2025 AKT Fiyat Tahmini: Bulut bilişim sektöründe Akash Network'ün tokeni için olumlu ve yükseliş odaklı bir görünüm

Giriş: AKT'nin Piyasadaki Konumu ve Yatırım Potansiyeli

Akash Network (AKT), merkeziyetsiz bulut bilişim alanında bir pazar yeri olarak kurulduğundan bu yana önemli aşamalar kaydetti. 2025 yılı itibarıyla Akash Network’ün piyasa değeri 187.609.114 $’a ulaştı; dolaşımdaki token sayısı yaklaşık 280.432.159 ve fiyatı 0,669 $ civarında seyrediyor. “DeCloud for DeFi” olarak anılan bu varlık, merkeziyetsiz bulut bilişim sektöründe giderek daha belirleyici bir konuma sahip.

Bu makalede, Akash Network’ün 2025-2030 arası fiyat eğilimleri; geçmiş fiyat hareketleri, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler ışığında profesyonel fiyat tahminleri ve yatırımcılara yönelik pratik stratejilerle bütüncül biçimde analiz edilecek.

I. AKT Fiyat Geçmişi ve Mevcut Piyasa Durumu

AKT Tarihsel Fiyat Hareketleri

- 2021: 7 Nisan’da AKT, 8,07 $ ile tüm zamanların zirvesine ulaşarak önemli bir kilometre taşı kaydetti

- 2022: Piyasa geriledi; AKT fiyatı 22 Kasım’da 0,164994 $ ile en düşük seviyesini gördü

- 2025: Piyasa toparlanma belirtileri gösteriyor ve AKT şu anda 0,669 $ seviyesinde işlem görüyor

AKT'nin Güncel Piyasa Durumu

19 Ekim 2025 itibarıyla AKT, 0,669 $ fiyatla işlem görmekte ve piyasa değeri 187.609.114 $’dır. Son 24 saatte %1,63 değer kaybeden tokenin işlem hacmi 560.771,95 $ olarak gerçekleşti. Mevcut fiyat, tüm zamanların zirve seviyesine göre ciddi bir düşüş göstererek uzun vadeli ayı eğilimini yansıtıyor. Yine de token, en düşük seviyesinden bir miktar toparlanma yaşadı. AKT için piyasa duyarlılığı “Korku” bölgesinde olup yatırımcıların temkinli davrandığını gösteriyor. Dolaşımdaki AKT miktarı 280.432.159 olup bu, maksimum arzın (%72,18) 388.539.008 tokenlik kısmına denk geliyor.

Güncel AKT piyasa fiyatını görmek için tıklayın

AKT Piyasa Duyarlılığı Göstergesi

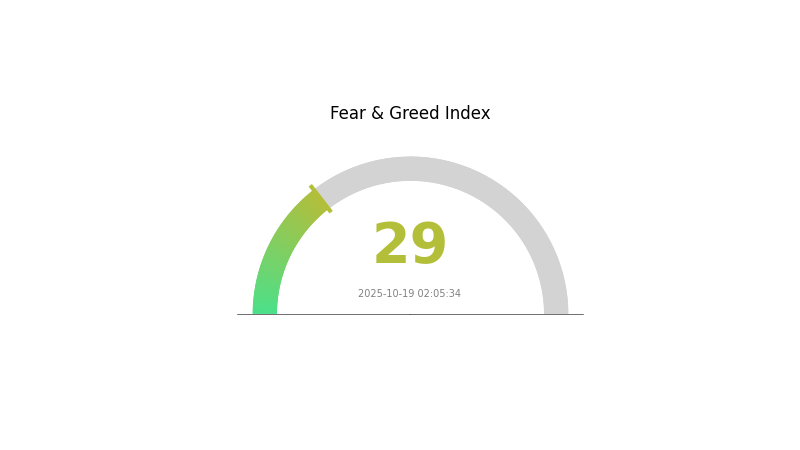

2025-10-19 Korku ve Açgözlülük Endeksi: 29 (Korku)

Güncel Korku ve Açgözlülük Endeksi için tıklayın

Kripto piyasasında şu anda korku hakim; Korku ve Açgözlülük Endeksi 29 seviyesinde. Bu tablo, yatırımcıların temkinli davrandığını ve yüksek risk toleransına sahip olanlar için potansiyel alım fırsatları doğurduğunu gösteriyor. Ancak yatırım kararlarınızda detaylı araştırma yapmak ve dikkatli davranmak şarttır. Piyasa duyarlılığı hızla değişebilir ve geçmiş performans asla geleceğin garantisi değildir. Bilgilenin, portföyünüzü çeşitlendirerek riski yönetmeyi ihmal etmeyin.

AKT Varlık Dağılımı

Adres varlık dağılım grafiği, farklı cüzdanlardaki AKT token yoğunluğunu gösterir. Ancak ilgili veri tablosu boş olduğundan, AKT’nin mevcut yoğunluk özellikleri hakkında kapsamlı analiz yapmak mümkün değildir.

Veri olmadan, adres dağılımının piyasa yapısına etkileri konusunda ancak genel değerlendirmeler yapılabilir. İyi dağıtılmış bir token, çok sayıda adrese dengeli biçimde dağılır ve bu, ağın daha merkeziyetsiz ve sağlıklı olduğuna işaret eder. Öte yandan, tokenlerin az sayıda adreste yoğunlaşması, fiyat oynaklığını ve piyasa manipülasyonu riskini artırabilir.

Somut veriler olmadan AKT’nin merkeziyetsizlik düzeyi ya da zincir üzerindeki yapısal istikrarını değerlendirmek güçtür. Token dağılımı ve piyasa dinamiklerine etkisi için daha fazla veri gereklidir.

Güncel AKT Varlık Dağılımını görmek için tıklayın

| Üst | Adres | Varlık Adedi | Varlık (%) |

|---|

II. AKT’nin Gelecek Fiyatına Etki Eden Temel Unsurlar

Teknik Gelişmeler ve Ekosistem İnşası

- Akash Network Güncellemeleri: Akash Network, merkeziyetsiz bulut platformunda sürekli iyileştirmeler yapıyor; bu gelişmeler AKT’nin değerini artırabilir.

- Ekosistem Uygulamaları: Akash Network üzerinde geliştirilen çeşitli merkeziyetsiz uygulamalar, AKT token talebini yükseltebilir.

III. 2025-2030 AKT Fiyat Tahminleri

2025 Görünümü

- Temkinli tahmin: 0,41 $ - 0,55 $

- Tarafsız tahmin: 0,55 $ - 0,70 $

- İyimser tahmin: 0,70 $ - 0,90 $ (güçlü piyasa toparlanması şartıyla)

2027 Görünümü

- Piyasa fazı beklentisi: Potansiyel büyüme dönemi

- Fiyat aralığı tahmini:

- 2026: 0,70 $ - 0,85 $

- 2027: 0,73 $ - 1,19 $

- Başlıca katalizörler: Merkeziyetsiz bulut bilişimin benimsenmesinin artması

2030 Uzun Vadeli Görünüm

- Temel senaryo: 1,00 $ - 1,30 $ (istikrarlı piyasa büyümesiyle)

- İyimser senaryo: 1,30 $ - 1,66 $ (hızlı benimseme halinde)

- Dönüştürücü senaryo: 1,66 $+ (teknolojide büyük atılımlar gerçekleşirse)

- 2030-12-31: AKT 1,66 $ (potansiyel zirve fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı (%) |

|---|---|---|---|---|

| 2025 | 0,90167 | 0,6679 | 0,4141 | 0 |

| 2026 | 0,84757 | 0,78478 | 0,7063 | 17 |

| 2027 | 1,19161 | 0,81617 | 0,73456 | 21 |

| 2028 | 1,15448 | 1,00389 | 0,7228 | 50 |

| 2029 | 1,52165 | 1,07919 | 0,93889 | 61 |

| 2030 | 1,66454 | 1,30042 | 0,9363 | 94 |

IV. AKT Yatırım Stratejileri ve Risk Yönetimi

AKT Yatırım Yaklaşımları

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: Risk toleransı yüksek, uzun vadeli bakış açısına sahip olanlar

- İşlem önerileri:

- Piyasa düşüşlerinde AKT biriktirin

- Kademeli kar alımı için fiyat hedefleri belirleyin

- AKT’yi güvenli, saklamalı cüzdanlarda tutun

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve destek/direnç seviyelerini belirlemek için kullanılır

- RSI (Göreli Güç Endeksi): Aşırı alım ve satım bölgelerini tespit etmeye yarar

- Dalgalı alım-satımda dikkat edilmesi gerekenler:

- AKT’nin genel kripto piyasasıyla korelasyonunu takip edin

- Risk yönetimi için zararı durdur emirleri kullanın

AKT Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3'ü

- Agresif yatırımcılar: Kripto portföyünün %5-10'u

- Profesyonel yatırımcılar: Kripto portföyünün en fazla %15'i

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Yatırımları birden fazla kripto varlığa yaymak

- Zararı durdur emirleri: Olası kayıpları sınırlamak için uygulanır

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan tavsiyesi: Gate Web3 Cüzdan

- Soğuk saklama çözümü: Uzun vadeli tutumda donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü kimlik doğrulama ve güçlü şifre kullanımı

V. AKT için Potansiyel Riskler ve Zorluklar

AKT Piyasa Riskleri

- Yüksek oynaklık: AKT fiyatı ciddi dalgalanmalara sahne olabilir

- Sınırlı likidite: Büyük işlem emirlerinin gerçekleşmesinde zorluk yaşanabilir

- Korelasyon riski: AKT, genel kripto piyasa duyarlılığından etkilenebilir

AKT Düzenleme Riskleri

- Belirsiz düzenleyici ortam: Merkeziyetsiz bulut bilişim için yeni düzenlemeler gelebilir

- Sınır ötesi uyumluluk: Farklı ülkelerin mevzuatına uyumda güçlükler

- Vergilendirme karmaşıklığı: Değişen vergi kanunları AKT sahiplerini etkileyebilir

AKT Teknik Riskler

- Ağ güvenliği: Akash Network’te olası güvenlik açıkları

- Ölçeklenebilirlik zorlukları: Artan talep ve işlem hacmine yanıt verebilme kapasitesi

- Rekabet: Merkeziyetsiz bulut bilişimde yeni projeler

VI. Sonuç ve Eylem Önerileri

AKT Yatırım Değeri Analizi

Akash Network (AKT), merkeziyetsiz bulut bilişim sektöründe özgün bir değer sunmaktadır. Uzun vadeli büyüme potansiyeline sahip olsa da, yatırımcıların kısa vadeli dalgalanmalar ve rekabetçi ortamda pazar payı kazanma kabiliyetini dikkate alması gerekir.

AKT Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Piyasa dinamiklerini tanımak için küçük ve düzenli yatırımlar yapın ✅ Deneyimli yatırımcılar: Uzun vadeli tutma ve stratejik alım-satım ile dengeli bir yaklaşımı tercih edin ✅ Kurumsal yatırımcılar: Detaylı inceleme yaparak AKT’yi çeşitlendirilmiş kripto portföyüne dahil etmeyi göz önünde bulundurun

AKT İşlem Katılım Yöntemleri

- Spot alım-satım: Gate.com spot piyasasında AKT alıp satabilirsiniz

- Staking: AKT stake ederek ödül kazanıp ağ güvenliğini destekleyebilirsiniz

- DeFi entegrasyonu: AKT ile merkeziyetsiz finans çözümlerini değerlendirin

Kripto para yatırımları son derece yüksek risk içerir. Bu makale yatırım tavsiyesi niteliğinde değildir. Yatırımcılar, kendi risk profillerini dikkate alarak temkinli karar vermeli ve profesyonel finans danışmanlarından destek almalıdır. Kaybetmeyi göze alabileceğinizden fazla yatırım yapmayın.

Sıkça Sorulan Sorular

Akash ne kadar yükselebilir?

Akash, merkeziyetsiz bulut bilişimin benimsenmesinin artması ve genel kripto piyasa büyümesiyle 2026’ya kadar 10-15 $ seviyelerine ulaşabilir.

Atom Cosmos’un geleceği var mı?

Evet, Atom Cosmos’un geleceği parlak. Yenilikçi birlikte çalışabilirlik çözümleri ve gelişen ekosistemi, blokzincir dünyasında uzun vadeli büyüme ve benimsenme potansiyeli sunuyor.

Akash kripto iyi mi?

Evet, Akash kripto gelecek vaat ediyor. Merkeziyetsiz bulut bilişim çözümleri sunuyor, güçlü bir ekip tarafından destekleniyor ve düzenli büyüme gösteriyor. Web3 alanındaki özgün değer önerisiyle potansiyel bir yatırım fırsatı oluşturuyor.

ACH coin 1 $’a ulaşır mı?

Kesin fiyat tahmini yapmak zor olsa da, ACH’nin uzun vadede 1 $’a ulaşması, artan benimseme ve piyasa büyümesiyle mümkün olabilir. Bunun için kayda değer gelişmeler ve olumlu piyasa koşulları gereklidir.

2025 ICP Fiyat Tahmini: Halving Sonrası Döngüde Büyüme Dinamiklerinin ve Pazar Potansiyelinin Değerlendirilmesi

2025 AR Fiyat Tahmini: Arweave Ekosisteminde Büyüme Faktörleri ile Piyasa Dinamiklerinin Analizi

2025 API3 Fiyat Tahmini: Merkeziyetsiz Oracle Token’ı için Piyasa Trendleri ve Büyüme Potansiyeli Analizi

2025 ICP Fiyat Tahmini: Benimseme ve geliştirme hızla artarken yükseliş beklentisi öne çıkıyor

2025 STORJ Fiyat Tahmini: Merkeziyetsiz Depolama Pazarında Gelecekteki Büyüme Potansiyelinin Analizi

2025 BAS Fiyat Tahmini: Piyasa Trendleri ve Blokzincir Tabanlı Varlık Tokenleri İçin Geleceğe Bakış

SEI Airdrop Ödülleri’ne Katılım ve Talep Etme Kılavuzu

Kripto para birimlerinde algoritmik alım satım için etkili stratejiler

Stock-to-Flow Model ile Bitcoin'in Değerlemesini Anlamak

İşlem hızının blockchain verimliliğini nasıl etkilediğini anlamak

ENS Domainleri ile Web3 Kimlik Yönetimi