2025 ETH Fiyat Tahmini: Yükselen Trendler ve Ethereum'un Gelecekteki Değerini Etkileyen Temel Unsurlar

Giriş: ETH'nin Piyasadaki Konumu ve Yatırım Potansiyeli

Ethereum (ETH), akıllı sözleşme platformlarının lideri olarak 2015 yılındaki çıkışından bu yana önemli başarılara imza attı. 2025 yılı itibarıyla Ethereum’un piyasa değeri 497,75 milyar dolar seviyesine ulaştı; dolaşımdaki arzı yaklaşık 120.698.861 ETH ve fiyatı 4.123,9 dolar civarında seyrediyor. “Dünya Bilgisayarı” olarak nitelendirilen ETH, merkeziyetsiz finans (DeFi), benzersiz tokenlar (NFT) ve merkeziyetsiz uygulamalar (dApp) ekosistemlerinde giderek daha belirleyici bir rol üstleniyor.

Bu makalede, Ethereum’un 2025-2030 yılları arasındaki fiyat hareketleri; tarihsel eğilimler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler temelinde kapsamlı şekilde incelenecek; yatırımcılara profesyonel fiyat tahminleri ve uygulamaya dönük yatırım stratejileri sunulacaktır.

I. ETH Fiyat Geçmişi ve Güncel Piyasa Durumu

ETH Fiyatının Tarihsel Gelişimi

- 2015: Ethereum piyasaya sürüldü, fiyatı 0,432979 dolardan başladı

- 2017: ICO dönemiyle ETH fiyatı 1.000 doların üzerine çıktı

- 2018-2020: Kripto kışı döneminde fiyat yaklaşık 100 dolara geriledi

- 2021: Boğa piyasasında ETH, 25 Ağustos 2025’te 4.946,05 dolar ile rekor kırdı

ETH Güncel Piyasa Durumu

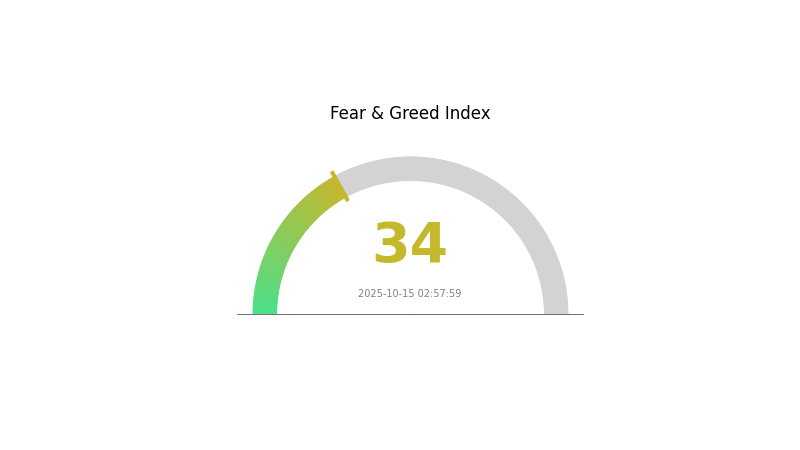

15 Ekim 2025 itibarıyla ETH, 4.123,9 dolardan işlem görüyor ve son 24 saatte %1,18 geriledi. Mevcut fiyatı, zirvesinin %16,6 altında. ETH’nin piyasa değeri 497,75 milyar dolar ile toplam kripto piyasasının %12,20’sini oluşturuyor. 24 saatlik işlem hacmi ise 1,85 milyar dolar. ETH, kısa vadede karmaşık bir performans sergiliyor: son bir saatte %0,49 yükseldi, son haftada %7,95, son 30 günde ise %10,63 değer kaybetti. Yıllık bazda ise %56,91 artış söz konusu. Piyasa duyarlılığı “Korku” seviyesinde; VIX endeksi 34 olarak ölçüldü.

Güncel ETH piyasa fiyatını görüntülemek için tıklayın

ETH Piyasa Duyarlılık Göstergesi

2025-10-15 Korku ve Açgözlülük Endeksi: 34 (Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında duyarlılık temkinli seyrediyor; endeksin 34 seviyesinde olması yatırımcıların çekingen davrandığını gösteriyor ve bu durum karşıt stratejiler arayan yatırımcılar için fırsat oluşturabilir. Ancak, piyasa duyarlılığı hızla değişebilir. Yatırımcıların güncel kalması, riskleri akıllıca yönetmesi ve portföylerini çeşitlendirmesi büyük önem taşır. Gate.com, bu koşullar için kapsamlı araç ve kaynaklar sunar.

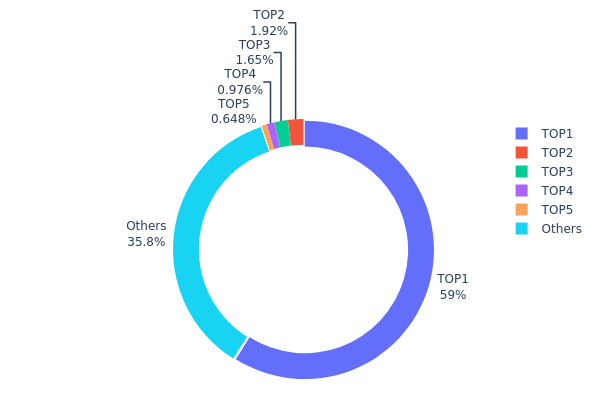

ETH Varlık Dağılımı

Adres dağılımı verileri, Ethereum (ETH) sahipliği yoğunlaşmasına dair önemli ipuçları sunar. Son verilere göre, en büyük adres toplam arzın %58,96’sını yani 71.163,62K ETH’yi elinde bulunduruyor. Bu seviyedeki yoğunlaşma, piyasa manipülasyonu ve volatilite açısından kaygı yaratıyor.

İlk beş adres, toplam arzın %64,16’sını kontrol ederken, kalan %35,84’ü diğer adreslere dağılmış durumda. Bu dengesiz yapı, Ethereum ekosisteminin büyük yatırımcılardan kaynaklı hassasiyetler taşıdığını ve fiyat oynaklığının artabileceğini gösteriyor; bu durum merkeziyetsizlik ilkesini de zayıflatabilir.

Öte yandan, ikinci en büyük adresin payı sadece %1,92 ve sonrasında sahiplik oranı hızla düşüyor. Dağılım hâlâ merkeziyetçi olsa da, en büyük sahibin ardından belli bir çeşitlilik oluşması, aşırı yoğunlaşmaya bağlı risklerin bir miktar hafiflemesini sağlıyor.

Güncel ETH Varlık Dağılımı için tıklayın

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...7705fa | 71.163,62K | 58,96% |

| 2 | 0xc02a...756cc2 | 2.321,37K | 1,92% |

| 3 | 0xbe0e...4d33e8 | 1.996,01K | 1,65% |

| 4 | 0x40b3...18e489 | 1.177,79K | 0,98% |

| 5 | 0x0e58...d9bfcd | 781,62K | 0,65% |

| - | Others | 43.258,54K | 35,84% |

II. ETH’nin Gelecekteki Fiyatını Belirleyecek Temel Faktörler

Arz Mekanizması

- Proof-of-Stake (PoS): Ethereum’un PoS’a geçişi, ağı daha verimli ve çevre dostu hale getirdi.

- Tarihsel Seyir: PoS’a geçiş genellikle ETH fiyatına olumlu yansıdı.

- Güncel Etki: PoS’un yeni arzı azaltması ve ağ verimliliğini artırması, ETH’nin değerini desteklemeye devam edecek.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Varlıklar: Büyük kurumlar ETH’yi dijital varlık portföylerine giderek daha fazla dahil ediyor.

- Kurumsal Benimseme: Şirketler, akıllı sözleşme ve merkeziyetsiz uygulamalarda Ethereum’u tercih ediyor.

- Regülasyon Politikaları: Bazı ülkelerdeki düzenleyici netlik, ETH için daha güvenli bir ortam sağlıyor.

Makroekonomik Ortam

- Para Politikası Etkisi: Merkez bankalarının özellikle faiz oranlarına yönelik kararları, ETH fiyatında belirleyici olmaya devam ediyor.

- Enflasyona Karşı Koruma: ETH, enflasyona karşı potansiyel bir koruma aracı olarak öne çıkıyor.

- Jeopolitik Unsurlar: Küresel ekonomik belirsizlikler, ETH gibi kripto paralara ilgiyi artırabilir.

Teknik Gelişim ve Ekosistem Büyümesi

- Ölçeklenebilirlik Geliştirmeleri: Ethereum’un ölçeklenebilirliğine yönelik güncellemeler, işlem kapasitesini artırıp maliyetleri azaltıyor.

- Layer 2 Çözümleri: Layer 2 ağlarının büyümesi, Ethereum ekosisteminin imkanlarını genişletiyor.

- Ekosistem Uygulamaları: DeFi, NFT ve diğer merkeziyetsiz uygulamalar, ETH talebini ve ağ kullanımını artırıyor.

III. 2025-2030 için ETH Fiyat Tahmini

2025 Görünümü

- Ihtiyatlı tahmin: 3.830 - 4.000 dolar

- Tarafsız tahmin: 4.000 - 4.200 dolar

- İyimser tahmin: 4.200 - 4.778 dolar (ETH ağının büyümesi ve benimsenmesinin devamı halinde)

2027-2028 Görünümü

- Piyasa fazı beklentisi: Kurumsal benimsemenin arttığı olası bir boğa piyasası

- Fiyat aralığı tahmini:

- 2027: 2.888 - 6.866 dolar

- 2028: 4.003 - 7.820 dolar

- Ana katalizörler: ETH 2.0 yükseltmeleri, DeFi ekosisteminin genişlemesi, kurumsal yatırımların artması

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 6.989 - 8.422 dolar (istikrarlı benimseme ve teknolojik iyileşmeler varsayımıyla)

- İyimser senaryo: 8.422 - 10.000 dolar (geniş çaplı benimseme ve olumlu düzenleyici ortamda)

- Dönüştürücü senaryo: 10.000 - 12.380 dolar (ETH’nin akıllı sözleşme platformlarında baskın hale gelmesi ve yaygın kabul görmesiyle)

- 2030-12-31: ETH 12.379,98 dolar (aşırı olumlu koşullar devam ederse potansiyel zirve)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 4.777,92 | 4.118,9 | 3.830,58 | 0 |

| 2026 | 6.450,2 | 4.448,41 | 2.624,56 | 7 |

| 2027 | 6.866,12 | 5.449,3 | 2.888,13 | 32 |

| 2028 | 7.820,3 | 6.157,71 | 4.002,51 | 49 |

| 2029 | 9.854,5 | 6.989,01 | 5.940,65 | 69 |

| 2030 | 12.379,98 | 8.421,75 | 7.242,71 | 104 |

IV. Profesyonel ETH Yatırım Stratejileri ve Risk Yönetimi

ETH Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Uygun profiller: Sabırlı ve yüksek risk toleranslı yatırımcılar

- İşlem önerileri:

- Piyasa düşüşlerinde ETH biriktirin

- Maliyet ortalaması için düzenli alım planı uygulayın

- Uzun vadeli saklama için güvenli soğuk cüzdanlar kullanın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve olası dönüş noktalarını belirler

- RSI (Göreceli Güç Endeksi): Aşırı alım veya aşırı satım koşullarını belirlemede yardımcı olur

- Swing işlemler için önemli noktalar:

- Kilit destek ve direnç seviyelerini takip edin

- Risk yönetimi için zarar durdur emirleri kullanın

ETH Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Ihtiyatlı yatırımcılar: %1-5

- Agresif yatırımcılar: %5-15

- Profesyonel yatırımcılar: %15-30

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Yatırımlarınızı farklı kripto ve geleneksel varlıklar arasında dağıtın

- Opsiyonlar: Düşüş riskine karşı korunmak için satım opsiyonlarını değerlendirin

(3) Güvenli Saklama Yöntemleri

- Donanım cüzdanı önerisi: Gate Web3 Wallet

- Yazılım cüzdan: Güvenlik için çoklu imzalı cüzdanlar

- Güvenlik önlemleri: Gizli anahtarları asla paylaşmayın, iki aşamalı doğrulama kullanın

V. ETH için Potansiyel Riskler ve Zorluklar

ETH Piyasa Riskleri

- Yüksek volatilite: Hızlı fiyat dalgalanmaları büyük kayıplara yol açabilir

- Piyasa duyarlılığı: Spekülatif balonlara ve panik satışlarına karşı hassasiyet

- Rekabet: Yeni blockchain platformları Ethereum’un liderliğine meydan okuyabilir

ETH Regülasyon Riskleri

- Bilinmez regülasyon ortamı: Farklı ülkelerde daha sıkı yasal düzenlemeler olasılığı

- Menkul kıymet sınıflandırması: ETH’nin bazı ülkelerde menkul kıymet olarak kabul edilme riski

- Vergi etkileri: Değişen vergi mevzuatı, ETH işlemleri ve varlıklarını etkileyebilir

ETH Teknik Riskleri

- Ölçeklenebilirlik sorunları: Yüksek talep dönemlerinde ağda tıkanıklıklar

- Akıllı sözleşme açıkları: Merkeziyetsiz uygulamalarda istismar riskleri

- Yükseltme riskleri: Büyük protokol güncellemeleri ve hard fork’larda yaşanabilecek sorunlar

VI. Sonuç ve Eylem Önerileri

ETH’nin Yatırım Değeri Değerlendirmesi

Ethereum, akıllı sözleşme teknolojisinin öncüsü olarak uzun vadede güçlü bir potansiyel taşımaktadır. Ancak yatırımcılar, kısa vadeli dalgalanmalara ve sürekli teknolojik yeniliklere karşı hazırlıklı olmalıdır.

ETH Yatırım Önerileri

✅ Yeni başlayanlar: Küçük ve düzenli yatırımlarla piyasayı tanıyın

✅ Deneyimli yatırımcılar: ETH’yi temel varlık olarak içeren dengeli bir portföy oluşturun

✅ Kurumsal yatırımcılar: Stratejik pozisyonlar ve Ethereum teknolojisini kullanma fırsatlarını değerlendirin

ETH İşlem Katılım Yöntemleri

- Spot alım-satım: ETH’nin doğrudan alımı ve tutulması

- Vadeli işlemler: Deneyimli yatırımcılar için kaldıraçlı işlem fırsatları

- Staking: Ethereum’un proof-of-stake mekanizmasına katılarak pasif gelir elde etme

Kripto para yatırımları çok yüksek risk içerir. Bu makale yatırım tavsiyesi niteliğinde değildir. Yatırımcılar, kendi risk profillerine göre hareket etmeli ve profesyonel finansal danışmanlardan destek almalıdır. Kaybetmeyi göze alabileceğinizden fazlasını asla yatırmayın.

SSS

2025’te 1 Ethereum’un değeri ne olur?

Mevcut tahminler, 2025’te 1 Ethereum’un 2.061 ile 6.000 dolar arasında olabileceğini ve ortalama tahminin 4.054 dolar civarında olduğunu gösteriyor. Bu öngörü, akıllı sözleşme kullanım oranı ve piyasa trendleri gibi faktörlere dayanmaktadır.

ETH 50.000 dolara ulaşabilir mi?

Evet, ETH 2030 yılına kadar 50.000 dolara ulaşabilir. Artan kullanım, ağ güncellemeleri ve piyasa büyümesi, değerinin önemli ölçüde yükselmesini sağlayabilir.

2030’da 1 ETH ne kadar olur?

Şu anki projeksiyonlara göre, 2030’da 1 ETH’nin yaklaşık 11.800 dolar olması bekleniyor. Bu, Ethereum’un akıllı sözleşme protokollerindeki liderliğini sürdürmesi halinde gerçekleşebilir.

Ethereum 10.000 doları görebilir mi?

Evet, Ethereum artan benimseme ve sürekli ağ güncellemeleriyle ilerleyen dönemde 10.000 dolara ulaşabilir.

2025 COMP Fiyat Tahmini: Compound Governance Token’a Yönelik Piyasa Analizi ve Gelecek Perspektifi

ETH Fiyat Analizi: Ethereum Bir Sonraki Boğa Koşusuna Liderlik Edebilir Mi?

Ethereum (ETH) Yatırım İçin Uygun mu?: Gelişen DeFi Ekosisteminde Uzun Vadeli Potansiyelin Değerlendirilmesi

Ethereum (ETH) iyi bir yatırım mı?: Lider akıllı sözleşme platformunun potansiyeli ve risklerinin analizi

Kripto para akışı ve elde tutma eğilimleri piyasa dinamiklerini nasıl etkiler?

Türev piyasa sinyalleri, 2025 yılında MORPHO'nun fiyat hareketini nasıl tahmin ediyor?

Ethereum'da Gas Ücretleri: Ayrıntılı Bir Rehber

Bored Ape NFT Koleksiyonu Üzerine İnceleme: Detaylı Bir Kılavuz

Simüle Edilmiş Kripto Para Ticareti: Yeni Başlayanlar için Kapsamlı Rehber

Blockchain Oracle’larının İşleyişi ve Önemi

Görüntüleri zahmetsiz ve ücretsiz olarak NFT'ye dönüştürün