2025 ASTER Fiyat Tahmini: Yükselen Kripto Para Birimi İçin Piyasa Trendleri ve Büyüme Potansiyeli Analizi

Giriş: ASTER'ın Piyasa Konumu ve Yatırım Değeri

ASTER (ASTER), yeni nesil merkeziyetsiz borsa olarak piyasaya adım attığından beri kripto para sektöründe önemli bir konum elde etti. 2025 yılı itibarıyla ASTER'ın piyasa değeri 2,43 milyar dolar seviyesine ulaşırken, dolaşımdaki token miktarı yaklaşık 1,66 milyar adet ve fiyatı yaklaşık 1,46 dolar civarında seyrediyor. Sıklıkla "tek noktadan zincir üstü alım-satım platformu" olarak anılan bu varlık, hem spot hem de sürekli vadeli işlemler alanında giderek daha kritik bir rol üstleniyor.

Bu makalede, ASTER'ın 2025-2030 yılları arasındaki fiyat trendleri; geçmiş fiyat hareketleri, piyasa arz ve talep dengesi, ekosistem gelişimi ile makroekonomik faktörler kapsamında ele alınacak ve profesyonel fiyat öngörüleri ile yatırımcılara yönelik pratik stratejiler sunulacaktır.

I. ASTER Fiyat Geçmişi ve Mevcut Piyasa Durumu

ASTER Tarihsel Fiyat Gelişimi

- 2025 (19 Eylül): ASTER, 0,6083 dolar ile tüm zamanların en düşük seviyesine indi

- 2025 (24 Eylül): ASTER, 2,428 dolar ile tüm zamanların en yüksek seviyesini gördü

- 2025 (Ekim): Son 24 saatte fiyat, 1,3011 ile 1,5302 dolar arasında sert dalgalandı

ASTER Güncel Piyasa Durumu

15 Ekim 2025 itibarıyla ASTER, 1,4647 dolardan işlem görüyor ve kripto para piyasasında 55. sırada yer alıyor. Token, son 24 saatte %4,28 değer kazanarak 55.850.748,60 dolar işlem hacmine ulaştı. ASTER'ın piyasa değeri 2.428.033.190 dolar, dolaşımdaki arzı ise 1.657.700.000 ASTER.

Mevcut fiyat, tarihi dip seviyesinden belirgin bir toparlanmaya işaret etse de, halen zirve değerinin altında bulunuyor. ASTER son 30 günde %1.640,03 gibi olağanüstü bir büyüme yaşarken, son bir haftada %25,86 düşüşle volatil bir piyasa ortamı sergiledi.

Token'ın tam seyreltilmiş piyasa değeri 11.717.600.000 dolar olup, toplam arzı 8.000.000.000 ASTER'dır. Dolaşımdaki arz, toplam arzın %20,72'sine denk gelerek, gelecekte ek token arzı potansiyeline işaret ediyor.

ASTER'ın piyasa hâkimiyeti şu anda %0,28 seviyesinde, bu da genel kripto ekosistemindeki yerini gösteriyor. Proje, 171.557 cüzdan sahibiyle ciddi ilgi topladı ve Aster merkeziyetsiz borsa platformunda büyüyen bir kullanıcı tabanına sahip.

Mevcut ASTER piyasa fiyatını görmek için tıklayın

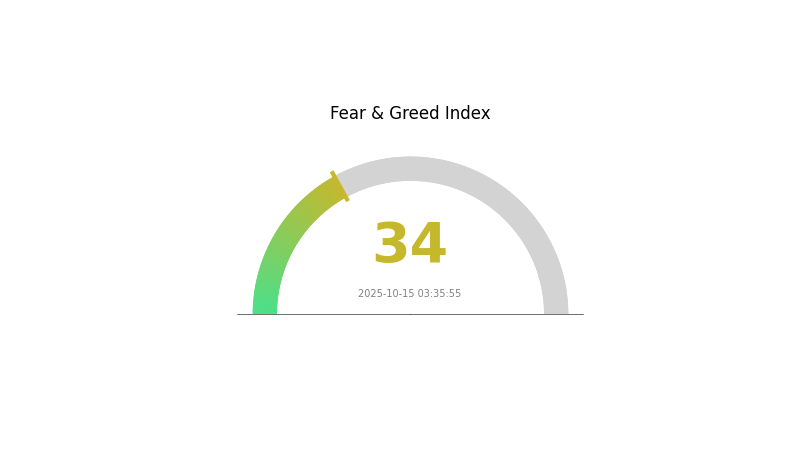

ASTER Piyasa Duyarlılık Göstergesi

2025-10-15 Korku ve Açgözlülük Endeksi: 34 (Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında duyarlılık, Korku ve Açgözlülük Endeksi'nin 34 seviyesinde seyretmesiyle temkinli kalıyor ve piyasada korku ortamı hakim. Yatırımcılar, daha güvenli limanlar arayışında. Bu tür dönemlerde dikkatli davranmak, aceleci kararlar almamak gerekir. Korku, cesur yatırımcılara alım fırsatı sunabilir; ancak derinlemesine araştırma yapmak ve riskleri iyi yönetmek şarttır. Piyasa duyarlılığının hızla değişebileceğini unutmayın; güncel gelişmeleri takip edin ve portföyünüzü çeşitlendirmeyi ihmal etmeyin.

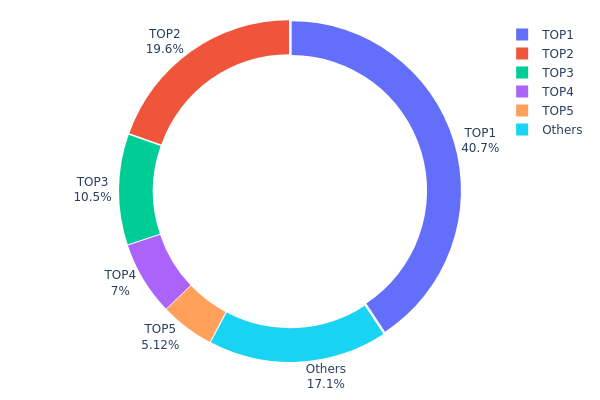

ASTER Varlık Dağılımı

ASTER'ın adres bazlı varlık dağılımı, sahipliğin yüksek oranda yoğunlaştığını gösteriyor. En büyük adres toplam arzın %40,70'ine sahipken, ilk beş adres tüm ASTER tokenlarının %82,94'ünü elinde bulunduruyor. Bu düzeyde yoğunlaşma, merkeziyetsizlik ve piyasa manipülasyonu risklerine dair endişeleri artırıyor.

Böyle bir dağılım, fiyatlarda ciddi dalgalanmalara ve piyasa istikrarsızlığına yol açabilir. "Balina" olarak adlandırılan büyük sahipler, yaptıkları işlemlerle token fiyatında önemli etki yaratabilir. Ayrıca bu yoğunluk, zincir üstü yönetişimde az sayıda aktörün hâkimiyetini de beraberinde getirebilir ve projenin merkeziyetsiz yapısını zayıflatabilir.

Her ne kadar birçok kripto parada belirli oranda yoğunlaşma bulunsa da, ASTER'ın mevcut dağılımı görece düşük merkeziyetsizlik seviyesine işaret ediyor. Bu yapı, likiditeyi azaltabilir ve fiyat manipülasyonu riskini yükseltebilir. Yatırımcılar ve paydaşlar, dağılımın gidişatını izlemeli; daha yaygın bir sahiplik yapısı, token'ın uzun vadeli istikrarı ve benimsenmesi için daha sağlıklı kabul edilmektedir.

Mevcut ASTER Varlık Dağılımı için tıklayın

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xe8c3...51a892 | 3.256.000,00K | 40,70% |

| 2 | 0xdfa6...2a3463 | 1.568.000,00K | 19,60% |

| 3 | 0x1284...a87974 | 841.994,29K | 10,52% |

| 4 | 0x798b...9269f7 | 560.000,00K | 7,00% |

| 5 | 0x8894...e2d4e3 | 409.828,71K | 5,12% |

| - | Others | 1.364.177,00K | 17,06% |

II. ASTER'ın Gelecekteki Fiyatını Etkileyen Temel Unsurlar

Arz Mekanizması

- Token Dağılımı: Mevcut dağılımda arzın %96'sı az sayıdaki adreste yoğunlaşıyor; bu, ileride fiyat hareketlerini etkileyebilir.

- Tarihsel Eğilim: 0,025 dolardan 1,94 dolara %7.660'lık yükseliş, aşırı volatilite ve spekülasyon iştahını gösteriyor.

- Güncel Etki: Yoğun token dağılımı, büyük sahipler satışa geçerse fiyat oynaklığını artırabilir.

Kurumsal ve Balina Dinamikleri

- Kurumsal Sahiplik: YZi Labs'ın ASTER'da payı bulunuyor, ancak oran açıklanmamış durumda.

- Kurumsal Benimseme: Gate.com'un ASTER'a desteği, benimsenmeyi ve fiyatı olumlu etkileyebilir.

- Devlet Politikaları: ASTER'a özel bir devlet politikası yok; genel kripto düzenlemeleri etkili olabilir.

Makroekonomik Ortam

- Parasal Politika Etkisi: Küresel parasal politikaların yönlendirdiği genel kripto piyasası duyarlılığı ASTER fiyatı üzerinde etkili olacaktır.

- Enflasyona Karşı Korumalı Olma: Kripto varlık olarak ASTER, enflasyona karşı koruma aracı olarak görülebilir ve bu talebi etkileyebilir.

Teknik Gelişim ve Ekosistem Büyümesi

- Çoklu Zincir Desteği: ASTER, BNB Chain dışında Arbitrum, OP, Linea ve Solana desteğiyle büyüyor ve daha fazla zincir eklemeyi planlıyor.

- Aster Chain: Aster Chain'in gelişimi, zincir üstü işlemlerde şeffaflık ve doğrulanabilirlik sağlarken gizliliği de korumayı amaçlıyor.

- Ekosistem Uygulamaları: Platform, özellikle sürekli vadeli işlemlere odaklanarak piyasa talebinin büyük kısmını karşılıyor.

III. 2025-2030 Dönemi ASTER Fiyat Tahmini

2025 Görünümü

- Ihtiyatlı tahmin: 1,10 - 1,30 dolar

- Tarafsız tahmin: 1,40 - 1,60 dolar

- İyimser tahmin: 1,80 - 1,97 dolar (güçlü piyasa duyarlılığı ve benimseme şartıyla)

2026-2027 Görünümü

- Piyasa dönemi beklentisi: Olası büyüme evresi

- Fiyat aralığı tahmini:

- 2026: 0,96 - 2,25 dolar

- 2027: 1,53 - 2,62 dolar

- Başlıca tetikleyiciler: Artan benimseme, teknolojik ilerleme ve pazar genişlemesi

2028-2030 Uzun Vadeli Görünüm

- Temel senaryo: 2,30 - 2,65 dolar (istikrarlı büyüme varsayımıyla)

- İyimser senaryo: 2,87 - 3,20 dolar (hızlanan benimseme ve olumlu piyasa koşullarıyla)

- Dönüştürücü senaryo: 3,50 dolar ve üzeri (son derece olumlu koşullarda ve yaygın entegrasyon sağlanırsa)

- 2030-12-31: ASTER 3,21 dolar (iyimser projeksiyonla potansiyel zirve)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1,97127 | 1,4711 | 1,10333 | 0 |

| 2026 | 2,25475 | 1,72119 | 0,96386 | 17 |

| 2027 | 2,62412 | 1,98797 | 1,53074 | 35 |

| 2028 | 2,55971 | 2,30605 | 2,07544 | 57 |

| 2029 | 2,8708 | 2,43288 | 1,58137 | 66 |

| 2030 | 3,20872 | 2,65184 | 1,61762 | 81 |

IV. ASTER için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

ASTER Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için: Sabırlı ve yüksek risk iştahına sahip yatırımcılar

- Uygulama önerileri:

- Piyasa düşüşlerinde ASTER biriktirin

- Fiyat hedefleri belirleyip belirli seviyelerde kısmi kâr alın

- Token'ları gözetim dışı cüzdanda güvenle saklayın

(2) Aktif Alım Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve dönüş noktalarını belirlemede kullanın

- RSI: Aşırı alım veya aşırı satım durumlarını ölçmek için kullanın

- Salınımlı işlem için ana noktalar:

- Trend teyidi için işlem hacmini takip edin

- Risk yönetimi için zarar durdur seviyeleri belirleyin

ASTER Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Ihtiyatlı yatırımcı: Portföyün %1-3'ü

- Agresif yatırımcı: Portföyün %5-10'u

- Profesyonel yatırımcı: Portföyün %15'ine kadar

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Farklı kripto paralara yatırım yapın

- Zarar durdur: Olası kayıpları sınırlamak için kullanın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Wallet

- Soğuk saklama: Uzun vadeli için donanım cüzdan

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama ve güçlü şifreler kullanın

V. ASTER İçin Olası Riskler ve Zorluklar

ASTER Piyasa Riskleri

- Volatilite: Kripto piyasalarına özgü aşırı fiyat dalgalanmaları

- Likidite: Büyük işlemlerde ciddi fiyat kaymaları yaşanabilmesi

- Rekabet: Yeni DEX platformlarının ortaya çıkmasıyla pazar payının azalması riski

ASTER Regülasyon Riskleri

- Düzenleyici belirsizlik: Küresel kripto düzenlemelerindeki değişimler, ASTER'ın faaliyetlerini etkileyebilir

- Uyumluluk zorunlulukları: DEX platformlarında KYC/AML gereksinimi doğabilir

- Hukuki statü: Bazı ülkelerde menkul kıymet olarak sınıflandırılma riski

ASTER Teknik Riskleri

- Akıllı sözleşme açıkları: Protokoldeki potansiyel güvenlik açıkları veya hatalar

- Ağ tıkanıklığı: Yoğun dönemlerde yüksek gas ücretleri veya yavaş işlemler

- Birlikte çalışabilirlik sorunları: Diğer blok zincirlerle entegrasyon zorlukları

VI. Sonuç ve Eylem Önerileri

ASTER Yatırım Değeri Değerlendirmesi

ASTER, yeni nesil DEX platformu olarak potansiyel taşıyor; ancak güçlü rekabet ve düzenleyici belirsizliklerle karşı karşıya. Uzun vadeli değer, inovasyon ve pazar payı kazanma kabiliyetine bağlıdır. Kısa vadede ise yüksek volatilite ve teknik zorluklar risk oluşturmaktadır.

ASTER Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük miktarlarla başlayın, DEX işlemlerini öğrenmeye odaklanın

✅ Deneyimli yatırımcılar: Çeşitlendirilmiş portföyün bir parçası olarak değerlendirin

✅ Kurumsal yatırımcılar: Kapsamlı inceleme yapın, regülasyonları yakından takip edin

ASTER İşlem Katılım Yöntemleri

- Spot alım satım: Gate.com üzerinden ASTER alıp tutun

- Likidite sağlama: Aster DEX platformunda likidite havuzlarına katılım

- Getiri elde etme: Uygun ise stake fırsatlarını değerlendirin

Kripto para yatırımları son derece yüksek risk içerir ve bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk profillerine göre dikkatli karar vermeli ve profesyonel finansal danışmanlardan destek almalıdır. Kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

Sıkça Sorulan Sorular

2030 için ASTR fiyat tahmini nedir?

Uzman analizlerine göre, 2030'da ASTR fiyatı 0,1387 ile 0,1608 dolar arasında öngörülüyor. 2033'e kadar ise 0,5815 dolara kadar büyüme potansiyeli bulunuyor.

2025 için Aster DM fiyat hedefi nedir?

Güncel projeksiyonlara göre, Aster DM'nin 2025 fiyat hedefi yaklaşık 0,75 dolar olup, piyasa koşulları uygun olursa 1 dolara kadar ulaşabilir.

2025 için ASTS fiyat tahmini nedir?

Analistlerin öngörüsüne göre, ASTS fiyatı 2025'te yaklaşık 1,50 dolara ulaşacaktır. Bu tahmin, mevcut piyasa trendleri ve şirket performansı dikkate alınarak yapılmıştır.

En yüksek fiyat tahminine sahip kripto para hangisi?

2025 yılı için en yüksek fiyat tahminine sahip kripto para Bitcoin (BTC) olup, ardından Ethereum (ETH) ve Solana (SOL) gelmektedir.

2025 EUL Fiyat Tahmini: DeFi Ekosisteminde Euler Finance Token’a Yönelik Piyasa Analizi ve Gelecek Trendleri

2025 EDGE Fiyat Tahmini: Büyüme Potansiyeli Analizi ve Gelecekteki Değeri Etkileyen Piyasa Faktörleri

2025 BENQI Fiyat Tahmini: DeFi Protokolü İçin Piyasa Trendleri ve Gelecek Değerleme Analizi

2025 OMG Fiyat Tahmini: Gelişen Kripto Ekosisteminde Token'ın Piyasa Trendleri ve Gelecek Potansiyelinin Değerlendirilmesi

2025 MORPHO Fiyat Tahmini: DeFi Tokenı için Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

2025 TOKEN Fiyat Tahmini: Piyasa Eğilimleri ve Yaklaşan Boğa Sezonunda Büyüme Potansiyelinin İncelenmesi

NFT Nadirlik Hesaplama Araçlarını İnceleyin

Polygon Mainnet'in MetaMask ile Entegrasyonu İçin Kılavuz

Blockchain Teknolojisinde Hashleme Mekanizmasının Nasıl Çalıştığını Anlamak

Farklılık Formasyonlarında Uzmanlaşmak: Ticaret Stratejileri Rehberi

Blokzincir teknolojisinde kriptografik fonksiyonları anlamak