2025 MANA Fiyat Tahmini: Decentraland’in Yerel Token’ı Metaverse Patlamasında Zirveye Tırmanmaya Hazırlanıyor

Giriş: MANA'nın Piyasadaki Yeri ve Yatırım Değeri

Decentraland (MANA), blokzincir tabanlı lider sanal dünya platformlarından biri olarak 2017'den bu yana önemli bir yol katetti. 2025 yılı itibarıyla Decentraland'ın piyasa değeri 450.234.687 $ düzeyine ulaşırken, dolaşımdaki yaklaşık 1.919.158.940 MANA tokenı bulunmakta ve fiyatı 0,2346 $ civarında seyretmektedir. Sıklıkla "blokzincir tabanlı sanal dünyaların öncüsü" olarak nitelendirilen bu varlık, merkeziyetsiz sanal gerçeklik ve dijital gayrimenkul alanında giderek daha belirleyici bir rol üstlenmektedir.

Bu makale, Decentraland’ın 2025-2030 arası fiyat eğilimlerini; tarihsel veriler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik göstergeler ışığında profesyonel fiyat öngörüleri ve yatırım stratejileriyle kapsamlı biçimde inceleyecektir.

I. MANA Fiyat Geçmişi ve Güncel Piyasa Durumu

MANA'nın Tarihsel Fiyat Seyri

- 2017: İlk çıkış, fiyat 0,00923681 $ seviyesinden başladı

- 2021: Boğa piyasasında zirve, tüm zamanların en yükseği olan 5,85 $’a ulaşıldı

- 2022-2023: Piyasa geriledi, fiyat ciddi şekilde düştü

MANA'nın Güncel Piyasa Durumu

17 Ekim 2025 itibarıyla MANA, 0,2346 $ seviyesinde işlem görmekte olup son 24 saatte %10,26’lık bir düşüş yaşamıştır. Güncel fiyat, tüm zamanların en yüksek seviyesinin %95,99 altında yer alıyor. MANA'nın piyasa değeri 450.234.687 $ ile kripto paralar arasında 168. sıradadır. 24 saatlik işlem hacmi 536.739 $ olup, orta düzeyde piyasa aktivitesine işaret etmektedir. Dolaşımdaki arz 1.919.158.940 MANA ile toplam arzın %87,51'ine karşılık gelmektedir. MANA için piyasa hissiyatı, 1 saatten 1 yıla kadarki tüm zaman dilimlerinde negatif seyirle ayı piyasasına işaret etmektedir.

Güncel MANA piyasa fiyatını görüntülemek için tıklayın

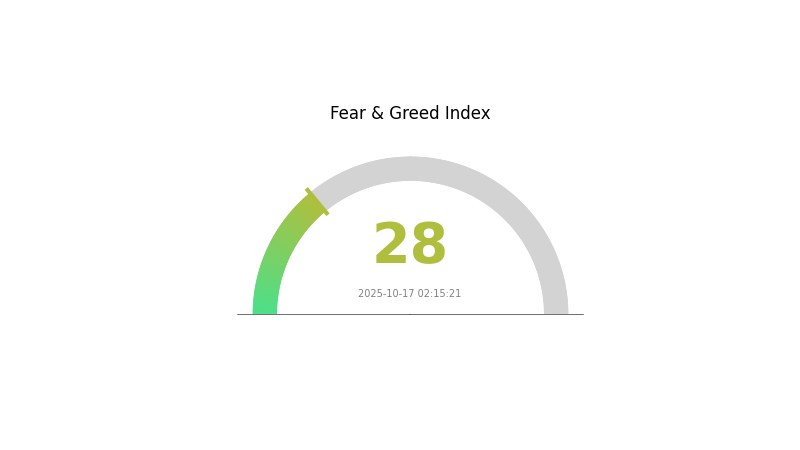

MANA Piyasa Duyarlılığı Göstergesi

17 Ekim 2025 Korku ve Açgözlülük Endeksi: 28 (Korku)

Güncel Korku ve Açgözlülük Endeksi için tıklayın

Kripto piyasasında şu anda korku hakim; Korku ve Açgözlülük Endeksi 28 seviyesinde. Bu, yatırımcılar arasında temkinli bir havaya işaret ediyor ve yüksek risk toleransına sahip olanlar için fırsatlar sunabilir. Ancak piyasaya temkinli yaklaşmak ve yatırım kararı öncesinde detaylı araştırma yapmak büyük önem taşır. Bu belirsiz ortamda, MANA'nın fiyat hareketlerini ve genel piyasa eğilimlerini yakından izleyerek karar almak gerekir.

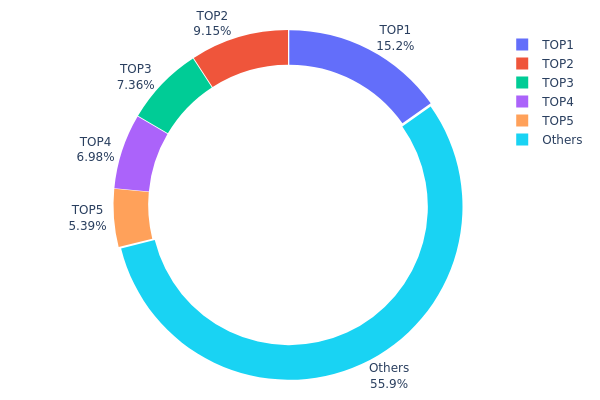

MANA Varlık Dağılımı

MANA'nın adres bazında varlık dağılımı, orta düzeyde yoğunlaşmış bir sahiplik yapısı sergiliyor. En büyük beş adres toplam arzın %44,06’sını elinde tutarken, en büyük tek adresin kontrolü %15,19 seviyesinde. Bu, az sayıda büyük paydaşın MANA ekosisteminde önemli etkiye sahip olduğunu gösteriyor.

Fazla merkeziyetçi olmasa da, bu dağılım modeli piyasa dinamiklerini etkileyebilir. Büyük sahiplerin büyük alım veya satışları fiyat dalgalanmasını artırabilir. Bununla birlikte, tokenlerin %55,94’ünün diğer adreslerde olması, merkeziyetsiz bir dağılımı destekler ve tekil katılımcının piyasayı manipüle etme riskini azaltır.

Bu yapı, ana paydaşlar ile geniş MANA topluluğu arasında bir dengeye işaret ediyor. Böylece hem anahtar oyuncuların etkisi hem de blokzincir prensiplerine uygun merkeziyetsizlik korunuyor. Dağılımdaki değişimler, MANA ekosisteminin uzun vadeli istikrarı ve merkeziyetsizliği açısından izlenmelidir.

Güncel MANA Varlık Dağılımı için tıklayın

| Top | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x67c2...5fed1b | 333.186,63K | 15,19% |

| 2 | 0xeea5...d17ee2 | 200.760,22K | 9,15% |

| 3 | 0xec5a...29d236 | 161.483,05K | 7,36% |

| 4 | 0xf977...41acec | 153.180,07K | 6,98% |

| 5 | 0x7a3a...05c1ac | 118.202,15K | 5,38% |

| - | Diğerleri | 1.226.367,21K | 55,94% |

II. MANA'nın Gelecekteki Fiyatını Etkileyen Temel Faktörler

Piyasa Duyarlılığı ve Makroekonomik Faktörler

- Küresel Ekonomik Koşullar: Küresel ekonomik dalgalanmalar ve piyasa hissiyatı, MANA'nın fiyat ve performansında etkili olur.

- Regülasyon Ortamı: Düzenleyici çerçevedeki değişiklikler, yatırımcı davranışını ve piyasa yapısını etkiler.

Kurumsal ve Büyük Paydaş Dinamikleri

- Kurumsal Yatırım: Kurumsal yatırımcıların yoğun alımları, fiyat hareketleri üzerinde belirleyici olabilir.

Teknik Gelişim ve Ekosistem Oluşumu

- Kullanıcı Katılımı: Decentraland dünyasında kullanıcıların aktifliği, MANA'nın değerine doğrudan etki eder.

- NFT Piyasa Eğilimleri: NFT piyasasındaki genel ilgi, sanal arsa alım-satımı sayesinde MANA fiyatını doğrudan etkiler.

- Ekosistem Uygulamaları: Decentraland'daki DApp'ler ve projelerdeki büyüme, MANA'ya olan talebi ve fiyatı artırabilir.

III. 2025-2030 MANA Fiyat Tahmini

2025 Görünümü

- Ihtiyatlı tahmin: 0,22512 $ - 0,23450 $

- Tarafsız tahmin: 0,23450 $ - 0,24000 $

- İyimser tahmin: 0,24000 $ - 0,24388 $ (olumlu piyasa koşulları ve artan Decentraland kullanımıyla)

2027-2028 Görünümü

- Piyasa aşaması: Kademeli büyüme ve olası dalgalanmalar

- Fiyat aralığı:

- 2027: 0,20795 $ - 0,27974 $

- 2028: 0,19510 $ - 0,32693 $

- Temel tetikleyiciler: Metaverse büyümesi, sanal gerçeklikte teknolojik ilerlemeler ve dijital varlıklara kurumsal ilgi

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,29529 $ - 0,35730 $ (Decentraland ekosisteminde istikrarlı büyüme varsayımıyla)

- İyimser senaryo: 0,35730 $ - 0,41931 $ (yaygın metaverse kullanımı ve MANA’nın işlevselliğinin artması halinde)

- Dönüştürücü senaryo: 0,41931 $ - 0,50000 $ (büyük kurumsal iş birlikleri ve ileri VR teknolojileri gibi olağanüstü olumlu koşullarda)

- 31 Aralık 2030: MANA 0,3573 $ (beklenen ortalama fiyat; 2025’e göre kayda değer büyüme potansiyeli)

| Yıl | Tahmini En Yüksek | Tahmini Ortalama | Tahmini En Düşük | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,24388 | 0,2345 | 0,22512 | 0 |

| 2026 | 0,25593 | 0,23919 | 0,2081 | 2 |

| 2027 | 0,27974 | 0,24756 | 0,20795 | 6 |

| 2028 | 0,32693 | 0,26365 | 0,1951 | 13 |

| 2029 | 0,41931 | 0,29529 | 0,22737 | 26 |

| 2030 | 0,41804 | 0,3573 | 0,20366 | 53 |

IV. MANA Yatırım Stratejileri ve Risk Yönetimi

MANA Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcılar: Uzun vadeli yatırımcılar ve metaverse tutkunları

- Öneriler:

- Piyasa düşüşlerinde MANA biriktirin

- En az 2-3 yıl tutarak büyüme potansiyelini değerlendirin

- Tokenları güvenli, gözetimsiz cüzdanlarda saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: 50 ve 200 günlük ortalamalar ile trend tespiti

- RSI: Aşırı alım/satım koşullarını izleyin

- Swing trade için kritik noktalar:

- Teknik göstergelere dayalı net giriş-çıkış noktaları belirleyin

- Fiyat tetikleyicileri için Decentraland platformundaki gelişmeleri takip edin

MANA Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Ihtiyatlı yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün %15’ine kadar

(2) Riskten Korunma Önlemleri

- Diversifikasyon: Yatırımları birden çok metaverse projesine yaymak

- Zarar durdur emirleri: Olası kayıpları sınırlamak için uygulayın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk depolama: Uzun vadeli tutumlar için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama ve güçlü şifreler kullanımı

V. MANA'nın Potansiyel Riskleri ve Zorlukları

MANA Piyasa Riskleri

- Yüksek oynaklık: Kripto piyasalarında sıkça görülen sert fiyat dalgalanmaları

- Rekabet: Yeni metaverse projeleri MANA'nın pazar payını azaltabilir

- Kullanıcı benimsemesi: Decentraland kullanıcı sayısındaki yavaş artış token değerini olumsuz etkileyebilir

MANA Regülasyon Riskleri

- Bilinmeyen düzenlemeler: Küresel çapta daha sıkı kripto regülasyonları olasılığı

- Vergi yükümlülükleri: Değişen vergi düzenlemeleri MANA işlemleri ve varlıkları üzerinde etkili olabilir

- Hukuki riskler: Sanal dünyalarda fikri mülkiyetle ilgili olası davalar

MANA Teknik Riskleri

- Akıllı sözleşme açıkları: İstismar ya da hata riski

- Ölçeklenebilirlik sorunları: Ethereum ağındaki tıkanıklık Decentraland performansını olumsuz etkileyebilir

- Teknolojik geri kalma: VR/AR’daki hızlı gelişmeler Decentraland'ın geride kalmasına sebep olabilir

VI. Sonuç ve Eylem Önerileri

MANA'nın Yatırım Değeri Değerlendirmesi

MANA, büyüyen metaverse alanında uzun vadede potansiyel sunarken, kısa vadede yüksek dalgalanma ve benimseme zorlukları yaşamaktadır. Değeri, Decentraland'ın başarısı ve genel kripto piyasası trendlerine yakından bağlıdır.

MANA Yatırım Önerileri

✅ Yeni başlayanlar: Piyasayı tanımak için küçük ve düzenli yatırımlarla başlayın ✅ Deneyimli yatırımcılar: Hem elde tutma hem de alım-satım stratejileriyle dengeli bir yaklaşım benimseyin ✅ Kurumsal yatırımcılar: Decentraland ekosisteminde stratejik iş birlikleri değerlendirin

MANA İşlem Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden MANA alıp satın

- Staking: Pasif gelir için MANA staking programlarına katılın

- Sanal arsa yatırımı: Decentraland parsellerini MANA ile satın alıp geliştirin

Kripto para yatırımları son derece yüksek risk taşır ve bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarına göre dikkatli karar vermeli ve profesyonel finansal danışmanlardan destek almalıdır. Kaybetmeyi göze alabileceğinizden fazlasını asla yatırmayın.

SSS

MANA coin 1 $’a ulaşır mı?

Mevcut öngörülere göre, MANA'nın 2025 yılına kadar 1 $’ı aşması ve 1,2 $’a kadar çıkması bekleniyor. Uzun vadeli tahminler ise 2030’da 6,68 $ - 7,81 $ aralığına ulaşabileceğini gösteriyor.

Decentraland’ın geleceği var mı?

Evet, Decentraland öncü metaverse platformlarından biri olarak güçlü bir gelecek vadediyor. Kullanıcı odaklı dijital dünya ve MANA ekosistemi, 2025 ve sonrasında sanal gerçeklik ve blokzincir tabanlı oyun pazarında büyümeye uygun bir pozisyonda.

Decentraland 10 $’a ulaşabilir mi?

Mevcut projeksiyonlar, Decentraland (MANA) için yakın vadede 10 $’a ulaşmanın mümkün olmadığını gösteriyor. Çoğu analist, bu seviyenin en erken 2030’larda aşılabileceğini öngörüyor.

MANA’ya yatırım yapmanın riskleri nelerdir?

Riskler arasında yüksek oynaklık, likidite eksikliği, kısa geçmiş, talepte belirsizlik ve olası çatallanma bulunmakta; bunların tamamı Mana'nın değerini doğrudan etkileyebilir.

2025 NFT Fiyat Tahmini: Olgunlaşan Ekosistemde Dijital Varlık Değerlemelerinin Evrimi

2025 NFT Fiyat Tahmini: Pandemi Sonrası Ekonomide Dijital Koleksiyonların Yükselişi

2025 VOXEL Fiyat Tahmini: Gelecekteki Piyasa Analizi ve Metaverse Ekonomisinde Yatırım Fırsatları

2025 BLOK Fiyat Tahmini: Metaverse Token’ı İçin Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

2025 FLOW Fiyat Tahmini: Flow Blockchain’in geleceğine yönelik potansiyel büyüme ve piyasa trendlerinin analizi

2025 BLOK Fiyat Tahmini: Metaverse Token’ı için Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

SEI Airdrop Ödülleri’ne Katılım ve Talep Etme Kılavuzu

Kripto para birimlerinde algoritmik alım satım için etkili stratejiler

Stock-to-Flow Model ile Bitcoin'in Değerlemesini Anlamak

İşlem hızının blockchain verimliliğini nasıl etkilediğini anlamak

ENS Domainleri ile Web3 Kimlik Yönetimi