2025 CVX Fiyat Tahmini: DeFi'nin Benimsenmesi Hızlanırken Yükseliş Eğilimi Öne Çıkıyor

Giriş: CVX'in Piyasa Konumu ve Yatırım Değeri

Convex Finance (CVX), DeFi getiri optimizasyonu sektöründe önde gelen bir oyuncu olarak 2021 yılında faaliyete geçtiğinden beri büyük ilerleme kaydetti. 2025 itibarıyla CVX’in piyasa değeri 188.988.572 dolar seviyesine ulaştı; yaklaşık 81.990.703 adet token dolaşımda ve fiyatı 2,305 dolar civarında. “Getiri artırıcı” olarak bilinen bu varlık, Curve Finance likidite sağlayıcılarının getirilerini maksimize etmede giderek daha önemli bir konuma sahip.

Bu makalede, 2025-2030 yılları arasında CVX’in fiyat hareketleri; tarihsel eğilimler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik etmenlerle birlikte analiz edilerek profesyonel fiyat tahminleri ve yatırımcılara yönelik stratejik öneriler sunulacaktır.

I. CVX Fiyat Geçmişi ve Mevcut Piyasa Durumu

CVX Tarihsel Fiyat Gelişim Süreci

- 2021: CVX piyasaya sürüldü, fiyatı başlangıç seviyelerinde dalgalı seyir izledi

- 2022: 2 Ocak’ta 60,09 dolar ile tüm zamanların en yüksek seviyesini gördü, ardından sert düşüş yaşandı

- 2025: 11 Ekim’de 1,36 dolar ile tüm zamanların en düşük seviyesine geriledi, aşırı oynaklık gözlendi

CVX Mevcut Piyasa Durumu

19 Ekim 2025 tarihi itibarıyla CVX 2,305 dolardan işlem görüyor; 24 saatlik işlem hacmi ise 57.956,77575 dolar. Son 24 saatte %1,2’lik bir değer kaybı yaşadı. CVX’in piyasa değeri 188.988.572,08 dolar ve kripto sıralamasında 281. sırada. Dolaşımdaki arzı 81.990.703,72 CVX olup, toplam arzın (99.928.999,53 CVX) %81,99’una karşılık geliyor. Son düşüşe rağmen CVX, geçtiğimiz hafta %7,10 oranında değer kazandı. Ancak son 30 günde yaşadığı %44,5’lik düşüş, orta vadede yüksek oynaklığa işaret ediyor. Güncel fiyat, zirve değerinden %96,16 düşük ve dip seviyesinden %69,49 yüksek.

Güncel CVX piyasa fiyatını görüntüleyin

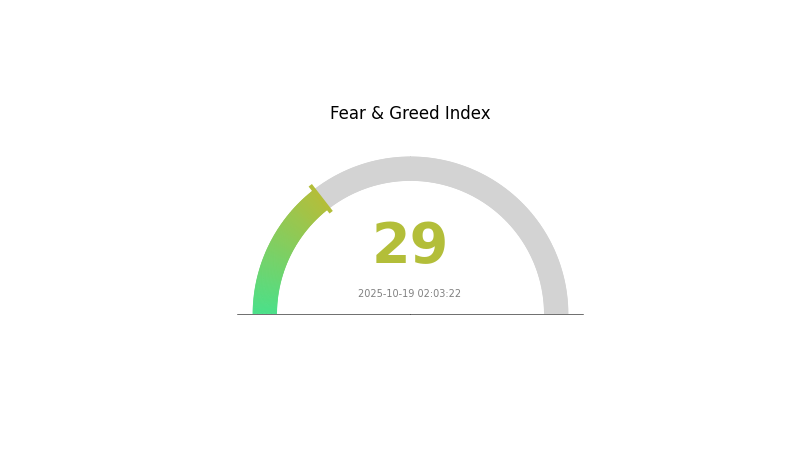

CVX Piyasa Duyarlılık Göstergesi

19 Ekim 2025 Korku ve Açgözlülük Endeksi: 29 (Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasasında duyarlılık şu anda “Korku” bölgesinde; Korku ve Açgözlülük Endeksi 29 seviyesinde. Bu, yatırımcılar arasında temkinli bir hava olduğunu ve uzun vadeli düşünenler için alım fırsatı olabileceğini gösteriyor. Ancak yatırım öncesi mutlaka detaylı araştırma yapılmalı ve dikkatli olunmalı. Piyasa duyarlılığı hızla değişebilir ve geçmiş performans gelecek için garanti değildir. Bilgilenerek ve sorumlu şekilde işlem yapın.

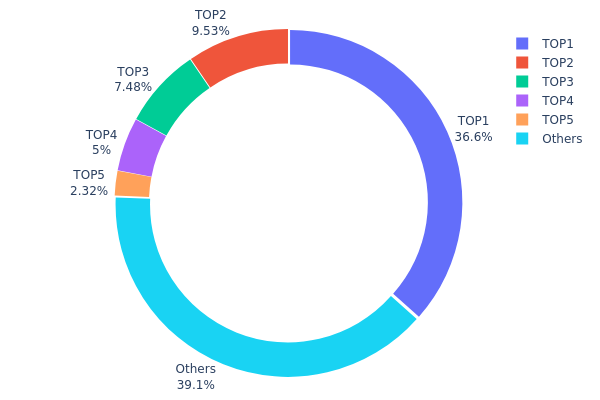

CVX Varlık Dağılımı

Adres bazlı varlık dağılımı verileri, CVX token’larının cüzdanlar arasında ne kadar yoğunlaştığını gösteriyor. İlk sıradaki adres, toplam arzın %36,55’ini elinde tutuyor; ilk beş adres ise tüm token’ların %60,87’sini kontrol ediyor. Bu durum, CVX sahipliğinde merkezileşme riskini artırıyor.

Büyük sahiplerin yoğunlaşması, fiyat oynaklığını ve piyasa dinamiklerini etkileyebilir. Büyük adresler yüksek hacimli işlem yaptığında fiyat dalgalanması riski artar. Ayrıca, bu merkeziyet piyasa manipülasyonuna elverişli bir ortam yaratabilir.

Bu dağılım, CVX’in zincir üzerindeki merkeziyetsizliğinin ideal düzeyde olmadığına işaret ediyor. Küçük yatırımcıların varlığı (toplamın %39,13’ü “Diğerleri”ne ait) belli bir dağılımı sağlasa da, üst adreslerdeki yoğunluk ekosistemin istikrarı ve adilliği için risk oluşturabilir.

Güncel CVX Varlık Dağılımı için tıklayın

| Üst | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x72a1...2db86e | 36.524,70K | 36,55% |

| 2 | 0xcf50...139332 | 9.521,76K | 9,52% |

| 3 | 0x1389...541bb7 | 7.476,01K | 7,48% |

| 4 | 0xf977...41acec | 5.000,00K | 5,00% |

| 5 | 0x5f46...d60605 | 2.318,43K | 2,32% |

| - | Diğerleri | 39.088,08K | 39,13% |

II. Gelecekteki CVX Fiyatını Etkileyecek Temel Faktörler

Arz Mekanizması

- Emisyon Takvimi: CVX sabit arz sınırına sahip olup emisyon oranı zamanla azalıyor.

- Tarihsel Model: Önceki arz azaltımları, kıtlık nedeniyle genellikle fiyat artışına yol açtı.

- Mevcut Etki: Yeni CVX emisyonlarının kademeli olarak azalması, fiyat üzerinde yukarı yönlü baskı oluşturuyor.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Kurumsal Varlıklar: Birçok büyük kripto fonu CVX biriktiriyor.

Makroekonomik Ortam

- Enflasyon Koruma Özellikleri: CVX, enflasyona karşı koruma sağlayan varlıklarla korelasyon göstererek yüksek enflasyon dönemlerinde yatırımcıların ilgisini çekebilir.

Teknolojik Gelişim ve Ekosistem İnşası

- Curve v2 Entegrasyonu: CVX, Curve’in v2 havuzlarını destekleyerek kullanım alanını genişletiyor.

- Ekosistem Uygulamaları: CVX, Curve tabanlı DeFi protokollerinin merkezinde; getiri optimizasyonu ve borç verme platformlarında kritik rol oynuyor.

III. 2025-2030 CVX Fiyat Tahminleri

2025 Görünümü

- Ihtiyatlı tahmin: 1,26 - 2,00 dolar

- Tarafsız tahmin: 2,00 - 2,60 dolar

- İyimser tahmin: 2,60 - 3,43 dolar (olumlu piyasa koşulları gerçekleşirse)

2027-2028 Görünümü

- Piyasa fazı beklentisi: Potansiyel büyüme dönemi

- Fiyat aralığı tahminleri:

- 2027: 2,55 - 4,14 dolar

- 2028: 3,01 - 4,74 dolar

- Başlıca tetikleyiciler: DeFi platformlarının genişlemesi, protokol yükseltmeleri

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 3,56 - 4,22 dolar (istikrarlı büyüme varsayımıyla)

- İyimser senaryo: 4,22 - 5,03 dolar (DeFi sektöründe güçlü büyüme)

- Dönüştürücü senaryo: 5,03 dolar üzeri (kripto piyasalarında aşırı olumlu koşullar)

- 2030-12-31: CVX 4,22 dolar (olası yıl sonu kapanış fiyatı)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı (%) |

|---|---|---|---|---|

| 2025 | 3,43445 | 2,305 | 1,26775 | 0 |

| 2026 | 3,01321 | 2,86973 | 1,52095 | 24 |

| 2027 | 4,14747 | 2,94147 | 2,55908 | 27 |

| 2028 | 4,74959 | 3,54447 | 3,0128 | 53 |

| 2029 | 4,31291 | 4,14703 | 3,56644 | 79 |

| 2030 | 5,03366 | 4,22997 | 2,36878 | 83 |

IV. CVX İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

CVX Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Uzun vadeli bakış açılı, risk toleransı yüksek yatırımcılar

- Operasyon tavsiyeleri:

- Piyasa düşüşlerinde CVX biriktirin

- Platform gelirlerinden faydalanmak için CVX stake edin

- Güvenli, saklama hizmeti olmayan bir cüzdanda saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalama: Trend ve olası dönüş noktalarını belirlemede kullanın

- RSI: Aşırı alım/aşırı satım alanlarını izleyin

- Dalgalı alım-satım için kritik noktalar:

- Teknik göstergelere göre net giriş ve çıkış noktaları belirleyin

- Fiyat tetikleyicileri için Curve ekosistem gelişmelerini gözlemleyin

CVX Risk Yönetim Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Ihtiyatlı yatırımcılar: Kripto portföyünün %1-3’ü

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

- Profesyonel yatırımcılar: Kripto portföyünün en fazla %15’i

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: CVX’i diğer DeFi ve DeFi dışı varlıklarla dengeleyin

- Zarar durdur emirleri: Olası kayıpları sınırlamak için uygulayın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan tavsiyesi: Gate Web3 Wallet

- Soğuk saklama: Uzun vadeli tutumlar için donanım cüzdanı

- Güvenlik önlemleri: İki aşamalı kimlik doğrulama, düzenli güvenlik denetimi

V. CVX için Olası Riskler ve Zorluklar

CVX Piyasa Riskleri

- Yüksek oynaklık: CVX fiyatında ciddi dalgalanmalar olabilir

- Likidite riski: Yüksek tutarlı işlemlerde zorluk yaşanabilir

- Genel kripto piyasası eğilimlerine bağlılık

CVX Düzenleyici Riskler

- DeFi projeleri için belirsiz düzenleyici ortam

- Menkul kıymet olarak sınıflandırılma ihtimali

- Uluslararası düzenleyici zorluklar

CVX Teknik Riskler

- Akıllı kontrat açıkları

- Convex Finance platformunda potansiyel istismarlar

- Ethereum ağında ölçeklenebilirlik sorunları

VI. Sonuç ve Eylem Önerileri

CVX Yatırım Değeri Değerlendirmesi

CVX, DeFi ekosisteminde yüksek risk-yüksek ödül potansiyeli barındırıyor. Uzun vadeli değeri Convex Finance’in Curve ekosistemindeki başarısına bağlı; kısa vadede ise ciddi oynaklık riski mevcut.

CVX Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Detaylı araştırma sonrası küçük, deneme amaçlı pozisyonlar alın ✅ Deneyimli yatırımcılar: Sıkı risk yönetimiyle ortalama maliyetle alım stratejisi uygulayın ✅ Kurumsal yatırımcılar: CVX’i çeşitlendirilmiş bir DeFi portföyünün parçası olarak değerlendirin

CVX Katılım Yöntemleri

- Doğrudan alım: Gate.com üzerinden CVX alın

- Stake: Convex Finance platformunda ödül kazanmak için katılım

- Getiri çiftçiliği: Ek getiri için CVX bağlantılı likidite havuzları değerlendirin

Kripto para yatırımları son derece yüksek risk taşır. Bu makale yatırım tavsiyesi değildir. Yatırımcılar, kararlarını kendi risk toleranslarına göre dikkatlice vermeli ve profesyonel finansal danışmanlara danışmalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

SSS

2025 için CVX fiyat hedefi nedir?

Piyasa analizi ve mevcut eğilimlere göre CVX’in 2025’te token başına 50-60 dolar seviyesine ulaşması öngörülmektedir.

CVX’in yükselmesi bekleniyor mu?

Evet, CVX’in yükselmesi bekleniyor. Token’ın Curve ekosistemindeki işlevi ve artan DeFi benimsenmesi, önümüzdeki yıllarda fiyatın değer kazanma potansiyelini gösteriyor.

2026 için CVX fiyat tahmini nedir?

Mevcut eğilim ve piyasa analizine göre, CVX’in 2026’da yaklaşık 25-30 dolar seviyesine ulaşması öngörülüyor; bu da mevcut değerinden 2-3 kat artış anlamına gelebilir.

2030’da Velodrome coin fiyatı ne kadar olur?

Piyasa eğilimleri ve ekosistemin büyümesiyle, 2030’da Velodrome coin fiyatı 5 ila 10 dolar aralığına ulaşabilir; bu, benimseme ve ekosistem genişlemesinin devam etmesi halinde mümkündür.

SEI Staking Analizi: %60-70 Arasında Arz Kilitli ve Fiyat Etkisi

SWELL ve RUNE: Zincirler Arası Likidite Yarışında İki Önde Gelen DeFi Protokolünün Karşılaştırılması

2025 ALCX Fiyat Tahmini: Alchemix Token’ın Geleceğine İlişkin Görünüm ve Piyasa Analizi

2025 CAKE Fiyat Tahmini: Yükseliş Trendleri ve PancakeSwap'ın Token Değerini Etkileyen Ana Unsurlar

SPO ve SNX: Yield Farming ve Staking Alanında İki Lider DeFi Protokolünün Karşılaştırılması

AVAX Token Akışının 2025’te Piyasa Değeri Üzerindeki Etkisi Nedir?

SEI Airdrop Ödülleri’ne Katılım ve Talep Etme Kılavuzu

Kripto para birimlerinde algoritmik alım satım için etkili stratejiler

Stock-to-Flow Model ile Bitcoin'in Değerlemesini Anlamak

İşlem hızının blockchain verimliliğini nasıl etkilediğini anlamak

ENS Domainleri ile Web3 Kimlik Yönetimi