2025 BOME Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Değerlendirilmesi

Giriş: BOME'un Piyasadaki Konumu ve Yatırım Değeri

BOOK OF MEME (BOME), Solana Zinciri üzerinde bir meme coin olarak 2024’te piyasaya sürülmesinden bu yana dikkat çekiyor. 2025 yılı itibarıyla BOME’un piyasa değeri 72.629.041 dolar seviyesine ulaşırken, dolaşımdaki arzı yaklaşık 68.999.659.569 tokena çıktı ve fiyatı 0,0010526 dolar civarında seyrediyor. “Doodle Master’ın Token’ı” olarak tanımlanan bu varlık, meme coin ve dijital sanat ekosistemlerinde giderek daha belirleyici bir rol üstleniyor.

Bu makalede, 2025-2030 arası dönemde BOME’nin fiyat hareketleri; geçmiş trendler, piyasa arz-talep dengesi, ekosistem büyümesi ve makroekonomik koşullar ışığında kapsamlı biçimde analiz edilerek yatırımcılara profesyonel fiyat öngörüleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. BOME Fiyat Geçmişi ve Güncel Piyasa Durumu

BOME Tarihsel Fiyat Gelişimi

- 2024: Proje lansmanı; 16 Mart’ta fiyat, 0,028312 dolar ile zirve yaptı

- 2025: Piyasa gerilemesiyle 10 Ekim’de fiyat, 0,0003723 dolar ile dip seviyesini gördü

BOME Güncel Piyasa Görünümü

22 Ekim 2025 itibarıyla BOME, 0,0010526 dolar seviyesinden işlem görüyor ve kripto para piyasasında 489. sırada yer alıyor. Token, son 24 saatte -%4,51’lik fiyat değişimiyle yüksek volatilite gösterdi. BOME’un piyasa değeri 72.629.041,66 dolar olup, toplam piyasa payı %0,0018 düzeyindedir.

BOME, son bir yılda %87,8 oranında değer kaybederek genel piyasa gerilemesini yansıttı. Kısa vadede ise token, farklı zaman dilimlerinde negatif performans sergiledi:

- 1 saatlik değişim: -%0,38

- 24 saatlik değişim: -%4,51

- 7 günlük değişim: -%12,62

- 30 günlük değişim: -%45,2

Son 24 saatteki işlem hacmi 2.943.853,42 dolar olup piyasanın orta düzeyde aktif olduğunu gösteriyor. BOME’un dolaşımdaki arzı 68.999.659.569 adet olup, toplam ve maksimum arzına eşittir; bu da gelecekte yeni token basımı planlanmadığına işaret eder.

Güncel BOME piyasa fiyatını görüntülemek için tıklayın

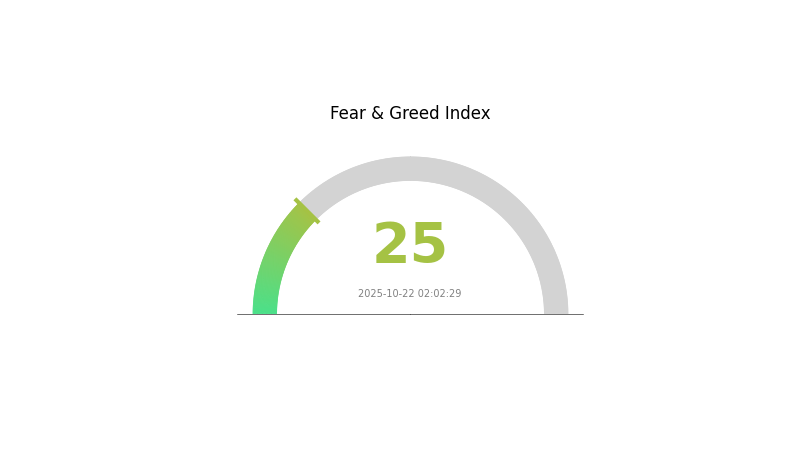

BOME Piyasa Duyarlılığı Göstergesi

22 Ekim 2025 Korku ve Açgözlülük Endeksi: 25 (Aşırı Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto para piyasasında şu an aşırı korku hakim; Korku ve Açgözlülük Endeksi 25 gibi düşük bir seviyede. Bu durum, yatırımcılar arasında temkinli bir havanın baskın olduğunu ve piyasanın aşırı satılmış olabileceğini gösteriyor. Bu seviyedeki korku, ters yatırımcılar için fırsatlar sunabilir; ancak piyasaya temkinli yaklaşmak, detaylı araştırma yapmak ve sağlam risk yönetimi uygulamak gerekir. Piyasa duyarlılığının hızla değişebileceği unutulmamalı ve stratejiler buna göre güncellenmelidir.

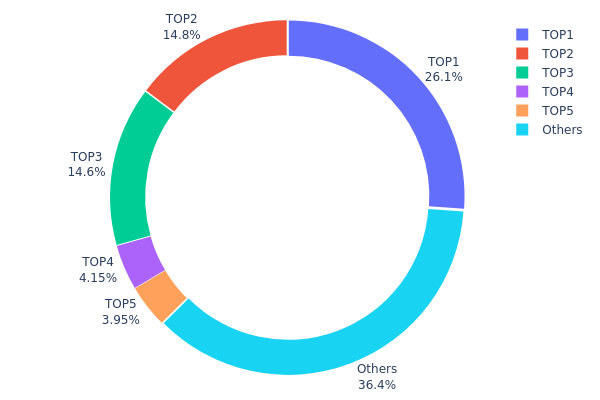

BOME Varlık Dağılımı

Adres bazlı varlık dağılımı grafiği, BOME tokenlarının cüzdanlar arasında nasıl dağıldığını gösterir. Verilere göre, en büyük sahiplerin elinde BOME’un yüksek oranı bulunuyor. İlk üç adres toplam arzın %55,5’ini, en büyük sahip ise tüm tokenların %26,12’sini elinde tutuyor.

Böyle bir yoğunlaşma, piyasa manipülasyonu ve fiyat oynaklığı riskini artırır. Büyük sahiplerin yüksek miktarda token hareket ettirmesi veya satması, piyasada önemli dalgalanmalara yol açabilir. Öte yandan, tokenların %36,42’si diğer adresler arasında dağılmış; bu da küçük yatırımcıların da sistemde yer aldığını gösteriyor.

Mevcut dağılım, BOME zincirinde orta seviyede merkeziyetleşmeye işaret ediyor. Büyük yatırımcılar piyasaya belli bir istikrar kazandırsa da, bu durum merkeziyetsizlik ve piyasa sağlığı açısından riskler barındırır. Bu büyük adreslerin ve önemli token hareketlerinin düzenli olarak izlenmesi, BOME’un geleceği için kritik öneme sahiptir.

Güncel BOME Varlık Dağılımı için tıklayın

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 3gd3dq...hCkW2u | 18.000.735,29K | 26,12% |

| 2 | 9WzDXw...YtAWWM | 10.162.887,35K | 14,75% |

| 3 | 5Q544f...pge4j1 | 10.085.544,61K | 14,63% |

| 4 | CBEADk...sebkVG | 2.856.651,50K | 4,14% |

| 5 | 5LZkAT...mtboT2 | 2.718.036,57K | 3,94% |

| - | Others | 25.071.478,02K | 36,42% |

II. BOME’un Gelecekteki Fiyatını Etkileyen Temel Unsurlar

Arz Mekanizması

- Tarihsel Eğilimler: Geçmiş arz değişiklikleri, BOME fiyatında hem keskin yükselişlere hem de sert düşüşlere neden olarak yüksek volatiliteye yol açtı.

- Güncel Etki: Mevcut arz dinamikleri fiyat hareketlerinde etkisini sürdürüyor ve istikrarsızlık yaratıyor.

Kurumsal ve Whale Dinamikleri

- Topluluk Benimsemesi: BOME, hem Çinli hem de İngilizce konuşan topluluklarda popülerlik kazandı; başarılı ön satışıyla 10.131 SOL topladı.

Makroekonomik Ortam

- Para Politikası Etkisi: ABD Üretici Fiyat Endeksi (PPI) gibi göstergeler, genel piyasa duyarlılığı ve Fed kararlarını etkileyerek BOME fiyatına da yansıyabilir.

- Jeopolitik Faktörler: Uluslararası ekonomik veriler ve merkez bankası politikaları, genel kripto piyasası trendlerini etkileyerek BOME üzerinde dolaylı etki yaratabilir.

Teknik Gelişim ve Ekosistem Oluşumu

- Piyasa Duyarlılığı: Meme coin olarak BOME’un fiyatı, sosyal medya trendleri ve kripto piyasasındaki genel duyarlılığa son derece duyarlıdır.

- Ekosistem Uygulamaları: BOME’un başarısı, genel meme coin piyasası ve Solana ekosistemindeki konumuna bağlıdır.

III. 2025-2030 BOME Fiyat Tahmini

2025 Beklentisi

- Temkinli tahmin: 0,00084 – 0,00095 dolar

- Tarafsız tahmin: 0,00095 – 0,00105 dolar

- İyimser tahmin: 0,00105 – 0,00119 dolar (olumlu piyasa havası ve artan benimseme şartıyla)

2027-2028 Beklentisi

- Piyasa döngüsü: Yüksek volatiliteyle potansiyel büyüme dönemi

- Fiyat aralığı öngörüsü:

- 2027: 0,00083 – 0,00190 dolar

- 2028: 0,00102 – 0,00170 dolar

- Ana katalizörler: BOME teknolojisinin yaygınlaşması, olumlu düzenleyici gelişmeler

2029-2030 Uzun Vadeli Beklenti

- Temel senaryo: 0,00166 – 0,00201 dolar (istikrarlı piyasa büyümesi ve benimseme varsayımıyla)

- İyimser senaryo: 0,00201 – 0,00236 dolar (hızlı benimseme ve olumlu piyasa koşullarıyla)

- Dönüştürücü senaryo: 0,00236 – 0,00250 dolar (çığır açıcı uygulamalar ve ana akım kabul şartıyla)

- 2030-12-31: BOME 0,00207 dolar (yıl sonu kar realizasyonu öncesi potansiyel zirve)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0,00119 | 0,00105 | 0,00084 | 0 |

| 2026 | 0,00154 | 0,00112 | 0,00086 | 6 |

| 2027 | 0,0019 | 0,00133 | 0,00083 | 26 |

| 2028 | 0,0017 | 0,00162 | 0,00102 | 53 |

| 2029 | 0,00236 | 0,00166 | 0,0009 | 57 |

| 2030 | 0,00207 | 0,00201 | 0,00185 | 90 |

IV. BOME İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

BOME Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Kimlere uygun: Uzun vadeli bakış açısıyla yüksek risk toleransına sahip yatırımcılar

- Operasyonel öneriler:

- Piyasa geri çekilmelerinde BOME biriktirin

- Kısmi kar realizasyonu için fiyat hedefleri belirleyin

- Token’ları güvenli Gate Web3 cüzdanında saklayın

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Kısa ve uzun vadeli trendleri izleyin

- RSI (Göreceli Güç Endeksi): Aşırı alım/satım noktalarını tespit edin

- Dalgalı işlemler için ana noktalar:

- Sıkı zarar durdur seviyeleri uygulayın

- Önceden belirlenmiş seviyelerde kar alın

BOME Risk Yönetimi Çerçevesi

(1) Portföy Dağılımı İlkeleri

- Temkinli yatırımcılar: Toplam portföyün %1-2’si

- Agresif yatırımcılar: %3-5

- Profesyonel yatırımcılar: %5-10

(2) Riskten Korunma Yöntemleri

- Diversifikasyon: Yatırımları farklı meme coin’ler ve diğer kripto varlıklar arasında dağıtın

- Zarar durdur emirleri: Potansiyel kayıpları sınırlamak için otomatik satış emirleri kullanın

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan: Gate Web3 cüzdan önerilir

- Soğuk depolama: Uzun vadeli varlıklar için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü doğrulama, güçlü şifreler ve özel anahtarları çevrimdışı tutmak

V. BOME İçin Potansiyel Riskler ve Zorluklar

BOME Piyasa Riskleri

- Yüksek volatilite: Meme coin’lerde aşırı fiyat dalgalanmaları sıktır

- Temel değer eksikliği: BOME fiyatı büyük ölçüde spekülasyon ve sosyal medya etkisiyle belirleniyor

- Piyasa duyarlılığı değişimleri: Yatırımcı duyarlığındaki ani değişimler, sert fiyat hareketlerine yol açabilir

BOME Düzenleyici Riskleri

- Artan denetim: Düzenleyiciler meme coin’lere yönelik daha sıkı kurallar getirebilir

- Olası yasaklar: Bazı ülkelerde meme coin alım-satımı veya bulundurulması yasaklanabilir

- Vergisel belirsizlikler: Meme coin yatırımlarında net olmayan veya değişken vergi düzenlemeleri

BOME Teknik Riskleri

- Akıllı sözleşme açıkları: Token kodundaki olası hatalar istismara açık olabilir

- Ölçeklenebilirlik sorunları: Solana ağı yoğunluk dönemlerinde tıkanıklık yaşayabilir

- Merkeziyet endişeleri: Proje sahibinin token dağıtımı ve yönetim üzerindeki etkisi

VI. Sonuç ve Eylem Önerileri

BOME Yatırım Değeri Değerlendirmesi

BOME, meme coin segmentinde yüksek riskli ve yüksek getirili bir seçenek olarak öne çıkıyor. Kayda değer bir fiyat artışı potansiyeli barındırsa da, uzun vadeli değer önerisi halen spekülatif nitelikte. Kısa vadeli riskler arasında yüksek volatilite ve düzenleyici belirsizlikler öne çıkıyor.

BOME Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Portföyünüzde çok küçük bir pay ayırın veya hiç yatırım yapmayın ✅ Deneyimli yatırımcılar: Çeşitlendirilmiş kripto portföyünde küçük oranlarda değerlendirilebilir ✅ Kurumsal yatırımcılar: Dikkatli yaklaşmalı, yalnızca geniş bir meme coin endeksi kapsamında değerlendirmelidir

BOME İşlem Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinden BOME alım-satımı

- Limit emirleri: Belirli fiyat seviyelerinden alış/satış emri vererek risk yönetimi

- Düzenli alım yöntemi: Volatilitenin etkisini azaltmak için düzenli ve küçük tutarlı yatırımlar

Kripto para yatırımları yüksek risk içerir ve bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk profillerine göre dikkatli karar vermeli ve profesyonel finansal danışmanlardan destek almalıdır. Kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

Sıkça Sorulan Sorular

BOME coin 1 dolara ulaşır mı?

Mevcut trendler dikkate alındığında, BOME’un 1 dolara ulaşması beklenmemektedir. Piyasa tahminleri, yakın vadede bu seviyenin aşılmayacağını gösteriyor.

BOME iyi bir yatırım mı?

BOME, yüksek riskli ve potansiyel getirisi sınırlı bir yatırım olarak öne çıkıyor. Yüksek volatilite ve belirsiz gelecek nedeniyle çoğu yatırımcı için önerilmez.

2025’te hangi meme coin 1 dolara ulaşır?

DOGE, 2025’te 1 dolara ulaşma ihtimali en yüksek meme coin olarak öne çıkıyor; ardından SHIB ve PEPE geliyor. Ancak hiçbir meme coin’in bu seviyeye ulaşacağı garanti değildir.

BOME coin, Shiba Inu ile nasıl karşılaştırılır?

BOME, piyasa değeri ve işlem hacmi bakımından Shiba Inu’dan küçüktür. Daha yeni olduğu için işlem geçmişi kısadır; Shiba Inu ise kripto piyasasında çok daha tanınır durumdadır.

2025 GIGAPrice Tahmini: Dijital Varlık Ekosisteminde Gelecek Piyasa Trendleri ve Yatırım Fırsatları

2025 MELANIA Fiyat Tahmini: Yükselen Kripto Para Birimi İçin Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

2025 MOODENG Fiyat Tahmini: Bu Yükselen Kripto Para Birimi İçin Piyasa Trendleri ve Gelecek Potansiyelinin Analizi

2025 GOAT Fiyat Tahmini: Dijital Varlıkta Piyasa Trendleri ve Olası Büyüme Analizi

$GIGA Nedir? Nihai Solana Meme Token'ı: Gigachad

Merkeziyetsiz kripto paraların alım satımı için en uygun tercihler

NFT İşlem Maliyetlerini Anlamak ve Azaltmak

Benzersiz NFT'ler oluşturmak için en iyi yapay zekâ araçlarını seçme rehberi

Bitcoin Analizi İçin Stock-to-Flow Modelinin Yeniden Ele Alınması

İşletmeler için En İyi Kripto Ödeme Çözümleri