2025 GRASS Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Etkenlerinin Analizi

Giriş: GRASS’ın Piyasadaki Konumu ve Yatırım Potansiyeli

Grass (GRASS), kullanılmayan internet bant genişliğini paylaşmaya yönelik bir ağ olarak faaliyete geçmesinden bu yana önemli bir büyüme sergilemiştir. 2025 itibarıyla GRASS’ın piyasa değeri 136.562.356 $’a ulaşmış, dolaşımdaki arzı yaklaşık 313.360.158 token seviyesine çıkmış ve fiyatı 0,4358 $ civarında seyretmektedir. “İnternet bant genişliği paylaşım tokenı” olarak bilinen bu varlık, merkeziyetsiz internet kaynaklarının kullanımı alanında giderek daha önemli bir rol oynamaktadır.

Bu makalede, 2025’ten 2030’a kadar GRASS’ın fiyat dinamikleri kapsamlı biçimde ele alınacak; tarihsel eğilimler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler bütüncül olarak incelenerek yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. GRASS Fiyat Geçmişi ve Mevcut Piyasa Durumu

GRASS Fiyat Geçmişi

- 2024: Proje başlangıcı, fiyat 8 Kasım’da 3,9691 $ ile zirve yaptı

- 2025: Piyasa düzeltmesi, fiyat 10 Ekim’de 0,1698 $ ile tüm zamanların en düşük seviyesine geriledi

GRASS Mevcut Piyasa Durumu

20 Ekim 2025 tarihi itibarıyla GRASS 0,4358 $ seviyesinden işlem görüyor; 24 saatlik işlem hacmi 732.922 $ olarak kaydedildi. Token, son 24 saatte %1,22 oranında değer kaybetti. GRASS, kripto para piyasasında 349. sırada yer almakta olup 136.562.356 $ piyasa değerine sahip.

Token fiyatı son dönemde yüksek volatilite gösterdi. Son bir haftada GRASS %18,47, son bir ayda ise %50,71 oranında geriledi. Bu veriler, kısa ve orta vadede düşüş eğilimini yansıtıyor.

GRASS’ın mevcut fiyatı, 8 Kasım 2024’te ulaşılan 3,9691 $’lık zirvenin oldukça altında. Ancak, 10 Ekim 2025’te görülen 0,1698 $’lık dip seviyesinden bir miktar toparlanma gözlendi.

Dolaşımdaki arz 313.360.158 token olup bu rakam, toplam 1.000.000.000 GRASS tokenının %31,34’üne karşılık geliyor. Tam seyreltilmiş piyasa değeri ise 435.800.000 $’dır.

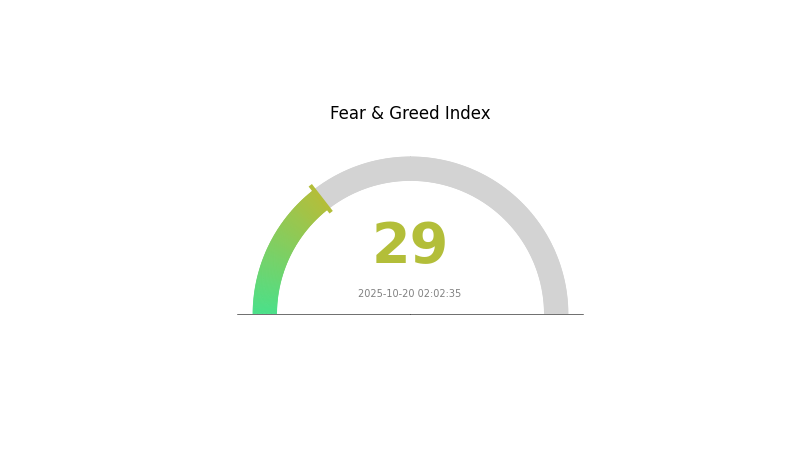

Genel kripto para piyasası hissiyatı, VIX endeksinin 29 seviyesinde seyretmesiyle yatırımcılar arasında korkunun hakim olduğunu gösteriyor ve bu durum GRASS fiyat performansını etkileyebilir.

Mevcut GRASS piyasa fiyatını görüntüleyin

GRASS Piyasa Hissiyatı Göstergesi

2025-10-20 Korku ve Açgözlülük Endeksi: 29 (Korku)

Mevcut Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında hâlihazırda korku hâkim; Korku ve Açgözlülük Endeksi 29 seviyesinde. Bu, yatırımcıların temkinli davrandığını gösteriyor ve kalabalığın aksi yönünde hareket etmek isteyenler için alım fırsatlarına işaret edebilir. Ancak piyasa hissiyatı hızla değişebilir. Yatırımcılar, kapsamlı araştırma yapmalı, portföylerini çeşitlendirmeli ve Gate.com gibi platformlarda sunulan risk yönetimi araçlarını kullanarak belirsiz dönemde etkin şekilde hareket etmelidir.

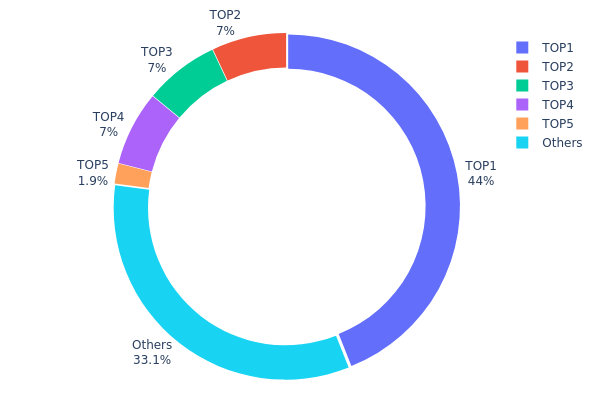

GRASS Token Dağılımı

GRASS’ın adres varlık dağılımı grafiği, sahipliğin büyük oranda birkaç adres üzerinde yoğunlaştığını gösteriyor. En büyük adres toplam arzın %44’üne sahipken, sonraki üç büyük adresin her biri %7’lik paya sahip ve toplamda %65’lik hakimiyet oluşturuyorlar. İlk 5 adres, toplam arzın neredeyse %67’sini elinde tutarken, kalan %33’lük kısım diğer yatırımcılara dağılmış durumda.

Böylesi bir yoğunlaşma, piyasa istikrarı ve fiyat manipülasyonu risklerini artırıyor. Az sayıda adresin çoğunluğu kontrol etmesi, büyük satışlar veya koordineli hareketlerle GRASS fiyatında ani değişimler yaratabilir. Yoğunlaşma, GRASS ekosisteminin merkeziyetsizlik ilkeleriyle de çelişen bir yapı sergiliyor.

Mevcut dağılım, GRASS piyasasının henüz olgunlaşmadığını ve tokenların geniş bir kullanıcı/yatırımcı tabanına yayılmadığını gösteriyor. Bu da kısa vadede yüksek volatilite ve düşük likidite anlamına gelebilir; zira büyük sahipler piyasa üzerinde ciddi etki yaratabilir.

Mevcut GRASS Token Dağılımı için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 31rYar...8tLGqQ | 440.017,61K | 44,00% |

| 2 | CMLjq7...Cqe8iP | 70.000,00K | 7,00% |

| 3 | 8XWdMc...5gMUiX | 70.000,00K | 7,00% |

| 4 | iauGQj...Mzmxjt | 70.000,00K | 7,00% |

| 5 | 2Exsx4...6zko9T | 19.000,00K | 1,90% |

| - | Diğerleri | 330.976,94K | 33,1% |

II. GRASS’ın Gelecekteki Fiyatını Etkileyecek Temel Faktörler

Arz Mekanizması

- Sabit Arz: GRASS’ın toplam arzı sabittir, bu da talep arttıkça kıtlık etkisiyle fiyatı yukarı taşıyabilir.

- Tarihsel Eğilim: Sınırlı arz, benzer kripto varlıklarda yükselen talep dönemlerinde fiyat artışı getirmiştir.

- Güncel Etki: Sabit arz, GRASS’ın benimsenmesi ve kullanımının artmasıyla fiyat istikrarı veya değer kazanımını destekleyebilir.

Makroekonomik Ortam

- Enflasyon Koruma Özelliği: GRASS, diğer dijital varlıklar gibi enflasyona karşı koruma amacıyla değerlendirilebilir.

- Jeopolitik Etkenler: Küresel ekonomik belirsizlikler ve jeopolitik gerilimler, GRASS gibi alternatif varlıklara olan ilgiyi artırabilir.

Teknik Gelişim ve Ekosistem Büyümesi

- Ekosistem Uygulamaları: GRASS ekosisteminde DApp ve projelerin gelişimi, tokenin kullanım alanını arttırarak talebi güçlendirebilir.

III. 2025-2030 GRASS Fiyat Tahminleri

2025 Öngörüsü

- Temkinli tahmin: 0,22 $ - 0,33 $

- Tarafsız tahmin: 0,33 $ - 0,43 $

- İyimser tahmin: 0,43 $ - 0,61 $ (olumlu piyasa koşulları gerektirir)

2026-2027 Öngörüsü

- Piyasa evresi: Kademeli büyüme ve istikrara geçiş

- Fiyat aralığı tahmini:

- 2026: 0,36 $ - 0,55 $

- 2027: 0,47 $ - 0,65 $

- Başlıca katalizörler: Artan benimseme ve teknolojik gelişmeler

2028-2030 Uzun Vadeli Öngörü

- Temel senaryo: 0,59 $ - 0,76 $ (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,76 $ - 0,88 $ (güçlü piyasa performansı varsayımıyla)

- Dönüştürücü senaryo: 0,88 $ - 1,09 $ (olağanüstü piyasa koşulları ve yaygın kullanım varsayımıyla)

- 2030-12-31: GRASS 1,09 $ (çok olumlu şartlarda zirve potansiyeli)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0,61109 | 0,4334 | 0,22103 | 0 |

| 2026 | 0,55358 | 0,52225 | 0,36557 | 19 |

| 2027 | 0,65626 | 0,53791 | 0,47874 | 23 |

| 2028 | 0,69859 | 0,59708 | 0,36422 | 37 |

| 2029 | 0,88106 | 0,64784 | 0,35631 | 48 |

| 2030 | 1,09316 | 0,76445 | 0,40516 | 75 |

IV. GRASS İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

GRASS Yatırım Yöntemi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun profil: Yüksek risk toleransına sahip uzun vadeli yatırımcılar

- İşlem önerileri:

- Piyasa düşüşlerinde GRASS biriktirin

- Fiyat hedefleri belirleyip portföyü düzenli gözden geçirin

- Tokenları güvenli, tercihen donanım cüzdanında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve olası dönüşleri belirlemek için kullanılır

- RSI: Aşırı alım veya aşırı satım koşullarını izlemek için kullanılır

- Dalgalı alım-satım için önemli noktalar:

- Grass ağına ilişkin piyasa hissiyatı ve haberleri takip edin

- Zarar-durdur emirleriyle kayıpları sınırlayın

GRASS Risk Yönetim Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: %5-10

- Profesyonel yatırımcılar: %15’e kadar

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: GRASS’ı diğer kripto varlıklarla ve geleneksel yatırımlarla dengeleyin

- Zarar-durdur emirleri: Kayıpları sınırlamak için uygulayın

(3) Güvenli Saklama Çözümleri

- Donanım cüzdanı tavsiyesi: Gate Web3 cüzdanı

- Yazılım cüzdanı seçeneği: Resmi Grass cüzdanı (varsa)

- Güvenlik önlemleri: İki faktörlü doğrulama, güçlü şifre ve özel anahtarları çevrimdışı tutmak

V. GRASS İçin Olası Riskler ve Zorluklar

GRASS Piyasa Riskleri

- Yüksek volatilite: GRASS fiyatı sert dalgalanmalara açık olabilir

- Rekabet: Yeni bant genişliği paylaşım ağları ortaya çıkabilir

- Kullanıcı benimsemesi: Grass ağının büyüme hızı yavaşlayabilir

GRASS Regülasyon Riskleri

- Regülasyon belirsizliği: Kripto mevzuatında olası değişiklikler

- Sınır ötesi işlemler: Farklı ülkelerde değişen yasal durum

- Veri gizliliği: Bant genişliği paylaşımının regülatif incelemeye tabi olması

GRASS Teknik Riskler

- Ağ güvenliği: Grass ağında olası zafiyetler

- Ölçeklenebilirlik: Kullanıcı sayısında artışla ilgili teknik zorluklar

- Akıllı sözleşme riskleri: Token sözleşmesinde hata veya açık oluşma riski

VI. Sonuç ve Eylem Önerileri

GRASS Yatırım Değeri Değerlendirmesi

GRASS, bant genişliği paylaşımı piyasasında özgün bir değer sunuyor ve uzun vadede büyüme potansiyeli taşıyor. Ancak yatırımcılar kısa vadeli volatiliteyi ve regülasyon belirsizliklerini göz önünde bulundurmalıdır.

GRASS Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayıp proje hakkında bilgi edinin ✅ Deneyimli yatırımcılar: Düzenli portföy dengelemesiyle dengeli bir yaklaşım benimseyin ✅ Kurumsal yatırımcılar: Kapsamlı analiz yapın ve GRASS’ı çeşitlendirilmiş kripto portföyüne dahil edin

GRASS Alım-Satım Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden GRASS token alıp satabilirsiniz

- Staking: Staking programlarına katılabilirsiniz (varsa)

- Ağ katılımı: Grass ağı üzerinden bant genişliği paylaşarak GRASS kazanabilirsiniz

Kripto para yatırımları son derece yüksek risk taşır ve bu metin yatırım tavsiyesi değildir. Yatırımcılar kararlarını kendi risk profiline göre dikkatli şekilde vermeli ve profesyonel finansal danışmanlara başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

SSS

GRASS tokenları ne kadar değerli olacak?

GRASS tokenlarının 2025 sonunda 0,15-0,20 $ aralığına ulaşması öngörülmektedir; bu tahmin artan benimseme ve ekosistem büyümesiyle desteklenmektedir.

GRASS kripto iyi mi?

Evet, GRASS kripto potansiyel sunuyor. Web3 ekosisteminde ivme kazanıyor, benimsemesi artıyor ve güçlü bir geliştirme ekibine sahip.

GRT 10 $’a ulaşabilir mi?

Evet, GRT güçlü temelleri ve Web3 ekosisteminde artan benimsenmesiyle 2025’e kadar 10 $’a ulaşabilir. Bunun için piyasanın güçlü büyümesi ve The Graph protokolünün sürekli gelişimi gerekir.

Grass coin şu anda ne kadar?

Ekim 2025 itibarıyla GRASS coin yaklaşık 0,75 $ değerindedir ve önceki seviyelere kıyasla istikrarlı bir artış göstermiştir.

2025 BLESS Fiyat Tahmini: Piyasa Trendleri ve Yatırımcılar İçin Gelecek Potansiyelinin Analizi

2025 HONEY Fiyat Tahmini: Tatlı Emtiaya İlişkin Piyasa Analizi ve Gelecek Perspektifi

Roam (ROAM) Yatırım İçin Uygun mu?: Bu Dijital Nomad Tokeninin Piyasa Potansiyeli ve Uzun Vadeli Perspektiflerinin Değerlendirilmesi

Dimitra (DMTR) Yatırım İçin Uygun mu?: Tarımsal Blockchain Teknolojisinin Potansiyeli ve Risklerinin Değerlendirilmesi

Fluence (FLT) iyi bir yatırım mı?: Bu merkeziyetsiz bulut bilişim platformunun potansiyeli ve riskleri üzerine analiz

2025 NODE Fiyat Tahmini: Halving Sonrası Dönemde NODE Token’a Yönelik Kapsamlı Analiz ve Piyasa Beklentileri

Ücretsiz Dogecoin’i Kazanın: Harcama Yapmadan Madencilik İçin İpuçları

En İyi DeFi İşlem Platformları: Merkeziyetsiz Finansa Erişiminiz

Veri Yapılarında Yönlendirilmiş Asiklik Grafik (DAG) Teknolojisinin Keşfi

2024'te İzlenmesi Gereken Başlıca Merkeziyetsiz Finans Platformları

Dijital Varlık Alım Satımı İçin En İyi Platformlar - Kapsamlı Rehber