2025 MASA Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

Giriş: MASA'nın Piyasadaki Konumu ve Yatırım Değeri

Merkeziyetsiz yapay zeka veri ve LLM alanında öncü konumda bulunan Masa Network (MASA), kuruluşundan bu yana 1,4 milyonun üzerinde benzersiz kullanıcıya ve 48.000 node operatörüne ulaşmıştır. 2025 yılı itibarıyla MASA'nın piyasa değeri 3.752.695 dolar seviyesindedir; dolaşımdaki token miktarı yaklaşık 387.355.000, fiyatı ise 0,009688 dolar civarındadır. “Yapay Zeka Veri Gücü” olarak öne çıkan bu varlık, kullanıcıya ait veri ve hesaplama gücüyle yapay zeka uygulamalarının gelişiminde kritik rol oynamaktadır.

Bu makalede, 2025’ten 2030’a kadar MASA’nın fiyat trendleri; tarihsel veriler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler bütününde analiz edilerek yatırımcılar için profesyonel fiyat tahminleri ve stratejik yatırım önerileri sunulacaktır.

I. MASA Fiyat Geçmişi ve Güncel Piyasa Durumu

MASA Tarihsel Fiyat Gelişim Süreci

- 2024: CoinList üzerinden halka arz, fiyat tüm zamanların en yüksek seviyesi olan 1,7 dolara ulaştı

- 2025: Piyasada düşüş, fiyat ciddi oranda gerileyerek tüm zamanların en düşük seviyesi olan 0,006094 dolara indi

MASA Güncel Piyasa Durumu

13 Ekim 2025 itibarıyla MASA 0,009688 dolardan işlem görmektedir; 24 saatlik işlem hacmi 564.348,11 dolardır. Token, son 24 saatte %8,6 değer kazanırken, haftalık -%22,14, aylık -%50,88 ve yıllık -%87,22 kayıplar yaşamıştır.

MASA'nın piyasa değeri 3.752.695,24 dolar olup genel kripto piyasasında 1944. sıradadır. Dolaşımdaki arz 387.355.000 MASA token ile toplam arzın %24,38’ini (1.574.448.226,014406 token) oluşturur.

Token, tüm zamanların en yüksek seviyesi olan 1,7 doların (11 Nisan 2024) %99,43 altında; en düşük seviyesi olan 0,006094 doların (10 Ekim 2025) ise %59 üzerinde işlem görmektedir.

Güncel MASA piyasa fiyatını görmek için tıklayın

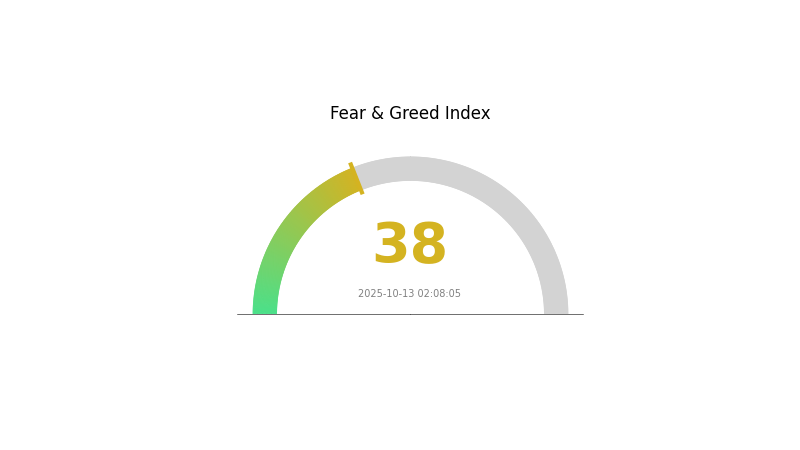

MASA Piyasa Duyarlılık Göstergesi

13.10.2025 Korku ve Açgözlülük Endeksi: 38 (Korku)

Güncel Korku & Açgözlülük Endeksini görmek için tıklayın

Kripto piyasasında temkinli bir hava hâkim. Korku ve Açgözlülük Endeksi 38 seviyesinde ve korkuyu işaret ediyor. Yatırımcılar tereddütlü davranıyor ve potansiyel alım fırsatlarını kolluyor. Ancak, piyasa duyarlılığı hızla değişebilir. Korku, uzun vadeli yatırımcılar için giriş fırsatı sunabilir; yine de, kripto piyasasının oynak yapısında kapsamlı araştırma yapmak ve kendi risk toleransınızı göz önünde bulundurmak önemlidir.

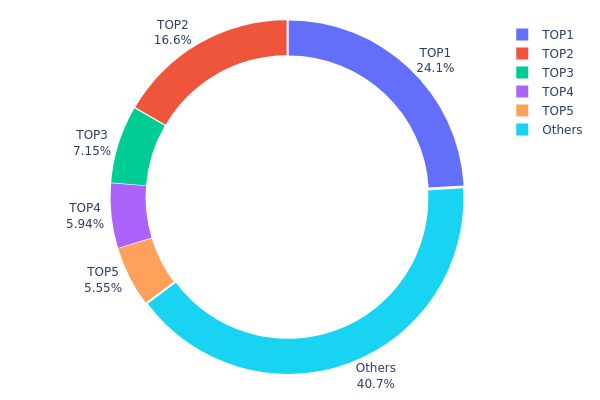

MASA Varlık Dağılımı

Adres dağılımı verileri, MASA tokenlarının farklı cüzdanlar arasındaki yoğunluğunu gösterir. Analizler, en büyük 5 adresin toplam arzın yaklaşık %59,26’sını elinde tuttuğunu ortaya koyuyor. En büyük sahibi %24,06, ikinci büyük %16,59 paya sahip.

Tokenların çok az adreste yoğunlaşması, piyasa manipülasyonu ve fiyat oynaklığı riskini artırıyor. Arzın önemli bir kısmı az sayıda varlıkta olduğunda, büyük çaplı işlemler fiyatı ciddi şekilde etkileyebilir. Ayrıca bu yoğunlaşma, merkeziyetsizlik iddiasını da zayıflatabilir; az sayıdaki büyük sahip, yönetim veya token ekonomisinde orantısız etki sahibi olabilir.

Diğer yandan, tokenların %40,74’ü “Diğerleri” arasında dağılmış durumda; bu da daha geniş bir dağılım ve büyük sahiplerin tetiklediği aşırı dalgalanmalara karşı kısmi bir denge sağlayabilir.

Güncel MASA Varlık Dağılımını görmek için tıklayın

| En Büyük | Adres | Varlık Adedi | Varlık (%) |

|---|---|---|---|

| 1 | 0x1961...752486 | 376.834,21K | 24,06% |

| 2 | 0x9d86...83b4ff | 259.870,00K | 16,59% |

| 3 | 0x3383...d786fb | 111.918,68K | 7,14% |

| 4 | 0x1892...c12884 | 93.000,00K | 5,93% |

| 5 | 0x9495...787853 | 86.856,55K | 5,54% |

| - | Diğerleri | 637.673,40K | 40,74% |

II. MASA’nın Gelecekteki Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Piyasa Arz ve Talebi: MASA piyasasındaki arz-talep dengesi fiyatı belirleyecektir.

- Mevcut Etki: Arzdaki değişikliklerin fiyatı etkileyebileceği öngörülüyor; spesifik detay bulunmuyor.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Benimseme: Tanınmış şirketlerin MASA’yı benimsemesi fiyatı etkileyebilir; ancak şirket isimleri belirtilmemiştir.

Makroekonomik Çevre

- Para Politikası Etkisi: Başlıca merkez bankalarının faiz ve para politikası kararları MASA’nın fiyatını etkileyebilir.

- Enflasyona Karşı Koruma: MASA’nın enflasyonist ortamlardaki performansı, yatırım cazibesine etki edebilir.

- Jeopolitik Faktörler: Küresel jeopolitik gelişmeler, genel kripto piyasasıyla birlikte MASA fiyatını da etkileyebilir.

Teknik Gelişim ve Ekosistem Oluşumu

- Ekosistem Uygulamaları: MASA ile ilişkili büyük DApp veya ekosistem projelerinin gelişimi fiyatı etkileyebilir; detay verilmemiştir.

III. 2025-2030 Dönemi İçin MASA Fiyat Tahmini

2025 Görünümü

- Ihtiyatlı tahmin: 0,0059 - 0,00951 dolar

- Tarafsız tahmin: 0,00951 - 0,01132 dolar

- İyimser tahmin: 0,01132 - 0,01312 dolar (olumlu piyasa duyarlılığı ile)

2027-2028 Görünümü

- Piyasa evresi: Aşamalı büyüme ve konsolidasyon

- Fiyat aralığı tahmini:

- 2027: 0,00804 - 0,01294 dolar

- 2028: 0,00861 - 0,01808 dolar

- Temel katalizörler: Artan benimseme, teknolojik gelişmeler, piyasa toparlanması

2029-2030 Uzun Vadeli Görünüm

- Taban senaryo: 0,01519 - 0,01648 dolar (istikrarlı piyasa büyümesiyle)

- İyimser senaryo: 0,01777 - 0,02323 dolar (güçlü boğa piyasasıyla)

- Dönüştürücü senaryo: 0,02323 doların üzerinde (çok elverişli piyasa koşullarıyla)

- 31.12.2030: MASA 0,02323 dolar (muhtemel zirve fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,01312 | 0,00951 | 0,0059 | -1 |

| 2026 | 0,012 | 0,01132 | 0,00611 | 16 |

| 2027 | 0,01294 | 0,01166 | 0,00804 | 20 |

| 2028 | 0,01808 | 0,0123 | 0,00861 | 26 |

| 2029 | 0,01777 | 0,01519 | 0,00911 | 56 |

| 2030 | 0,02323 | 0,01648 | 0,01137 | 70 |

IV. MASA İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

MASA Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun profiller: Sabırlı ve yüksek risk toleranslı yatırımcılar

- Operasyonel öneriler:

- Piyasa geri çekilmelerinde MASA biriktirin

- En az 2-3 yıl tutma hedefi koyun

- Tokenları güvenli, kendinize ait bir cüzdanda saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve olası dönüş noktalarını tespit edin

- RSI: Aşırı alım/satım seviyelerini izleyin

- Dalgalı al-sat için ana noktalar:

- Teknik göstergelere göre net giriş ve çıkış seviyeleri belirleyin

- Zarar-durdur emirleriyle riskinizi yönetin

MASA Risk Yönetim Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcı: Kripto portföyünün %1-3’ü

- Agresif yatırımcı: Kripto portföyünün %5-10’u

- Profesyonel yatırımcı: Kripto portföyünün en fazla %15’i

(2) Riskten Korunma Çözümleri

- Diversifikasyon: Yatırımları farklı kripto varlıklara dağıtın

- Zarar-durdur: Olası kayıpları sınırlayın

(3) Güvenli Saklama Çözümleri

- Donanım cüzdan önerisi: Gate web3 cüzdanı

- Yazılım cüzdanı: Resmi MASA cüzdanı (mevcutsa)

- Güvenlik: İki faktörlü kimlik doğrulama ve güçlü şifreler kullanın

V. MASA İçin Potansiyel Riskler ve Zorluklar

MASA Piyasa Riskleri

- Yüksek volatilite: Yeni kripto projelerinde sık yaşanan sert fiyat dalgalanmaları

- Kısıtlı likidite: Büyük işlemlerin fiyatı etkilemeden yapılmasının zor olması

- Rekabet: Yeni çıkan yapay zeka ve veri projeleri MASA’nın pazar payını etkileyebilir

MASA Yasal Riskleri

- Belirsiz yasal ortam: Yapay zeka ve veri odaklı kripto projelerine artan denetim ihtimali

- Veri gizliliği: Gelişen düzenlemeler MASA’nın veri paylaşım modelini zorlayabilir

- Uluslararası uyumluluk: Farklı ülkelerdeki mevzuat, küresel benimsemeyi sınırlayabilir

MASA Teknik Riskleri

- Akıllı kontrat açıkları: Kodda ortaya çıkabilecek istismar veya hata riski

- Ölçeklenebilirlik: Ağın yüksek işlem talebini kaldırmada kısıtlar oluşabilir

- Uyumluluk: Diğer blockchain ağları veya yapay zeka sistemleriyle entegrasyonda sorunlar yaşanabilir

VI. Sonuç ve Eylem Önerileri

MASA Yatırım Değeri Analizi

MASA, merkeziyetsiz yapay zeka veri ve LLM ağı segmentinde benzersiz bir değer önerisi sunmaktadır. Büyüyen pazarda uzun vadeli potansiyeli olsa da, kısa vadede yüksek oynaklık ve yasal belirsizlikler gibi riskler taşır.

MASA Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Uzun vadeli hedefle küçük ve deneme amaçlı pozisyonlar alınabilir ✅ Deneyimli yatırımcılar: Düzenli küçük alımlarla maliyet ortalaması yapılabilir ✅ Kurumsal yatırımcılar: Kapsamlı inceleme yapmalı ve MASA’yı çeşitlendirilmiş bir kripto portföyünde değerlendirmelidir

MASA İşlem Katılım Yöntemleri

- Spot al-sat: Gate.com üzerinden MASA token alımı

- Staking: MASA ağında staking programlarına katılım

- Node çalıştırma: Ağı destekleyip ödül kazanmak için node işletme

Kripto para yatırımları çok yüksek risk taşır; bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleransları doğrultusunda karar vermeli ve profesyonel finansal danışmanlardan destek almalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

Sıkça Sorulan Sorular

MASA coin iyi bir yatırım mı?

Evet, Masa coin umut vaat ediyor. Tahminler, 2026 ortasına kadar %170’e varan potansiyel getiriyle kripto piyasasında cazip bir yatırım olarak öne çıkarıyor.

MANA 1 dolara ulaşır mı?

Mevcut öngörülere göre, MANA’nın 1 dolara ulaşması beklenmiyor. Uzmanlar, 2033’e kadar maksimum 0,37 dolara ulaşacağını tahmin ediyor.

Mask crypto yükselecek mi?

Mask crypto’nun geleceği kesin değildir. Son tahminler olası bir düşüşe işaret etse de, uzun vadeli eğilimler belirsizliğini koruyor. Güncel piyasa verilerini araştırarak karar vermek önemlidir.

Hamster Kombat coin 1 dolara ulaşır mı?

Kısa vadede 1 dolara ulaşması beklenmiyor; analistler 2025’te 0,67 dolar öngörüyor. Büyüme, sürdürülebilir ilgi ve piyasa koşullarına bağlıdır.

Flock.io (FLOCK) yatırım için uygun mu? Bu yeni kripto projesinin potansiyeli ve riskleri nasıl değerlendirilmeli?

Sahara AI (SAHARA) iyi bir yatırım mı?: Bu yükselen yapay zeka kripto parasının potansiyelini ve risklerini inceliyoruz

Trusta.AI (TA) Yatırım İçin Uygun mu?: AI Güvenlik Token’inin Piyasa Potansiyeli ve Uzun Vadeli Büyüme Perspektiflerinin Analizi

2025 VADER Fiyat Tahmini: Kripto Para Dünyasında Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

2025 AI16Z Fiyat Tahmini: Dalgalı Piyasalarda Yapay Zeka Destekli Kripto Paraların Geleceğinde Yol Almak

2025 GAI Fiyat Tahmini: Gelişen dijital ekonomide GAI'nin piyasa trendleri ve gelecekteki değerlemesini analiz etmek

NFT Nadirliği Anlamak: Puanlama Sistemleri Rehberi

Blokzincirde Proof-of-Work Konsensüs Mekanizmasını Anlamak

Satoshi'den Bitcoin'e Dönüşümün Anlaşılması: Kolay Anlatım

Web3'te Hashing Kavramı: Kapsamlı Bir Blockchain Rehberi

Ethereum Gas Ücretlerini Anlamak: Tam Kapsamlı Rehber