2025 CHEEMS Fiyat Tahmini: Bu Meme Coin Yeni Rekorlara Ulaşacak mı, Yoksa Unutulup Gidecek mi?

Giriş: CHEEMS’in Piyasa Konumu ve Yatırım Değeri

Mizahi bir tema ile geliştirilen CHEEMS (CHEEMS), piyasaya çıktığı günden bu yana önemli bir ilerleme kaydetti. 2025 yılı itibarıyla CHEEMS’in piyasa değeri 295.977.534 $’a ulaşırken, yaklaşık 203.672.952.113.698 token dolaşımda bulunmakta ve fiyatı 0,0000014532 $ civarında seyretmektedir. “Meme’lerin Shiba Inu lordu” olarak da anılan bu varlık, kripto para sektöründe topluluk katılımı ve dayanıklılığı açısından giderek daha önemli bir konuma ulaşmaktadır.

Bu makalede, 2025-2030 döneminde CHEEMS’in fiyat hareketleri; tarihsel eğilimler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler ışığında kapsamlı biçimde analiz edilerek yatırımcılara profesyonel fiyat öngörüleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. CHEEMS Fiyat Geçmişi ve Güncel Piyasa Durumu

CHEEMS’in Tarihsel Fiyat Gelişimi

- 2024: Proje başlatıldı, fiyatı 0,0000003432 $’dan işlem gördü

- 2024 Ekim: Fiyat, tüm zamanların en düşük seviyesi olan 0,000000115 $’a indi

- 2025 Mart: CHEEMS, tüm zamanların en yüksek noktası olan 0,0000021763 $’ı gördü

CHEEMS’in Güncel Piyasa Durumu

18 Ekim 2025 itibarıyla CHEEMS, 0,0000014532 $ seviyesinden işlem görmektedir. Token, son bir yılda %386,13 artış sergileyerek güçlü bir büyüme ortaya koydu. Ancak kısa vadede dalgalı bir performans gösterdi; son 30 günde %15,39 yükselirken, geçtiğimiz hafta %8,04 ve son 24 saatte %0,89 düşüş yaşadı.

CHEEMS, kripto para piyasasında 219. sırada yer almakta, piyasa değeri 295.977.534 $’dır. Dolaşımdaki arzı 203.672.952.113.698,72 CHEEMS olup, toplam arzın %92,67’sine karşılık gelmektedir. Tam seyreltilmiş piyasa değeri ise 319.378.558,52 $’dır.

Token’ın 24 saatlik işlem hacmi 30.821,06 $ ile orta düzeyde piyasa faaliyeti göstermektedir. CHEEMS, şu an 13 farklı borsada listelenerek yatırımcılara çeşitli ticaret imkanları sunmaktadır.

Güncel CHEEMS piyasa fiyatını görüntülemek için tıklayın

CHEEMS Piyasa Duyarlılığı Göstergesi

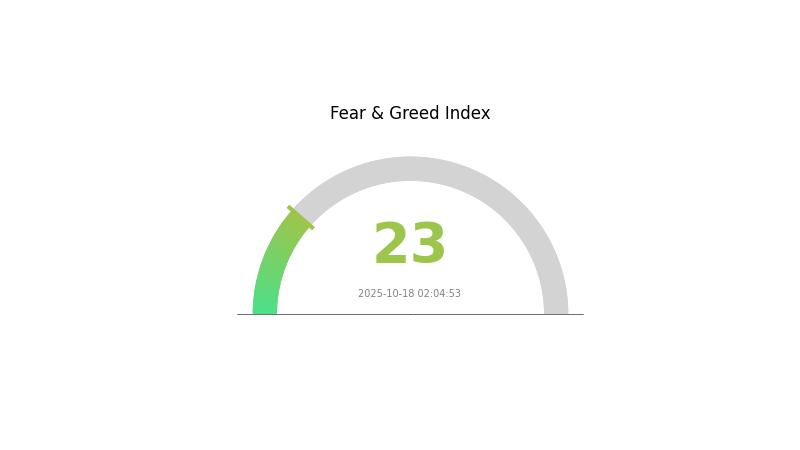

18 Ekim 2025 Korku ve Açgözlülük Endeksi: 23 (Aşırı Korku)

Güncel Korku & Açgözlülük Endeksi’ni görüntülemek için tıklayın

Kripto piyasasında aşırı korku hâkim ve duyarlılık endeksi 23’e kadar düştü. Bu seviyedeki karamsarlık, karşıt yatırımcılar için potansiyel alım fırsatı olarak değerlendirilebilir. Ancak piyasa oynaklığının sürebileceği unutulmamalı ve tedbirli hareket edilmelidir. Deneyimli yatırımcılar, riskleri azaltmak için ortalama maliyet yöntemi gibi stratejiler uygulayabilir. Her zaman olduğu gibi, kapsamlı araştırma yapmak ve etkili risk yönetimi uygulamak, bu belirsiz ortamda yatırım kararı almadan önce şarttır.

CHEEMS Varlık Dağılımı

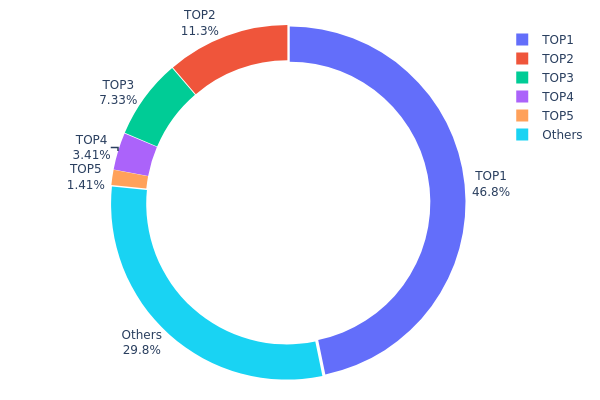

Adres bazlı varlık dağılımı verileri, CHEEMS tokenlarının adresler arasındaki yoğunlaşma düzeyine dair önemli bilgiler sunar. Yapılan analiz, oldukça yoğunlaşmış bir dağılımı ortaya koyuyor. En büyük adres, toplam arzın %46,75’ini, ilk beş adres ise toplamda %70,17’sini elinde tutuyor. Bu yoğunlaşma, token’ın merkezsizleşme seviyesi ve olası piyasa manipülasyonu açısından dikkat çekici bir risk barındırıyor.

Böylesi bir dağılım, piyasa dinamikleri açısından ciddi sonuçlar doğurabilir. “Balina” olarak adlandırılan büyük sahiplerin yüksek hacimli alım-satım işlemleri fiyat oynaklığını artırabilir. Ayrıca, bu yoğunlaşma, az sayıda adresin token yönetişimi ve fiyat hareketleri üzerinde belirleyici bir etki oluşturmasına neden olabilir.

Piyasa karakteristiği bakımından mevcut CHEEMS dağılımı, görece düşük merkezsizleşme ve kırılgan bir zincir üstü istikrar anlamına gelmektedir. Kripto piyasasında belirli bir yoğunluk olağan olsa da, bu seviyedeki toplulaşma, piyasa oyuncuları ve analistler tarafından olası riskler ve gelecekteki varlık dağılımı yakından izlenerek değerlendirilmelidir.

Güncel CHEEMS Varlık Dağılımını görüntülemek için tıklayın

| Top | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 102.754.785.353,13K | 46,75% |

| 2 | 0x0c89...518820 | 24.813.554.506,69K | 11,29% |

| 3 | 0x0000...00dead | 16.103.099.718,97K | 7,32% |

| 4 | 0x32a4...fe9a0c | 7.499.824.889,16K | 3,41% |

| 5 | 0x3823...6499c3 | 3.097.643.891,89K | 1,40% |

| - | Diğerleri | 65.507.143.472,83K | 29,83% |

II. CHEEMS’in Gelecekteki Fiyatını Etkileyen Temel Unsurlar

Arz Mekanizması

- Deflasyonist Model: CHEEMS, arzı zamanla azaltmak için token yakma mekanizması uygular.

- Tarihsel Eğilim: Önceki token yakımları genellikle kısa vadeli fiyat artışlarını beraberinde getirmiştir.

- Güncel Etki: Devam eden deflasyonist mekanizmanın, talep sabit ya da artarsa, fiyat üzerinde yukarı yönlü baskı oluşturması bekleniyor.

Kurumsal ve Balina Dinamikleri

- Kurumsal Varlıklar: Son dönemde önde gelen kripto yatırım şirketleri CHEEMS’i portföylerine dahil etti.

Makroekonomik Koşullar

- Enflasyona Karşı Koruma: CHEEMS, geleneksel enflasyon korumalarıyla belirli bir korelasyon göstererek yüksek enflasyon dönemlerinde yatırımcıların ilgisini çekebilir.

Teknik Gelişim ve Ekosistem Oluşumu

- Akıllı Kontrat Güncellemeleri: CHEEMS akıllı kontratlarındaki son güncellemeler, güvenlik ve işlevsellikte artış sağladı.

- Ekosistem Uygulamaları: CHEEMS ekosisteminde, yield farming ve likidite sağlama platformları başta olmak üzere DeFi uygulamalarında büyüme yaşandı.

III. CHEEMS 2025-2030 Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,00010 $ – 0,00012 $

- Tarafsız tahmin: 0,00012 $ – 0,00015 $

- İyimser tahmin: 0,00015 $ – 0,00018 $ (güçlü piyasa duygusu ve artan benimsenme ile)

2027-2028 Görünümü

- Piyasa evresi beklentisi: Artan oynaklıkla birlikte büyüme potansiyeli

- Fiyat aralığı öngörüsü:

- 2027: 0,00017 $ – 0,00024 $

- 2028: 0,00022 $ – 0,00030 $

- Kilit etkenler: Geniş kripto piyasası toparlanması, CHEEMS ekosisteminde artan kullanım

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,00035 $ – 0,00045 $ (istikrarlı piyasa büyümesi ve proje gelişiminin sürmesiyle)

- İyimser senaryo: 0,00050 $ – 0,00060 $ (güçlü piyasa koşulları ve kayda değer ekosistem büyümesiyle)

- Dönüştürücü senaryo: 0,00070 $ – 0,00080 $ (çığır açıcı ortaklıklar ve yaygın benimsenme ile)

- 31 Aralık 2030: CHEEMS 0,00075 $ (piyasa şartları çok elverişli olursa potansiyel zirve)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0 | 0 | 0 | 0 |

| 2026 | 0 | 0 | 0 | 19 |

| 2027 | 0 | 0 | 0 | 43 |

| 2028 | 0 | 0 | 0 | 52 |

| 2029 | 0 | 0 | 0 | 79 |

| 2030 | 0 | 0 | 0 | 89 |

IV. CHEEMS’e Özel Profesyonel Yatırım Stratejileri ve Risk Yönetimi

CHEEMS Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Uygun profiller: Uzun vadeli bakış açısına sahip, risk toleransı yüksek yatırımcılar

- İşlem önerileri:

- Piyasa düşüşlerinde CHEEMS biriktirin

- Kısmi kar almak için fiyat hedefleri belirleyin

- Token’ları çok faktörlü doğrulama ile korunan güvenli cüzdanlarda saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve olası dönüş seviyelerini belirleyin

- RSI: Aşırı alım ve aşırı satım durumlarını analiz edin

- Dalgalı işlem için önemli noktalar:

- Trend teyidi için işlem hacmini izleyin

- Riskleri sınırlamak amacıyla zararı durdur emirleri oluşturun

CHEEMS Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Orta riskli yatırımcılar: Kripto portföyünün %3-5’i

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Farklı kripto varlıklara yatırım yapın

- Zararı durdur emirleri: Potansiyel kayıpları sınırlandırmak için kullanın

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan tercihi: Gate Web3 Cüzdan

- Soğuk saklama: Uzun vadeli tutumlar için donanım cüzdanı kullanın

- Güvenlik önlemleri: İki faktörlü doğrulama aktif edin, güçlü şifreler tercih edin

V. CHEEMS İçin Potansiyel Riskler ve Zorluklar

CHEEMS Piyasa Riskleri

- Yüksek oynaklık: Meme coin’ler büyük fiyat dalgalanmalarına açık

- Piyasa duyarlılığı: Sosyal medya akımlarından yoğun şekilde etkilenir

- Likidite riski: Büyük pozisyonların likide edilmesinde zorluk yaşanabilir

CHEEMS Regülasyon Riskleri

- Regülatif inceleme: Finansal otoritelerin meme coin’lere yaklaşımı sıkılaşıyor

- Hukuki belirsizlik: Bazı ülkelerde menkul kıymet olarak sınıflandırılabilir

- İşlem kısıtlamaları: Regülasyon nedeniyle borsalardan çıkarılma olasılığı

CHEEMS Teknik Riskleri

- Akıllı kontrat açıkları: Kodda olası istismar riskleri

- Ağ tıkanıklığı: Yoğun dönemlerde yüksek işlem ücretleri

- Teknolojik eskime: Daha gelişmiş projelerin gerisinde kalma riski

VI. Sonuç ve Eylem Önerileri

CHEEMS Yatırım Değeri Değerlendirmesi

CHEEMS, meme coin’lerde sıkça karşılaşılan yüksek risk ve yüksek getiri potansiyeline sahip. Uzun vadeli değeri topluluk katılımı ve piyasa trendlerine; kısa vadede ise yüksek oynaklık ve regülasyon belirsizliğine bağlıdır.

CHEEMS Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük miktarda fon ayırın, eğitim ve araştırmaya odaklanın ✅ Deneyimli yatırımcılar: Çeşitlendirilmiş kripto portföyüne dahil edin, sıkı risk yönetimi uygulayın ✅ Kurumsal yatırımcılar: Dikkatli yaklaşın, kapsamlı durum tespiti yapın ve regülasyon etkilerini dikkate alın

CHEEMS İşlem Yöntemleri

- Spot alım-satım: Gate.com üzerinden CHEEMS alıp satabilirsiniz

- Staking: Desteklenen platformlarda staking programlarına katılın

- DeFi: Getiri çiftçiliği veya likidite sağlamak için merkeziyetsiz finans seçeneklerini değerlendirin

Kripto para yatırımları son derece yüksek risk içerir; bu makale yatırım tavsiyesi değildir. Her yatırımcı, risk toleransına göre karar vermeli ve profesyonel mali danışmanlardan destek almalıdır. Kaybetmeyi göze alamayacağınızdan fazla yatırım yapmayın.

Sıkça Sorulan Sorular

Cheems token iyi bir yatırım mı?

Evet, Cheems token güçlü bir potansiyel sergiliyor. Yenilikçi özellikleri ve büyüyen topluluk desteği, onu mevcut kripto piyasasında cazip bir seçenek haline getiriyor.

1000 Cheems Pet Coin için fiyat tahmini nedir?

Güncel piyasa eğilimleri ve evcil hayvan temalı kripto sektörünün büyüme potansiyeli dikkate alındığında, 1000 Cheems Pet Coin’in 2025 sonuna kadar 0,05 $ – 0,10 $ seviyesine ulaşması ve mevcut değerinin 5-10 katına çıkması mümkündür.

1000 Cheems Coin nedir?

1000 Cheems Coin, popüler Cheems Doge meme’inden ilham alan bir meme kripto para birimidir. Amacı, kripto ekosistemine mizah ve topluluk katılımı kazandırmaktır.

Cheems coin’e yatırım yapmanın riskleri nelerdir?

Cheems coin’e yatırım yapmak; yüksek oynaklık, regülasyon belirsizlikleri ve olası piyasa manipülasyonu gibi riskler taşır. Meme coin doğası, değerinin ve uzun vadeli sürdürülebilirliğinin öngörülemez olmasına yol açar.

2025 TOSHI Fiyat Tahmini: Dijital Varlık Ekosisteminde Piyasa Eğilimleri ve Büyüme Potansiyeli Analizi

2025 BABYDOGE Fiyat Tahmini: Bu Meme Coin, Kripto Para Piyasasında Yeni Zirvelere Yükselebilir mi?

2025 DOG Fiyat Tahmini: DOG Token’lerinin Geleceğine Yön Veren Piyasa Trendleri ve Ana Etkenlerin Analizi

2025 BAN Fiyat Tahmini: Banano Kripto Parası'nın Piyasa Trendleri ve Gelecek Büyüme Potansiyelinin Analizi

2025 ELON Fiyat Tahmini: Dogelon Mars Token’ın Gelecekteki Büyüme Potansiyeli ve Piyasa Trendleri Analizi

2025 DOGS Fiyat Tahmini: Yaklaşan Boğa Sezonu İçin Piyasa Analizi ve Tahminler

Web3 Dünyasında Gerçek Varlıkların Tokenleştirilmesi Fırsatlarını Keşfedin

Lüks tutkunlarına özel, yat konseptli NFT koleksiyonlarını keşfedin

Verimli Kripto Musluk Yönetimi İçin En İyi Araçlar

Devrim niteliğindeki milyon dolarlık Layer 2 Ethereum ölçeklendirme çözümünü keşfedin

Maksimum getiri sağlamak isteyenler için en avantajlı kripto tasarruf hesapları