2025 MKR Fiyat Tahmini: MakerDAO'nun Token Değerini Artıran Boğa Trendleri ve Temel Etkenler

Giriş: MKR'nin Piyasa Konumu ve Yatırım Potansiyeli

MakerDAO (MKR), Ethereum üzerinde merkeziyetsiz otonom organizasyon ve akıllı sözleşme alanında öncü konumuyla 2017 yılından beri önemli başarılar elde etti. 2025 yılı itibarıyla MakerDAO'nun piyasa değeri 1,76 milyar dolar seviyesinde olup, yaklaşık 977.631 dolaşımdaki token ve ortalama 1.803,98 dolar fiyatla işlem görmektedir. Sıklıkla “merkeziyetsiz finansın belkemiği” olarak anılan bu varlık; ipotek kredileri, kaldıraçlı işlemler, riskten korunma, uluslararası para transferleri, tedarik zincirleri ve kamu açık muhasebesinde giderek daha stratejik bir rol oynamaktadır.

Bu makalede, MakerDAO'nun 2025-2030 dönemindeki fiyat eğilimleri; tarihsel performans, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik koşullar ışığında uzman fiyat tahminleri ve yatırım stratejileriyle bütüncül olarak incelenecektir.

I. MKR Fiyat Geçmişi ve Güncel Piyasa Durumu

MKR Tarihsel Fiyat Gelişimi

- 2017: MakerDAO, Ethereum üzerinde faaliyete geçti; MKR fiyatı yaklaşık 22,1 dolar seviyesindeydi

- 2020: Covid-19 piyasa çöküşüyle MKR, 17 Mart'ta tüm zamanların en düşük seviyesi olan 168,36 dolara indi

- 2021: Boğa piyasası zirvesinde MKR, 4 Mayıs'ta 6.292,31 dolarla en yüksek seviyesine ulaştı

MKR'nin Güncel Piyasa Durumu

16 Ekim 2025 tarihi itibarıyla MKR, 1.803,98 dolardan işlem görmektedir. Token'ın piyasa değeri 1,76 milyar dolar olup, kripto piyasasında 66'ncı sıradadır. MKR'nin dolaşımdaki arzı 977.631 olup, bu miktar maksimum arzın (%97,22) büyük kısmına tekabül etmektedir.

Son 24 saatte MKR fiyatı sabit kaldı (%0 değişim). Ancak daha geniş vadede MKR'nin performansı karmaşık bir seyir izliyor: Son 1 saatte %0,32 artış, son 1 yılda %36,18 yükseliş; öte yandan son 7 günde %11,90 ve son 30 günde %18,73 oranında gerileme yaşandı.

Mevcut fiyat, tarihi zirvesinin oldukça altında; piyasa koşulları iyileştiğinde bu durum yükseliş potansiyeline işaret ediyor. Bununla birlikte, fiyat halen en düşük seviyesinin üstünde seyrediyor; yani son dalgalanmalara rağmen uzun vadede değerinde ciddi artış gerçekleşti.

Güncel MKR piyasa fiyatını görmek için tıklayın

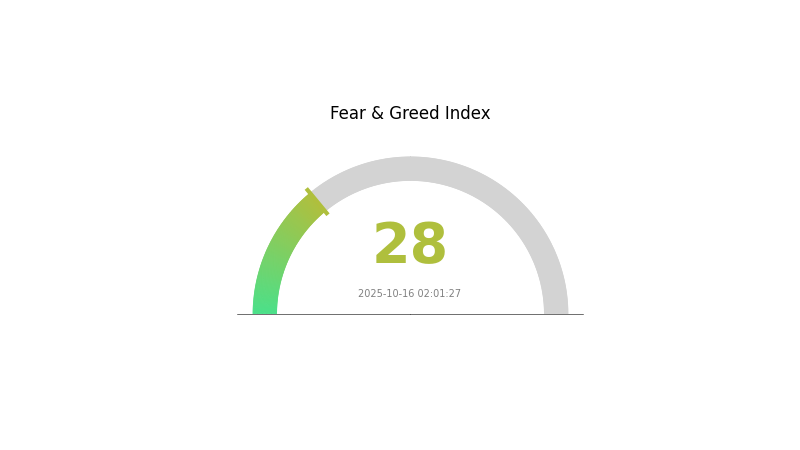

MKR Piyasa Duyarlılığı Göstergesi

16 Ekim 2025 Korku ve Açgözlülük Endeksi: 28 (Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında duyarlılık temkinli seyretmektedir; Korku ve Açgözlülük Endeksi 28 seviyesinde, piyasada belirgin bir korku atmosferi var. Bu, yatırımcıların riskten kaçındığını ve temkinli davrandığını gösteriyor. Böyle dönemlerde bazı yatırımcılar, “diğerleri açgözlü olduğunda kork, diğerleri korktuğunda açgözlü ol” prensibiyle fırsat arayabilir. Yine de yatırım öncesi detaylı araştırma yapılması ve risk toleransının gözetilmesi temel gerekliliktir.

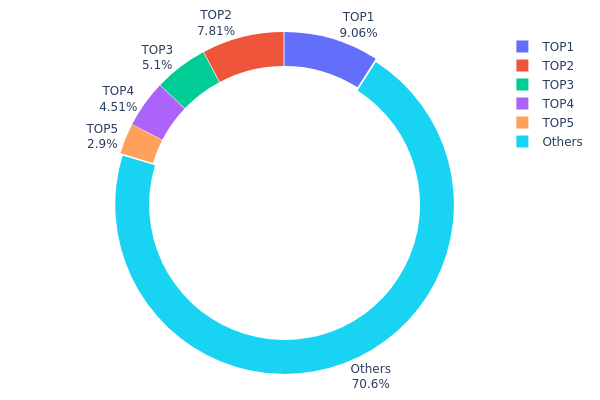

MKR Varlık Dağılımı

Adres bazlı varlık dağılımı verileri, MKR tokenlarının farklı cüzdan adresleri arasında ne ölçüde yoğunlaştığına dair önemli bilgiler sunar. Bu analiz, MKR varlıklarında makul düzeyde bir yoğunlaşma olduğunu gösteriyor. En büyük beş adres toplam arzın %29,35'ini elinde bulundururken, en büyük sahip %9,06 paya sahip. Bu yapı, tek bir aktörün hakim olmadığı dengeli bir sahiplik profili anlamına gelir.

Önde gelen sahiplerde belli bir yoğunlaşma olsa da MKR tokenlarının %70,65'i diğer adreslere dağılmış durumda; bu ise yüksek merkeziyetsizlik düzeyine işaret eder. Böyle bir dağılım, piyasada tek bir aktörün fiyatı manipüle etme riskini azaltarak istikrarı artırabilir. Yine de en büyük sahiplerin koordineli hareketi, piyasa üzerinde etkili olabilir.

Güncel MKR sahiplik yapısı, zincir üstü istikrar ve orta düzeyde merkeziyetsizlik sunuyor. Konsantre ve dağınık sahiplik arasındaki bu denge, aşırı volatiliteyi sınırlarken, piyasa dinamikleri ve proje gelişmeleriyle organik fiyat hareketlerini mümkün kılabilir.

Güncel MKR Varlık Dağılımı için tıklayın

| Üst Sıra | Adres | Varlık Miktarı | Pay (%) |

|---|---|---|---|

| 1 | 0x7d61...6841b4 | 28.16K | 9,06% |

| 2 | 0x04b6...a98598 | 24.25K | 7,80% |

| 3 | 0x098f...73fb1d | 15.83K | 5,09% |

| 4 | 0xf654...dfda5d | 14.00K | 4,50% |

| 5 | 0x0a05...82a464 | 9.02K | 2,90% |

| - | Diğerleri | 219.44K | 70,65% |

II. MKR'nin Gelecekteki Fiyatını Etkileyecek Temel Faktörler

Kurumsal ve Büyük Yatırımcı Etkileri

- Kurumsal Varlıklar: Büyük kurumsal yatırımcıların MKR tutması fiyat istikrarı ve büyüme potansiyeli sağlayabilir.

- Kurumsal Benimseme: Bazı büyük şirketler MakerDAO teknolojisini araştırıyor; bu da MKR talebini yukarı çekebilir.

Makroekonomik Ortam

- Para Politikası Etkisi: Merkez bankalarının faiz ve enflasyon politikaları MKR fiyatını doğrudan etkileyebilir.

- Enflasyon Koruma Özelliği: MKR, ekonomik belirsizlik dönemlerinde enflasyona karşı koruma aracı olarak görülebilir.

Teknolojik Gelişim ve Ekosistem Genişlemesi

- Endgame Planı: MakerDAO'nun uzun vadeli Endgame planı, protokolün verimliliği ve merkeziyetsizliğini artırarak MKR'nin değerini olumlu etkileyebilir.

- Gerçek Dünya Varlıkları (RWA): MakerDAO ekosistemine gerçek varlıkların entegrasyonu, kullanım alanlarını ve MKR talebini artırabilir.

- Ekosistem Uygulamaları: MakerDAO üzerinde veya entegre çalışan DeFi uygulamalarının büyümesi, MKR'ye olan talebi ve değerini yükseltebilir.

III. 2025-2030 MKR Fiyat Tahminleri

2025 Görünümü

- Temkinli tahmin: 1.695 - 1.800 dolar

- Tarafsız tahmin: 1.800 - 2.200 dolar

- İyimser tahmin: 2.200 - 2.687 dolar (güçlü DeFi benimsemesi gerektirir)

2027-2028 Görünümü

- Piyasa dönemi beklentisi: Olası boğa piyasası konsolidasyonu

- Fiyat aralığı tahmini:

- 2027: 1.308 - 3.018 dolar

- 2028: 1.964 - 3.486 dolar

- Temel katalizörler: DeFi ekosisteminde büyüme, MakerDAO yönetişim iyileştirmeleri

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 3.126 - 3.533 dolar (kripto piyasasının istikrarlı büyümesi varsayımıyla)

- İyimser senaryo: 3.939 - 4.593 dolar (yaygın DeFi entegrasyonu ile)

- Dönüştürücü senaryo: 4.600+ dolar (MakerDAO'nun baskın bir DeFi protokolü olmasıyla)

- 31 Aralık 2030: MKR 3.533 dolar (2025'e göre %95 artış)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Fiyat Değişimi (%) |

|---|---|---|---|---|

| 2025 | 2.687,93 | 1.803,98 | 1.695,74 | 0 |

| 2026 | 2.784,98 | 2.245,96 | 1.931,52 | 24 |

| 2027 | 3.018,56 | 2.515,47 | 1.308,04 | 39 |

| 2028 | 3.486,44 | 2.767,02 | 1.964,58 | 53 |

| 2029 | 3.939,68 | 3.126,73 | 1.719,7 | 73 |

| 2030 | 4.593,16 | 3.533,2 | 1.801,93 | 95 |

IV. Profesyonel MKR Yatırım Stratejileri ve Risk Yönetimi

MKR Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Hedef kitle: Uzun vadeli değer yatırımcıları, DeFi ekosistemi takipçileri

- Uygulama önerileri:

- Piyasa gerilemelerinde MKR biriktirin

- MakerDAO yönetimine katılarak ek ödüller kazanın

- Büyük tutarları donanım cüzdanında güvenli şekilde saklayın

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Fiyat eğilimlerini ve olası geri dönüş noktalarını tespit edin

- RSI (Göreli Güç Endeksi): Aşırı alım/aşırı satım sinyallerini değerlendirin

- Kısa vadeli al-sat için dikkat edilmesi gerekenler:

- MakerDAO ekosistemi gelişmeleri ve token yakımlarını takip edin

- DeFi piyasa duyarlılığı ve ETH fiyat hareketlerini izleyin

MKR Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3'ü

- Aggresif yatırımcılar: Kripto portföyünün %5-10'u

- Profesyonel yatırımcılar: Kripto portföyünün %15'ine kadar

(2) Riskten Korunma Stratejileri

- Çeşitlendirme: Farklı DeFi protokollerine yatırım yaparak riskleri dağıtın

- Opsiyon stratejileri: MKR opsiyonları ile aşağı yönlü riskleri hedge edin

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan tercihi: Gate Web3 Cüzdan

- Soğuk depolama: Yüklü tutarları donanım cüzdanında saklayın

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama ve güçlü şifre kullanımı

V. MKR için Potansiyel Riskler ve Zorluklar

MKR Piyasa Riskleri

- Volatilite: Kripto piyasalarında yüksek fiyat dalgalanmaları

- Likidite: Büyük işlemlerde fiyat kayması riski

- Rekabet: Yeni DeFi protokolleri MakerDAO'nun pazar payını azaltabilir

MKR Düzenleyici Riskler

- Düzenleyici belirsizlik: DeFi ile ilgili mevzuatta olası değişiklikler

- Uyum gereklilikleri: Küresel finansal regülasyonlara adapte olmak

- Yargı riski: Ülkelere göre değişen yasal statü

MKR Teknik Riskler

- Akıllı sözleşme açıkları: MakerDAO sisteminde potansiyel güvenlik sorunları

- Ölçeklenebilirlik sorunları: Ethereum ağında tıkanıklık nedeniyle operasyonel aksaklıklar

- Oracle hataları: Fiyat akışında doğruluk problemleri

VI. Sonuç ve Eylem Önerileri

MKR Yatırım Değeri Analizi

MKR, DeFi ekosisteminin ana aktörlerinden biri olarak uzun vadede yüksek değer potansiyeli sunuyor; ancak yatırımcılar kısa vadeli volatilite ve regülasyon belirsizliklerini dikkate almalı.

MKR Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük tutarlarla başlayarak MakerDAO ekosistemini keşfedin ✅ Deneyimli yatırımcılar: Tutma ve aktif al-sat kombinasyonuyla dengeli yaklaşım benimseyin ✅ Kurumsal yatırımcılar: Yönetişim süreçlerinde aktif rol alın ve stratejik portföy büyüklüklerini değerlendirin

MKR Alım-Satım Katılım Yöntemleri

- Spot işlem: Gate.com üzerinden MKR token alıp saklayın

- Vadeli işlemler: MKR vadeli sözleşmeleriyle kaldıraçlı pozisyon alın

- Staking: MakerDAO yönetimine katılarak ek kazanç elde edin

Kripto para yatırımlarında risk çok yüksektir. Bu makale yatırım tavsiyesi değildir. Yatırımcılar kendi risk profillerine göre karar vermeli, profesyonel finansal danışmanlardan destek almalıdır. Kaybetmeyi göze alamayacağınız miktarlar ile asla yatırım yapmayın.

SSS

Maker MKR iyi bir yatırım mı?

Evet, MKR DeFi ekosistemindeki geniş kullanım alanı ve güçlü talebiyle uzun vadede cazip bir yatırım potansiyeli sunmaktadır.

MKR alınmalı mı satılmalı mı?

Mevcut piyasa analizine göre MKR satılmalı. Son veriler alım için en uygun zaman olmadığını gösteriyor.

MKR coininin durumu nedir?

MKR, 2021 yılında SKY olarak yeniden markalandı; sabit oranla 1 MKR = 24.000 SKY dönüşümü gerçekleşti. Orijinal MKR artık işlem görmemektedir.

MKR'nin tüm zamanların en yüksek fiyatı nedir?

MKR'nin rekor fiyatı 6.391,78 dolar olup, 3 Mayıs 2021 tarihinde kaydedilmiştir.

Uniswap Fiyat Analizi 2025: DeFi Pazar Pozisyonu ve Uzun Vadeli Yatırım Beklentileri

2025 LDO Fiyat Tahmini: Lido DAO Token’ın Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

2025 WEETH Fiyat Tahmini: Gelişen DeFi Ekosisteminde Piyasa Trendlerini ve Büyüme Potansiyelini Analiz Etmek

2025 LDO Fiyat Tahmini: Lido DAO Tokenleri İçin Piyasa Analizi ve Gelecek Büyüme Potansiyeli

2025 ETH Fiyat Tahmini: Yükselen Trendler ve Ethereum'un Gelecekteki Değerini Etkileyen Temel Unsurlar

2025 COMP Fiyat Tahmini: Compound Governance Token’a Yönelik Piyasa Analizi ve Gelecek Perspektifi

Fantasy Sports Platformu, kriptoya olan odaklanmayı azaltarak daha geniş bir kullanıcı kitlesine ulaşmayı amaçlıyor

Solana ağında USDT’yi güvenli ve verimli bir şekilde nasıl kullanacağınızı öğrenin

Solana'nın fiyatı 2024 yılında 10.000 dolara ulaşabilir mi?

Android ve iOS kullanıcıları için en iyi 5 ücretsiz madencilik uygulaması

ELXAI Token Güncel Değeri: Anlık Fiyat ve Grafik