2025 BTC Fiyat Tahmini: Makroekonomik Faktörler ve Kurumsal Benimseme Trendlerinin Analizi

Giriş: BTC'nin Piyasa Konumu ve Yatırım Potansiyeli

Bitcoin (BTC), kripto para sektörünün öncüsü ve lideri olarak, 2008'deki doğuşundan bu yana olağanüstü bir başarı elde etti. 2025 yılı itibarıyla Bitcoin'in piyasa değeri $2.236.308.488.262,60 seviyesine ulaşırken, dolaşımdaki arzı yaklaşık 19.916.431 coin ve fiyatı $112.284,6 civarında seyrediyor. "Dijital altın" olarak adlandırılan bu varlık, küresel finans sisteminde ve değer saklama aracı olarak giderek daha stratejik bir rol üstleniyor.

Bu makalede, Bitcoin'in 2025-2030 yılları arasındaki fiyat hareketleri; geçmiş trendler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler ışığında kapsamlı şekilde analiz edilerek yatırımcılara profesyonel fiyat öngörüleri ve pratik yatırım stratejileri sunulacaktır.

I. BTC Fiyat Geçmişi ve Güncel Piyasa Durumu

BTC Fiyatının Tarihsel Gelişimi

- 2009: Bitcoin piyasaya sürüldü, fiyatı fiilen $0

- 2013: İlk büyük fiyat artışı, Kasım'da $1.242'ye ulaştı

- 2017: Boğa piyasası, Aralık'ta fiyat $19.783,06 ile zirve yaptı

- 2020: COVID-19 pandemisi etkisiyle Mart'ta fiyat $3.858'e geriledi

- 2021: Kasım'da tüm zamanların en yüksek seviyesi $68.789,63'e ulaşıldı

BTC'nin Güncel Piyasa Durumu

5 Eylül 2025 itibarıyla Bitcoin (BTC) $112.284,6 seviyesinden işlem görüyor. Son 24 saatte %1,3'lük pozitif fiyat değişimi ve $1.094.534.246,01 işlem hacmiyle BTC, $2.236.308.488.262,60 piyasa değeri ve %54,56 piyasa hakimiyetiyle en büyük kripto para olma konumunu sürdürüyor.

Bitcoin, son bir yılda %93,60 oranında kayda değer bir yükseliş yaşadı. Ancak son 30 günde %1,48'lik hafif bir gerileme görüldü. Mevcut fiyat, 14 Ağustos 2025'te kaydedilen $124.128'lik tüm zamanların en yüksek seviyesine oldukça yakın.

Dolaşımdaki Bitcoin arzı 19.916.431 BTC olup, bu miktar maksimum arzın (%21.000.000 BTC) %94,84'üne karşılık gelmektedir. Bitcoin'in tam seyreltilmiş piyasa değeri ise $2.357.976.600.000,00'dır.

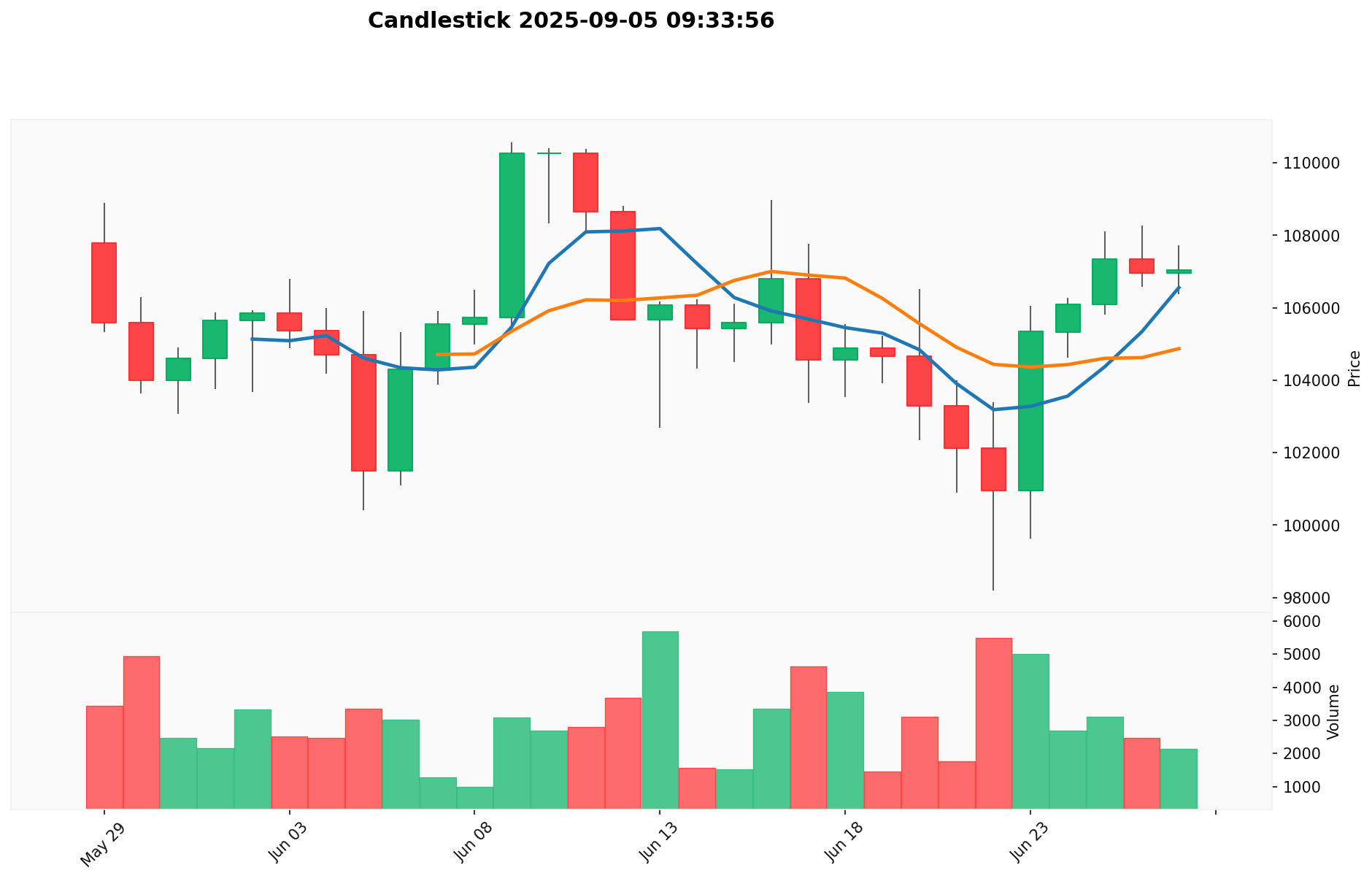

Güncel BTC piyasa fiyatını görüntülemek için tıklayın

BTC Piyasa Duyarlılığı Endeksi

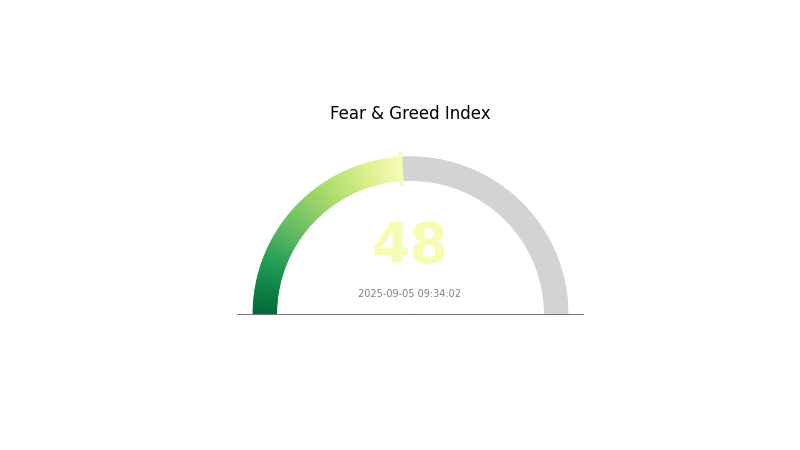

2025-09-05 Korku ve Açgözlülük Endeksi: 48 (Nötr)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto para piyasasında duyarlılık bugün nötr seviyede; Korku ve Açgözlülük Endeksi 48 olarak ölçülüyor. Bu dengeli durum, yatırımcıların aşırı korku veya aşırı açgözlülükten uzak olduğunu gösteriyor. Piyasada temkinli bir istikrar hakim. Yatırımcılar ve traderlar, bu nötr pozisyonun kripto sektöründeki yeni gelişmelere bağlı olarak her iki yöne de değişebileceği için piyasa trendlerini yakından takip etmelidir.

BTC Varlık Dağılımı

Bitcoin adreslerindeki varlık dağılımı, ağ genelinde BTC sahipliğinin yoğunluğunu gösterir. Verilere göre, ilk 5 adres toplam Bitcoin arzının yaklaşık %3,79'unu elinde bulundururken, en büyük adres tüm BTC'nin %1,25'ini kontrol ediyor.

Bu dağılım, sahipliğin görece merkeziyetsiz olduğunu gösteriyor; Bitcoin'in büyük kısmı (%96,21) ilk 5 adres dışında tutuluyor. Bu çeşitlilik, tek bir büyük sahibin piyasa manipülasyonu riskini azaltıyor. Ancak, 100.000 BTC'nin üzerinde varlığa sahip adresler, ekosistemde etkili oyuncuların varlığına işaret ediyor ve piyasa dinamiklerini etkileyebiliyor.

Mevcut dağılım, büyük paydaşlarla birlikte çeşitli küçük sahipler arasında sağlıklı bir denge sunuyor. Bu yapı, Bitcoin'in genel istikrarını ve koordineli piyasa hareketlerine karşı dayanıklılığını artırıyor. Ayrıca, merkeziyetsizlik ilkesine uygun olsa da, sahiplik yoğunluğunun izlenmesi, uzun vadeli piyasa sağlığı ve olası risklerin değerlendirilmesi açısından kritik önem taşıyor.

Güncel BTC Varlık Dağılımı için tıklayın

| Üst | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 34xp4v...4Twseo | 248,60K | %1,25 |

| 2 | bc1ql4...8859v2 | 140,57K | %0,71 |

| 3 | 3M219K...DjxRP6 | 140,40K | %0,70 |

| 4 | bc1qgd...jwvw97 | 130,01K | %0,65 |

| 5 | bc1qaz...uxwczt | 94,64K | %0,48 |

| - | Diğerleri | 19.162,06K | %96,21 |

II. BTC'nin Gelecekteki Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Halving: Bitcoin'in arzı, blok ödülünün yaklaşık her dört yılda bir yarıya indirildiği "halving" süreciyle kontrol ediliyor.

- Tarihsel Desen: Önceki halving dönemlerinde, sonraki aylarda genellikle belirgin fiyat artışları yaşandı.

- Mevcut Etki: Bir sonraki halving'in 2024'te gerçekleşmesi bekleniyor ve bu, Bitcoin fiyatını yukarı çekebilir.

Kurumsal ve Whale Dinamikleri

- Kurumsal Varlıklar: Büyük kurumlar Bitcoin varlıklarını artırıyor; MicroStrategy ve Tesla gibi şirketler önemli yatırımlar yaptı.

- Kurumsal Benimseme: PayPal, Square ve Visa gibi şirketler Bitcoin'i hizmetlerine entegre ederek ana akım kabulünü artırıyor.

- Ulusal Politikalar: El Salvador, Bitcoin'i yasal para olarak kabul etti; diğer ülkeler ise kripto paralar için düzenleyici çerçeveler oluşturmayı araştırıyor.

Makroekonomik Ortam

- Para Politikası Etkisi: Merkez bankalarının, özellikle Federal Reserve'in politikaları, Bitcoin'in enflasyona karşı koruma aracı olarak görülmesi nedeniyle fiyatını etkileyebiliyor.

- Enflasyon Korumalı Özellikler: Bitcoin, yüksek enflasyon ve ekonomik belirsizlik dönemlerinde yatırımcıların ilgisini çekerek enflasyona karşı koruma potansiyeli gösteriyor.

- Jeopolitik Faktörler: Küresel siyasi gerilimler ve ekonomik istikrarsızlık, Bitcoin'e değer saklama aracı ve geleneksel finansal sistemlere alternatif olarak ilgiyi artırıyor.

Teknik Gelişmeler ve Ekosistem Genişlemesi

- Lightning Network: Bu ikinci katman çözümü, Bitcoin'in ölçeklenebilirliğini ve işlem hızını artırarak günlük işlemler için kullanımını genişletiyor.

- Taproot Yükseltmesi: Bitcoin'in gizlilik ve akıllı sözleşme yeteneklerini geliştiren bu yükseltme, kullanım alanlarını artırıyor.

- Ekosistem Uygulamaları: Bitcoin yan zincirlerinde ve ikinci katman çözümlerinde geliştirilen DeFi uygulamaları, Bitcoin ekosistemini basit transferlerin ötesine taşıyor.

III. 2025-2030 Bitcoin Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: $69.550 - $90.000

- Nötr tahmin: $90.000 - $112.178

- İyimser tahmin: $112.178 - $144.710 (olumlu piyasa koşulları ve artan kurumsal benimseme ile)

2027 Orta Vadeli Görünüm

- Piyasa aşaması beklentisi: Yüksek büyüme ve volatilite potansiyeli

- Fiyat aralığı tahmini:

- 2026: $83.488 - $159.271

- 2027: $115.086 - $175.506

- Ana katalizörler: Halving, artan ana akım benimseme ve düzenleyici netlik

2030 Uzun Vadeli Görünüm

- Temel senaryo: $151.582 - $174.233 (istikrarlı büyüme ve benimseme ile)

- İyimser senaryo: $174.233 - $228.245 (yaygın kurumsal benimseme ve olumlu düzenlemeler ile)

- Dönüştürücü senaryo: $228.245+ (Bitcoin'in küresel rezerv varlığı haline gelmesiyle)

- 2025-09-05: Bitcoin $112.178 (2025 için ortalama fiyat tahmini)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 144.710,39 | 112.178,6 | 69.550,73 | 0 |

| 2026 | 159.271,18 | 128.444,50 | 83.488,92 | 14 |

| 2027 | 175.506,56 | 143.857,84 | 115.086,27 | 28 |

| 2028 | 164.472,66 | 159.682,20 | 124.552,11 | 42 |

| 2029 | 186.389,05 | 162.077,43 | 111.833,43 | 44 |

| 2030 | 228.245,54 | 174.233,24 | 151.582,92 | 55 |

IV. BTC Profesyonel Yatırım Stratejileri ve Risk Yönetimi

BTC Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Bitcoin'in uzun vadeli potansiyeline inananlar

- Uygulama önerileri:

- Zamanlama riskini azaltmak için dolar-maliyet ortalaması (DCA) uygulayın

- Piyasa döngülerinde pozisyonunuzu koruyun, uzun vadeli değer odaklı hareket edin

- Güvenli saklama için donanım cüzdanı kullanın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve olası dönüş noktalarını belirleyin

- Göreli Güç Endeksi (RSI): Aşırı alım/aşırı satım bölgelerini tespit edin

- Dalgalı ticaret için ana noktalar:

- Teknik göstergelere göre net giriş ve çıkış noktaları belirleyin

- Pozisyon büyüklüğünü yönetin, zarar durdur emirleriyle riski sınırlayın

BTC Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Portföyün %1-5'i

- Orta düzey yatırımcılar: Portföyün %5-10'u

- Agresif yatırımcılar: Portföyün %10-20'si

(2) Riskten Korunma Çözümleri

- Opsiyon stratejileri: Aşağı yönlü koruma için put opsiyonları kullanın

- Çeşitlendirme: Farklı kripto paralar ve geleneksel varlıklar arasında dağıtım yapın

(3) Güvenli Saklama Çözümleri

- Donanım cüzdanı önerisi: Ledger Nano X veya Trezor Model T

- Soğuk saklama: Kağıt cüzdan veya hava boşluklu bilgisayar kullanımı

- Güvenlik önlemleri: Güçlü şifreler, 2FA etkinleştirme, düzenli yedekleme

V. BTC Potansiyel Riskler ve Zorluklar

BTC Piyasa Riskleri

- Volatilite: Yoğun fiyat dalgalanmaları ciddi kayıplara yol açabilir

- Likidite riski: Büyük işlemler fiyatları etkileyebilir

- Piyasa manipülasyonu: Whale aktiviteleri fiyat hareketlerini etkileyebilir

BTC Düzenleyici Riskler

- Devlet müdahaleleri: Bazı ülkelerde olası yasaklar veya kısıtlamalar

- Vergi etkileri: Değişen vergi mevzuatı kârlılığı etkileyebilir

- AML/KYC gereklilikleri: Sıkı düzenlemeler erişimi sınırlayabilir

BTC Teknik Riskler

- 51% saldırısı: Ağın kontrolünü ele geçirme riski

- Yazılım hataları: Protokolde kritik açıklar oluşabilir

- Kuantum bilgisayar tehdidi: Gelecekteki teknolojik gelişmeler kriptografik güvenliği riske atabilir

VI. Sonuç ve Eylem Önerileri

BTC Yatırım Değeri Değerlendirmesi

Bitcoin, yüksek riskli ve yüksek getirili bir varlık olmayı sürdürüyor; uzun vadede önemli potansiyel sunarken kısa vadede de ciddi volatilite barındırıyor. Sınırlı arzı ve artan kurumsal benimseme değerini desteklerken, düzenleyici belirsizlik ve piyasa manipülasyonu riskleri devam ediyor.

BTC Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayın, eğitim ve risk yönetimine odaklanın ✅ Deneyimli yatırımcılar: Temel bir portföy tutun, kenarda aktif alım-satım yapın ✅ Kurumsal yatırımcılar: Bitcoin'i portföy çeşitlendirme ve enflasyon koruma aracı olarak değerlendirin

BTC Katılım Yöntemleri

- Spot alım-satım: Bitcoin'i doğrudan satın alın ve sahip olun

- Bitcoin ETF'leri: Düzenlenmiş finansal ürünler aracılığıyla yatırım yapın (uygun olduğu ülkelerde)

- Bitcoin madenciliği: Ağ güvenliğine katkı sağlayarak blok ödülleri kazanın

Kripto para yatırımları yüksek risk taşır; bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarına göre hareket etmeli ve profesyonel finansal danışmanlara başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

2025 yılı BTC fiyat tahmini: Dijital altının 200.000 ABD Doları seviyesini aşma potansiyeline ilişkin teknik ve makro analiz

2025 yılı BTC fiyat tahmini: Bitcoin boğa piyasası döngüsünde ulaşılacak yeni zirveler ve küresel makroekonomik etkilerin kapsamlı analizi

2025 BTC Fiyat Tahmini: Halving Sonrası Dönemde Piyasa Döngüleri ve Kurumsal Benimsemede Yol Haritası

2025'te Bitcoin'in Fiyat Dalgalanması Ne Kadar Yüksek Olacak?

2025 BTC Fiyat Tahmini: Bitcoin'in Gelecekteki Değeri İçin Piyasa Trendleri ve Uzman Tahminlerinin Analizi

Bitcoin Fiyat Eğilimleri ve Geleceğe Yönelik Piyasa Analizleri

Dropee Günlük Kombinasyonu 9 Aralık 2025

Tomarket Günlük Kombinasyonu 9 Aralık 2025

Web3 Dünyasında Gerçek Varlıkların Tokenleştirilmesi Fırsatlarını Keşfedin

Lüks tutkunlarına özel, yat konseptli NFT koleksiyonlarını keşfedin

Verimli Kripto Musluk Yönetimi İçin En İyi Araçlar