2025 CFX Fiyat Tahmini: Conflux Network’te Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

Giriş: CFX’in Piyasa Konumu ve Yatırım Potansiyeli

Conflux (CFX), ölçeklenebilir merkeziyetsiz blokzincir ağı olarak, 2020’den bu yana kayda değer başarılara imza atmıştır. 2025 itibarıyla Conflux’un piyasa değeri 560.074.972 dolar seviyesine ulaşmış, dolaşımdaki arzı yaklaşık 5.145.383.306 token ve fiyatı 0,10885 dolar civarına yerleşmiştir. “Ağaç-graf konsensüsü öncüsü” olarak tanımlanan CFX, yüksek işlem hacmine sahip blokzincir uygulamaları ve merkeziyetsiz finans alanında günden güne daha kritik bir rol üstlenmektedir.

Bu makalede, Conflux’un 2025’ten 2030’a kadar olan fiyat hareketleri; tarihsel eğilimler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler ışığında değerlendirilip yatırımcılara profesyonel fiyat tahminleriyle pratik yatırım stratejileri sunulacaktır.

I. CFX Fiyat Geçmişi ve Güncel Piyasa Durumu

CFX’in Tarihsel Fiyat Gelişimi

- 2021: CFX, 27 Mart’ta 1,7 dolar ile tüm zamanların en yüksek seviyesine ulaşarak fiyat tarihinde önemli bir dönüm noktası yaşadı.

- 2022: Kripto piyasasında yaşanan düşüşle birlikte CFX fiyatı, 30 Aralık’ta 0,02199898 dolarla en düşük seviyesini gördü.

- 2025: CFX fiyatı toparlanarak şu anda 0,10885 dolardan işlem görüyor ve en düşük seviyesinden %394 oranında yükseldi.

CFX’in Güncel Piyasa Görünümü

17 Ekim 2025 itibarıyla CFX fiyatı 0,10885 dolar olup, piyasa değeri 560.074.972,87 dolardır. Token, son 24 saatte %4,5 değer kaybetmiş ve işlem hacmi 5.188.895,45 dolara ulaşmıştır. CFX, kripto piyasasında 135. sırada yer almakta ve %0,015’lik bir pazar payına sahiptir. Dolaşımdaki arz 5.145.383.306 CFX ile toplam arzın %89,98’ini oluşturmaktadır. Tamamen seyreltilmiş değeri ise 622.441.756,39 dolardır. Son bir haftada %21,64, son 30 günde ise %39,93 oranında değer kaybederek kısa ve orta vadede ayı piyasası eğilimi göstermektedir.

Güncel CFX piyasa fiyatını görüntülemek için tıklayın

CFX Piyasa Duyarlılık Göstergesi

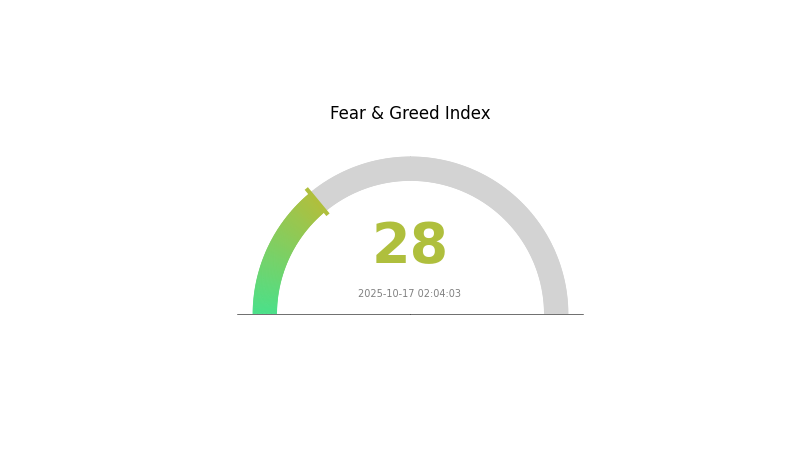

17 Ekim 2025 Korku ve Açgözlülük Endeksi: 28 (Korku)

Güncel Korku & Açgözlülük Endeksini görüntülemek için tıklayın

Kripto piyasasında duyarlılık hâlâ temkinli; Korku ve Açgözlülük Endeksi 28 ile korku düzeyinde. Bu durum, yatırımcıların çekimserliğini ve fırsat arayışını yansıtıyor. Korku ortamı yatırım için uygun bir zaman dilimi sunabilse de, kapsamlı araştırma yapmak ve kişisel risk toleransınızı göz önünde bulundurmak önemlidir. Piyasa duyarlılığının hızla değişebileceğini unutmayın; güncel kalın ve portföyünüzü çeşitlendirin. Gate.com, bu piyasa koşullarında yol almanız için farklı araçlar ve kaynaklar sunar.

CFX Varlık Dağılımı

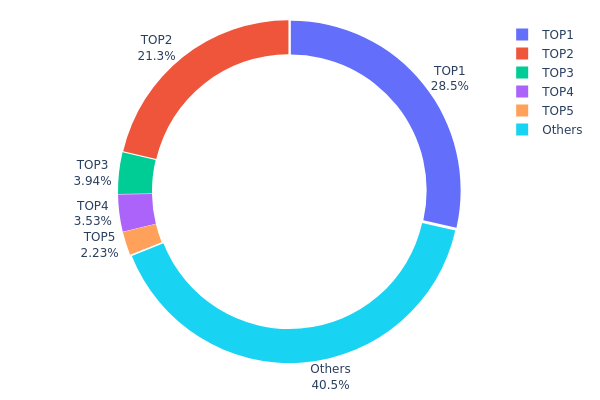

CFX adres varlık dağılımı, tokenların büyük kısmının birkaç ana sahibin elinde toplandığını gösteriyor. En büyük adres toplam arzın %28,52’sine sahipken, ikinci en büyük adresin payı %21,31. Bu iki adres, tüm CFX tokenlarının neredeyse yarısını elinde bulunduruyor. İlk beş adresin toplam payı %59,52’ye ulaşarak yüksek merkezileşmeye işaret ediyor.

Böyle bir yoğunlaşma; piyasa istikrarı ve fiyat manipülasyonu risklerini artırmaktadır. Tokenların büyük bölümünün az sayıda elde bulunması, bu yatırımcıların satış ya da transfer kararlarında volatiliteyi tetikleyebilir. Ayrıca bu düzeydeki yoğunluk, ağın merkeziyetsizlik ilkesini zedeleyebilir ve yönetişim süreçlerinde dengesiz güç dağılımına yol açabilir.

Yine de, tokenların %40,48’inin diğer adreslere dağılmış olması, daha geniş bir sahiplik tabanına işaret ediyor. Küçük yatırımcıların bu payı, büyük sahiplerin piyasadaki etkisini dengeleyerek uzun vadede istikrar ve ekosistemde çeşitli katılım fırsatları yaratabilir.

Güncel CFX Varlık Dağılımını görüntülemek için tıklayın

| En Büyük | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 307.343,85K | 28,52% |

| 2 | 0x5a52...70efcb | 229.617,08K | 21,31% |

| 3 | 0xc9c2...3cea06 | 42.500,00K | 3,94% |

| 4 | 0xa371...fa3879 | 38.087,11K | 3,53% |

| 5 | 0x112a...547efd | 24.000,13K | 2,22% |

| - | Diğerleri | 435.893,03K | 40,48% |

II. CFX’in Gelecekteki Fiyatını Belirleyen Temel Faktörler

Arz Mekanizması

- Blok Ödülü Yarılanması: Bu mekanizma, yeni CFX arzını azaltarak piyasadaki arz-talep dengesini etkileyebilir.

- Tarihsel Eğilimler: Geçmiş yarılanma dönemlerinde, arz enflasyonunun azalmasıyla fiyatlarda genellikle artış yaşanmıştır.

- Güncel Etki: Bir sonraki yarılanmanın arzı kısıtlaması ve CFX fiyatı üzerinde yukarı yönlü baskı oluşturması bekleniyor.

Kurumsal ve Balina Davranışları

- Ulusal Politikalar: Çin’in blokzincir ve kripto paralara yönelik düzenleyici tutumu, CFX’in benimsenmesi ve fiyatı üzerinde belirleyici etkiye sahiptir.

Makroekonomik Ortam

- Jeopolitik Etkenler: Özellikle Çin ve “Kuşak ve Yol Girişimi” kapsamında uluslararası ilişkiler, CFX’in küresel benimsenmesi ve değeri üzerinde etkili olabilir.

Teknolojik Gelişim ve Ekosistem Oluşumu

- Ağaç-graf Teknolojisi: Conflux’un özgün konsensüs mekanizması, işlemlerin paralel işlenmesini sağlayarak ölçeklenebilirliği artırır ve daha fazla kullanıcı ile geliştirici çekebilir.

- Ekosistem Uygulamaları: Conflux ağında DeFi, NFT ve diğer DApp’lerin gelişimi, CFX talebini artırabilir ve değerini destekleyebilir.

III. 2025-2030 Dönemine Yönelik CFX Fiyat Tahmini

2025 Görünümü

- Ihtiyatlı tahmin: 0,08589 - 0,10000 dolar

- Nötr tahmin: 0,10000 - 0,11000 dolar

- İyimser tahmin: 0,11000 - 0,13373 dolar (olumlu piyasa duyarlılığı ve proje gelişimiyle)

2027-2028 Görünümü

- Piyasa aşaması: Artan volatiliteyle potansiyel büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: 0,06585 - 0,18265 dolar

- 2028: 0,09821 - 0,22711 dolar

- Başlıca tetikleyiciler: Teknolojik ilerlemeler, genişleyen benimseme, genel kripto piyasası eğilimleri

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,19028 - 0,22548 dolar (istikrarlı büyüme ve benimseme varsayımıyla)

- İyimser senaryo: 0,22548 - 0,26069 dolar (güçlü piyasa koşulları ve proje başarısı ile)

- Dönüştürücü senaryo: 0,26069 - 0,31342 dolar (çığır açan inovasyonlar ve kitlesel kabul ile)

- 31 Aralık 2030: CFX 0,31342 dolar (iyimser projeksiyonla potansiyel zirve fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,13373 | 0,10872 | 0,08589 | 0 |

| 2026 | 0,12728 | 0,12122 | 0,10061 | 11 |

| 2027 | 0,18265 | 0,12425 | 0,06585 | 14 |

| 2028 | 0,22711 | 0,15345 | 0,09821 | 41 |

| 2029 | 0,26069 | 0,19028 | 0,14081 | 74 |

| 2030 | 0,31342 | 0,22548 | 0,12402 | 107 |

IV. CFX İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

CFX Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Uygun profiller: Uzun vade yatırımcıları ve Conflux teknolojisine inananlar

- Operasyon önerileri:

- Piyasa düşüşlerinde CFX toplayın

- Kısmi kar realizasyonu için fiyat hedefleri belirleyin

- Varlıklarınızı güvenli, saklama hizmeti olmayan bir cüzdanda saklayın

(2) Aktif Alım Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve potansiyel dönüşleri tespit etmek için

- RSI: Aşırı alım/satım durumlarını ölçmek için

- Salınım ticaretinde dikkat edilmesi gerekenler:

- Trend onayı için işlem hacmini izleyin

- Zarar-durdur emirleriyle riskleri yönetin

CFX Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcı: Kripto portföyünün %1-3’ü

- Orta riskli yatırımcı: Kripto portföyünün %3-7’si

- Agresif yatırımcı: Kripto portföyünün %7-15’i

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Farklı kripto varlıklara yatırım yapın

- Zarar-durdur emirleri: Olası kayıpları sınırlayın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan: Gate Web3 Wallet önerilir

- Soğuk depolama: Uzun vadeli tutum için donanım cüzdan

- Güvenlik: İki faktörlü kimlik doğrulama etkinleştirilmeli, güçlü şifre kullanılmalı

V. CFX’e İlişkin Potansiyel Riskler ve Zorluklar

CFX Piyasa Riskleri

- Volatilite: Kripto piyasaları aşırı dalgalı

- Rekabet: Blokzincir ölçeklenebilirlik alanında artan oyuncu sayısı

- Benimsenme: Yavaş benimsenme uzun vadede değer üzerinde baskı oluşturabilir

CFX Düzenleyici Riskler

- Düzenleyici belirsizlik: Değişen küresel düzenlemeler CFX’i etkileyebilir

- Uyum sorunları: Yeni standartlara uyumda zorluklar

- Hukuki statü: Bazı ülkelerde hukuki durum belirsiz

CFX Teknik Riskler

- Ağ güvenliği: Conflux ağında olası açıklar

- Ölçeklenebilirlik sorunları: Yüksek işlem hacmini sürdürememe riski

- Akıllı sözleşme riskleri: Conflux’ta geliştirilen akıllı sözleşmelerde hata veya açıklar

VI. Sonuç ve Öneriler

CFX Yatırım Değeri Değerlendirmesi

CFX, yüksek işlem hacmine olanak tanıyan blokzincir çözümüyle benzersiz bir değer sunar, ancak ciddi rekabet ve düzenleyici belirsizliklerle karşı karşıyadır. Uzun vadede potansiyel mevcut, ancak kısa vadede volatilite ve benimseme zorlukları risk oluşturmaktadır.

CFX Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük miktarlarda başlayın, teknoloji hakkında bilgi edinin

✅ Deneyimli yatırımcılar: CFX’i çeşitlendirilmiş portföye dahil edin

✅ Kurumsal yatırımcılar: Detaylı araştırma yapın, düzenleyici gelişmeleri izleyin

CFX İşlem Katılım Yöntemleri

- Spot işlem: Gate.com’da CFX alım-satımı yapın

- Staking: Pasif gelir için staking programlarına katılın

- DeFi: Conflux tabanlı merkeziyetsiz finans uygulamalarını keşfedin

Kripto para yatırımları çok yüksek risk içerir. Bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarına göre dikkatli karar vermeli ve profesyonel finansal danışmanlara başvurmalıdır. Kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

SSS

CFX iyi bir yatırım mı?

CFX, 2030’da 1 dolar ve 2040’ta 4 dolar seviyelerine ulaşabileceği öngörüsüyle güçlü bir büyüme potansiyeline sahip. Çin blokzincir ekosistemindeki özel konumu, yüksek getiri arayan risk iştahlı yatırımcılar için cazip bir seçenek oluşturuyor.

CFX neden yükseliyor?

CFX, olumlu düzenleyici ortam, teknolojik ilerlemeler ve politik destek sayesinde yükselişte. Bu faktörlerin birleşimi, değer artışını destekliyor.

CFX neden değer kazanıyor?

CFX, artan benimseme, ağ güncellemeleri ve Conflux üzerindeki DeFi ekosisteminin büyümesiyle talep ve yatırımcı ilgisinin artması sonucunda yükseliyor.

Conflux’a yatırım yapmanın riskleri neler?

Conflux’a yatırım yapmak; Çin hükümetinin etkisiyle ortaya çıkan jeopolitik ve düzenleyici riskler, piyasa volatilitesi ve olası teknolojik zorluklar içerir.

2025 DEEP Fiyat Tahmini: Dijital Ekonomi Geliştirilmiş Protokollerinin Gelecek Piyasa Trendleri ve Büyüme Potansiyeli Analizi

2025 UMA Fiyat Tahmini: DeFi Sektöründe Piyasa Trendleri ve Gelecek Büyüme Potansiyelinin Analizi

2025 SPK Fiyat Tahmini: SPK Token’e Yönelik Piyasa Eğilimleri ve Gelecekteki Değerleme Beklentilerinin Analizi

2025 AUCTION Fiyat Tahmini: Küresel açık artırma sektöründe piyasa trendleri ve gelecekteki değerleme faktörlerinin profesyonel analizi

2025 WNXM Fiyat Tahmini: Merkeziyetsiz Sigorta Sektöründe Büyüme Potansiyeli ve Piyasa Faktörlerinin Analizi

2025 INJ Fiyat Tahmini: Yükseliş Eğilimleri ve Injective Protocol’ün Gelecekteki Değerini Belirleyen Temel Unsurlar

Web3 için ENS Domainlerinin sağladığı avantajları keşfedin

Dijital cüzdanda Açık Anahtar ve Özel Anahtar kavramlarını anlamak

Merkeziyetsiz Alım Satımın Keşfi: Cosmos Platformuna Kapsamlı Bir Rehber

Dogecoin madenciliği teknikleriyle maksimum kâr elde edin

Gelişmiş MPC Cüzdan Teknolojisi sayesinde kripto para güvenliği daha üst seviyeye taşınıyor