2025 LPT Price Prediction: Analyzing Livepeer's Potential in the Evolving Web3 Streaming Landscape

Introduction: LPT's Market Position and Investment Value

Livepeer (LPT), as a decentralized video streaming network, has made significant strides since its inception in 2018. As of 2025, Livepeer's market capitalization has reached $225,754,330, with a circulating supply of approximately 45,551,721 tokens, and a price hovering around $4.956. This asset, often referred to as the "blockchain's video infrastructure", is playing an increasingly crucial role in the realm of decentralized video streaming and content delivery.

This article will provide a comprehensive analysis of Livepeer's price trends from 2025 to 2030, taking into account historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, to offer professional price predictions and practical investment strategies for investors.

I. LPT Price History Review and Current Market Status

LPT Historical Price Evolution

- 2019: LPT launched, price reached an all-time low of $0.354051 on October 27

- 2021: Bull market peak, LPT hit all-time high of $99.03 on November 10

- 2022-2025: Market correction and consolidation, price fluctuated between previous highs and lows

LPT Current Market Situation

As of October 18, 2025, LPT is trading at $4.956, with a market cap of $225,754,330. The token has experienced a 0.56% decrease in the past 24 hours, but shows a 9.68% increase over the past week. However, LPT has seen significant declines of 29.53% and 58.3% over the past 30 days and 1 year, respectively. The current price represents a 95% decrease from its all-time high, indicating a prolonged bear market for LPT. Despite recent short-term gains, the overall trend remains bearish, with the token facing resistance to reclaim previous price levels.

Click to view current LPT market price

LPT Market Sentiment Indicator

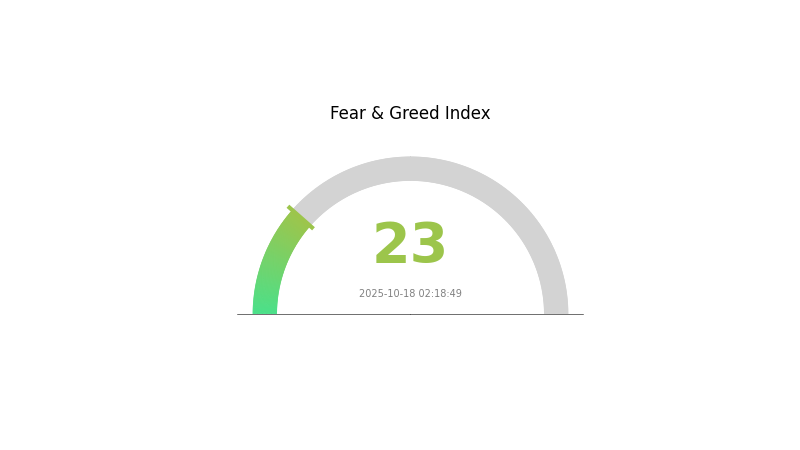

2025-10-18 Fear and Greed Index: 23 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is experiencing extreme fear, with the Fear and Greed Index at a low 23. This indicates significant pessimism among investors, potentially creating buying opportunities for those with a contrarian approach. However, caution is advised as market sentiment can shift rapidly. Traders should consider diversifying their portfolios and setting stop-loss orders to manage risk. Remember, extreme fear often precedes market bottoms, but timing the exact turnaround is challenging. Stay informed and make decisions based on thorough research and your risk tolerance.

LPT Holdings Distribution

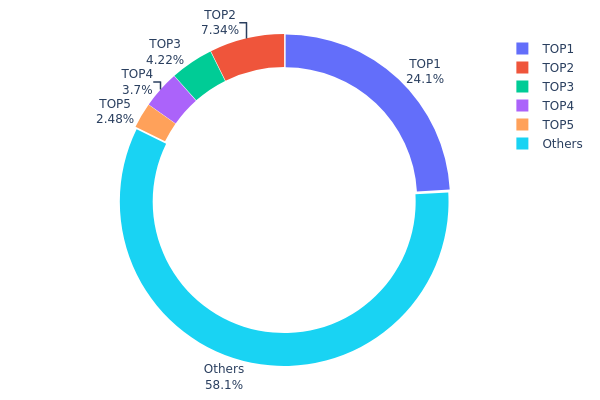

The address holdings distribution data for LPT reveals a notable concentration of tokens among a few top addresses. The largest holder possesses 24.10% of the total supply, while the top 5 addresses collectively control 41.83% of LPT tokens. This level of concentration raises concerns about potential market manipulation and centralization risks.

Such a distribution pattern could lead to increased price volatility, as large holders have the capacity to significantly impact market dynamics through substantial buy or sell orders. The concentration of tokens in a few hands may also undermine the project's decentralization ethos, potentially affecting governance decisions and overall network stability.

However, it's worth noting that 58.17% of LPT tokens are distributed among other addresses, indicating a degree of broader market participation. This wider distribution could help mitigate some of the centralization risks, though the influence of top holders remains a key consideration for investors and market analysts evaluating LPT's long-term prospects and market structure.

Click to view the current LPT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x6a23...fa210a | 6007.00K | 24.10% |

| 2 | 0xf977...41acec | 1829.59K | 7.34% |

| 3 | 0xd8b9...1f9997 | 1051.86K | 4.22% |

| 4 | 0x04fc...7d1550 | 921.34K | 3.69% |

| 5 | 0x501d...1e5f6c | 618.83K | 2.48% |

| - | Others | 14489.90K | 58.17% |

II. Key Factors Affecting LPT's Future Price

Technical Development and Ecosystem Building

- Livepeer Studio: A developer platform that allows easy integration of video functionality into applications, potentially expanding LPT's utility and adoption.

- Ecosystem Applications: Livepeer is being used in various decentralized video streaming applications, enhancing its practical use cases and potential value.

III. LPT Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $3.66 - $4.50

- Neutral prediction: $4.50 - $5.40

- Optimistic prediction: $5.40 - $5.69 (requires strong market sentiment and project developments)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $3.58 - $8.94

- 2028: $4.90 - $9.50

- Key catalysts: Technological advancements, partnerships, and market expansion

2030 Long-term Outlook

- Base scenario: $8.00 - $10.00 (assuming steady growth and adoption)

- Optimistic scenario: $10.00 - $11.69 (with significant ecosystem expansion)

- Transformative scenario: $11.69+ (under extremely favorable market conditions and widespread adoption)

- 2030-12-31: LPT $9.35 (potential year-end average price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 5.6925 | 4.95 | 3.663 | 0 |

| 2026 | 7.44975 | 5.32125 | 4.52306 | 7 |

| 2027 | 8.9397 | 6.3855 | 3.57588 | 28 |

| 2028 | 9.50162 | 7.6626 | 4.90406 | 54 |

| 2029 | 10.12689 | 8.58211 | 5.40673 | 73 |

| 2030 | 11.69313 | 9.3545 | 5.23852 | 88 |

IV. Professional LPT Investment Strategies and Risk Management

LPT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in decentralized video streaming

- Operational suggestions:

- Accumulate LPT during market dips

- Stake LPT to earn rewards and support the network

- Store LPT in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI (Relative Strength Index): Gauge overbought/oversold conditions

- Key points for swing trading:

- Monitor Livepeer network usage and adoption metrics

- Stay informed about upgrades and partnerships in the video streaming industry

LPT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance LPT with other crypto assets and traditional investments

- Stop-loss orders: Set appropriate levels to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Paper wallet for long-term holding

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for LPT

LPT Market Risks

- Volatility: Cryptocurrency markets are highly volatile, leading to significant price swings

- Competition: Emergence of new decentralized video streaming platforms

- Adoption: Slow user and developer adoption could impact LPT's value

LPT Regulatory Risks

- Uncertain regulations: Changing cryptocurrency regulations may affect LPT's utility and trading

- Token classification: Potential for LPT to be classified as a security in some jurisdictions

- Cross-border restrictions: International regulatory differences may limit global adoption

LPT Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying Ethereum-based contracts

- Scalability challenges: Ethereum network congestion could affect Livepeer's performance

- Technological obsolescence: Rapid advancements in video streaming technology may outpace Livepeer

VI. Conclusion and Action Recommendations

LPT Investment Value Assessment

Livepeer (LPT) presents a unique value proposition in the decentralized video streaming space, with potential for long-term growth. However, short-term volatility and adoption challenges pose significant risks.

LPT Investment Recommendations

✅ Beginners: Consider a small allocation (1-3%) as part of a diversified crypto portfolio ✅ Experienced investors: Explore staking opportunities and monitor network growth metrics ✅ Institutional investors: Conduct thorough due diligence on Livepeer's technology and market position

LPT Trading Participation Methods

- Spot trading: Buy and sell LPT on Gate.com

- Staking: Participate in the Livepeer network by staking LPT

- DeFi integration: Explore liquidity provision opportunities in decentralized exchanges

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the future of LPT coin?

LPT coin has a promising future in the Web3 ecosystem. As video streaming grows, Livepeer's decentralized network could see increased adoption, potentially driving up LPT's value and utility.

Will pi coin reach $100?

It's highly unlikely for Pi coin to reach $100. Given its large supply and current market trends, a more realistic long-term price target might be in the range of $0.01 to $1.

How much will be 1 pi in 2025?

Based on market trends and expert predictions, 1 pi could potentially reach $0.50 to $1 by 2025, depending on adoption and network growth.

How much will pi be worth in 2026?

Based on current trends and market analysis, Pi could potentially reach $0.50 to $1 by 2026, depending on its adoption rate and overall crypto market conditions.

Share

Content