2025 BLOK Fiyat Tahmini: Metaverse Token’ı için Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

Giriş: BLOK’un Piyasadaki Konumu ve Yatırım Değeri

Bloktopia (BLOK), kripto para VR deneyimi sektöründe öncü bir proje olarak, 2021’deki çıkışından bu yana önemli mesafe kat etti. 2025 itibarıyla BLOK’un piyasa değeri 3.910.213 $ düzeyinde, dolaşımdaki arzı yaklaşık 25.017.359.648 adet ve fiyatı 0,0001563 $ civarında seyrediyor. “Kripto için VR Merkezi” olarak anılan bu varlık, kripto topluluğu için etkileyici sanal gerçeklik deneyimleri sunmada giderek daha belirleyici bir rol üstleniyor.

Bu yazı, BLOK’un 2025-2030 yılları arasındaki fiyat eğilimini; tarihsel hareketler, piyasa arz-talep dengesi, ekosistem gelişmeleri ve makroekonomik değişkenler ışığında kapsamlı biçimde irdeleyerek, yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunmayı amaçlamaktadır.

I. BLOK Fiyat Geçmişi ve Güncel Piyasa Durumu

BLOK Fiyatının Tarihsel Seyri

- 2021: BLOK piyasaya çıktı, 31 Ekim’de tüm zamanların en yüksek seviyesi olan 0,178281 $’a ulaştı

- 2022-2024: Genel kripto piyasa düşüşüyle birlikte fiyat kademeli olarak geriledi

- 2025: 11 Ekim’de tüm zamanların en düşük seviyesi olan 0,00013019 $’ı gördü

BLOK Güncel Piyasa Görünümü

13 Ekim 2025 itibarıyla BLOK, 0,0001563 $ seviyesinden işlem görüyor ve 24 saatlik işlem hacmi 18.603 $’a ulaştı. Son 24 saatte token %0,63’lük hafif bir düşüş yaşadı. BLOK’un piyasa değeri 3.910.213 $ olup, kripto para piyasasında 1.914. sırada bulunuyor.

BLOK, son bir haftada %22,78’lik kayda değer bir değer kaybı yaşarken, 30 günlük düşüşü %31,69 ile daha da çarpıcı. Yıllık performansta %78,7’lik keskin bir azalma görülüyor; bu da uzun soluklu bir ayı trendine işaret ediyor.

Mevcut fiyat, tüm zamanların en yüksek seviyesinin %99,91 altında ve son dip seviyesinin %20,05 üzerinde; bu da token’ın dibe vurduktan sonra toparlanma sürecinde olduğunu, ancak zirveye hâlâ çok uzak bulunduğunu gösteriyor.

Dolaşımdaki BLOK miktarı 25.017.359.648 adet, toplam arz ise 77.388.071.935; dolaşımdaki oran %12,51. Tam seyreltilmiş piyasa değeri ise 31.260.000 $ seviyesinde.

BLOK’un güncel piyasa fiyatını görüntülemek için tıklayın

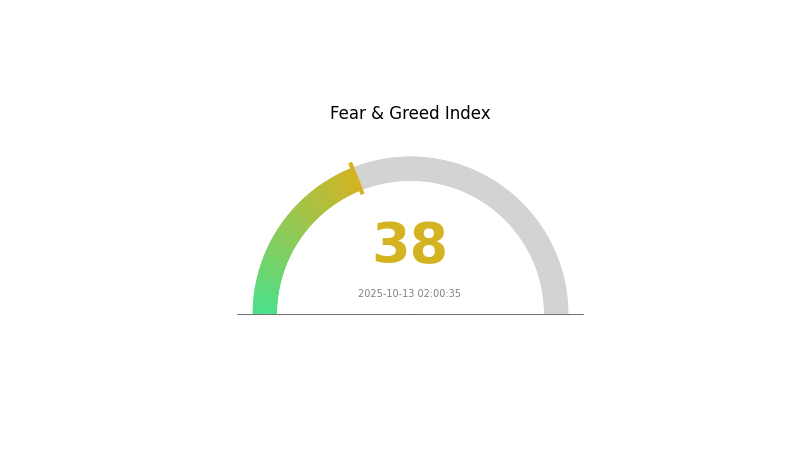

BLOK Piyasa Duyarlılığı Göstergesi

2025-10-13 Korku ve Açgözlülük Endeksi: 38 (Korku)

Güncel Korku ve Açgözlülük Endeksi için tıklayın

Kripto piyasası şu anda “korku” bölgesinde ve Korku & Açgözlülük Endeksi 38 düzeyinde. Bu, yatırımcıların temkinli olduğuna işaret ederek stratejik girişler için fırsat oluşturabilir. Ancak, yatırım kararı öncesi dikkatli olunmalı ve kapsamlı araştırma yapılmalıdır. Unutmayın: piyasa hissiyatı hızlı değişir ve kripto piyasasının oynaklığında çeşitlendirme en önemli silahtır.

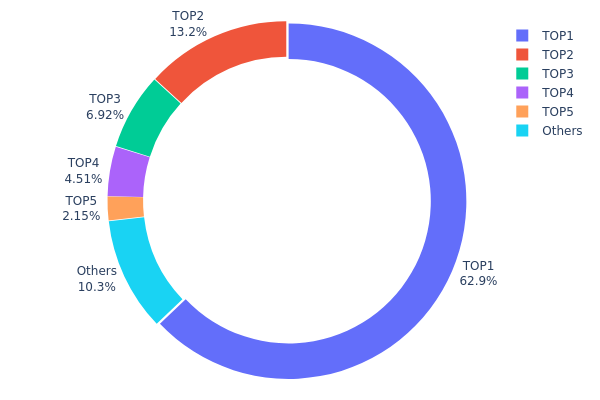

BLOK Varlık Dağılımı

BLOK’un adres bazlı dağılım verileri, sahipliğin oldukça yoğunlaştığını gösteriyor. En büyük adres (muhtemelen bir yakım adresi; 0x0000...00dead) toplam arzın %62,88’ini elinde tutarak bu token’ları piyasadan çıkarmış durumda. İkinci en büyük cüzdan %13,20, üçüncü ve dördüncü en büyük adresler sırasıyla %6,92 ve %4,51 oranında pay sahibi. Yani BLOK token’larının %87’si yalnızca dört adreste toplanmış durumda.

Böylesine yoğun bir sahiplik, piyasa likiditesi ve fiyat oynaklığı açısından risk oluşturuyor. Az sayıda kişinin elinde büyük miktarda token olması, bu varlıkların satılması veya taşınması halinde ciddi fiyat dalgalanmalarına yol açabilir. Ayrıca bu yoğunluk, projenin merkeziyetsizlik iddiasını da zedeleyebilir ve arz üzerinde büyük bir kontrol yaratabilir.

Mevcut varlık dağılımı, BLOK için zincir üstünde görece merkezi bir yapı ortaya koyuyor. En büyük sahiplerin satış baskısının azalması açısından istikrarlı görünse de, manipülasyon ve serbest dolaşımdaki arzın azalması açısından riskler de barındırıyor. BLOK’un piyasa dinamiklerini ve fiyat hareketlerini değerlendirirken bu yoğunlaşma mutlaka dikkate alınmalı.

BLOK varlık dağılımını görmek için tıklayın

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...00dead | 122611928,06K | 62,88% |

| 2 | 0x24de...82234b | 25742889,69K | 13,20% |

| 3 | 0x3b72...a5926f | 13500000,00K | 6,92% |

| 4 | 0x9616...9ea870 | 8800000,00K | 4,51% |

| 5 | 0x6878...d2fa0b | 4200000,00K | 2,15% |

| - | Others | 20119414,05K | 10,34% |

II. BLOK’un Gelecekteki Fiyatını Etkileyen Temel Unsurlar

Arz Mekanizması

- Halving: 2024’te blok ödüllerinin 6,25 BTC’den 3,125 BTC’ye düşmesi, yeni Bitcoin arzını ciddi biçimde azaltacak ve fiyat üzerinde yukarı yönlü baskı oluşturabilir.

- Tarihsel Eğilim: Bitcoin fiyatları geçmişte, her halving’den sonraki yıl yeni zirveler görmüştür.

- Güncel Etki: 2024 halving’iyle birlikte oluşacak kıtlık, 2025’te BLOK fiyatında yukarı yönlü potansiyel yaratabilir.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Yatırımlar: Geleneksel finans kurumlarının artan ilgisi, talebi yükseltiyor ve Bitcoin’i makro düzeyde koruma aracı olarak öne çıkarıyor.

- Şirketlerin Benimsemesi: MicroStrategy gibi şirketlerin büyük Bitcoin yatırımları, piyasaya güven veriyor.

- Ulusal Politikalar: ABD’deki kripto dostu atamalar gibi regülasyon gelişmeleri, piyasaya olumlu sinyaller gönderiyor.

Makroekonomik Ortam

- Para Politikası Etkisi: Özellikle Fed’in adımları, Bitcoin’in enflasyona karşı cazibesini şekillendiriyor.

- Enflasyona Karşı Koruma: Bitcoin, giderek “dijital altın” ve ekonomik belirsizlikte güvenli liman olarak görülüyor.

- Jeopolitik Gelişmeler: Küresel ekonomik ve politik gelişmeler, Bitcoin’in küresel finans sistemindeki rolünü etkiliyor.

Teknolojik Gelişim ve Ekosistem Oluşumu

- ETF’lerin Piyasaya Girişi: Bitcoin ETF’leri, hem bireysel hem kurumsal yatırımcılar için bariyerleri düşürerek talebi artırdı.

- Ağ Yükseltmeleri: Bitcoin altyapısındaki sürekli iyileştirmeler, kullanım alanını genişletiyor ve yeni kullanıcılar çekiyor.

- Ekosistem Uygulamaları: Layer 2 çözümlerinin ve yeni varlık modellerinin büyümesi, BLOK değer önerisini dolaylı olarak güçlendiriyor.

III. 2025-2030 BLOK Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,00008 $ - 0,00014 $

- Nötr tahmin: 0,00014 $ - 0,00018 $

- İyimser tahmin: 0,00018 $ - 0,0002 $ (olumlu piyasa koşullarıyla mümkün)

2026-2028 Görünümü

- Piyasa Beklentisi: Benimsemenin arttığı potansiyel bir büyüme dönemi

- Fiyat aralığı tahmini:

- 2026: 0,00013 $ - 0,00021 $

- 2027: 0,00014 $ - 0,00025 $

- 2028: 0,00015 $ - 0,0003 $

- Belirleyici Faktörler: Teknolojik gelişmeler, yeni kullanım alanları, piyasa duyarlılığının güçlenmesi

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,00026 $ - 0,00029 $ (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,00029 $ - 0,00033 $ (benimsemede artış ve olumlu piyasa trendleriyle)

- Dönüştürücü senaryo: 0,00033 $ üzeri (son derece elverişli koşullar ve yenilikçi gelişmeler halinde)

- 2030-12-31: BLOK 0,00033 $ (dönemin potansiyel zirvesi)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0,0002 | 0,00016 | 0,00008 | 0 |

| 2026 | 0,00021 | 0,00018 | 0,00013 | 14 |

| 2027 | 0,00025 | 0,00019 | 0,00014 | 24 |

| 2028 | 0,0003 | 0,00022 | 0,00015 | 42 |

| 2029 | 0,00033 | 0,00026 | 0,00017 | 66 |

| 2030 | 0,00033 | 0,00029 | 0,00016 | 87 |

IV. BLOK için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

BLOK Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için: Uzun vadeli bakış açısına ve risk toleransına sahip yatırımcılar

- Öneriler:

- Piyasa düşüşlerinde BLOK biriktirin

- Piyasa oynaklığını aşmak için en az 2-3 yıl elde tutun

- Token’larınızı güvenli bir donanım cüzdanında saklayın

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend yönünü ve olası dönüşleri belirlemek için kullanılır

- RSI (Göreceli Güç Endeksi): Aşırı alım-satım seviyelerini izleyin

- Kısa vadeli işlem için önemli noktalar:

- Teknik göstergelere dayalı net giriş-çıkış noktaları belirleyin

- Potansiyel kayıpları sınırlamak için stop-loss (zarar durdur) emirleri kullanın

BLOK Risk Yönetimi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Daha agresif yatırımcılar: %5-10’u

- Profesyonel yatırımcılar: %15’e kadar

(2) Riskten Korunma Yöntemleri

- Diversifikasyon: Birden fazla kripto varlığa yatırım yapın

- Stop-loss emirleri: Bireysel işlemlerdeki potansiyel zararları sınırlayın

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan önerisi: Gate Web3 Wallet

- Soğuk depolama: Uzun vadeli tutumlar için donanım cüzdanı

- Güvenlik: İki aşamalı doğrulama, güçlü şifreler kullanın

V. BLOK İçin Olası Riskler ve Zorluklar

BLOK Piyasa Riskleri

- Yüksek oynaklık: Fiyatlarda ciddi dalgalanmalar yaşanabilir

- Sınırlı likidite: Büyük işlemlerde zorlanma riski

- Piyasa duyarlılığı: Genel kripto piyasası trendlerinden güçlü biçimde etkilenir

BLOK Regülasyon Riskleri

- Belirsiz regülasyon ortamı: Olumsuz düzenleme riski

- Sınır ötesi uyum: Farklı ülkelerde değişen yasal düzenlemeler

- Vergisel etkiler: Kripto varlıklar için değişen vergi mevzuatı

BLOK Teknik Riskler

- Akıllı sözleşme açıkları: Sömürü veya hata riski

- Ölçeklenebilirlik sorunları: Yüksek işlem talebinde ağ tıkanıklığı

- Teknolojik demode olma riski: Yeni nesil blockchain teknolojileriyle geride kalma olasılığı

VI. Sonuç ve Eylem Önerileri

BLOK Yatırım Değeri Değerlendirmesi

BLOK, VR tabanlı kripto ekosisteminde yüksek riskli ve yüksek potansiyelli bir yatırım fırsatı sunar. Yenilikçi özelliklere sahip olsa da, yatırımcılar ciddi oynaklığa ve regülasyon belirsizliklerine karşı hazırlıklı olmalıdır.

BLOK Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Kripto portföyünüzün %1-2’siyle sınırlı tutun, öğrenmeye öncelik verin ✅ Deneyimli yatırımcılar: %5-10 aralığında pozisyon alın, aktif şekilde yönetin ✅ Kurumsal yatırımcılar: Detaylı inceleme yaparak, çeşitlendirme amacıyla %15’e kadar ayırmayı değerlendirin

BLOK İşlemlerine Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden BLOK token işlemleri

- Staking: BLOK staking programları mevcutsa katılım

- DeFi entegrasyonu: BLOK içeren merkeziyetsiz finans çözümlerini inceleyin

Kripto para yatırımları son derece yüksek risk içerir; bu makale yatırım tavsiyesi değildir. Yatırımcılar kararlarını kendi risk toleranslarına göre dikkatle vermeli ve profesyonel finansal danışmanlardan görüş almalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

Sıkça Sorulan Sorular

Blok iyi bir yatırım mı?

Evet, Blok yatırım için umut vadeder. Dijital varlıklara odaklanan, aktif yönetilen bir ETF olarak, büyüyen blockchain sektörüne erişim sağlar. Stratejik portföyüyle Blok, gelişen kripto piyasasında potansiyel kazançlar için iyi bir pozisyonda.

2025’te Blockdag fiyat tahmini nedir?

Uzun vadeli analizlere göre, Blockdag’ın fiyatının 2025 yılında 3.421,87 $ seviyesine ulaşması bekleniyor.

Blok’un hisse fiyatı ne kadar oynak?

Blok’un hisse fiyatı, 0,00 beta katsayısıyla düşük oynaklık gösteriyor. 13 Ekim 2025 itibarıyla fiyat hareketleri minimum düzeyde.

Analistlerin Blok için fiyat hedefleri nedir?

Analistlerin mevcut 12 aylık Blok fiyat hedefi, ortalama konsensüse göre 88,87 $ olarak belirlenmiştir.

2025 BLOK Fiyat Tahmini: Metaverse Token’ı İçin Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

2025 ETH Fiyat Tahmini: Piyasa Trendleri ve Kurumsal Benimseme Faktörlerinin Analizi

2025 LUNC Fiyat Tahmini: Terra Luna Classic’in Çöküş Sonrası Dönemde Potansiyel Toparlanma ve Piyasa Görünümünün Analizi

2025 HBAR Fiyat Tahmini: Hedera Hashgraph, Kripto Piyasasında Yeni Zirvelere Ulaşabilir mi?

2025 CFX Fiyat Tahmini: Conflux Network İçin Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

2025 SMARTPrice Tahmini: Yatırım Portföyü Optimizasyonu İçin Gelişmiş Yapay Zekâ Destekli Piyasa Analitikleri

Yönetim Tokenlarını Anlamak: Web3 Dünyasında Merkeziyetsiz Finansın Derinliklerine Yolculuk

Web3 Ekosisteminde MONKY Token’a Kapsamlı Bir Rehber

Avalanche Ağı’na Varlık Transferini Güvenle Yapma Rehberi