2025 PAXG Price Prediction: Will the Gold-Backed Token Reach New Heights in a Volatile Crypto Market?

Introduction: PAXG's Market Position and Investment Value

PAX Gold (PAXG) has established itself as a unique digital asset backed by physical gold since its inception in 2019. As of 2025, PAXG's market capitalization has reached $1,322,034,875, with a circulating supply of approximately 310,202 tokens and a price hovering around $4,261.85. This asset, often referred to as "digital gold," is playing an increasingly crucial role in providing investors with a cost-effective way to hold physical gold in the digital asset market.

This article will provide a comprehensive analysis of PAXG's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. PAXG Price History Review and Current Market Status

PAXG Historical Price Evolution

- 2019: PAXG launched, initial price established

- 2020: COVID-19 pandemic impact, price volatility increased

- 2021-2024: Gradual price appreciation, reflecting gold market trends

PAXG Current Market Situation

As of October 16, 2025, PAXG is trading at $4,261.85, showing a 1.52% increase in the last 24 hours. The token has demonstrated strong performance recently, with a 5.38% gain over the past week and an impressive 15.35% surge in the last 30 days. The current price is very close to its all-time high of $4,265.89, recorded on the same day. Over the past year, PAXG has experienced substantial growth, with a 59.88% increase in value.

The market capitalization of PAXG stands at $1,322,034,875, based on a circulating supply of 310,202.113 tokens. The 24-hour trading volume is $5,210,092, indicating moderate market activity. With 58,063 holders, PAXG has established a significant user base in the digital gold-backed token market.

Click to view the current PAXG market price

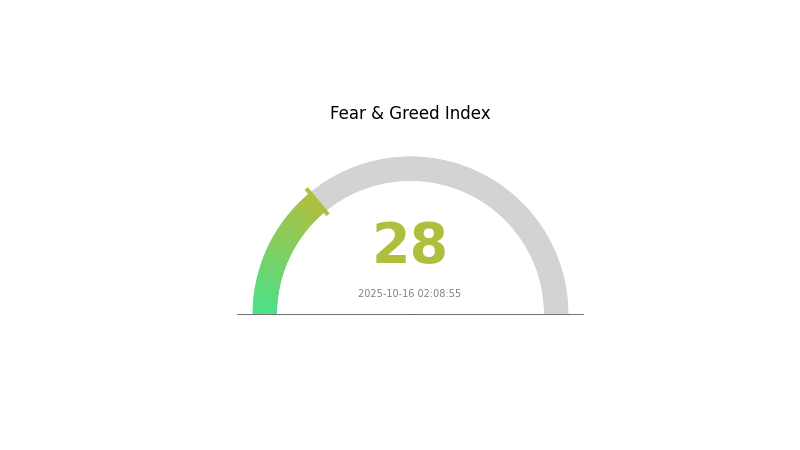

PAXG Market Sentiment Indicator

2025-10-16 Fear and Greed Index: 28 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment for PAXG is currently in the "Fear" zone, with a reading of 28. This indicates a cautious atmosphere among investors. During such periods, some traders may view it as a potential buying opportunity, adhering to the contrarian strategy of "be fearful when others are greedy, and greedy when others are fearful." However, it's crucial to conduct thorough research and consider multiple factors before making any investment decisions in the volatile crypto market.

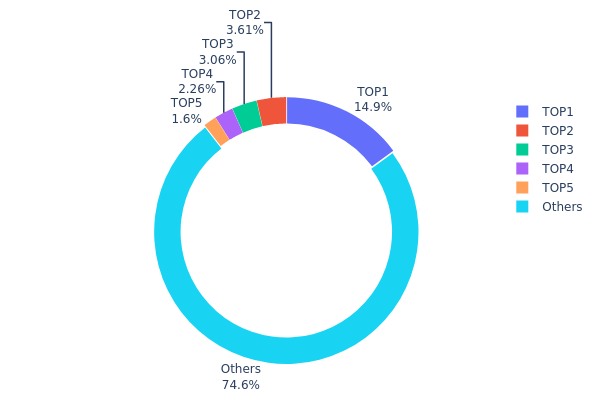

PAXG Holdings Distribution

The address holdings distribution data for PAXG reveals significant insights into the token's concentration and market structure. The top address holds 14.85% of the total supply, with 46.07K PAXG tokens. This is followed by four addresses holding between 1.60% and 3.60% each. Collectively, the top 5 addresses control 25.37% of the total PAXG supply, while the remaining 74.63% is distributed among other addresses.

This distribution pattern indicates a moderate level of concentration, with a notable proportion held by a single address. However, the fact that nearly 75% of the supply is spread across numerous smaller holders suggests a relatively decentralized structure overall. This balance between large holders and a diverse base of smaller participants could contribute to market stability, potentially mitigating extreme price volatility driven by individual actors.

The current distribution may have implications for market dynamics. While the presence of large holders could pose some risk of market manipulation, the substantial distribution among smaller addresses likely provides a counterbalance, enhancing overall market resilience and liquidity.

Click to view the current PAXG Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 46.07K | 14.85% |

| 2 | 0x7d76...68107d | 11.18K | 3.60% |

| 3 | 0xd2dd...e6869f | 9.49K | 3.06% |

| 4 | 0x28c6...f21d60 | 7.02K | 2.26% |

| 5 | 0x3eba...51bf23 | 4.97K | 1.60% |

| - | Others | 231.47K | 74.63% |

II. Key Factors Influencing PAXG's Future Price

Supply Mechanism

- Gold-backed tokens: Each PAXG token represents one troy ounce of gold stored in London vaults

- Historical pattern: PAXG price closely follows the spot gold price movements

- Current impact: PAXG supply adjusts based on gold market demand and availability

Institutional and Whale Dynamics

- Institutional holdings: Major financial institutions are increasingly adopting gold-backed tokens like PAXG

- Corporate adoption: Companies are exploring PAXG as a digital gold reserve asset

- National policies: Some countries are considering recognizing PAXG as a digital gold reserve

Macroeconomic Environment

- Monetary policy impact: Central bank policies, especially interest rates, significantly affect gold prices and PAXG

- Inflation hedging properties: PAXG serves as an inflation hedge, potentially increasing in value during high inflation periods

- Geopolitical factors: Global political tensions and economic uncertainties drive demand for gold and PAXG

Technological Development and Ecosystem Building

- DeFi integration: PAXG is increasingly used in decentralized finance protocols for lending and liquidity provision

- Cross-chain compatibility: Efforts to make PAXG available on multiple blockchain networks

- Ecosystem applications: PAXG is utilized in various DApps and financial products within the cryptocurrency ecosystem

III. PAXG Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $3,877.50 - $4,260.99

- Neutral prediction: $4,260.99 - $5,049.27

- Optimistic prediction: $5,049.27 - $5,837.56 (requires stable economic conditions and increased demand for gold-backed assets)

2027-2028 Outlook

- Market phase expectation: Potential volatility with overall upward trend

- Price range forecast:

- 2027: $3,631.44 - $6,574.15

- 2028: $4,107.28 - $8,599.62

- Key catalysts: Global economic uncertainties, inflation concerns, and growing interest in digital gold assets

2029-2030 Long-term Outlook

- Base scenario: $7,508.62 - $8,822.63 (assuming steady growth in adoption of gold-backed cryptocurrencies)

- Optimistic scenario: $8,822.63 - $10,136.64 (favorable market conditions and increased institutional investment)

- Transformative scenario: $10,136.64 - $10,763.61 (widespread acceptance of PAXG as a digital gold standard)

- 2030-12-31: PAXG $10,763.61 (potential peak based on bullish projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 5837.56 | 4260.99 | 3877.5 | 0 |

| 2026 | 7472.92 | 5049.27 | 4291.88 | 18 |

| 2027 | 6574.15 | 6261.1 | 3631.44 | 46 |

| 2028 | 8599.62 | 6417.63 | 4107.28 | 50 |

| 2029 | 10136.64 | 7508.62 | 7283.36 | 76 |

| 2030 | 10763.61 | 8822.63 | 6881.65 | 107 |

IV. PAXG Professional Investment Strategies and Risk Management

PAXG Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking gold exposure

- Operational advice:

- Accumulate PAXG during market dips

- Set up recurring purchases to average costs

- Store in a secure hardware wallet or custodial service

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversals

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor gold market news and economic indicators

- Set stop-loss orders to manage downside risk

PAXG Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 5-10%

- Moderate investors: 10-15%

- Aggressive investors: 15-20%

(2) Risk Hedging Solutions

- Diversification: Combine PAXG with other asset classes

- Options strategies: Use put options for downside protection

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable 2FA, use strong passwords, backup private keys

V. Potential Risks and Challenges for PAXG

PAXG Market Risks

- Gold price volatility: PAXG value fluctuates with gold markets

- Liquidity risk: Potential challenges in large-volume trading

- Counterparty risk: Reliance on Paxos for gold backing

PAXG Regulatory Risks

- Changing cryptocurrency regulations: Potential impact on tokenized assets

- Gold market regulations: Changes could affect PAXG operations

- Tax implications: Evolving treatment of digital gold tokens

PAXG Technical Risks

- Smart contract vulnerabilities: Potential for exploitation

- Blockchain network issues: Ethereum congestion or upgrades may affect transactions

- Custodial risks: Security of physical gold reserves

VI. Conclusion and Action Recommendations

PAXG Investment Value Assessment

PAXG offers a digital gateway to gold investment, combining the stability of gold with blockchain efficiency. Long-term value lies in gold's historical role as a store of value, while short-term risks include market volatility and regulatory uncertainties.

PAXG Investment Recommendations

✅ Beginners: Start with small allocations, focus on learning about gold markets ✅ Experienced investors: Consider PAXG for portfolio diversification, implement dollar-cost averaging ✅ Institutional investors: Explore PAXG for gold exposure in digital asset portfolios, conduct thorough due diligence

PAXG Participation Methods

- Spot trading: Purchase PAXG on Gate.com

- Savings products: Explore PAXG-based savings options if available

- DeFi integration: Utilize PAXG in decentralized finance protocols for yield generation

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions cautiously based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the future of PAXG?

PAXG is projected to reach $4,272 by November 2025, showing a positive outlook. Its future looks promising due to its gold-backed nature and market trends.

Is it safe to buy PaXG?

Yes, buying PAXG is generally considered safe. It's a digital asset backed by physical gold, offering a secure way to invest in gold without holding bullion. Always research and use reputable platforms when purchasing.

How high can Pax gold go?

Pax Gold could potentially reach $4,250 by October 2025, based on current market trends and positive sentiment.

Is PaXG really backed by gold?

Yes, PaXG is fully backed by physical gold. Each token represents one troy ounce of gold stored in a London vault, and can be redeemed for physical gold bars.

Share

Content