2025 AAVE Fiyat Tahmini: DeFi Borç Verme Ekosisteminde Büyüme Potansiyeli ve Piyasa Faktörlerinin Analizi

Giriş: AAVE'nin Piyasa Pozisyonu ve Yatırım Değeri

Kripto para piyasasının önde gelen merkeziyetsiz borç verme protokollerinden biri olan AAVE (AAVE), 2020'de faaliyete geçmesinden bu yana dikkate değer başarılara imza atmıştır. 2025 yılı itibarıyla, AAVE'nin piyasa değeri 4,54 milyar ABD dolarına ulaşırken, dolaşımdaki arzı yaklaşık 15,23 milyon token ve fiyatı 298,12 ABD doları seviyesindedir. "DeFi borç verme öncüsü" olarak anılan bu varlık, merkeziyetsiz finans (DeFi) ekosistemi içinde giderek daha önemli bir konuma sahiptir.

Bu makale, AAVE'nin 2025-2030 arası fiyat gelişimini; tarihsel eğilimler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik değişkenlerle birlikte derinlemesine analiz etmeyi hedeflemektedir. Yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. AAVE Fiyat Geçmişi ve Mevcut Piyasa Durumu

AAVE'nin Tarihsel Fiyat Gelişimi

- 2020: AAVE token, AIP1 önerisiyle piyasaya sunuldu; LEND 100:1 oranında AAVE'ye dönüştürüldü

- 2021: 19 Mayıs'ta AAVE, tüm zamanların en yüksek seviyesi olan 661,69 ABD dolarına ulaştı

- 2022-2023: Piyasa döngülerinin etkisiyle fiyatlar hızlı bir şekilde zirveden tabana indi

AAVE Güncel Piyasa Durumu

10 Eylül 2025 itibarıyla AAVE, 298,12 ABD doları seviyesinden işlem görüyor ve kripto para piyasasında 37. sırada bulunuyor. 24 saatlik işlem hacmi 5.617.504,26 ABD doları. Son 24 saatte %1,07 gerileyen AAVE'nin haftalık düşüşü %5,1, ancak yıllık kazancı %112,71 ile oldukça güçlü.

AAVE'nin güncel piyasa değeri 4.539.455.346,49 ABD doları ile toplam kripto piyasasının %0,11'ine karşılık gelmektedir. Dolaşımdaki arzı 15.226.939,98 AAVE olup, bu toplam arzın %95,17'sine tekabül etmektedir.

Token, 19 Mayıs 2021'de ulaştığı 661,69 ABD doları rekorunun altında işlem görmekle birlikte, 5 Kasım 2020'deki 26,02 ABD doları ile kaydedilen dip seviyesinin oldukça üzerindedir. Bu tablo, piyasadaki dalgalanmalara rağmen Aave protokolüne olan güvenin ve ilginin güçlü şekilde devam ettiğini göstermektedir.

Güncel AAVE piyasa fiyatını görmek için tıklayın.

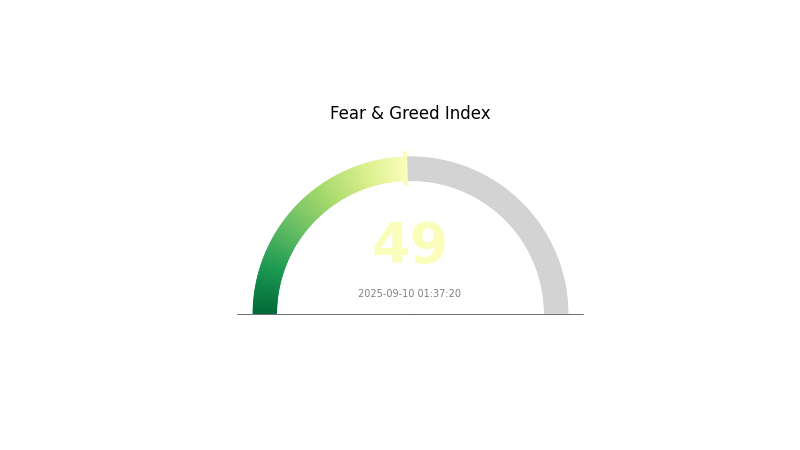

AAVE Piyasa Duyarlılığı Endeksi

10 Eylül 2025 Korku ve Açgözlülük Endeksi: 49 (Nötr)

Güncel Korku ve Açgözlülük Endeksi'ne ulaşmak için tıklayın.

AAVE piyasasında duyarlılık dengede seyretmektedir. 49 seviyesindeki Korku ve Açgözlülük Endeksi, yatırımcılar arasında ne aşırı korku ne de aşırı iyimserlik olduğunu, piyasada ölçülü bir yaklaşım benimsendiğini göstermektedir. Yatırımcılar, karar almadan önce dikkatli bir şekilde araştırma yapmalı ve piyasa gelişmelerini yakından izlemelidir. Her zaman olduğu gibi, çeşitlendirme ve etkin risk yönetimi, kripto para piyasalarını başarılı bir şekilde yönetmenin temelidir.

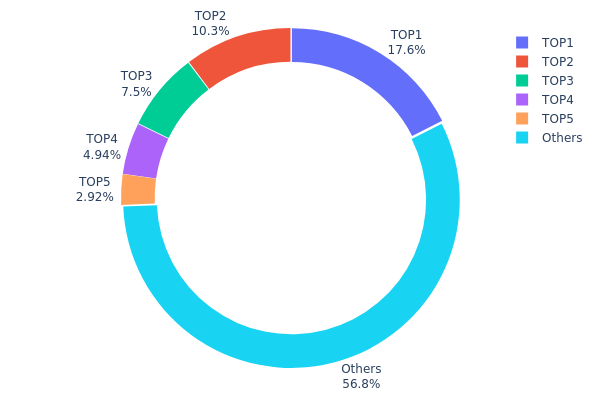

AAVE Token Dağılımı

AAVE adreslerinin sahiplik oranlarına ilişkin veriler, başlıca sahipler arasında belirgin bir yoğunlaşmaya işaret etmektedir. En büyük adres toplam arzın %17,56'sını elinde bulundururken, ilk 5 adresin kontrol ettiği token oranı %43,2'dir. Bu tür bir yoğunluk, görece merkezi bir sahiplik yapısını ortaya koymakta ve piyasa dinamiklerini etkileyebilmektedir.

Büyük miktarda token sahibi olan adresler, önemli alım-satım işlemleriyle hem fiyat oynaklığını artırabilir hem de piyasa likiditesini doğrudan etkileyebilir. Öte yandan, toplam tokenların %56,8'i diğer adresler arasında dağılmıştır; bu da üst düzey sahiplerin dışında kayda değer bir merkeziyetsizlik seviyesine işaret eder.

Mevcut dağılım, AAVE'nin zincir üstü yapısında orta düzeyde merkezileşme olduğunu gösteriyor. Bu yoğunlaşma, piyasa manipülasyonu riski taşırken aynı zamanda ana paydaşların projenin başarısına yüksek oranda bağlı olduklarını ortaya koyuyor. İlerleyen dönemde dağılımda yaşanacak değişimleri takip etmek, AAVE ekosisteminin merkeziyetsizlik ve istikrar seviyesini ölçmek açısından kritik önemdedir.

Güncel AAVE Token Dağılımı'nı incelemek için tıklayın.

| Sıra | Adres | Miktar (Bin) | Pay (%) |

|---|---|---|---|

| 1 | 0x4da2...e870f5 | 2.811,01 | 17,56% |

| 2 | 0xa700...4ff6c9 | 1.647,79 | 10,29% |

| 3 | 0xf977...41acec | 1.200,00 | 7,50% |

| 4 | 0x494a...e9e945 | 790,37 | 4,93% |

| 5 | 0x25f2...286491 | 467,63 | 2,92% |

| - | Diğerleri | 9.083,21 | 56,8% |

II. AAVE'nin Gelecekteki Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Toplam Arz: Toplam AAVE arzı 16.000.000 token ile sınırlıdır.

- Güncel Etki: Dolaşımdaki 15.227.066,77918962 AAVE ile bu sınırlı arz, kıtlık yaratarak fiyat üzerinde yukarı yönlü baskı oluşturabilir.

Kurumsal ve Büyük Yatırımcı (Whale) Dinamikleri

- Kurumsal Yatırım: Grayscale gibi büyük kurumların portföylerinde AAVE'yi bulundurması kurumsal ilginin arttığını göstermektedir.

- Kurumlarda Benimsenme: Öncü bir DeFi protokolü olarak AAVE, merkeziyetsiz finans ekosisteminde artan oranda kullanılmaktadır.

Makroekonomik Koşullar

- Enflasyona Karşı Koruma: AAVE, genel kripto para piyasasıyla birlikte potansiyel bir enflasyon koruma aracı olarak görülebilir.

- Jeopolitik Faktörler: Küresel ekonomik belirsizlikler ve jeopolitik gerginlikler, AAVE ve genel kripto piyasasına olan yatırımcı ilgisini etkileyebilir.

Teknoloji ve Ekosistem Gelişimi

- Çok zincirli erişim: AAVE; Ethereum, Polygon, Avalanche gibi birden çok blokzincir ağına entegre olarak kullanıcı erişimini genişletmiştir.

- Protokol V4: Yakında lanse edilecek olan Protokol V4, AAVE ekosistemine yeni işlevler ve iyileştirmeler kazandıracaktır.

- Ekosistem Uygulamaları: GHO stabilcoin ve Lens Protocol gibi DeFi ekosistemine katkı sunan AAVE projeleri, kullanım alanını genişletmektedir.

10 Eylül 2025 itibarıyla, AAVE 298,06 ABD doları seviyesinden işlem görmektedir. Piyasa değeri 4,54 milyar ABD doları ve kripto piyasasında 30. sıradadır. Son 24 saatte %-1,06, son bir haftada ise %-4,91 değişim göstermiştir.

III. 2025-2030 Dönemi AAVE Fiyat Tahminleri

2025 Tahmini

- İhtiyatlı tahmin: 262,84 – 298,68 ABD doları

- Nötr tahmin: 298,68 – 365,88 ABD doları

- İyimser tahmin: 365,88 – 433,09 ABD doları (sürdürülebilir DeFi benimsenmesi ve piyasa istikrarı koşuluyla)

2027-2028 Tahmini

- Piyasa fazı: Artan benimsenmeyle büyüme dönemi potansiyeli

- Fiyat aralığı tahmini:

- 2027: 256,41 – 488,78 ABD doları

- 2028: 413,58 – 631,49 ABD doları

- Temel etkenler: DeFi ekosisteminin büyümesi, kurumsal ilgi ve teknolojik atılımlar

2029-2030 Uzun Vadeli Beklenti

- Temel senaryo: 538,10 – 581,15 ABD doları (DeFi sektöründeki sürdürülebilir büyüme)

- İyimser senaryo: 624,20 – 807,80 ABD doları (yaygın benimsenme, olumlu regülasyon ortamı)

- Transformasyonel senaryo: >807,80 ABD doları (AAVE'nin lider DeFi protokolüne dönüşmesi durumunda)

- 2030-12-31: AAVE 581,15 ABD doları (2025 yılına kıyasla %94 artış)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 433,09 | 298,68 | 262,84 | 0 |

| 2026 | 435,4 | 365,88 | 212,21 | 22 |

| 2027 | 488,78 | 400,64 | 256,41 | 34 |

| 2028 | 631,49 | 444,71 | 413,58 | 49 |

| 2029 | 624,2 | 538,1 | 468,15 | 80 |

| 2030 | 807,8 | 581,15 | 395,18 | 94 |

IV. AAVE İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

AAVE Yatırım Stratejileri

(1) Uzun Vadeli Tutma Stratejisi

- Kime uygun: Uzun vadeli düşünen ve risk alabilen yatırımcılar

- Öneriler:

- Piyasa geri çekilmelerinde AAVE biriktirin

- Piyasa dalgalanmalarına karşı en az 2-3 yıl tokenlarınızı tutun

- Tokenlarınızı güvenli bir donanım cüzdanında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend tespiti ve olası dönüş noktalarını görmek için kullanın

- RSI: Aşırı alım veya satım bölgelerini belirleyin

- Dalga ticareti için kilit noktalar:

- Teknik göstergelere göre net giriş-çıkış seviyeleri belirleyin

- Olası kayıpları sınırlamak için zarar-durdur emirleri uygulayın

AAVE Risk Yönetimi Çerçevesi

(1) Varlık Dağıtım İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3'ü

- Agresif yatırımcılar: Kripto portföyünün %5-8'i

- Profesyonel yatırımcılar: Kripto portföyünün %15'ine kadar AAVE'ye ayrılabilir

(2) Riskten Korunma Stratejileri

- Çeşitlendirme: Yatırımı birden fazla DeFi projesine dağıtın

- Zarar-durdur emirleri: Olası kayıpları sınırlandırmak için kullanın

(3) Güvenli Saklama Yöntemleri

- Donanım cüzdanı: Gate Web3 Cüzdan önerilir

- Yazılım cüzdanı: Resmi Aave cüzdanı tercih edilebilir

- Güvenlik önlemleri: İki faktörlü doğrulama etkinleştirilip güçlü şifreler kullanılmalı

V. AAVE'de Potansiyel Riskler ve Zorluklar

AAVE Piyasa Riskleri

- Volatilite: DeFi tokenları yüksek fiyat dalgalanmalarına maruz kalabilir

- Rekabet: Yeni DeFi protokolleri Aave'nin pozisyonunu zorlayabilir

- Likidite riski: Piyasa stres koşullarında likidite azalabilir

AAVE Regülasyon Riskleri

- Regülasyon belirsizliği: DeFi düzenlemelerindeki değişiklikler Aave operasyonlarını etkileyebilir

- Uyumluluk gereklilikleri: İleride KYC/AML uygulanması gerekebilir

- Sınır ötesi zorluklar: Farklı ülkelerde değişen regülasyon yaklaşımları

AAVE Teknik Riskleri

- Akıllı sözleşme açıkları: Protokolde istismar veya saldırı riski bulunur

- Oracle arızaları: Hatalı fiyat verileri borç verme/borçlanma işleyişini bozabilir

- Ölçeklenebilirlik sorunları: Ağ yoğunluğu yüksek gas ücretlerine yol açabilir

VI. Sonuç ve Eylem Önerileri

AAVE Yatırım Değeri Değerlendirmesi

AAVE, öncü bir DeFi protokolü olarak uzun vadede güçlü bir değer vadeder. Bununla birlikte, kısa vadeli volatilite ve regülasyonlardaki belirsizlikler risk oluşturmaktadır.

AAVE Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayın; öncelikle DeFi konseptlerini öğrenin

✅ Tecrübeli yatırımcılar: Portföyünüzün %3-5'ini AAVE'ye ayırmayı değerlendirin

✅ Kurumsal yatırımcılar: Çeşitli bir DeFi stratejisinin parçası olarak AAVE'yi değerlendirin

AAVE İşlem Katılım Yöntemleri

- Spot işlemler: Gate.com'da AAVE alın ve tutun

- DeFi katılımı: Aave protokolünde AAVE stake ederek ek getiri elde edin

- Likidite sağlama: AAVE likidite havuzlarına katılarak ödüller kazanın

Kripto para yatırımları son derece yüksek risk içerir. Bu makale yatırım tavsiyesi değildir. Yatırım kararlarınızı kendi risk toleransınızı gözeterek verin ve profesyonel finansal danışmanlarla görüşün. Kaybetmeyi göze alabileceğiniz miktardan fazlasını asla yatırmayın.

Sıkça Sorulan Sorular

2025'te Aave'nin fiyatı ne olacak?

Piyasa analizlerine göre, Aave'nin 2025 yılı içinde maksimum 380,55 ABD doları, minimum 115,03 ABD doları ve ortalama 279,02 ABD doları seviyelerinde olması beklenmektedir.

Aave 1.000 ABD dolarına çıkabilir mi?

Evet, Aave'nin uzun vadede 1.000 ABD dolarına ulaşma potansiyeli mevcuttur. Güçlü büyüme ivmesi ve piyasa trendleri bu hedefi ulaşılabilir kılıyor.

Aave'nin geleceği var mı?

Evet, Aave'nin gelecek vadettiği söylenebilir. Yenilikçi DeFi çözümleri, güçlü topluluk ve geliştirici ekibiyle büyüme potansiyeli yüksek; ancak piyasa koşulları ve regülasyonlar, yolculuğunu belirleyecektir.

2030'da Aave'nin değeri ne olur?

Nötr piyasa senaryosunda, Aave'nin 2030 Temmuz ortasında yaklaşık 607,93 € seviyesine ulaşması beklenmektedir. Ancak, kripto piyasasında dalgalanmalar ve ani değişiklikler her zaman mümkündür.

2025 EUL Fiyat Tahmini: DeFi Ekosisteminde Euler Finance Token’a Yönelik Piyasa Analizi ve Gelecek Trendleri

2025 1INCH Fiyat Tahmini: DeFi Toplayıcı Tokeninin Büyüme Potansiyeli ve Piyasa Trendlerinin Analizi

2025 DEEP Fiyat Tahmini: Dijital Ekonomi Geliştirilmiş Protokollerinin Gelecek Piyasa Trendleri ve Büyüme Potansiyeli Analizi

2025 EDGE Fiyat Tahmini: Büyüme Potansiyeli Analizi ve Gelecekteki Değeri Etkileyen Piyasa Faktörleri

2025 BENQI Fiyat Tahmini: DeFi Protokolü İçin Piyasa Trendleri ve Gelecek Değerleme Analizi

2025 UMA Fiyat Tahmini: DeFi Sektöründe Piyasa Trendleri ve Gelecek Büyüme Potansiyelinin Analizi

Dropee Günlük Kombinasyonu 12 Aralık 2025

Tomarket Günlük Kombinasyonu 12 Aralık 2025

SEI Airdrop Ödülleri’ne Katılım ve Talep Etme Kılavuzu

Kripto para birimlerinde algoritmik alım satım için etkili stratejiler

Stock-to-Flow Model ile Bitcoin'in Değerlemesini Anlamak