2025 POL Fiyat Tahmini: Polygon’un Yerel Token’ı İçin Potansiyel Büyüme Dinamikleri ve Piyasa Eğilimlerinin Analizi

Giriş: POL'un Piyasadaki Konumu ve Yatırım Değeri

Polygon Ecosystem Token (POL), Ethereum ağının ölçeklenmesi ve altyapı geliştirmelerinde kilit bir rol üstlenerek ekosistemin önde gelen varlıklarından biri haline gelmiştir. 2025 yılı itibarıyla POL’un piyasa değeri 2,81 milyar ABD doları seviyesine ulaşırken, dolaşımdaki arz yaklaşık 10,5 milyar token ve fiyatı da 0,2678 ABD doları civarında seyretmektedir. “Ethereum Ölçeklendirme Çözümü” olarak bilinen bu varlık, blokzincir teknolojisinde ölçeklenebilirlik ve birlikte çalışabilirlik adına artan bir öneme sahiptir.

Bu makalede, 2025’ten 2030’a kadar POL fiyat trendleri kapsamlı şekilde analiz edilerek, tarihsel fiyat hareketleri, piyasa arz ve talebi, ekosistem gelişimi ve makroekonomik faktörler ışığında profesyonel fiyat tahminleriyle yatırımcılar için uygulanabilir stratejiler sunulacaktır.

I. POL Fiyat Geçmişi ve Güncel Piyasa Durumu

POL Tarihsel Fiyat Gelişimi

- 2023: Piyasa dibi, 16 Kasım’da fiyat 0,0921 ABD doları ile en düşük seviyeye indi

- 2024: Boğa piyasası zirvesi, 22 Nisan’da fiyat tüm zamanların en yüksek seviyesi olan 1,5711 ABD dolarını gördü

- 2025: Piyasa düzeltmesi, fiyat mevcut seviyeye 0,2678 ABD dolarına geriledi

POL Güncel Piyasa Görünümü

10 Eylül 2025 itibarıyla POL, 0,2678 ABD doları fiyatından işlem görmekte olup, son 24 saatte %3,98 gerilemiştir. Token, farklı zaman dilimlerinde karışık bir performans sergiledi: Son bir saatte %0,04 artış, son 30 günde %9,56 yükseliş, ancak yıllık bazda %30,04’lük bir düşüş yaşandı. POL’un piyasa değeri 2.810.890.606 ABD doları ile kripto piyasasında %0,067 pay ve 54. sıradadır. Dolaşımdaki ve toplam arz 10.496.230.792,90537 POL olup, yeni token basımı yapılmayacağı anlamına gelmektedir. Mevcut fiyat, tüm zamanların en yüksek seviyesine göre %82,95 düşerken, en düşük seviyesine göre %190,77 yükseliş göstermiştir; bu da token’ın bir konsolidasyon sürecinde olduğunu göstermektedir.

Güncel POL piyasa fiyatını görüntüleyin

POL Piyasa Duyarlılığı Göstergesi

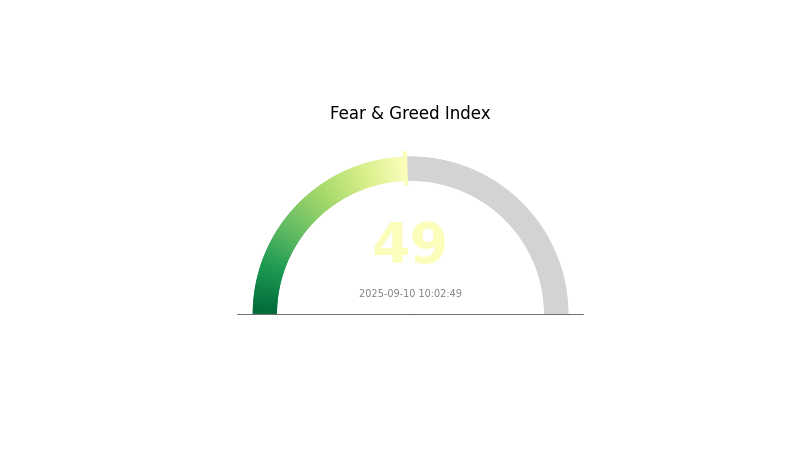

10 Eylül 2025 Korku ve Açgözlülük Endeksi: 49 (Nötr)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Bugün kripto para piyasası dengeli bir görünüm sergiliyor; Korku ve Açgözlülük Endeksi 49 ile nötr seviyede. Bu, yatırımcıların mevcut koşullara ne aşırı iyimser ne de aşırı kötümser yaklaştığını gösteriyor. Yatırımcılar hem fırsatlar hem de riskler konusunda temkinli davranmalı, titiz araştırmalar yapmalı ve yatırımlarını çeşitlendirmelidir.

POL Varlık Dağılımı

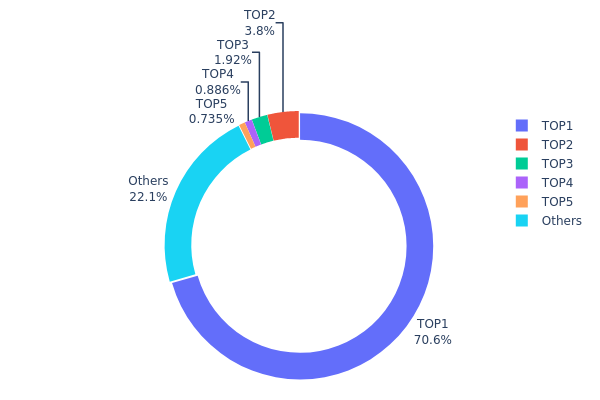

Adres bazlı varlık dağılımı, POL tokenlerinin sahiplik konsantrasyonunu analiz etmek için kritik verilere ulaşmamızı sağlar. Mevcut dağılım incelendiğinde, oldukça merkezileşmiş bir yapı görülmektedir: En büyük adres toplam POL arzının %70,56’sını elinde bulunduruyor. Sonraki dört adresin toplam payı %7,34 iken geri kalan adresler ise %22,1’lik kısmı tutuyor.

Böylesine yüksek bir merkezileşme, piyasa manipülasyonu ve fiyat dalgalanması riskini artırır. Bir adresin üçte ikiden fazla pay kontrol etmesi, yüklü satış ya da transferlerde piyasa üzerinde ciddi etkilere neden olabilir. Bu durum, kripto projelerinin hedeflediği merkeziyetsizlik ilkesine de ciddi bir engel teşkil etmektedir.

Mevcut dağılım yapısı, POL’un zincir üstü ekosisteminin henüz yeterince dağılmadığına işaret etmekte; bu da küçük yatırımcıların fiyat manipülasyonuna dair endişeler nedeniyle çekimser kalmasına ve piyasa likiditesinin zayıflamasına yol açabilir. Ancak en büyük sahibin (örneğin bir vakıf ya da geliştirme fonu olması) kimliği ve amacı, bu yoğunlaşmanın uzun vadeli projeye etkileri açısından belirleyici olabilir.

Güncel POL Varlık Dağılımını görüntüleyin

| Sıra | Adres | Varlık Miktarı | Pay (%) |

|---|---|---|---|

| 1 | 0x0000...001010 | 7.405.721,86K | 70,56% |

| 2 | 0x4c56...989ff4 | 398.337,84K | 3,80% |

| 3 | 0x0d50...df1270 | 201.692,82K | 1,92% |

| 4 | 0x79b4...c2cf38 | 93.026,38K | 0,89% |

| 5 | 0x7d34...c4777e | 77.147,01K | 0,73% |

| - | Diğerleri | 2.320.304,89K | 22,1% |

II. POL'un Gelecek Fiyatını Belirleyen Ana Etkenler

Arz Mekanizması

- Tarihsel Gözlem: POL’da geçmişteki arz değişimlerinin fiyat üzerindeki etkisi büyüktür.

- Mevcut Durum: POL'un toplam arzı 10.496.230.792,90537531 ve dolaşımdaki arz 10.496.230.782,90537531 seviyesindedir.

Kurumsal ve Büyük Yatırımcı Etkisi

- Kurumsal Benimseme: Tether, 2025 Ağustos’unda Polygon üzerinde USDT ve altın destekli XAUt0 tokenlerini piyasaya sürerek çapraz zincir likiditesini artırmıştır.

Makroekonomik Ortam

- Enflasyona Karşı Dayanıklılık: POL, günümüz ekonomik koşullarında enflasyona karşı bir koruma aracı olma potansiyeli göstermektedir.

Teknik Gelişim ve Ekosistem Yapılanması

- Ethereum Ölçeklenebilirliği: POL’un gelecekteki fiyatı, Ethereum ölçeklenebilirliğinde sağlanacak gelişmelere bağlıdır.

- Ekosistem Uygulamaları: Polygon ekosisteminin temel DApp’leri olan QuickSwap ve Polymarket, TVL (Kilitli Toplam Değer) büyümesine önemli katkı sağlamıştır.

2025’in başında Polygon’un TVL’si yıl başından itibaren %43 artışla 1,23 milyar ABD doları seviyesine ulaşmıştır.

III. 2025-2030 POL Fiyat Tahmini

2025 Görünümü

- Ihtiyatlı tahmin: 0,20345 – 0,25 ABD doları

- Nötr tahmin: 0,25 – 0,28 ABD doları

- İyimser tahmin: 0,28 – 0,31053 ABD doları (olumlu piyasa koşulları halinde)

2027-2028 Görünümü

- Piyasa fazı beklentisi: Güçlü büyüme olasılığı

- Fiyat aralığı tahmini:

- 2027: 0,2027 – 0,51919 ABD doları

- 2028: 0,31493 – 0,60362 ABD doları

- Kilit katalizörler: Artan benimsenme, teknolojik ilerlemeler ve genel kripto piyasa büyümesi

2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,45 – 0,60 ABD doları (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,60 – 0,71799 ABD doları (güçlü piyasa performansı halinde)

- Dönüştürücü senaryo: 0,71799 ABD doları üzeri (olağanüstü piyasa koşulları ve yaygın benimseme halinde)

- 31 Aralık 2030: POL için olası ortalama fiyat 0,54393 ABD doları

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Fiyat Artış Oranı |

|---|---|---|---|---|

| 2025 | 0,31053 | 0,2677 | 0,20345 | 0 |

| 2026 | 0,42211 | 0,28912 | 0,23708 | 7 |

| 2027 | 0,51919 | 0,35561 | 0,2027 | 32 |

| 2028 | 0,60362 | 0,4374 | 0,31493 | 63 |

| 2029 | 0,56736 | 0,52051 | 0,48407 | 94 |

| 2030 | 0,71799 | 0,54393 | 0,31004 | 103 |

IV. POL İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

POL Yatırım Stratejileri

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için uygun: Uzun vadeli yatırımcılar ve Polygon ekosisteminin potansiyeline inananlar

- Uygulama önerileri:

- Piyasa gerilemelerinde POL biriktirin

- Stake işlemleriyle ek ödüller kazanın

- Uzun vadeli saklama için güvenli donanım cüzdanlarını tercih edin

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve dönüş noktalarını saptamada kullanılır

- RSI (Göreceli Güç Endeksi): Aşırı alım/satım seviyelerini belirlemede faydalı

- Swing trade için temel noktalar:

- Polygon ekosistemindeki gelişme ve duyuruları izleyin

- Genel kripto piyasa duyarlılığını takip edin

POL Risk Yönetim Çerçevesi

(1) Varlık Dağılımı Esasları

- Korumacı yatırımcılar: Kripto portföyünün %1-3’ü

- Orta riskli yatırımcılar: %3-7

- Agresif yatırımcılar: %7-15

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Layer 2 projeleri arasında yatırımı dağıtın

- Zarar durdur: Olası zararları sınırlandırmak için uygun seviyeler belirleyin

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk depolama: Uzun vadeli saklama için donanım cüzdanları

- Güvenlik: İki aşamalı doğrulama kullanın, özel anahtarlarınızı güvenli şekilde muhafaza edin

V. POL İçin Olası Riskler ve Zorluklar

POL Piyasa Riskleri

- Oynaklık: Kripto piyasalarında yüksek volatilite hakimdir

- Rekabet: Layer 2 ölçeklendirme çözümleri arasında rekabet giderek artmaktadır

- Piyasa duyarlılığı: Ani duyarlılık değişimleri fiyat üzerinde etkili olur

POL Düzenleyici Riskler

- Düzenleme belirsizliği: Kripto alanında daha sıkı düzenleme olasılığı

- Sınır ötesi kısıtlamalar: Farklı ülkelerde değişen mevzuat ve düzenlemeler

- Uyumluluk gereklilikleri: Blokzincir projeleri için değişen standartlar

POL Teknik Riskler

- Akıllı sözleşme açıkları: Temel kodda olası açıklar ve istismar riskleri

- Ölçeklenebilirlik sorunları: Polygon 2.0 uygulamasında beklenmedik teknik güçlükler çıkabilir

- Birlikte çalışabilirlik: Diğer blokzincirlerle entegrasyonda potansiyel zorluklar

VI. Sonuç ve Eylem Önerileri

POL Yatırım Değeri Değerlendirmesi

Polygon ekosistemi kapsamında Ethereum’un ölçeklenmesi hedefinde POL, uzun vadeli güçlü bir yatırım fırsatı sunar. Ancak kısa vadede yüksek volatilite ve Layer 2 alanındaki rekabet büyük risk oluşturuyor.

POL Yatırım Önerileri

✅ Yeni başlayanlar: Küçük hacimlerle başlayıp Polygon ekosistemini öğrenmeye odaklanmalı

✅ Deneyimli yatırımcılar: Çeşitlendirilmiş kripto portföyünüzde POL’a yer verebilir

✅ Kurumsal yatırımcılar: Layer 2 ölçeklendirme stratejinizde POL’u değerlendirin

POL İşlem Katılım Yöntemleri

- Spot işlemler: POL token’ı güvenilir borsalarda alıp tutabilirsiniz

- Staking: POL stake ederek ek ödüller elde edin

- DeFi katılımı: Polygon ağı üzerinde geliştirilen DeFi uygulamalarını kullanın

Kripto para yatırımları çok yüksek risk içerir. Bu makale yatırım tavsiyesi niteliğinde değildir. Yatırımcılar, kendi risk toleranslarına göre bilinçli karar vermeli ve profesyonel finansal danışmanlarla görüşmelidir. Kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

Sıkça Sorulan Sorular

POL 1 ABD doları olur mu?

POL’un 1 ABD doları seviyesine ulaşması mümkündür ancak kesin değildir. Gelecek fiyatı belirlemede piyasa koşulları ve proje gelişimi belirleyici olacaktır.

2025’te Polygon’un fiyatı ne olur?

Mevcut tahminlere göre, Polygon’un 2025’teki fiyatı piyasa ve teknolojik gelişmelere bağlı olarak 0,53 – 0,78 ABD doları aralığında beklenmektedir.

2025’te POL coin kaç dolar olacak?

Piyasa öngörülerine göre, POL coin 2025’te piyasa koşulları ve teknik gelişmelere göre 0,53 – 0,78 ABD doları arasında değerlenebilir.

POL alınır mı satılır mı?

Güncel piyasa analizlerine göre POL ‘al’ olarak öne çıkıyor. Teknik göstergeler olumlu bir ivme gösteriyor, fakat piyasayı daima yakından takip etmek gerekir.

2025 OP Fiyat Tahmini: Optimism’in Layer 2 (Katman 2) Ölçekleme Çözümlerindeki Uzun Vadeli Değer Potansiyelinin Analizi

2025 LINEA Fiyat Tahmini: Layer 2 Çözümüne Yönelik Piyasa Trendleri, Teknik Gelişmeler ve Benimsenme Unsurlarının Analizi

LightLink (LL) iyi bir yatırım mı?: Bu yükselen blockchain platformunun DeFi ekosistemindeki potansiyelini analiz ediyoruz

YFII ve OP: DeFi Ekosisteminde Getiri Farming Protokollerinin Rekabeti

CORE ve ETH: DeFi Ekosistemlerinde Ölçeklenebilirlik Çözümlerinin Karşılaştırılması

Arbitrum (ARB) iyi bir yatırım mı?: Gelişen kripto ekosisteminde bu Layer 2 ölçeklendirme çözümünün potansiyelini değerlendirmek

Kripto piyasası analizinde üçlü tepe formasyonlarını tanımlama

SegWit Adreslerini Anlamak: Bitcoin'de Segregated Witness'ın Temel Unsurları

Nostr Protokolünün Temelleri Hakkında Bilgi Edinmek

Layer 0'ı Anlamak: Ana Zincirler ve Yan Zincirlerle Blockchain Altyapısının Geleceği

Yeni başlayanlar için etkili Dogecoin madenciliği stratejileri