2025 NODE Fiyat Tahmini: Halving Sonrası Dönemde NODE Token’a Yönelik Kapsamlı Analiz ve Piyasa Beklentileri

Giriş: NODE'un Piyasa Konumu ve Yatırım Potansiyeli

NodeOps (NODE), kuruluşundan bu yana ölçeklenebilir doğrulanabilir hesaplama alanında lider bir platform olarak konumlanmıştır. 2025 yılı itibarıyla NODE'un piyasa değeri 10,7 milyon dolara ulaşırken, dolaşımdaki token miktarı yaklaşık 133.390.828 ve fiyatı 0,08021 dolar civarındadır. "Blokzincir dağıtımının Vercel’i" olarak nitelendirilen bu varlık, 60'tan fazla blokzincirde GPU/CPU orkestrasyonu ve RPC hizmeti sunarak giderek daha kritik bir rol üstlenmektedir.

Bu makalede, NODE'un 2025-2030 dönemine ait fiyat eğilimleri kapsamlı biçimde analiz edilmekte; tarihsel hareketler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler göz önünde bulundurularak profesyonel fiyat tahminleri ve yatırımcılar için pratik stratejiler sunulmaktadır.

I. NODE Fiyat Geçmişi ve Güncel Piyasa Durumu

NODE Tarihsel Fiyat Hareketleri

- 2025: Proje başlangıcı, fiyat 0,05594 ile 0,12502 dolar arasında dalgalandı

- 1 Eylül 2025: NODE, 0,12502 dolar ile tüm zamanların en yüksek seviyesine ulaştı

- 25 Eylül 2025: NODE, 0,05594 dolar ile tüm zamanların en düşük seviyesine geriledi

NODE Güncel Piyasa Tablosu

8 Ekim 2025 tarihi itibarıyla NODE 0,08021 dolardan işlem görmektedir. Son 24 saatte token %15,7 oranında yüksek volatilite göstermiştir. Mevcut fiyat, en yüksek seviyeye göre %35,84 gerilemiş; en düşük seviyeye göre ise %43,39 yükselmiştir. NODE'un piyasa değeri 10.699.278 dolar ile kripto piyasasında 1.382. sırada yer almaktadır. 24 saatlik işlem hacmi 897.508 dolar olup piyasa aktivitesi orta düzeydedir. Dolaşımdaki arz 133.390.828 NODE token ve toplam arzın %13,34’üne karşılık gelmektedir (toplam arz: 1.000.000.000). Tam seyreltilmiş piyasa değeri ise 54.449.253 dolardır.

Fiyatı görmek için tıklayın: NODE piyasa fiyatı

NODE Piyasa Duyarlılığı Göstergesi

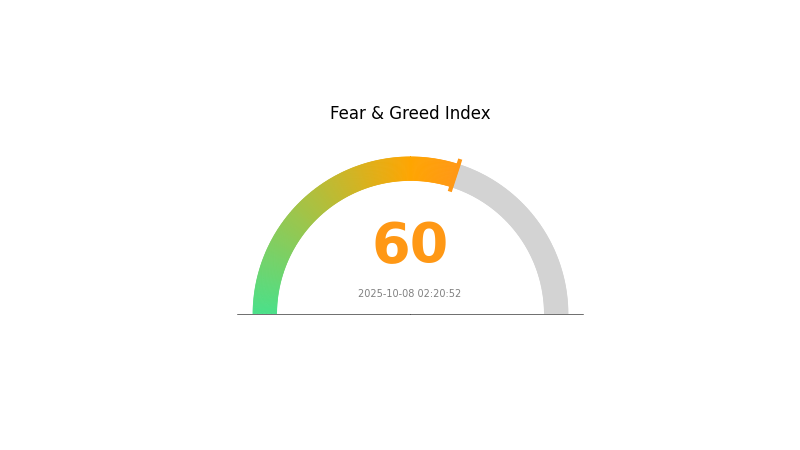

08 Ekim 2025 Korku & Açgözlülük Endeksi: 60 (Açgözlülük)

Güncel Fear & Greed Index için tıklayın

Korku & Açgözlülük Endeksi 60 seviyesinde ve bu, piyasa beklentilerinin daha iyimser ve yükseliş yönlü olduğunu gösteriyor. Ancak, aşırı açgözlülük dönemlerinde piyasa düzeltmeleri yaşanabileceğinden yatırımcılar dikkatli olmalı ve portföylerini çeşitlendirmelidir. Sağlıklı yatırım kararları için kapsamlı araştırma yapmalı ve piyasa trendlerini yakından takip etmelisiniz.

NODE Varlık Dağılımı

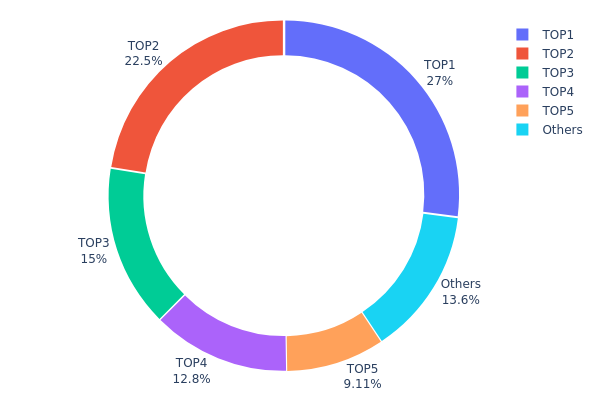

NODE’un adres bazlı varlık dağılımı oldukça yoğunlaşmış bir sahiplik yapısı gösteriyor. İlk 5 adres toplam arzın %86,33’ünü elinde tutarken, en büyük adresin payı %27. Bu yoğunlaşma, token dağılımında kayda değer bir dengesizliğe işaret ediyor.

Böyle bir yoğunlaşma, piyasa istikrarı ve olası fiyat manipülasyonu açısından risklidir. Arzın dörtte birinden fazlası tek bir adreste bulunuyor; bu da ani büyük işlemlerle NODE fiyatında keskin dalgalanmalara neden olabilir. Ayrıca, ilk 5 adresin toplam arzın %86’sından fazlasını kontrol etmesi, merkeziyetsizlik düzeyinin düşük olduğunu gösteriyor. Bu durum, blokzincir projelerinin temel ilkeleriyle çelişebilir.

Bu dağılım, NODE’un zincir üstü yönetim mekanizmasının (varsa) az sayıda büyük yatırımcı tarafından belirgin şekilde yönlendirilebileceği anlamına gelir. Yatırımcılar ve paydaşlar, olası piyasa hareketleri ve proje gelişmeleri için bu adresleri yakından takip etmelidir.

Güncel NODE varlık dağılımını görmek için tıklayın

| En Büyük | Adres | Token Adedi | Pay (%) |

|---|---|---|---|

| 1 | 0xcdfc...79f7b2 | 183.285,11K | 27,00% |

| 2 | 0x750a...9be278 | 152.737,59K | 22,49% |

| 3 | 0xc9b1...ce8125 | 101.825,06K | 14,99% |

| 4 | 0x1bce...3ed090 | 86.551,30K | 12,75% |

| 5 | 0xa516...1a970a | 61.818,35K | 9,10% |

| - | Diğerleri | 92.616,32K | 13,67% |

II. NODE'un Gelecek Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Sabit Maksimum Arz: NODE'un maksimum arzı sınırlandırılmıştır; bu durum, fiyatın istikrarı ve kademeli değer artışı için tarihsel olarak destekleyici bir unsur olmuştur.

- Mevcut Etki: Kontrol altında tutulan arz, fiyat dinamiklerini olumlu yönde etkilemeye devam edecektir.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Benimseme: NODE ETF’leri piyasaya sürülürse, geleneksel yatırımcılar için erişim kolaylığı sağlayarak ciddi sermaye akışlarını tetikleyebilir.

- Kurumsal Katılım: MicroStrategy gibi kurumlar NODE yatırımlarını sürdürdüğünde, kurumsal katılım ve projenin meşruiyeti artar.

Makroekonomik Ortam

- Enflasyon Karşıtı Özellikler: NODE’un enflasyonist koşullardaki performansı, değer saklama aracı olarak cazibesini belirleyebilir.

- Jeopolitik Faktörler: Uluslararası gerilimler ve ekonomik belirsizlikler, NODE’un güvenli liman algısını etkileyebilir.

Teknolojik Gelişim ve Ekosistem Büyümesi

- Ekosistem Uygulamaları: NODE ağı üzerinde DApp ve ekosistem projelerinin gelişmesi, kullanım alanı ve talebi artırabilir.

- Ölçeklenebilirlik Güncellemeleri: NODE blokzincirine yapılacak yenilikler, platformun kabiliyetini artırıp kullanıcı çekimini güçlendirebilir.

III. NODE 2025-2030 Fiyat Tahminleri

2025 Görünümü

- Temkinli tahmin: 0,04901 - 0,07 dolar

- Tarafsız tahmin: 0,07 - 0,09 dolar

- İyimser tahmin: 0,09 - 0,094 dolar (olumlu piyasa koşulları gerektirir)

2027-2028 Görünümü

- Piyasa fazı beklentisi: Potansiyel büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 0,06407 - 0,1418 dolar

- 2028: 0,09133 - 0,14193 dolar

- Temel tetikleyiciler: Artan benimseme ve teknolojik ilerleme

2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,13 - 0,17 dolar (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,17 - 0,2066 dolar (güçlü piyasa performansı ile)

- Dönüştürücü senaryo: 0,20 - 0,25 dolar (devrim niteliğinde yenilikler ve yaygın benimseme ile)

- 31 Aralık 2030: NODE için potansiyel ortalama fiyat 0,15191 dolar

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,094 | 0,08034 | 0,04901 | 0 |

| 2026 | 0,12291 | 0,08717 | 0,07845 | 8 |

| 2027 | 0,1418 | 0,10504 | 0,06407 | 30 |

| 2028 | 0,14193 | 0,12342 | 0,09133 | 53 |

| 2029 | 0,17115 | 0,13268 | 0,07297 | 65 |

| 2030 | 0,2066 | 0,15191 | 0,10634 | 89 |

IV. NODE için Yatırım Stratejileri ve Risk Yönetimi

NODE Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun profil: Sabırlı, yüksek risk toleransına sahip yatırımcılar

- Uygulama önerileri:

- Piyasa geri çekilmelerinde NODE token biriktirin

- Belirlediğiniz fiyat hedeflerine ulaşınca portföyü yeniden dengeleyin

- Tokenları donanım cüzdanı veya güvenilir saklama hizmetlerinde koruyun

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve dönüş noktalarını belirlemek için kullanılır

- RSI: Aşırı alım veya aşırı satım durumlarını izleyin

- Swing trade için kritik noktalar:

- NodeOps Network’teki gelişim kilometre taşlarını ve iş birliklerini takip edin

- Genel DePIN sektöründeki trendleri izleyin

NODE Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Portföyün %1-3’ü

- Agresif yatırımcılar: Portföyün %5-10’u

- Uzman yatırımcılar: Portföyün %15’ine kadar

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Yatırımları birden fazla DePIN projesi arasında dağıtın

- Zarar durdur emri: Olası kayıpları sınırlamak için kullanın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan: Gate Web3 cüzdan

- Soğuk cüzdan: Uzun vadeli saklama için donanım cüzdanı kullanın

- Güvenlik önlemleri: İki adımlı kimlik doğrulama ve güçlü şifreler kullanın

V. NODE İçin Potansiyel Riskler ve Zorluklar

NODE Piyasa Riskleri

- Volatilite: Kripto piyasaları yüksek oynaklık gösterir

- Rekabet: DePIN alanında artan rekabet

- Benimseme: NodeOps Network hizmetlerinin beklenenden yavaş benimsenmesi

NODE Düzenleyici Riskler

- Düzenleyici belirsizlik: Kripto paralara ilişkin değişen uluslararası düzenlemeler

- Uyum zorlukları: Sınır ötesi işlemlerde yaşanabilecek uyum problemleri

- Vergi etkileri: Kripto varlıklara ilişkin değişen vergi mevzuatı

NODE Teknik Riskler

- Akıllı sözleşme açıkları: Token sözleşmesindeki olası güvenlik zafiyetleri

- Ölçeklenebilirlik sorunları: Ağ talebinin artmasıyla yaşanabilecek darboğazlar

- Birlikte çalışabilirlik: Farklı blokzincirlerle entegrasyonda teknik zorluklar

VI. Sonuç ve Eylem Önerileri

NODE Yatırım Değeri Değerlendirmesi

NODE, büyüyen DePIN ekosisteminde uzun vadeli değer potansiyeli sunarken, piyasa oynaklığı ve düzenleyici belirsizlikler nedeniyle kısa vadede risk barındırmaktadır.

NODE Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Piyasayı anlamak için küçük ve düzenli yatırımlar yapın

✅ Tecrübeli yatırımcılar: Orta düzeyde tahsis ile aktif yönetim uygulayın

✅ Kurumsal yatırımcılar: Stratejik ortaklıklar ve daha büyük pozisyonlar değerlendirin

NODE Alım-Satım Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden NODE token alıp satabilirsiniz

- Stake etme: Varsa stake programlarına katılabilirsiniz

- DeFi entegrasyonu: NODE token destekli DeFi protokollerini değerlendirin

Kripto para yatırımları yüksek risk içerir. Bu içerik yatırım tavsiyesi olarak değerlendirilmemelidir. Yatırımcılar, kendi risk profiline göre karar vermeli ve profesyonel finansal danışmanlardan destek almalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

SSS

Node.ai'nin geleceği var mı?

Node.ai, büyüme potansiyeli gösteriyor ve tahminlere göre 2025 yılında fiyatı 0,2634 dolara ulaşabilir. Geleceği kesin olmamakla birlikte, AI ve blokzincir alanında umut vaat eden gelişmeler sergiliyor.

En yüksek fiyat tahminine sahip kripto para hangisi?

Bitcoin (BTC), 2025 yılında en yüksek fiyat tahminine sahip kripto para olarak öne çıkıyor. Hâlâ yatırımcılar için en çok tercih edilen seçenek ve yükseliş trendini sürdürüyor.

Shiba Inu 2030 yılında hangi fiyata ulaşacak?

Mevcut tahminlere göre Shiba Inu (SHIB) 2030 yılında yaklaşık 0,00009 ile 0,00010 dolar arasında bir değere ulaşabilir; bu da mevcut fiyatına göre önemli bir büyüme potansiyeli anlamına gelmektedir.

2025 yılında kripto için fiyat tahmini nedir?

Bitcoin’in 118.000 doların, Ethereum’un ise 3.000 doların üzerine çıkması bekleniyor; popüler altcoinlerin de 2025 yılında ciddi bir yükseliş göstermesi öngörülmektedir.

2025 BLESS Fiyat Tahmini: Piyasa Trendleri ve Yatırımcılar İçin Gelecek Potansiyelinin Analizi

2025 HONEY Fiyat Tahmini: Tatlı Emtiaya İlişkin Piyasa Analizi ve Gelecek Perspektifi

Roam (ROAM) Yatırım İçin Uygun mu?: Bu Dijital Nomad Tokeninin Piyasa Potansiyeli ve Uzun Vadeli Perspektiflerinin Değerlendirilmesi

2025 GRASS Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Etkenlerinin Analizi

Dimitra (DMTR) Yatırım İçin Uygun mu?: Tarımsal Blockchain Teknolojisinin Potansiyeli ve Risklerinin Değerlendirilmesi

Fluence (FLT) iyi bir yatırım mı?: Bu merkeziyetsiz bulut bilişim platformunun potansiyeli ve riskleri üzerine analiz

Gate Perp DEX: Kripto Tüccarları İçin En İyi Yüksek Performanslı Merkeziyetsiz Sürekli Ticaret Platformu

Ethereum'u Zincir Üzerinde Staking Yapma: 2025 için ETH Staking Getirileri ve Minimum Gereksinimler Rehberi

Gate Meme Go: Yeni Başlayanlar için Sıfır Ücretli Web3 Meme Token Ticaret Platformu

Meme Coin'ları Nasıl Alınır? Gate Meme Go için Tam Kılavuz

ETH nasıl stake edilir? Gate’in yeni zincir üstü staking rehberi