analizi

2025 XCN Fiyat Tahmini: Değişen Kripto Ekosisteminde XCN’in Piyasa Trendleri ve Potansiyel Büyüme Dinamiklerinin Analizi

2025 QKC Fiyat Tahmini: QuarkChain Kripto Parası İçin Gelecek Perspektifi ve Piyasa Analizi

2025 BICO Fiyat Tahmini: Biconomy'nin Geleceğine Yönelik Piyasa Trendleri ve Uzman Tahminlerinin Analizi

NFT Nadirliği Anlamak: Puanlama Sistemleri Rehberi

Blokzincirde Proof-of-Work Konsensüs Mekanizmasını Anlamak

Satoshi'den Bitcoin'e Dönüşümün Anlaşılması: Kolay Anlatım

Web3'te Hashing Kavramı: Kapsamlı Bir Blockchain Rehberi

Ethereum Gas Ücretlerini Anlamak: Tam Kapsamlı Rehber