2025 MORPHO Fiyat Tahmini: DeFi Tokenı için Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

Giriş: MORPHO'nun Piyasadaki Konumu ve Yatırım Potansiyeli

Ethereum blokzincirinde borç verme protokolü olarak faaliyet gösteren Morpho Labs (MORPHO), kuruluşundan itibaren önemli kilometre taşlarına ulaşmıştır. 2025 yılı itibarıyla MORPHO'nun piyasa değeri 1,01 milyar dolara yükselmiş, dolaşımdaki arz yaklaşık 522,48 milyon tokene ulaşmış ve fiyatı 1,93 dolar civarında seyretmektedir. "Lending pool optimizer" olarak tanınan bu varlık, merkeziyetsiz finans (DeFi) borç verme ekosisteminde giderek daha kritik bir konuma sahip olmaktadır.

Bu makalede, MORPHO'nun 2025-2030 arasındaki fiyat hareketleri; geçmiş eğilimler, piyasa arz ve talebi, ekosistem gelişimi ve makroekonomik faktörler çerçevesinde kapsamlı şekilde analiz edilecek; yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. MORPHO Fiyat Geçmişi ve Güncel Piyasa Görünümü

MORPHO Tarihsel Fiyat Süreci

- 2025: MORPHO, 17 Ocak'ta 4,1905 dolar ile zirveye ulaştı

- 2025: Token, 10 Ekim'de 0,5291 dolar ile en düşük seviyeyi gördü

- 2025: MORPHO, ilk kez 21 Temmuz'da 0,75 dolardan işlem görmeye başladı

MORPHO Güncel Piyasa Durumu

16 Ekim 2025 tarihinde MORPHO, 1,9348 dolardan işlem görüyor. Token son 24 saatte %2,95 değer kaybederken, işlem hacmi 4.325.079,29 dolar seviyesinde gerçekleşti. MORPHO'nun piyasa değeri 1.010.885.763 dolara ulaşarak kripto para piyasasında 98'inci sırada yer aldı. Dolaşımdaki arzı ise 522.475.585,70 MORPHO olup, toplam arzın %52,25'ini temsil ediyor.

Son bir haftada MORPHO, %9,15 oranında yükselerek olumlu bir ivme yakaladı. Ancak son 30 günlük performansı %0,91'lik hafif bir düşüşe işaret ediyor. Yıl başından bu yana ise MORPHO, geçen yıla kıyasla %56,73 artış göstererek güçlü bir performans sergiledi.

Mevcut piyasa duyarlılığı MORPHO için nötr görünmekte; fiyat, son 24 saatte 2,0757 dolar ile 1,852 dolar arasında dalgalandı. Token, ilk listeleme fiyatının üzerinde işlem gördüğü için, lansmandan bu yana genel olarak pozitif bir büyüme gösteriyor.

Güncel MORPHO piyasa fiyatını görmek için tıklayın

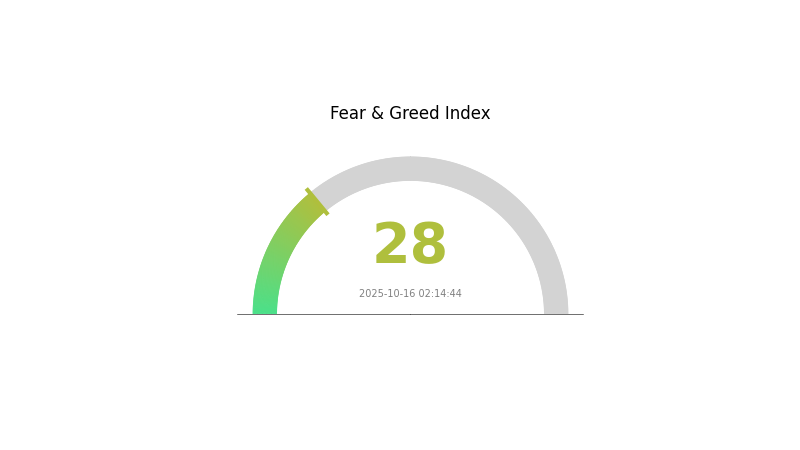

MORPHO Piyasa Duyarlılığı Endeksi

16 Ekim 2025 Korku ve Açgözlülük Endeksi: 28 (Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında duyarlılık temkinli seyrediyor; Korku ve Açgözlülük Endeksi'nin 28 seviyesinde olması, piyasada korkunun hakim olduğunu gösteriyor. Bu, yatırımcıların çekimser davrandığı ve olası alım fırsatlarını değerlendirdiği anlamına gelir. Böyle dönemlerde güncel haberleri takip etmek ve titiz kararlar almak kritik önem taşır. Piyasa döngüleri doğaldır; korku genellikle toparlanma öncesi ortaya çıkar. Portföyünüzü çeşitlendirerek, sağlam temellere sahip projelere odaklanın. Her zaman detaylı araştırma yapın ve riskinizi kontrollü yönetin.

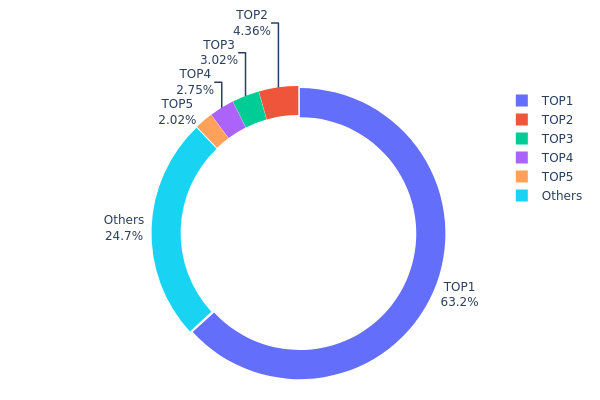

MORPHO Varlık Dağılımı

MORPHO'nun adres bazlı varlık dağılımı, yüksek oranda yoğunlaşmış bir sahiplik yapısı ortaya koyuyor. En büyük adres, toplam arzın %63,16'sını elinde bulunduruyor ve bu ciddi bir merkezileşme anlamına geliyor. Sonraki dört büyük sahip ise toplamda %12,14'lük ek paya sahipken, kalan adresler MORPHO tokenlerinin %24,7'sini kontrol ediyor.

Bu aşırı yoğunlaşma, MORPHO'nun piyasa yapısı ve fiyat istikrarı için risk oluşturuyor. Tek bir adresin arzın neredeyse üçte ikisini kontrol etmesi, büyük ölçekli piyasa hareketlerine ve olası manipülasyonlara karşı kırılganlığı artırıyor. En büyük sahibin herhangi bir ciddi hamlesinde tokenin likiditesi ve fiyatı hızlıca dalgalanabilir.

Mevcut dağılım MORPHO'nun düşük merkeziyetsizlik seviyesine işaret ediyor; bu durum zincir üstü yapısal istikrarı sorgulatıyor. Gücün birkaç elde toplanması, yönetişim ve tokenin genel kullanımını etkileyebilir; bu nedenle piyasa katılımcılarının ve yatırımcıların yakından takip etmesi gereklidir.

Güncel MORPHO Varlık Dağılımı için tıklayın

| En Büyük | Adres | Varlık Miktarı | Pay (%) |

|---|---|---|---|

| 1 | 0x9d03...0e5123 | 631.657,36K | 63,16% |

| 2 | 0x5305...79b281 | 43.609,60K | 4,36% |

| 3 | 0x3154...0f2c35 | 30.158,58K | 3,01% |

| 4 | 0x72b2...696fae | 27.503,39K | 2,75% |

| 5 | 0x2419...925dfe | 20.205,02K | 2,02% |

| - | Diğerleri | 246.866,05K | 24,7% |

II. MORPHO'nun Gelecek Fiyatını Etkileyen Temel Unsurlar

Arz Mekanizması

- Tarihsel Örüntü: Geçmiş arz değişiklikleri MORPHO fiyatında doğrudan etkiler göstermiştir.

- Mevcut Etki: Beklenen arz değişimleri yakın vadede MORPHO'nun piyasa performansını belirleyici olacaktır.

Kurumsal ve Whale Dinamikleri

- Kurumsal Benimseme: MORPHO, merkeziyetsiz borç verme platformlarının yerel tokeni olarak DeFi alanındaki kurumsal ilgiyi artırmaktadır.

Makroekonomik Çerçeve

- Enflasyona Karşı Koruma: MORPHO'nun enflasyonist ortamlardaki performansı yatırımcıların yakın takibindedir.

Teknolojik Gelişim ve Ekosistem Büyümesi

- Borç Verme Ağı Genişlemesi: MORPHO'nun borç verme ağının büyümesi, uzun vadede fiyat performansı için belirleyici olacaktır.

- Kullanıcı Tabanı Artışı: Kullanıcı sayısının artması, MORPHO fiyatını yukarı taşıyacak ana unsurlardan biridir.

- Ekosistem Uygulamaları: MORPHO platformunda geliştirilen DApp ve ekosistem projeleri, tokenin değer önerisini güçlendirecektir.

Not: Uzun vadeli öngörüler, MORPHO mevcut gelişim ivmesini korursa 2030 yılında 5-8 dolar aralığına ulaşabileceğini göstermektedir.

III. 2025-2030 MORPHO Fiyat Tahmini

2025 Beklentisi

- Temkinli tahmin: 1,10 - 1,50 dolar

- Nötr tahmin: 1,50 - 1,93 dolar

- İyimser tahmin: 1,93 - 2,11 dolar (olumlu piyasa koşulları ile)

2026-2027 Beklentisi

- Piyasa fazı: Büyüme dönemi olasılığı

- Fiyat aralığı tahmini:

- 2026: 1,94 - 2,81 dolar

- 2027: 2,25 - 3,46 dolar

- Ana katalizörler: DeFi platformlarının yaygınlaşması, kripto piyasasında toparlanma

2028-2030 Uzun Vadeli Görünüm

- Temel senaryo: 2,94 - 3,37 dolar (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 3,37 - 4,62 dolar (DeFi sektöründe güçlü büyüme ile)

- Dönüştürücü senaryo: 4,62 dolar ve üzeri (kripto ve DeFi piyasalarında son derece olumlu koşullar)

- 31 Aralık 2030: MORPHO 3,37 dolar (projeksiyon ortalaması)

| Yıl | Tahmini Maksimum Fiyat | Tahmini Ortalama Fiyat | Tahmini Minimum Fiyat | Fiyat Değişimi (%) |

|---|---|---|---|---|

| 2025 | 2,11286 | 1,9384 | 1,10489 | 0 |

| 2026 | 2,81562 | 2,02563 | 1,9446 | 4 |

| 2027 | 3,46149 | 2,42063 | 2,25118 | 25 |

| 2028 | 3,70574 | 2,94106 | 2,67636 | 52 |

| 2029 | 3,4231 | 3,3234 | 2,29314 | 71 |

| 2030 | 4,62135 | 3,37325 | 3,00219 | 74 |

IV. MORPHO Profesyonel Yatırım Stratejileri ve Risk Yönetimi

MORPHO Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Uzun vadeli değer yatırımcıları ve DeFi odaklı kullanıcılar

- İşlem önerileri:

- Piyasa düşüşlerinde MORPHO token biriktirin

- Morpho protokolüne katılarak getiri elde edin

- Tokenleri güvenli, saklamalı olmayan bir cüzdanda saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve olası dönüş noktalarını tespit edin

- Relative Strength Index (RSI): Aşırı alım/aşırı satım seviyelerini takip edin

- Dalgalı işlemde temel noktalar:

- Teknik göstergelere göre giriş-çıkış noktalarını belirleyin

- DeFi piyasa duyarlılığını ve Morpho protokol güncellemelerini izleyin

MORPHO Risk Yönetim Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3'ü ile sınırlı tutun

- Daha agresif yatırımcılar: %5-10 arasında tutabilirsiniz

- Profesyoneller: DeFi odaklı portföyün %15'ine kadar çıkabilirsiniz

(2) Riskten Korunma Çözümleri

- Diversifikasyon: MORPHO'yu farklı DeFi varlıkları ile dengeleyin

- Zarar durdur emirleri: Potansiyel kayıpları sınırlandırmak için kullanın

(3) Güvenli Saklama Alternatifleri

- Sıcak cüzdan tavsiyesi: Gate Web3 Wallet

- Soğuk saklama: Uzun vadeli tutumlar için donanım cüzdanı

- Güvenlik: İki faktörlü kimlik doğrulama ve güçlü şifreler kullanın

V. MORPHO İçin Olası Riskler ve Zorluklar

MORPHO Piyasa Riskleri

- Volatilite: DeFi tokenleri büyük fiyat dalgalanmalarına açık

- Rekabet: Yeni DeFi protokolleri Morpho'nun pazar payını etkileyebilir

- Likidite: Piyasa stresinde likiditenin azalması riski

MORPHO Düzenleyici Riskler

- Belirsiz regülasyonlar: DeFi alanındaki değişen mevzuat operasyonları etkileyebilir

- Uyumluluk gereksinimleri: KYC/AML entegrasyonu gerekebilir

- Sınır ötesi kısıtlamalar: Uluslararası regülasyon farklılıkları

MORPHO Teknik Riskler

- Akıllı sözleşme açıkları: İstismar veya hata olasılığı

- Ölçeklenebilirlik sorunları: Ethereum ağındaki tıkanıklık performansı etkileyebilir

- Oracle bağımlılığı: Harici veri kaynaklarından doğan riskler

VI. Sonuç ve Eylem Önerileri

MORPHO Yatırım Değeri Değerlendirmesi

MORPHO, DeFi borç verme ekosisteminde protokol optimizasyonlarıyla uzun vadeli cazip bir değer sunar. Ancak kısa vadede piyasa volatilitesi ve regülasyon belirsizliği gibi riskler taşır.

MORPHO Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayın, DeFi ve Morpho teknolojisini öğrenin

✅ Deneyimli yatırımcılar: Çeşitlendirilmiş DeFi portföyünde orta ölçekli tahsisat düşünün

✅ Kurumsal yatırımcılar: Kapsamlı risk analiziyle stratejik ortaklıklar ve büyük pozisyonları değerlendirin

MORPHO Katılım Yöntemleri

- Token alımı: Gate.com üzerinden MORPHO token edinebilirsiniz

- Protokole katılım: Varlıklarınızı Morpho optimizasyonlu borç verme havuzlarına yatırın

- Yönetişim: MORPHO token stake ederek protokol kararlarında oy hakkı kazanın

Kripto para yatırımları oldukça yüksek risk içerir ve bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarına göre özenli şekilde karar vermeli ve profesyonel finansal danışmanlara başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

Sıkça Sorulan Sorular

Morpho için fiyat tahmini nedir?

Morpho'nun fiyatının, 2027 yılı için uzun vadeli piyasa tahminlerine göre 1,79 dolar ile 2,06 dolar arasında olması bekleniyor.

2025 yılında hangi kripto para yükselişi bekleniyor?

Bitcoin, Ethereum, Solana, XRP ve Binance Coin'in 2025 yılında yükselişe geçmesi, boğa piyasası koşullarında ciddi fiyat artışları göstermesi bekleniyor.

Melania Trump coin bugün ne kadar?

Melania Trump coin'in bugünkü fiyatı 0,12 dolardır. Son bir saatte değeri %1,7 oranında gerilemiştir.

Holo coin 1 dolara ulaşabilir mi?

Holo coin'in 1 dolara ulaşma ihtimali mevcut ancak kesin değildir. Tahminler yıl sonunda 0,20 ile 0,73 dolar arasında bir fiyat öngörüyor; uzun vadede ise 1 dolar seviyesine yönelik spekülasyonlar sürmektedir.

2025 EUL Fiyat Tahmini: DeFi Ekosisteminde Euler Finance Token’a Yönelik Piyasa Analizi ve Gelecek Trendleri

2025 EDGE Fiyat Tahmini: Büyüme Potansiyeli Analizi ve Gelecekteki Değeri Etkileyen Piyasa Faktörleri

2025 BENQI Fiyat Tahmini: DeFi Protokolü İçin Piyasa Trendleri ve Gelecek Değerleme Analizi

2025 ASTER Fiyat Tahmini: Yükselen Kripto Para Birimi İçin Piyasa Trendleri ve Büyüme Potansiyeli Analizi

2025 OMG Fiyat Tahmini: Gelişen Kripto Ekosisteminde Token'ın Piyasa Trendleri ve Gelecek Potansiyelinin Değerlendirilmesi

2025 TOKEN Fiyat Tahmini: Piyasa Eğilimleri ve Yaklaşan Boğa Sezonunda Büyüme Potansiyelinin İncelenmesi

Cysic: AI ve Dağıtık Hesaplama için Sıfır Bilgi Altyapı Platformu

ABD Bankacılık Düzenleyicisi OCC, ulusal bankaların kripto para ticareti yapmasını kolaylaştırıyor

ASTER Spot İşlem Rehberi: Anlık Fiyat Analizi ve İşlem Hacmi Bilgileri

Cantor Equity ile birleşmenin ardından Twenty One Capital Bitcoin hissesi yüzde 25 değer kaybetti

Dropee Günlük Kombinasyonu 10 Aralık 2025