2025 IDPrice Prediction: Emerging Trends and Market Analysis for Digital Identity Valuations

Introduction: Market Position and Investment Value of ID

Space ID (ID), as a universal name service network for Web3 identities, has made significant strides since its inception. As of 2025, Space ID's market capitalization has reached $64,317,616, with a circulating supply of approximately 430,506,132 tokens, and a price hovering around $0.1494. This asset, known as the "Web3 Identity Pioneer," is playing an increasingly crucial role in providing decentralized identity and domain name solutions for the blockchain ecosystem.

This article will comprehensively analyze Space ID's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. ID Price History Review and Current Market Status

ID Historical Price Evolution

- 2024: Reached all-time high of $1.8404 on March 17

- 2025: Hit all-time low of $0.1344 on June 22, significant price drop

ID Current Market Situation

As of September 29, 2025, ID is trading at $0.1494. The token has seen a 5.14% increase in the last 24 hours, with a trading volume of $131,306.72. However, ID has experienced a decline of 5.45% over the past week and a more substantial drop of 14.01% in the last 30 days. The current market cap stands at $64,317,616, ranking ID at 599th in the overall cryptocurrency market. Despite the recent short-term gains, ID is still down 64.33% compared to its price one year ago, indicating a significant bearish trend in the long term.

Click to view the current ID market price

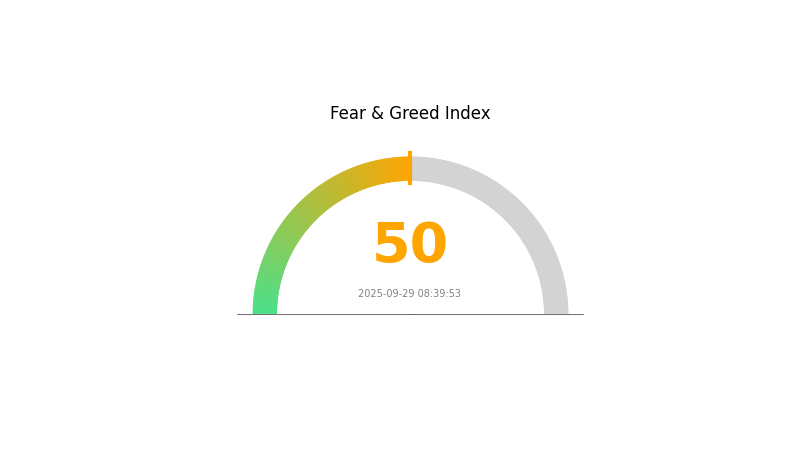

ID Market Sentiment Indicator

2025-09-29 Fear and Greed Index: 50 (Neutral)

Click to view the current Fear & Greed Index

The crypto market sentiment is currently balanced, with the Fear and Greed Index at 50. This neutral position suggests investors are neither overly fearful nor excessively greedy. It's an opportune time for traders to reassess their strategies and portfolios. While the market doesn't show extreme emotions, it's crucial to remain vigilant and conduct thorough research before making any investment decisions. Gate.com offers a range of tools and resources to help you navigate these market conditions effectively.

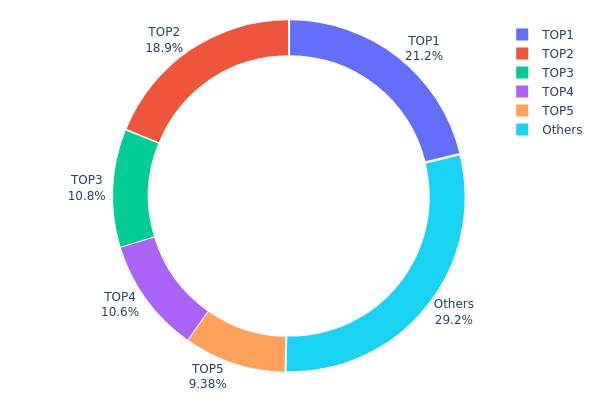

ID Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of ID tokens among different addresses. Analysis of this data reveals a highly concentrated distribution pattern, with the top 5 addresses collectively holding 70.79% of the total supply.

The top address alone controls 21.16% of all tokens, while the second largest holder possesses 18.87%. This high concentration in a few addresses raises concerns about potential market manipulation and price volatility. Such a centralized distribution structure could lead to increased market instability, as large holders have the ability to significantly impact token prices through their trading activities.

This concentration level indicates a relatively low degree of decentralization in the ID token ecosystem. While 29.21% of tokens are distributed among other addresses, the dominance of the top holders suggests a need for increased token dispersion to enhance market stability and reduce manipulation risks. The current distribution pattern may deter some investors due to concerns about market fairness and long-term sustainability.

Click to view the current ID holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x706a...896ab3 | 380000.00K | 21.16% |

| 2 | 0xa490...204a66 | 338834.99K | 18.87% |

| 3 | 0x4296...3a31f7 | 194416.66K | 10.82% |

| 4 | 0x062a...9ddca6 | 189783.25K | 10.57% |

| 5 | 0x48a6...740454 | 168333.33K | 9.37% |

| - | Others | 523984.94K | 29.21% |

II. Key Factors Affecting Future Gold Prices

Supply Mechanism

- Mining Production: Gold mining production has remained relatively stable, with annual output around 3,500-4,000 tons in recent years.

- Historical Pattern: Limited supply growth has contributed to price increases when demand rises.

- Current Impact: Supply constraints continue to support gold prices, with mine production only increasing from 3,573 tons in 2021 to 3,673 tons in 2024.

Institutional and Large Holder Dynamics

- Institutional Holdings: Central banks, especially from developing countries, have been increasing their gold reserves significantly.

- Corporate Adoption: Growing industrial demand for gold in electronics, aerospace, medical equipment, and other high-tech sectors.

- Government Policies: Many countries, particularly emerging markets, are pursuing "de-dollarization" policies and increasing gold reserves.

Macroeconomic Environment

- Monetary Policy Impact: Expected interest rate cuts by the Federal Reserve and other central banks likely to support gold prices.

- Inflation Hedging Properties: Gold remains attractive as an inflation hedge, with global inflation pressures expected to persist.

- Geopolitical Factors: Ongoing geopolitical tensions and conflicts continue to drive safe-haven demand for gold.

Technological Development and Ecosystem Building

- Financial Innovation: Growing popularity of gold ETFs and futures contracts has increased gold's liquidity and tradability as a financial asset.

- Industrial Applications: Advancements in sectors like semiconductors, aerospace, and medical devices are expanding industrial gold demand.

III. ID Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.12866 - $0.14960

- Neutral prediction: $0.14960 - $0.17877

- Optimistic prediction: $0.17877 - $0.20794 (requires favorable market conditions)

2027-2028 Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2027: $0.15267 - $0.25518

- 2028: $0.13725 - $0.24847

- Key catalysts: Market adoption and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.24256 - $0.27773 (assuming steady market growth)

- Optimistic scenario: $0.27773 - $0.31290 (assuming strong market performance)

- Transformative scenario: $0.31290 - $0.32772 (assuming breakthrough developments)

- 2030-12-31: ID $0.27773 (potential average price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.20794 | 0.1496 | 0.12866 | 0 |

| 2026 | 0.25743 | 0.17877 | 0.12693 | 19 |

| 2027 | 0.25518 | 0.2181 | 0.15267 | 45 |

| 2028 | 0.24847 | 0.23664 | 0.13725 | 58 |

| 2029 | 0.3129 | 0.24256 | 0.2086 | 62 |

| 2030 | 0.32772 | 0.27773 | 0.20274 | 85 |

IV. Professional Investment Strategies and Risk Management for ID

ID Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with a high risk tolerance and belief in Web3 technologies

- Operation suggestions:

- Accumulate ID tokens during market dips

- Hold for at least 2-3 years to ride out market volatility

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use 50-day and 200-day MAs to identify trends

- RSI: Monitor for overbought/oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit potential losses

- Take profits at predetermined price targets

ID Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple Web3 projects

- Options trading: Use put options to protect against downside risk

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Use a hardware wallet for long-term storage

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for ID

ID Market Risks

- High volatility: Significant price fluctuations in short periods

- Limited liquidity: Potential difficulties in executing large trades

- Market sentiment: Susceptible to broader crypto market trends

ID Regulatory Risks

- Uncertain regulations: Potential for adverse regulatory actions

- Cross-border compliance: Challenges in adhering to various jurisdictions

- Tax implications: Evolving tax treatment of crypto assets

ID Technical Risks

- Smart contract vulnerabilities: Potential for exploitation of code flaws

- Scalability issues: Challenges in handling increased network activity

- Interoperability concerns: Difficulties in seamless integration with other blockchains

VI. Conclusion and Action Recommendations

ID Investment Value Assessment

Space ID shows long-term potential in the Web3 domain name and identity space, but faces short-term volatility and regulatory uncertainties.

ID Investment Recommendations

✅ Beginners: Start with small positions and focus on learning about Web3 technologies ✅ Experienced investors: Consider a balanced approach with both long-term holding and active trading ✅ Institutional investors: Conduct thorough due diligence and consider OTC options for large transactions

ID Trading Participation Methods

- Spot trading: Buy and sell ID tokens on Gate.com

- Staking: Participate in staking programs to earn additional rewards

- DeFi integration: Explore decentralized finance options using ID tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will 1 inch reach $100?

It's highly unlikely. 1inch would need to rise 320 times, reaching a $103 billion market cap. This is improbable based on current market trends.

What is the price prediction for Cardano 2025?

Cardano is predicted to trade between $1.16 and $1.17 by December 2025, based on current market analysis and trends.

Will the IDs share price go up?

While predicting exact price movements is challenging, IDs have shown potential for growth in the Web3 space. Market trends and increased adoption could drive the price upward.

Which coin will be the next Bitcoin prediction in 2025?

Bitcoin itself is predicted to reach $77,000 to $155,000 in 2025. No other coin is expected to match Bitcoin's dominance or value in this timeframe.

Share

Content