2025 ECHO Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

Giriş: ECHO'nun Piyasa Konumu ve Yatırım Potansiyeli

Echo (ECHO), Move tabanlı bir Bitcoin staking ve likidite altyapısı olarak, BTC varlıklarının likiditesini artırmada giderek daha önemli bir rol üstleniyor. 2025 yılı itibarıyla ECHO'nun piyasa değeri 5.528.640 $ seviyesine ulaşırken, dolaşımdaki yaklaşık 208.000.000 token ve yaklaşık 0,02658 $ fiyatıyla işlem görüyor. "BTC likidite artırıcı" olarak tanımlanan bu varlık, hem kurumsal hem de bireysel Bitcoin sahipleri için yenilikçi yeniden staking çözümleri ve getiri fırsatlarında önemli ilerlemeler sağlıyor.

Bu makalede, 2025-2030 yılları arasında ECHO'nun fiyat hareketleri kapsamlı şekilde analiz edilecek; geçmiş fiyat hareketleri, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler temelinde yatırımcılara profesyonel fiyat tahminleri ve uygulamaya dönük yatırım stratejileri sunulacaktır.

I. ECHO Fiyat Geçmişi ve Güncel Piyasa Durumu

ECHO Tarihsel Fiyat Seyri

- 2025 9 Temmuz: ECHO, tüm zamanların en yüksek seviyesi olan 0,07526 $'a ulaştı

- 2025 14 Temmuz: ECHO, 0,015 $ ile tüm zamanların en düşük seviyesini gördü ve zirveden sert bir düşüş yaşadı

- 2025 Ekim: ECHO, volatilite dönemine girerek fiyat dalgalanmalarıyla piyasa belirsizliğini ortaya koydu

ECHO Güncel Piyasa Görünümü

11 Ekim 2025 itibarıyla ECHO, 0,02658 $ seviyesinden işlem görüyor ve son 24 saatte %24,85 oranında ciddi bir değer kaybı yaşadı. Token'ın piyasa değeri 5.528.640 $ olup, küresel kripto para sıralamasında 1.659. sırada yer alıyor. Son 24 saatlik işlem hacmi ise 61.322,65 $'a ulaşarak piyasada aktif katılımı gösteriyor.

Mevcut fiyat, ECHO'nun tüm zamanların en yüksek seviyesinden önemli bir gerilemeyi ifade ediyor ve kısa vadede düşüş eğilimi sinyali veriyor. Token'ın fiyatı farklı zaman dilimlerinde de olumsuz performans gösteriyor; son bir saatte %10,22 düşerken, son bir haftada %34,21 ve yıl başından bu yana %21,76 azaldı.

ECHO'nun dolaşımdaki arzı 208.000.000 token olup, toplam arzın %20,8'ine karşılık geliyor (toplam arz: 1.000.000.000). Düşük dolaşım oranı, piyasa likiditesi ve fiyat hareketleri üzerinde etkili olabilir.

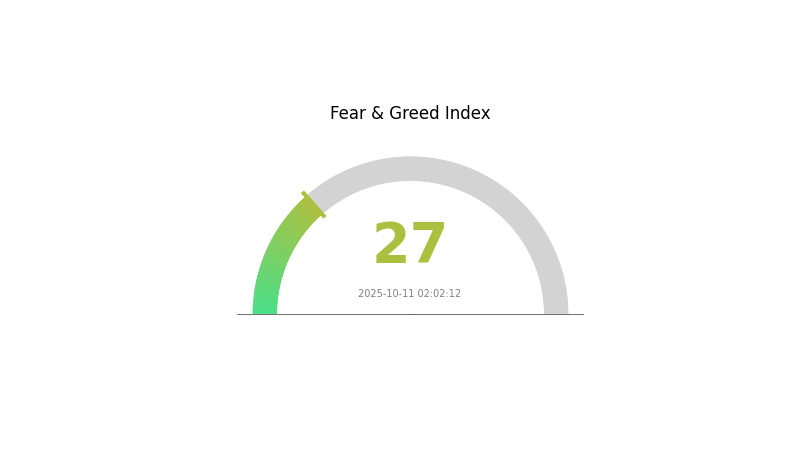

Piyasa genelinde hissiyat olumsuz; Korku ve Açgözlülük Endeksi 27 seviyesinde, yatırımcılar arasında korkunun hakim olduğu bir dönem yaşanıyor. Bu hissiyat, ECHO'nun son fiyat performansıyla örtüşüyor ve yakın vadede yatırımcı davranışlarını etkilemesi muhtemel.

Güncel ECHO piyasa fiyatını görmek için tıklayın

ECHO Piyasa Hissiyat Göstergesi

2025-10-11 Korku ve Açgözlülük Endeksi: 27 (Korku)

Güncel Korku ve Açgözlülük Endeksi'ni görüntüleyin

Kripto para piyasasında şu anda korku hakim. Korku ve Açgözlülük Endeksi'nin 27 seviyesinde olması, yatırımcıların temkinli davrandığını ve risk almaktan kaçındığını gösteriyor. Böyle dönemlerde yatırım kararlarını almadan önce detaylı araştırma yapmak büyük önem taşır. Piyasa hissiyatı kısa sürede değişebilir; korku dönemleri ise uzun vadeli düşünenler için fırsat sunabilir. Güncel kalın ve belirsiz piyasa koşullarında riskleri azaltmak için portföyünüzü çeşitlendirmeyi göz önünde bulundurun.

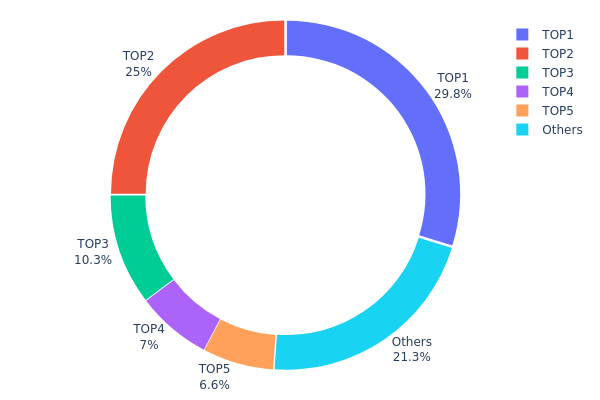

ECHO Varlık Dağılımı

ECHO'nun adres bazlı varlık dağılımı, son derece yoğun bir sahiplik yapısına işaret ediyor. En büyük beş adres toplam arzın %78,72'sini elinde bulundururken, en büyük sahip %29,82 ile başı çekiyor. Bu derece yoğunlaşma, merkezileşme ve olası piyasa manipülasyonu riskleri açısından dikkat çekiyor.

İkinci ve üçüncü en büyük sahipler sırasıyla %25,00 ve %10,30 oranında token tutuyor; bu da sahiplikteki ağırlığın ne kadar yüksek olduğunu gösteriyor. Böyle bir yapı, büyük sahiplerin varlıklarının önemli bir kısmını işlemeye karar vermeleri halinde volatilitenin ve fiyat dalgalanmalarının artmasına neden olabilir. Ayrıca, bu yoğunlaşma token'ın zincir üstü yönetişimi ve karar alma süreçlerinde merkeziyetsizlik ilkesini zayıflatabilir.

Diğer adresler arasında dağıtılan token oranı %21,28 ile sınırlı kalıyor ve bu, yaygın benimseme veya perakende katılımın henüz düşük olduğunu gösteriyor. Bu konsantrasyon, ECHO'nun piyasa yapısının balina hareketlerine karşı savunmasız olduğunu ve daha geniş bir dağılımın istikrar sağlamak ve manipülasyon riskini azaltmak için faydalı olacağını gösteriyor.

Güncel ECHO Varlık Dağılımı'nı görmek için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x12b7...c13cdf | 298.176,04K | 29,82% |

| 2 | 0x2bd1...cb19e9 | 250.024,71K | 25,00% |

| 3 | 0x4d59...f57fd5 | 103.039,85K | 10,30% |

| 4 | 0xc9db...d3246b | 70.000,00K | 7,00% |

| 5 | 0x57de...ed04c1 | 66.000,00K | 6,60% |

| - | Diğerleri | 212.759,40K | 21,28% |

II. ECHO'nun Gelecekteki Fiyatını Etkileyecek Temel Unsurlar

Kurumsal ve Balina Etkileri

- Kurumsal Varlıklar: Kurumsal benimseme ve ECHO varlıklarının elde tutulması, fiyat hareketleri üzerinde belirleyici olabilir.

- Kurumsal Benimseme: Önde gelen şirketlerin ECHO entegrasyonu, varlığın değerine ve piyasa algısına doğrudan etki yapabilir.

Makroekonomik Koşullar

- Para Politikası Etkisi: Büyük merkez bankalarının politikaları, ECHO fiyatına önemli ölçüde yön verebilir.

- Enflasyon Koruma Özellikleri: ECHO'nun enflasyonist ortamlardaki performansı, yatırım cazibesini artırabilir veya azaltabilir.

- Jeopolitik Faktörler: Küresel jeopolitik gelişmeler, ECHO'nun dünya genelindeki benimsenmesini ve değerini etkileyebilir.

Teknik Gelişim ve Ekosistem Oluşturma

- Ekosistem Uygulamaları: ECHO üzerinde geliştirilecek önemli DApp ve ekosistem projeleri, benimsenme ve değer üzerinde kilit rol oynayabilir.

III. 2025-2030 ECHO Fiyat Tahminleri

2025 Beklentisi

- Temkinli tahmin: 0,0156 $ - 0,02476 $

- Tarafsız tahmin: 0,02476 $ - 0,02773 $

- İyimser tahmin: 0,02773 $ - 0,03 $ (önemli bir piyasa toparlanması gerektirir)

2027-2028 Beklentisi

- Piyasa aşaması: Büyüme dönemi potansiyeli

- Fiyat aralığı tahmini:

- 2027: 0,02701 $ - 0,04752 $

- 2028: 0,02562 $ - 0,05844 $

- Kilit tetikleyiciler: Kripto piyasasında genel toparlanma, artan kullanım

2030 Uzun Vadeli Beklenti

- Temel senaryo: 0,05785 $ - 0,06855 $ (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,06855 $ - 0,07926 $ (güçlü piyasa koşulları varsayımıyla)

- Dönüştürücü senaryo: 0,07926 $ - 0,09 $ (ekosistemin olağanüstü gelişmesi halinde)

- 2030-12-31: ECHO 0,07926 $ (yılın olası zirve fiyatı)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,02773 | 0,02476 | 0,0156 | -6 |

| 2026 | 0,03884 | 0,02625 | 0,02336 | -1 |

| 2027 | 0,04752 | 0,03254 | 0,02701 | 22 |

| 2028 | 0,05844 | 0,04003 | 0,02562 | 50 |

| 2029 | 0,06647 | 0,04924 | 0,03053 | 85 |

| 2030 | 0,07926 | 0,05785 | 0,0376 | 117 |

IV. ECHO İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

ECHO Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Hedef kitle: Bitcoin ekosistemi yatırımcıları ve getiri arayışı olanlar

- Operasyon önerileri:

- Piyasa geri çekilmelerinde ECHO token biriktirin

- Staking ve likidite sağlama programlarına katılım sağlayın

- Token'ları güvenli, saklama dışı cüzdanlarda muhafaza edin

(2) Aktif Ticaret Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve olası dönüş noktalarını tespit etmek için kullanılır

- Göreceli Güç Endeksi (RSI): Aşırı alım veya aşırı satım bölgelerini belirleyin

- Dalgalı ticaret için temel noktalar:

- Bitcoin fiyat değişimlerini izleyin; bu hareketler ECHO'yu etkileyebilir

- Echo Protocol ekibinin duyuru ve güncellemelerini takip edin

ECHO Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Esasları

- Temkinli yatırımcılar: Kripto portföyünün %1-3'ü

- Agresif yatırımcılar: Kripto portföyünün %5-10'u

- Profesyonel yatırımcılar: Kripto portföyünün %15'ine kadar

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: ECHO'yu farklı kripto varlıklarla dengeleyin

- Zarar durdur emirleri: Potansiyel kayıpları sınırlamak için uygun seviyeleri belirleyin

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk saklama: Uzun vadeli tutucular için donanım cüzdanları

- Güvenlik önlemleri: 2FA etkinleştirin, güçlü şifreler kullanın ve kimlik avı girişimlerine karşı dikkatli olun

V. ECHO İçin Olası Riskler ve Zorluklar

ECHO Piyasa Riskleri

- Fiyat oynaklığı: ECHO, yeni bir token olarak yüksek fiyat dalgalanmaları yaşayabilir

- Likidite riski: Sınırlı işlem çiftleri ve düşük hacim, giriş ve çıkış pozisyonları üzerinde etkili olabilir

- Bitcoin ile korelasyon: ECHO'nun fiyatı, BTC'nin hareketlerinden güçlü şekilde etkilenebilir

ECHO Düzenleyici Riskleri

- Belirsiz düzenleyici ortam: Kripto düzenlemelerinde olası değişiklikler ECHO'yu etkileyebilir

- Uyum sorunları: Küresel finansal regülasyonlara uyum sağlama gerekliliği

- Sınır ötesi kısıtlamalar: ECHO'nun bazı ülkelerde erişiminde olası sınırlamalar

ECHO Teknik Riskleri

- Akıllı kontrat açıkları: Protokol kodunda hata veya istismar riski

- Ölçeklenebilirlik sorunları: Kullanım arttıkça ağ yükünü yönetmede zorluklar

- İşbirliği endişeleri: Farklı Bitcoin L2 çözümleriyle entegrasyonun sorunsuz sağlanması

VI. Sonuç ve Eylem Tavsiyeleri

ECHO Yatırım Değeri Analizi

ECHO, Bitcoin ekosisteminde staking ve likidite altyapısı sağlayarak özgün bir değer sunuyor. Uzun vadeli büyüme potansiyeli taşısa da kısa vadede volatilite ve benimseme zorlukları önemli riskler barındırıyor.

ECHO Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayın, Echo Protocol hakkında bilgi edinin ✅ Deneyimli yatırımcılar: Çeşitlendirilmiş portföyde orta büyüklükte bir pozisyonu değerlendirin ✅ Kurumsal yatırımcılar: ECHO'yu getiri fırsatları ve Bitcoin ekosistemi maruziyeti için analiz edin

ECHO Katılım Yöntemleri

- Token satın alma: Gate.com veya desteklenen diğer borsalardan ECHO token edinin

- Staking: ECHO varlıklarınızı staking programlarında değerlendirerek getiri elde edin

- Likidite sağlama: Ekosistemi desteklemek ve ödül kazanmak için likidite havuzlarına katkı sunun

Kripto para yatırımları yüksek risk içerir; bu içerik yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarına göre dikkatli karar vermeli ve profesyonel finansal danışmanlara başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

SSS

Hangi kripto para için en yüksek fiyat öngörülüyor?

Bitcoin için en yüksek fiyat tahmini yapılıyor; öngörülen zirve fiyatı 122.937 $. Chainlink ise 59,67 $ ile ikinci sırada yer alıyor.

Echo Energy için hisse fiyatı öngörüsü nedir?

Echo Energy hisse fiyatının, mevcut piyasa analizine göre bir yıl içinde 0,000300 GBX'ten 1,394 GBX seviyesine yükseleceği tahmin ediliyor.

2025 yılında kripto para fiyatı için öngörü nedir?

Uzmanlar, 2025 yılında kripto paralarda önemli büyüme bekliyor; bazı tahminler fiyatların yeni zirvelere ulaşabileceğini gösteriyor. Ancak piyasa oynaklığı nedeniyle kesin rakamlar belirsizliğini koruyor.

Echo coin nedir?

Echo coin (ECHO), Solana blokzinciri üzerinde çalışan bir kripto para birimi olup, hızlı ve düşük maliyetli işlemleriyle bilinir ve verimli Web3 çözümleri sunmayı hedefler.

El Salvador'daki En Zengin Kişi Kim?

El Salvador'daki Bitcoin Benimsemesi ve En Zengin Kişi Gerçek Bir Hikaye

2030 Yılında Düzenleyici Uyumluluk Bitcoin'in Değerini Nasıl Etkileyecek?

Bugüne Kadar Kaç Bitcoin Kayboldu?

Bitcoin Pizza Günü’nün Doğuş Hikayesi

Güney Amerika'da Bitcoin'in Büyümesini Keşfetmek

Tap Crypto'yu Keşfetmek: Web3 İşlemlerine Yönelik Eksiksiz Başlangıç Rehberi

Ethereum Name Service (ENS) Hakkında Temel Bilgiler: Basit ve Açık Bir Rehber

Aptos Blockchain’i İncelemek: Detaylı Bir Kılavuz

ETH İşlem Maliyetlerini Anlama ve Azaltma

Blockchain Teknolojisinde Nonce Kavramının Anlaşılması