2025 ATS Fiyat Tahmini: Otomatik Alım Satım Sistemi Token'ının Piyasa Eğilimleri ve Gelecekteki Değerlemesinin Analizi

Giriş: ATS'nin Piyasa Konumu ve Yatırım Değeri

Alltoscan (ATS), yenilikçi bir Web3 altyapı projesi olarak 2022'de faaliyete geçtiğinden bu yana önemli ortaklıklar kurdu ve istikrarlı bir büyüme yakaladı. 2025 yılı itibarıyla ATS'nin piyasa değeri 8.703.142 dolar, dolaşımdaki token miktarı yaklaşık 62.536.054 ve fiyatı 0,13917 dolar civarında. "Multichain block explorer" özelliğiyle öne çıkan bu varlık, DeFi çözümleri ve blokzincir altyapısının gelişiminde giderek daha kritik bir rol üstlenmektedir.

Bu makalede, ATS'nin 2025-2030 yılları arasındaki fiyat değişimi; geçmiş fiyat hareketleri, piyasa arz ve talebi, ekosistem gelişimi ve makroekonomik faktörler ışığında kapsamlı şekilde analiz edilerek, yatırımcılara profesyonel fiyat tahminleri ve pratik yatırım stratejileri sunulacaktır.

I. ATS Fiyat Geçmişi ve Güncel Piyasa Durumu

ATS'nin Tarihsel Fiyat Gelişimi

- 2024: 20 Nisan'da 2,5165 dolar ile tarihi zirveye ulaşarak önemli bir kilometre taşı kaydetti

- 2025: 15 Nisan'da 0,04001 dolar ile tarihi dip seviyeye gerileyerek ciddi bir piyasa düzeltmesi yaşandı

- 2025: Toparlanma döneminde, 9 Ekim'de fiyat 0,13917 dolara çıktı

ATS Güncel Piyasa Durumu

9 Ekim 2025 itibarıyla ATS'nin fiyatı 0,13917 dolar; 24 saatlik işlem hacmi 39.143,61 dolar. Token, son 24 saatte %2,74 artış göstererek kısa vadede yükseliş eğilimi sergiledi. Ancak 7 günlük performans %9,48 gerileme ile son dönemde volatilitenin arttığını gösteriyor. 30 günlük trend ise %19,53 artış ile orta vadede toparlanma sinyali veriyor. Mevcut piyasa değeri 8.703.142,64 dolar olup, ATS kripto para piyasasında 1.490. sırada yer alıyor. Dolaşımdaki token miktarı 62.536.054 ATS ve bu, toplam arzın %62,54'üne karşılık geliyor; piyasada dengeli bir dağılım mevcut. Tam seyreltilmiş değerleme 13.917.000 dolar; tüm arz dolaşıma girdiğinde büyüme potansiyeli bulunuyor.

Güncel ATS piyasa fiyatını görüntülemek için tıklayın

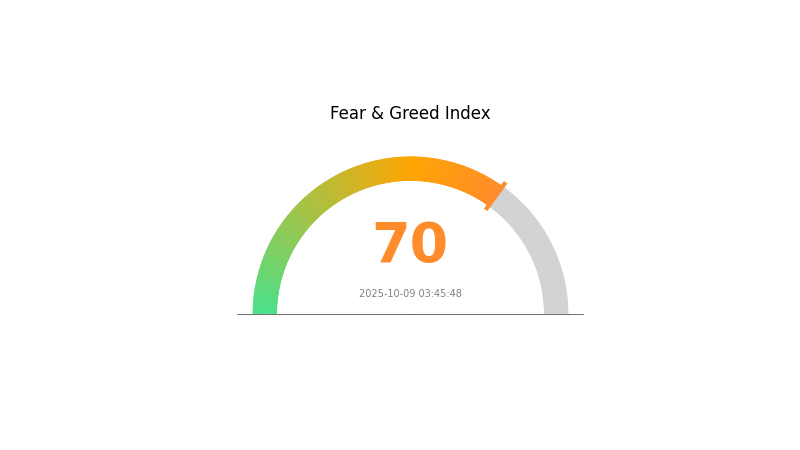

ATS Piyasa Duyarlılık Göstergesi

09 Ekim 2025 Korku ve Açgözlülük Endeksi: 70 (Açgözlülük)

Güncel Korku & Açgözlülük Endeksi için tıklayın

Kripto piyasası şu anda açgözlülük modunda; Korku ve Açgözlülük Endeksi 70 seviyesinde. Yatırımcıların iyimserliği fiyatların yükselmesini tetikleyebilir. Ancak bu kadar yüksek açgözlülük, piyasanın aşırı ısınmış olabileceğine işaret eder. Yatırımcılar temkinli olmalı, olası düzeltmeleri hesaba katmalı ve portföylerini çeşitlendirmelidir. Piyasa duyarlılığına kapılıp ani kararlar vermekten kaçının; unutmayın, aşırı açgözlülük genellikle piyasa düşüşlerinden önce gelir.

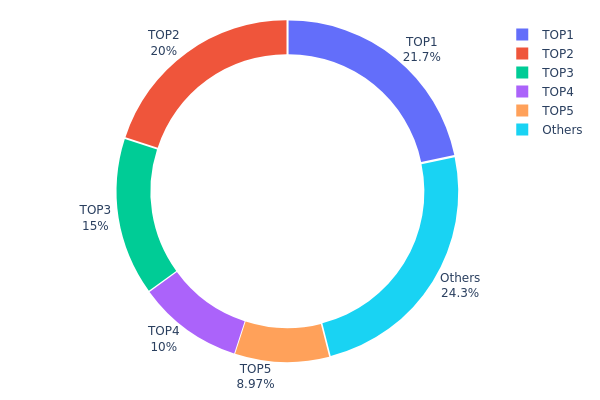

ATS Varlık Dağılımı

ATS'nin adres varlık dağılımı, sahipliğin son derece yoğunlaştığını gösteriyor. En büyük beş adres, toplam arzın %75,67'sini elinde tutarken en büyük adresin payı %21,71. Bu durum, olası piyasa manipülasyonu ve volatilite endişelerini artırıyor.

Böyle bir dağılım, ATS'nin merkeziyetsizliğinin zayıf olduğunu gösterir. Yüksek miktarda token tutan az sayıda adres, büyük işlemlerle fiyat oynaklığını artırabilir. Ayrıca, bu yoğunlaşma piyasa dinamiklerini etkileyerek, büyük sahiplerin kararlarının ATS'nin değerinde ve genel piyasa duyarlılığında orantısız rol oynamasına yol açabilir.

Riskler bulunsa da, arzın %24,33'ü diğer adreslerde ve belirli bir çeşitlilik sunuyor. Ancak mevcut varlık yapısı, ATS'nin zincir üstü istikrarını ve manipülasyona karşı direncini zayıflatabilir; bu nedenle yatırımcılar dikkatli olmalıdır.

Güncel ATS Varlık Dağılımı için tıklayın

| En Büyük | Adres | Varlık Adedi | Varlık (%) |

|---|---|---|---|

| 1 | 0xc22d...5d318e | 21.719,37K | 21,71% |

| 2 | 0xd9cb...28e10b | 20.000,00K | 20,00% |

| 3 | 0xdf3b...ae047f | 15.000,00K | 15,00% |

| 4 | 0xf9ef...d85657 | 10.000,00K | 10,00% |

| 5 | 0x0d07...b492fe | 8.968,50K | 8,96% |

| - | Diğerleri | 24.312,13K | 24,33% |

II. ATS'nin Gelecekteki Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Piyasa Talebi: ATS'nin gelecekteki fiyatı piyasa talebine ve rekabet ortamına bağlı olarak şekillenir.

- Tarihsel Model: Geçmişteki arz değişimleri ATS fiyatlarını etkiledi; artan talep genellikle fiyatlarda yükselişe yol açtı.

- Mevcut Etki: Güncel arz değişikliklerinin, piyasa koşulları ve talep düzeyine bağlı olarak fiyatlara etkisi olması beklenmektedir.

Makroekonomik Ortam

- Para Politikası Etkisi: Küresel ekonomik koşullardaki ve politika değişimlerindeki dalgalanmalar ATS fiyatı için kritik önemdedir.

- Enflasyona Karşı Koruma Özelliği: ATS, enflasyonist baskılardan etkilenebilir ve yüksek fiyatlara karşı koruma işlevi görebilir.

- Jeopolitik Faktörler: Uluslararası jeopolitik gerilimler, çeşitli piyasalarda büyümenin yavaşlamasıyla birlikte ATS'nin fiyatını etkileyebilir.

Teknik Gelişim ve Ekosistem Oluşumu

- Maliyet Optimizasyonu: ATS, zorlu piyasa koşullarında fiyat baskısı ve enflasyona karşı geniş çaplı maliyet optimizasyonu ve verimlilik artırma planları uygulamaktadır.

- Üretim Hattı Genişlemesi: Malezya Kulim ve Avusturya Leoben'deki üretim hattı girişimleri, ATS'nin gelecekteki performansı ve fiyatlamasını etkileyecek.

- Ekosistem Uygulamaları: Belirli uygulamalar belirtilmese de, ATS'nin teknolojik yenilik odağı büyümeyi ve fiyat hareketlerini destekleyebilir.

III. ATS 2025-2030 Fiyat Tahmini

2025 Görünümü

- Temkinli tahmin: 0,11417 - 0,13923 dolar

- Tarafsız tahmin: 0,13923 - 0,15246 dolar

- İyimser tahmin: 0,15246 - 0,16568 dolar (olumlu piyasa koşulları gerektirir)

2027 Orta Vadeli Görünüm

- Piyasa fazı beklentisi: Büyüme potansiyeli

- Fiyat aralığı tahmini:

- 2026: 0,12044 - 0,17228 dolar

- 2027: 0,14451 - 0,1851 dolar

- Temel katalizörler: Artan benimsenme ve teknolojik atılımlar

2030 Uzun Vadeli Görünüm

- Baz senaryo: 0,17216 - 0,22955 dolar (istikrarlı büyüme varsayımıyla)

- İyimser senaryo: 0,22955 - 0,26628 dolar (güçlü piyasa performansı varsayımıyla)

- Dönüştürücü senaryo: 0,26628 dolar üzeri (aşırı olumlu koşullar)

- 31 Aralık 2030: ATS 0,26628 dolar (potansiyel zirve)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,16568 | 0,13923 | 0,11417 | 0 |

| 2026 | 0,17228 | 0,15246 | 0,12044 | 9 |

| 2027 | 0,1851 | 0,16237 | 0,14451 | 16 |

| 2028 | 0,21369 | 0,17373 | 0,09555 | 24 |

| 2029 | 0,26538 | 0,19371 | 0,1356 | 39 |

| 2030 | 0,26628 | 0,22955 | 0,17216 | 64 |

IV. ATS için Profesyonel Yatırım Stratejileri ve Risk Yönetimi

ATS Yatırım Yaklaşımları

(1) Uzun Vadeli Tutma Stratejisi

- Uygun profil: Yüksek risk toleransına sahip uzun vadeli yatırımcılar

- Operasyon önerileri:

- Piyasa düşüşlerinde ATS token biriktirin

- Fiyat hedefleri belirleyip portföyü periyodik olarak dengeleyin

- Tokenları donanım cüzdanında güvenli şekilde saklayın

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri belirlemek için kullanılır

- RSI: Aşırı alım/aşırı satım seviyelerini izleyin

- Kısa vadeli al-sat için başlıca noktalar:

- Destek ve direnç seviyelerini tespit edin

- Zarar-durdur emirleri ile riski yönetin

ATS Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcı: %1-3

- Agresif yatırımcı: %5-10

- Profesyonel yatırımcı: %10-15

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Yatırımları farklı kripto varlıklara yayarak riskleri azaltın

- Zarar-durdur emirleri: Olası kayıpları sınırlandırmak için kullanın

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan: Gate Web3 Wallet

- Soğuk saklama: Donanım cüzdanı ile uzun vadeli saklama

- Güvenlik önlemleri: İki aşamalı doğrulama aktif edin, güçlü şifreler kullanın

V. ATS için Potansiyel Riskler ve Zorluklar

ATS Piyasa Riskleri

- Yüksek oynaklık: Kripto piyasasında büyük fiyat dalgalanmaları

- Düşük likidite: Büyük işlemlerin gerçekleştirilmesinde zorluk

- Piyasa duyarlılığı: Yatırımcı psikolojisindeki ani değişimlere duyarlılık

ATS Düzenleyici Riskler

- Belirsiz mevzuat: ATS'nin faaliyetlerini etkileyebilecek yeni regülasyonlar

- Sınır ötesi uyum: Farklı ülkelerde mevzuata uyum zorlukları

- Vergisel etkiler: Kripto varlıkların vergilendirilmesindeki değişkenlik

ATS Teknik Riskler

- Akıllı sözleşme açıkları: Kodda potansiyel güvenlik zafiyetleri

- Ağ tıkanıklığı: Yoğun trafik dönemlerinde işlem gecikmeleri

- Teknolojik eskime: Daha yeni blokzincir çözümlerine karşı geride kalma riski

VI. Sonuç ve Eylem Önerileri

ATS Yatırım Değeri Değerlendirmesi

ATS, Web3 altyapı projesi olarak potansiyel taşımaktadır; ancak ciddi piyasa ve teknoloji riskleri ile karşı karşıyadır. Uzun vadeli değer, yaygın benimsenme ve multichain çözümlerin başarılı şekilde hayata geçirilmesine bağlıdır.

ATS Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük miktarlarla başlayın, eğitim ve risk yönetimine öncelik verin ✅ Deneyimli yatırımcılar: ATS'yi çeşitlendirilmiş kripto portföyüne dahil edin ✅ Kurumsal yatırımcılar: Detaylı inceleme yapın, proje gelişimini yakından takip edin

ATS İşlem Katılım Yöntemleri

- Spot işlem: Gate.com üzerinden ATS alım-satımı

- Staking: Program mevcutsa staking'e katılım

- DeFi entegrasyonu: ATS token ile merkeziyetsiz finans seçeneklerini değerlendirin

Kripto para yatırımları son derece yüksek risk içerir; bu makale yatırım tavsiyesi değildir. Yatırımcılar kararlarını kendi risk toleranslarına göre dikkatle vermeli ve profesyonel finans danışmanları ile görüşmelidir. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

SSS

ATS alınacak iyi bir hisse mi?

Evet, ATS alınması uygun bir hisse olarak görülüyor. Mevcut fiyat cazip bir giriş fırsatı sunarken, analistlere göre önümüzdeki yıllarda %29 oranında güçlü bir büyüme bekleniyor.

ATS için hedef fiyat nedir?

ATS'nin hedef fiyatı analistlerin ortak görüşüne göre 47,65 dolar; önümüzdeki 12 ayda tahminler 47,65 ila 54 dolar arasında değişiyor.

Astera Labs için 2025 hedef fiyatı nedir?

Astera Labs için 2025 ortalama hedef fiyatı 159,83 dolar; analist tahminlerine göre en yüksek rakam 275,00 dolar.

En yüksek fiyat tahminine sahip kripto para hangisi?

2025 itibarıyla Bitcoin (BTC) en yüksek fiyat tahminiyle öne çıkıyor. Kurumsal benimsenme ve sınırlı arz büyümeyi destekliyor; analistler güncel piyasa eğilimlerine göre güçlü fiyat artışları bekliyor.

Yatırım Yapmak için En Çok Hangi Sebep Sizinle Yankı Buluyor ve Neden?

Kripto'da Boğa ve Ayı Piyasaları: Web3 Yatırımcıları için Piyasa Döngülerini Anlamak

Bir Ajan veya Broker Hangi Faaliyetleri Yapmasına İzin Verilir? Açıklamalı

2025 IDPrice Tahmini: Dijital Kimlik Değerlemelerinde Yükselen Eğilimler ve Piyasa Analizi

2025 FORT Fiyat Öngörüsü: Halving Sonrası Kripto Ekosisteminde Piyasa Trendleri ve Büyüme Potansiyelinin Değerlendirilmesi

2025 ASR Fiyat Tahmini: Otomatik Konuşma Tanıma Sektöründe Piyasa Trendleri, Teknolojik İlerlemeler ve Yatırım Olanaklarının Analizi

Nostr'a Yakından Bakış: Merkeziyetsiz Sosyal Medyanın Geleceği

BEP-20 Token Standardı: Temel Özellikleri ve Avantajları

Tap Crypto’yu Anlamak: Dijital Takas Üzerine Kapsamlı Bir Rehber

ENS Alan Adları: Web3’te Kimlik Yönetimini Kolaylaştırıyor

Kripto para birimlerinde çift harcama sorununun anlaşılması