2025 MERL Fiyat Tahmini: Dijital Varlık için Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

Giriş: MERL’in Piyasadaki Yeri ve Yatırım Değeri

Merlin Chain (MERL), Bitcoin’in yerel bir Katman 2 çözümü olarak, ana ağının devreye alınmasından sonraki ilk 30 gün içinde 3,5 milyar doların üzerinde TVL (toplam kilitli değer) elde etti. 2025 yılı itibarıyla MERL’in piyasa değeri 351.876.935 dolar seviyesine ulaştı; dolaşımdaki arzı yaklaşık 978.958.758 token ve fiyatı 0,35944 dolar civarında seyrediyor. “Bitcoin’in Eğlenceli Katman 2’si” olarak anılan bu varlık, Bitcoin’in yerel varlıklarını, protokollerini ve ürünlerini güçlendirmede her geçen gün daha önemli bir rol üstleniyor.

Bu makalede 2025-2030 döneminde MERL’in fiyat eğilimleri, geçmişteki desenler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik ortam birlikte ele alınarak, yatırımcılara profesyonel fiyat tahminleri ve pratik yatırım stratejileri sunulacaktır.

I. MERL Fiyat Geçmişi ve Mevcut Piyasa Durumu

MERL Fiyatının Tarihsel Seyri

- 2024: Ana ağ açılışı, 19 Nisan’da tüm zamanların en yüksek seviyesi olan 1,888 dolara yükseliş

- 2025: Piyasa düzeltmesi, 3 Şubat’ta tüm zamanların en düşük seviyesi olan 0,0623 dolara gerileme

- 2025: Toparlanma dönemi, fiyatın bugünkü 0,35944 dolar seviyesine yükselişi

MERL Güncel Piyasa Durumu

17 Ekim 2025 itibarıyla MERL, 0,35944 dolar seviyesinden işlem görüyor ve piyasa değeri 351.876.935 dolar. Token, son 24 saatte %21,38 yükselerek güçlü bir performans gösterdi. 7 günlük eğilim de pozitif ve %5,58’lik bir artış var. Özellikle son 30 günde MERL, %91,44’lük kayda değer bir yükseliş yaşadı ve bu, piyasadaki ilginin ve benimsemenin arttığını gösteriyor.

Mevcut fiyat, 3 Şubat 2025’teki 0,0623 dolarlık tüm zamanların en düşüğünün oldukça üzerinde; ancak 19 Nisan 2024’teki 1,888 dolarlık tüm zamanların en yüksek seviyesinin altında. Bu durum, piyasa elverişli kalırsa büyüme potansiyelinin devam ettiğine işaret ediyor.

MERL’in son 24 saatteki işlem hacmi 12.380.897 dolar olarak kaydedildi ve piyasada aktif bir katılımın göstergesi oldu. Dolaşımdaki MERL arzı 978.958.758 adet olup, bu da toplam 2.100.000.000 MERL’in %46,62’sine karşılık geliyor.

Güncel MERL piyasa fiyatını görüntülemek için tıklayın

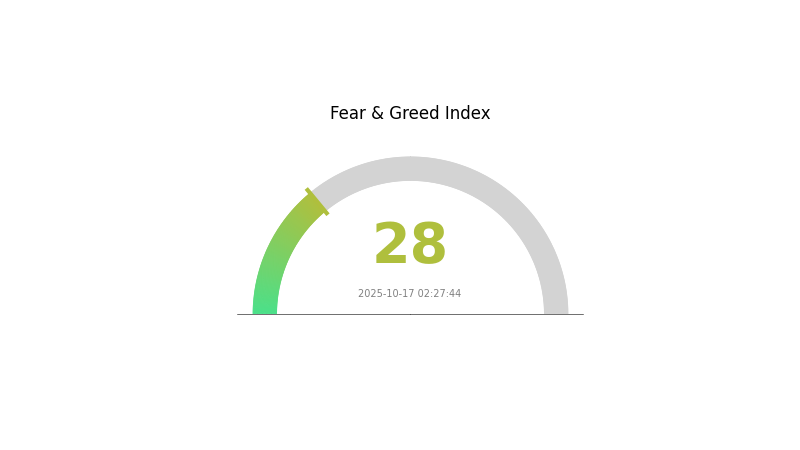

MERL Piyasa Duyarlılığı Göstergesi

17 Ekim 2025 Korku ve Açgözlülük Endeksi: 28 (Korku)

Güncel Korku & Açgözlülük Endeksini görüntülemek için tıklayın

Kripto piyasasında şu an belirgin bir korku ortamı hakim; Korku ve Açgözlülük Endeksi 28 seviyesinde. Bu durum, yatırımcılar arasında temkinli bir havaya işaret ediyor ve uzun vadeli bakış açısına sahip olanlar için alım fırsatı sunabilir. Ancak piyasa duyarlılığının hızla değişebileceği unutulmamalı. Yatırımcılar dikkatli hareket etmeli, kapsamlı araştırma yapmalı ve bu belirsiz ortamda risklerini azaltmak için portföylerini çeşitlendirmelidir. Her zaman olduğu gibi, piyasayı ve kripto para değerlerini etkileyebilecek küresel gelişmeleri yakından takip etmek önemlidir.

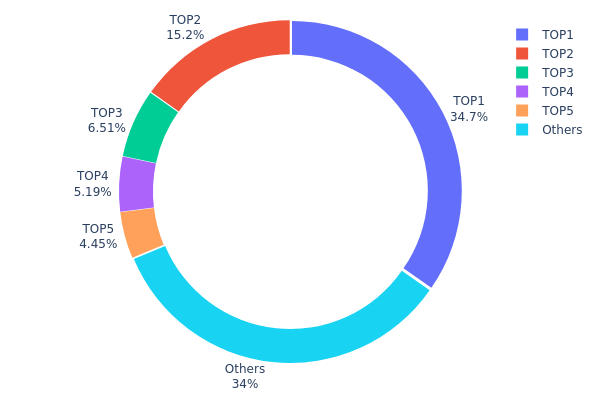

MERL Varlık Dağılımı

MERL’in adres bazlı varlık dağılımı verileri, oldukça yoğunlaşmış bir sahiplik yapısına işaret ediyor. En büyük adres toplam arzın %34,68’ini elinde tutarken, ilk beş adresin toplam kontrolü %66,02 seviyesinde. Bu yoğunlaşma, tokenin merkezsizliği ve olası piyasa manipülasyonları açısından risk oluşturuyor.

Böylesine yoğun bir dağılım, büyük sahiplerin satışa geçmesi durumunda fiyatta yüksek dalgalanmalara ve ani düşüşlere yol açabilir. Birkaç adresin ağırlığı, MERL’in yönetişim ve karar süreçlerinde az sayıda büyük token sahibinin etkili olabileceğini gösteriyor ve bu durum projenin merkezsiz yapısını zedeleyebilir.

“Diğerleri” kategorisindeki %33,98’lik oran daha geniş bir sahiplik tabanına işaret etse de, genel dağılım halen az sayıdaki baskın sahip lehine dengesiz. Bu da tokenin uzun vadeli istikrarı ve sürdürülebilir piyasa yapısı açısından soru işareti yaratıyor.

Güncel MERL varlık dağılımını görüntülemek için tıklayın

| Top | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xa2ff...ad8443 | 693.103,78K | 34,68% |

| 2 | 0x6353...326813 | 303.643,79K | 15,19% |

| 3 | 0x6414...f10d59 | 130.148,10K | 6,51% |

| 4 | 0xdc94...a44536 | 103.782,44K | 5,19% |

| 5 | 0xbd37...4f45ab | 88.851,83K | 4,45% |

| - | Diğerleri | 678.937,92K | 33,98% |

II. MERL’in Gelecekteki Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Maksimum Arz: MERL’in toplam arzı 2.100.000.000 token ile sınırlı.

- Mevcut Etki: Dolaşımdaki 978.958.758 MERL token, mevcut piyasa dinamikleri ve fiyat üzerinde belirleyici rol oynuyor.

Kurumsal ve Whale Dinamikleri

- Kurumsal Varlıklar: Kurumsal yatırımcılar MERL’e giderek daha fazla ilgi gösteriyor; 2025’te ciddi fon girişleri bekleniyor.

Makroekonomik Ortam

- Para Politikası Etkisi: ABD Merkez Bankası’nın faiz indirimi yapması halinde MERL’in fiyatı ciddi biçimde etkilenebilir; bazı analistler Eylül’de indirim olursa fiyatın 3 dolara çıkabileceğini öngörüyor.

- Jeopolitik Faktörler: Yaklaşan seçim dönemi ve bunun piyasa duyarlılığı üzerindeki etkileri, MERL’in fiyat eğilimini belirleyebilir.

Teknolojik Gelişim ve Ekosistem Oluşumu

- Layer 2 Çözümü: MERL, Bitcoin için bir Katman 2 çözümü olarak konumlanıyor ve ağın ölçeklenebilirliğini, verimliliğini, işlevselliğini artırmayı hedefliyor.

- ZK-Rollup Entegrasyonu: ZK-Rollup teknolojisinin entegrasyonu, işlem işleme ve ağ performansını iyileştirmeyi amaçlıyor.

- Merkeziyetsiz Oracle Ağı: Merlin Chain ekosisteminin kapasitesini artırmak üzere merkeziyetsiz oracle ağı kullanılıyor.

- Ekosistem Kullanımları: MERL; staking, doğrulayıcı delegasyonu, işlem ücretleri ve Merlin ekosisteminde yerel likidite/teminat olarak kullanılıyor.

III. 2025-2030 Dönemi MERL Fiyat Tahmini

2025 Görünümü

- İhtiyatlı tahmin: 0,3465 - 0,35722 dolar

- Tarafsız tahmin: 0,35722 - 0,38937 dolar

- İyimser tahmin: 0,38937 - 0,42152 dolar (olumlu piyasa ortamı gerektirir)

2027 Orta Vadeli Görünüm

- Piyasa aşaması beklentisi: Olası büyüme dönemi

- Fiyat aralığı tahmini:

- 2026: 0,3115 - 0,47114 dolar

- 2027: 0,3442 - 0,58514 dolar

- Temel etkenler: Artan benimseme ve teknolojik gelişmeler

2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,51706 - 0,71814 dolar (istikrarlı piyasa büyümesi halinde)

- İyimser senaryo: 0,71814 - 0,85243 dolar (güçlü piyasa performansı varsayımıyla)

- Dönüştürücü senaryo: 0,85243 - 1,03412 dolar (olağanüstü piyasa koşulları)

- 31 Aralık 2030: MERL 1,03412 dolar (muhtemel zirve fiyat)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0,42152 | 0,35722 | 0,3465 | 0 |

| 2026 | 0,47114 | 0,38937 | 0,3115 | 8 |

| 2027 | 0,58514 | 0,43025 | 0,3442 | 19 |

| 2028 | 0,66001 | 0,5077 | 0,36047 | 41 |

| 2029 | 0,85243 | 0,58385 | 0,54882 | 62 |

| 2030 | 1,03412 | 0,71814 | 0,51706 | 99 |

IV. MERL için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

MERL Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Kimlere uygun: Yüksek risk iştahına sahip ve Bitcoin’in uzun vadeli potansiyeline inanan yatırımcılar

- İşlem önerileri:

- Fiyat düşüşlerinde MERL biriktirin

- Giriş maliyetini ortalamak için düzenli alımlar yapın

- Tokenleri güvenli bir donanım cüzdanında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve olası dönüş noktalarını tespit edin

- RSI: Aşırı alım-satım koşullarını izleyin

- Dalgalı alım-satımda dikkat edilmesi gerekenler:

- Bitcoin fiyat hareketlerini yakından takip edin; MERL üzerinde etkili olabilir

- Merlin Chain’deki TVL ve kullanıcı aktivitesini izleyerek piyasa duyarlılığındaki değişimleri öngörün

MERL Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Konservatif yatırımcılar: %1-3

- Agresif yatırımcılar: %5-10

- Profesyonel yatırımcılar: %15’e kadar

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Birden fazla Katman 2 projeye yatırım yaparak riski azaltın

- Zarar durdur emri: Olası kayıpları sınırlandırmak için kullanın

(3) Güvenli Saklama Yöntemleri

- Donanım cüzdanı önerisi: Gate web3 cüzdanı

- Yazılım cüzdanı seçeneği: Resmi Merlin Chain cüzdanı (mevcutsa)

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama, güçlü şifre kullanımı ve yazılım güncellemeleri

V. MERL için Olası Riskler ve Zorluklar

MERL Piyasa Riskleri

- Yüksek oynaklık: Kripto piyasasında fiyat dalgalanmaları çok sert olabilir

- Bitcoin ile korelasyon: MERL, Bitcoin fiyat hareketlerine duyarlı olabilir

- Rekabet: Diğer Katman 2 çözümleri Merlin Chain’in pazar payını etkileyebilir

MERL Düzenleyici Riskler

- Belirsiz regülasyon ortamı: Katman 2 çözümlerine ilişkin yeni düzenlemeler gelebilir

- Sınır ötesi kısıtlamalar: Farklı ülkelerdeki düzenleyici yaklaşımlar benimsemeyi zorlaştırabilir

- Vergi sonuçları: Değişen vergi mevzuatı MERL sahiplerini etkileyebilir

MERL Teknik Riskler

- Akıllı sözleşme güvenlik açıkları: Merlin Chain’de suistimal riski

- Ölçeklenebilirlik sorunları: Artan ağ yüküyle başa çıkmada beklenmeyen sorunlar

- Oracle güvenilirliği: Merkeziyetsiz oracle yapısında ortaya çıkabilecek riskler

VI. Sonuç ve Eylem Önerileri

MERL Yatırım Değeri Değerlendirmesi

MERL, Bitcoin Katman 2 çözümü olarak güçlü bir başlangıç ivmesiyle öne çıkıyor. Ancak, yatırımcıların yüksek oynaklık ve gelişen blokzincir teknolojilerine ilişkin risklerin farkında olması kritik önem taşıyor.

MERL Yatırım Önerileri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayın ve Katman 2 teknolojileri konusunda bilgi edinin ✅ Deneyimli yatırımcılar: Risk iştahınıza ve Bitcoin piyasasına bağlı olarak orta ölçekli bir tahsis düşünebilirsiniz ✅ Kurumsal yatırımcılar: MERL’i, Bitcoin ekosistemini güçlendirme potansiyeline odaklanarak çeşitlendirilmiş bir kripto portföyünde değerlendirin

MERL Alım-Satım Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden MERL token alın

- DeFi katılımı: Merlin Chain ekosistem projelerine dahil olun (varsa)

- Staking: Proje tarafından sunuluyorsa pasif gelir için staking fırsatlarını değerlendirin

Kripto para yatırımları çok yüksek risk içerir; bu makale yatırım tavsiyesi değildir. Yatırım kararlarınızı kendi risk toleransınıza göre dikkatlice verin ve mutlaka profesyonel finansal danışmanlara başvurun. Kaybetmeyi göze alabileceğinizden fazlasını asla yatırmayın.

Sıkça Sorulan Sorular

Merlin Crypto’nun geleceği nedir?

Merlin Crypto, Ağustos 2025’te Sui ile entegre olmayı hedefliyor ve zincirler arası DeFi fırsatlarını genişletiyor. Başarı, uygulama performansı ve piyasa rekabetine bağlı olacak. Süregelen token kilit açılımları fiyat üzerinde etkili olabilir.

MERL kripto nedir?

MERL, Merlin Chain’in yerel kripto parasıdır; Bitcoin Katman 2’ye ölçeklenebilirlik ve DeFi işlevleri kazandırır. İşlem hızlarını artırmayı ve ücretleri düşürmeyi amaçlar.

En yüksek fiyat tahmini hangi kriptoya ait?

Bitcoin’in, kitlesel benimsenme ve mevcut eğilimler ışığında 2026’da trilyonlarca dolarlık piyasa değerine ulaşarak en yüksek fiyata sahip olması bekleniyor.

MERL ne tür bir tokendir?

MERL, Merlin Chain ekosisteminde yönetişim tokenidir ve sahiplerine ağda karar alma ve geliştirme süreçlerine katılım hakkı sağlar.

2025 B2Price Fiyat Tahmini: Dijital Para Birimi İçin Piyasa Trendleri ve Yatırım Fırsatları

2025 B2 Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

BSquared Network (B2) iyi bir yatırım mı?: Bu gelişmekte olan blokzincir platformunun sunduğu potansiyel ve karşılaşabileceği risklerin ayrıntılı değerlendirilmesi

2025’te B2 Projesinin temel değeri ve risk analizi nedir?

2025 MERL Fiyat Tahmini: Bu Yükselen Kripto Varlık Yeni Zirvelere Ulaşabilir mi?

Stacks (STX) yatırım için uygun mu?: Bu Bitcoin layer-2 çözümünün potansiyeli üzerine analiz

Blockchain’de Çifte Harcama Nedir? Kapsamlı Bir İnceleme

Dijital varlık alım satımında üçlü tepe formasyonlarının anlaşılması

Layer 2 Ölçeklenme Çözümü: Arbitrum Optimistic Rollup’a Kapsamlı Bir Bakış

Bitcoin Ordinals’ı Anlamak: Detaylı Bir Rehber

Kripto Alım Satımında Algoritmik Stratejilerin En İyi Şekilde Optimizasyonu