2025 BDG Fiyat Tahmini: BitDegree Tokenları İçin Piyasa Trendleri ve Olası Büyüme Analizi

Giriş: BDG'nin Piyasa Konumu ve Yatırım Potansiyeli

Beyond Gaming (BDG), GameFi alanını yapay zeka ve Meme’lerle yeniden şekillendiren yenilikçi bir proje olarak, çıkışından bu yana kayda değer ilerlemeler sağlamıştır. 2025 yılı itibarıyla BDG'nin piyasa değeri 3.711.150 ABD doları, dolaşımdaki arzı yaklaşık 4.500.000.000 token ve fiyatı yaklaşık 0,0008247 ABD doları seviyesindedir. “Yapay Zeka Destekli GameFi Yenilikçisi” olarak anılan bu varlık, blokzincir tabanlı oyunlar ve yapay zeka entegrasyonunun kesişiminde gitgide daha önemli bir rol üstleniyor.

Bu makalede, BDG'nin 2025-2030 fiyat eğilimleri; geçmiş veriler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik dinamikler ışığında profesyonel fiyat tahminleriyle birlikte yatırımcılara yönelik pratik yatırım stratejileriyle kapsamlı şekilde analiz edilecektir.

I. BDG Fiyat Geçmişi ve Güncel Piyasa Durumu

BDG Tarihsel Fiyat Gelişimi

- 2025 Mart: BDG, 0,003702 ABD doları ile tarihi zirvesine ulaşarak proje için önemli bir dönüm noktası kaydetti

- 2025 Temmuz: Token, 0,0005 ABD doları ile tüm zamanların en düşük seviyesini gördü ve ciddi bir düzeltme yaşandı

- 2025 Ekim: BDG fiyatı dalgalı seyrediyor, şu an 0,0008247 ABD dolarından işlem görüyor

BDG Güncel Piyasa Görünümü

13 Ekim 2025 itibarıyla BDG, 0,0008247 ABD doları seviyesinden işlem görüyor. Bu token son 24 saatte %7,74 değer kaybetti; işlem hacmi ise 16.090,76 ABD doları. BDG'nin piyasa değeri 3.711.150 ABD doları ile kripto para piyasasında 1.955. sırada. Dolaşımdaki arz 4.500.000.000 BDG ve bu, toplam 20.000.000.000 token arzının %22,5’ini oluşturuyor. Tam seyreltilmiş piyasa değeri ise 16.494.000 ABD doları seviyesinde.

BDG son dönemde ciddi bir volatilite sergiledi. Son bir haftada %20,8, son 30 günde ise %38,21 oranında değer kaybı yaşandı. Bu negatif trend, kısa ve orta vadede düşüş eğiliminin baskın olduğunu gösteriyor. Token, 1 Mart 2025’te kaydedilen 0,003702 ABD doları seviyesindeki tarihi zirvesinin %77,72 altında işlem görüyor.

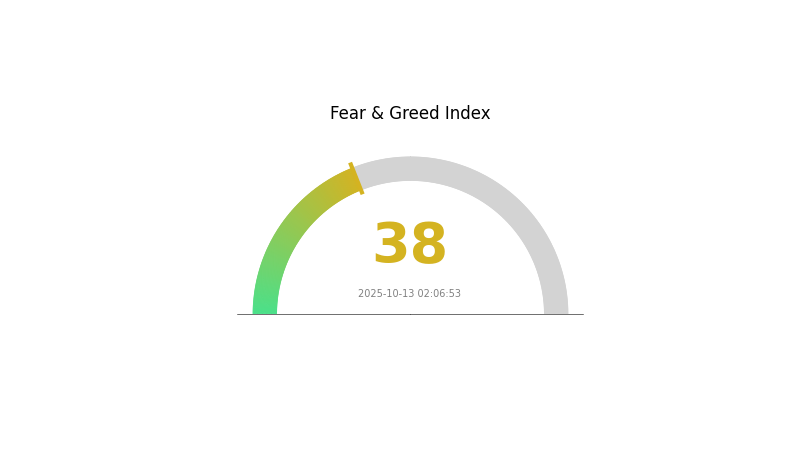

BDG için piyasa duyarlılığı şu anda “Korku” kategorisinde, VIX endeksi ise 38 seviyesinde. Bu, mevcut piyasa koşullarında yatırımcı ve işlemcilerin temkinli davrandığını gösteriyor.

Güncel BDG piyasa fiyatını görmek için tıklayın

BDG Piyasa Duyarlılığı Göstergesi

2025-10-13 Korku ve Açgözlülük Endeksi: 38 (Korku)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto para piyasasında duyarlılık temkinli seyrini sürdürüyor; Korku ve Açgözlülük Endeksi 38’de ve piyasa korku modunda. Yatırımcılar tereddütlü ve alım fırsatlarını kolluyor. Bu gibi dönemlerde güncel kalmak ve ortalama maliyetle alım (dollar-cost averaging) stratejilerini değerlendirmek önemlidir. Unutmayın, piyasa döngüleri doğaldır; korku genellikle toparlanmadan önce gelir. Temel destek seviyelerini ve sektördeki gelişmeleri yakından takip edin.

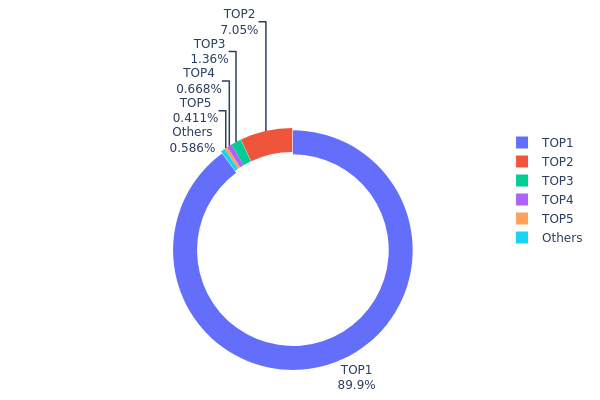

BDG Varlık Dağılımı

BDG’nin adres bazında sahiplik dağılımı, son derece yoğunlaşmış bir yapıya sahip. En büyük adres toplam arzın %89,92’sini, ikinci büyük adres ise %7,05’ini elinde tutuyor. Bu yüksek yoğunlaşma, token’ın merkeziyetsizliği ve piyasa dinamikleri açısından ciddi endişelere yol açıyor.

Böylesine yoğun bir sahiplik yapısı, BDG’nin piyasa istikrarı ve fiyat manipülasyonu riski açısından önemli tehditler oluşturuyor. Arzın yaklaşık %97’sinin iki adreste toplanmış olması, bu sahipler tarafından tetiklenebilecek büyük ölçekli fiyat hareketlerinin olasılığını artırıyor. Bu durum, piyasadaki diğer katılımcılar için volatiliteyi ve likidite yetersizliğini beraberinde getirebilir.

Mevcut dağılım, BDG’nin düşük merkeziyetsizliğe ve zincir üstü yapısının kırılgan olabileceğine işaret ediyor. Tek bir adresin hakimiyeti, merkezi kontrol olasılığını ya da büyük miktarda token’ın rezerve alınmış olabileceğini düşündürerek, yatırımcı güveni ve token’ın kripto ekosistemindeki uzun vadeli sürdürülebilirliği üzerinde etkili olabilir.

Güncel BDG Varlık Dağılımı için tıklayın

| Top | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xa8b9...06c308 | 17.630.392,22K | 89,92% |

| 2 | 0xf389...d88847 | 1.382.300,49K | 7,05% |

| 3 | 0x0d07...b492fe | 266.635,89K | 1,35% |

| 4 | 0xc299...f80d6f | 130.914,83K | 0,66% |

| 5 | 0x20db...f815b3 | 80.535,93K | 0,41% |

| - | Diğerleri | 114.912,09K | 0,61000000000001% |

II. BDG'nin Gelecekteki Fiyatını Etkileyecek Temel Faktörler

Arz Mekanizması

- Dolaşımdaki Arz: Toplam dolaşımdaki BDG arzı 4.500.000.000 token.

- Güncel Etki: Gate.com’dan alınan son verilere göre, BDG'nin CAD fiyatı -0,0001106 ABD doları düştü ve %8,84’lük düşüşle piyasada düşüş trendinin sürdüğünü gösteriyor.

Makroekonomik Ortam

- Enflasyona Karşı Koruma: Pek çok kripto parada olduğu gibi, BDG de küresel ekonomik eğilimler ve finansal piyasa dalgalanmalarında potansiyel bir enflasyon koruması olarak değerlendirilebilir.

- Jeopolitik Faktörler: Uluslararası ekonomik koşullar, olası resesyonlar ve piyasa daralmaları gibi dinamikler, kripto piyasasını ve BDG’yi önemli ölçüde etkileyebilir.

Teknik Gelişim ve Ekosistem Kurulumu

- Ar-Ge: BDG'nin arkasındaki şirket, arz fazlası ve fiyat baskısı gibi piyasa zorluklarına karşı Ar-Ge yatırımlarını artırmaya ve son kullanıcılarla ilişkileri güçlendirmeye odaklanıyor.

- Ekosistem Uygulamaları: Spesifik DApp veya ekosistem projeleri açıklanmasa da, şirketin Ar-Ge’ye öncelik vermesi BDG ekosisteminin ve uygulamalarının geliştirilmesine yönelik devam eden çabaların göstergesi.

III. 2025-2030 BDG Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,00055 - 0,00082 ABD doları

- Tarafsız tahmin: 0,00082 - 0,00103 ABD doları

- İyimser tahmin: 0,00103 - 0,00123 ABD doları (olumlu piyasa koşulları gerekir)

2026-2027 Görünümü

- Piyasa fazı beklentisi: Kademeli büyüme ve konsolidasyon

- Fiyat aralığı öngörüsü:

- 2026: 0,00067 - 0,00121 ABD doları

- 2027: 0,00102 - 0,00125 ABD doları

- Temel itici güçler: Artan benimsenme ve teknolojik ilerlemeler

2028-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,00119 - 0,00174 ABD doları (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: 0,00174 - 0,00206 ABD doları (güçlü piyasa performansı varsayımıyla)

- Dönüştürücü senaryo: 0,00206 - 0,00234 ABD doları (çığır açıcı gelişmeler varsayımıyla)

- 2030-12-31: BDG 0,00234 ABD doları (iyimser projeksiyona göre potansiyel zirve)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00123 | 0.00082 | 0.00055 | 0 |

| 2026 | 0.00121 | 0.00103 | 0.00067 | 24 |

| 2027 | 0.00125 | 0.00112 | 0.00102 | 35 |

| 2028 | 0.00164 | 0.00119 | 0.00076 | 43 |

| 2029 | 0.00206 | 0.00141 | 0.00097 | 71 |

| 2030 | 0.00234 | 0.00174 | 0.00146 | 110 |

IV. BDG için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

BDG Yatırım Yöntemleri

(1) Uzun Vadeli Tutma Stratejisi

- Hedef yatırımcı profili: Yüksek risk toleransına sahip uzun vadeli yatırımcılar

- Uygulama önerileri:

- Piyasa düşüşlerinde BDG biriktirin

- Fiyat hedefleri belirleyin ve plana sadık kalın

- BDG’yi Gate Web3 Cüzdan gibi güvenli bir cüzdanda saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Kısa ve uzun vadeli trendleri izleyin

- RSI: Aşırı alım ve aşırı satım noktalarını tespit edin

- Dalgalı işlem için stratejik noktalar:

- Zarar durdur emirleriyle potansiyel kayıpları sınırlayın

- Belirlenen direnç seviyelerinde kar alın

BDG Risk Yönetim Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Portföyün %1-3’ü

- Agresif yatırımcılar: Portföyün %5-10’u

- Profesyonel yatırımcılar: Portföyün %15’ine kadar

(2) Riskten Korunma Çözümleri

- Diversifikasyon: Yatırımlarınızı farklı kripto paralar arasında dağıtın

- Zarar durdur emirleri ile olası kayıpları sınırlayın

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan: Gate Web3 Cüzdan

- Soğuk depolama: Uzun vadeli tutum için donanım cüzdanı

- Güvenlik: İki faktörlü kimlik doğrulama etkinleştirin, güçlü şifre kullanın

V. BDG için Potansiyel Riskler ve Zorluklar

BDG Piyasa Riskleri

- Yüksek volatilite: BDG fiyatında belirgin dalgalanmalar yaşanabilir

- Düşük likidite: İşlem hacmi görece az

- Piyasa duyarlılığı: Genel kripto piyasa trendlerinden etkilenir

BDG Düzenleyici Riskler

- Belirsiz düzenlemeler: Kripto regülasyonları hızlı değişebilir

- Ülke bazlı uyumluluk: Farklı ülkeler BDG’ye farklı yaklaşabilir

- Vergi konusu: Birçok ülkede vergilendirme net değildir

BDG Teknik Riskler

- Akıllı sözleşme açıkları: İstismar veya hata riski

- Ölçeklenebilirlik sorunları: Ağ büyüdükçe teknik engeller ortaya çıkabilir

- Rekabet: Diğer GameFi projeleri BDG’yi geride bırakabilir

VI. Sonuç ve Eylem Önerileri

BDG Yatırım Değeri Değerlendirmesi

BDG, GameFi ve yapay zeka alanında umut vadetse de kısa vadede yüksek volatilite ve yoğun rekabetle karşı karşıya. Uzun vadeli değer, projenin başarılı geliştirilmesi ve piyasa tarafından benimsenmesine bağlıdır.

BDG Yatırım Önerileri

✅ Yeni başlayanlar: Detaylı araştırmadan sonra küçük, deneysel pozisyonlar alın

✅ Deneyimli yatırımcılar: Sıkı risk yönetimiyle ortalama maliyetle alım uygulayın

✅ Kurumsal yatırımcılar: Büyük tahsisler öncesinde BDG’nin gelişimini yakından takip edin

BDG Alım-Satım Katılım Yöntemleri

- Spot işlem: Gate.com üzerinden

- Staking: Sunuluyorsa staking programlarına katılım

- GameFi katılımı: BDG ekosisteminde kullanım ve fayda deneyimi

Kripto para yatırımları ciddi risk içerir ve bu makale yatırım tavsiyesi değildir. Yatırım kararlarınızı kendi risk profilinize göre alın ve profesyonel finansal danışmanlara başvurun. Kaybetmeyi göze alamayacağınız bir tutarı asla yatırım olarak kullanmayın.

SSS

Baby DOGE 1 dolara ulaşır mı?

Mevcut devasa dolaşımdaki arzı nedeniyle Baby DOGE’in 1 dolara ulaşması son derece düşük ihtimaldir. Gereken piyasa değeri astronomik seviyede olacağından bu hedef gerçekçi değildir.

DOGE 10 dolara çıkar mı?

2025 yılı itibarıyla DOGE 10 dolara ulaşmadı. Analist tahminlerine göre, önemli bir piyasa değişimi olmadıkça DOGE muhtemelen 1,10 doların altında kalacaktır.

DGB 10 dolar olur mu?

DigiByte için 10 dolara ulaşmak uzun vadede iddialı fakat imkansız değildir. Şu anda 0,007717 ABD doları seviyesinde olan DGB, 1.000 kat büyüme gerektiriyor.

2025’te Baby DOGE’in değeri ne olur?

Baby DOGE’in 2025 yılındaki ortalama fiyatının 0,0₈1547 ABD doları olacağı ve kasım ayında potansiyel olarak 0,0₈1965 ABD dolarına ulaşacağı öngörülüyor.

kripto neden çöküyor ve toparlanacak mı?

2025 PIPPIN Fiyat Tahmini: PIPPIN’in Gelecekteki Piyasa Değerine İlişkin Kapsamlı Analiz ve Tahmin

ChainOpera AI ($COAI): Patlayıcı fiyat dalgalanmasının arkasındaki etkenler

Binance'deki COAI Fiyatı: Meme-AI Token'ının Nasıl Momentum Kazandığı

2025 GROK Fiyat Tahmini: Yapay Zeka Destekli Kripto Para İçin Potansiyel Yükseliş mi, Piyasa Düzeltmesi mi?

ANI vs XLM: Dil Modellerinde Yapay Zekâ Liderliği Yarışı

Dropee Günlük Kombinasyonu 12 Aralık 2025

Tomarket Günlük Kombinasyonu 12 Aralık 2025

SEI Airdrop Ödülleri’ne Katılım ve Talep Etme Kılavuzu

Kripto para birimlerinde algoritmik alım satım için etkili stratejiler

Stock-to-Flow Model ile Bitcoin'in Değerlemesini Anlamak