2025 SUTPrice Prediction: Comprehensive Analysis and Future Outlook for Sustainable Urban Transportation Market Trends

Introduction: SUT's Market Position and Investment Value

SuperTrust (SUT) has established itself as a payment method for globally developed and operated platforms since its inception. As of 2025, SuperTrust's market capitalization has reached $1.81 billion, with a circulating supply of approximately 188,403,732 tokens, and a price hovering around $9.598. This asset, known for its role in global advertising and natural landscape sharing platforms, is playing an increasingly crucial role in digital marketing and eco-tourism sectors.

This article will comprehensively analyze SuperTrust's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

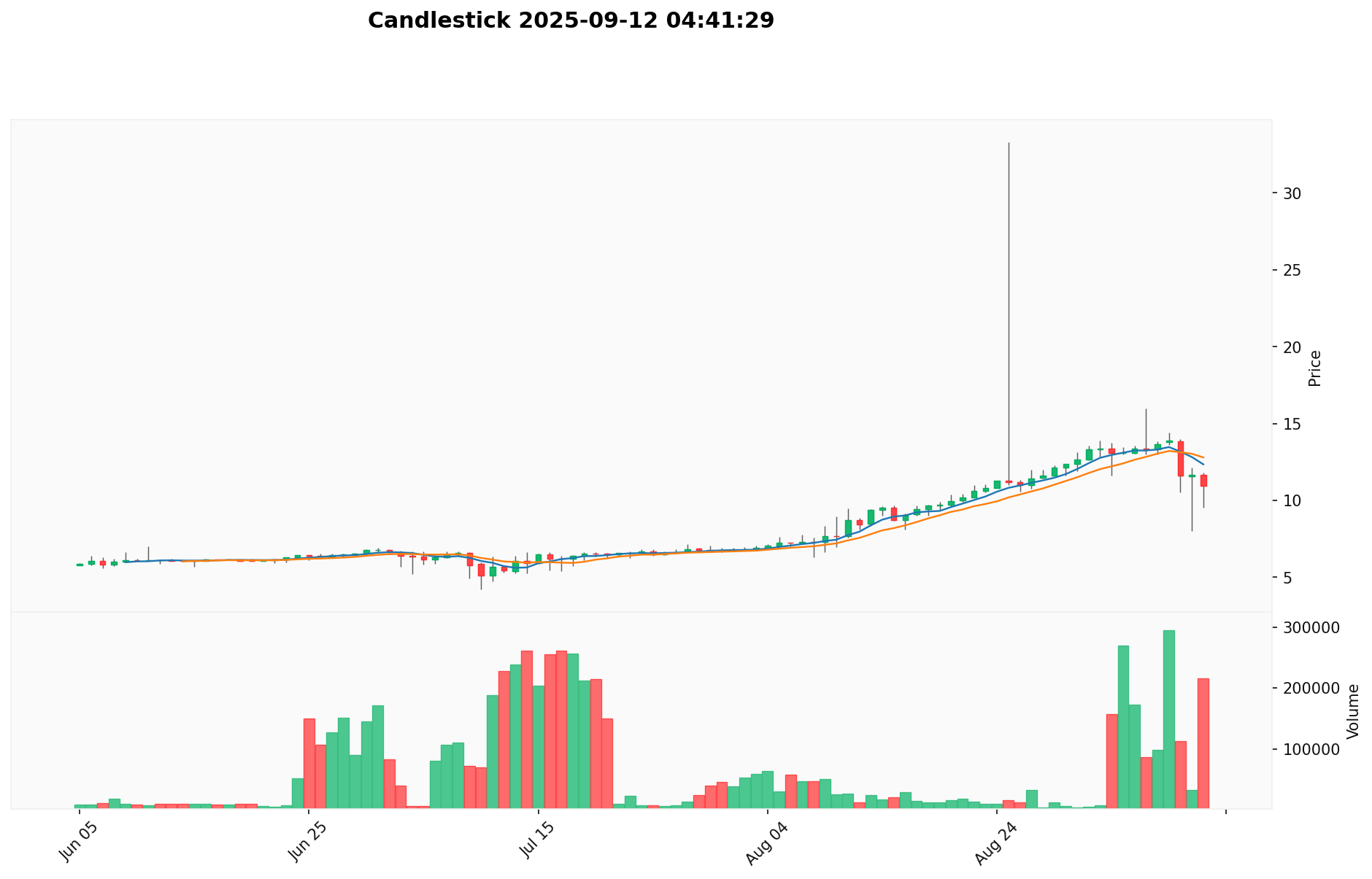

I. SUT Price History Review and Current Market Status

SUT Historical Price Evolution

- 2025: SUT reached its all-time high of $33.3 on August 25th

- 2025: SUT hit its all-time low of $3.9 on April 4th

- 2025: Significant price volatility, with a 320.80% increase over the past year

SUT Current Market Situation

As of September 12, 2025, SUT is trading at $9.598, experiencing a 14.17% decrease in the last 24 hours. The token has a market capitalization of $1,808,299,019.736, ranking 77th in the overall cryptocurrency market. SUT's trading volume in the past 24 hours stands at $1,620,652.39389.

Despite the recent 24-hour decline, SUT has shown positive performance over the past month, with an 11.75% increase. However, the token has experienced a significant drop of 27.41% in the last 7 days, indicating short-term bearish sentiment.

The current circulating supply of SUT is 188,403,732 tokens, which is 99.99% of its total supply. The fully diluted market cap is $2,288,199,019.7360, suggesting potential for future growth if the project meets its objectives.

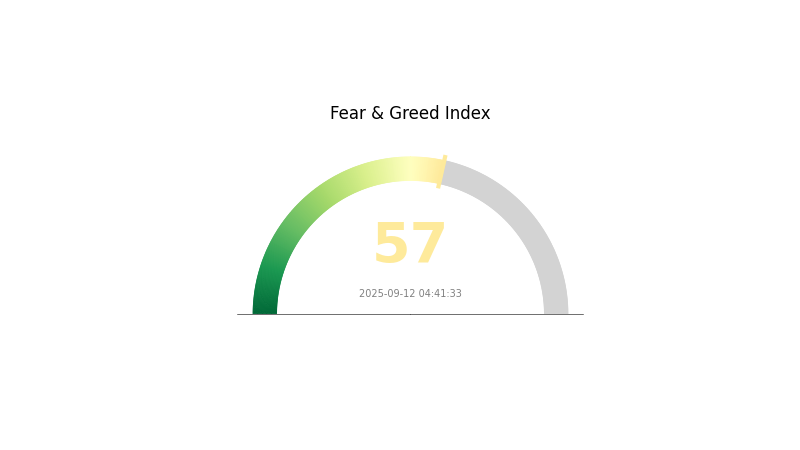

The market sentiment for cryptocurrencies overall appears to be in a state of "Greed" with a VIX index of 57, which may influence SUT's price movements in the near term.

Click to view the current SUT market price

SUT Market Sentiment Indicator

2025-09-12 Fear and Greed Index: 57 (Greed)

Click to view the current Fear & Greed Index

The crypto market is exhibiting signs of greed today, with the Fear and Greed Index at 57. This suggests investors are becoming more optimistic, potentially driven by recent positive market movements or news. However, it's crucial to remain cautious as excessive greed can lead to overvaluation and increased volatility. Traders should consider balancing their portfolios and not letting FOMO (Fear of Missing Out) drive their decisions. As always, thorough research and risk management are essential in navigating the crypto market's dynamic landscape.

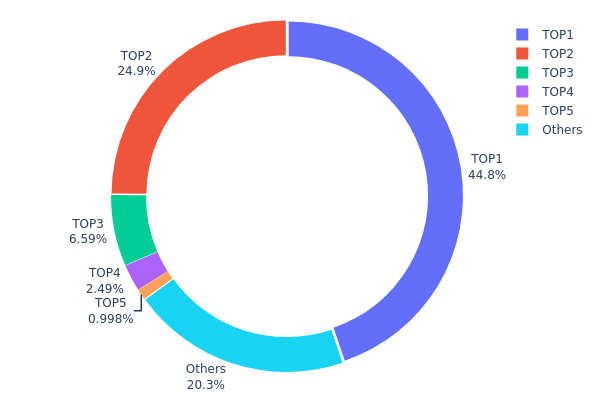

SUT Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of SUT tokens among different wallet addresses. Analysis of this data reveals a highly concentrated ownership structure for SUT. The top address holds a significant 44.78% of the total supply, while the second-largest holder, likely a burn address, controls 24.88%. Together, the top two addresses account for nearly 70% of all SUT tokens.

This concentration level raises concerns about market stability and potential price manipulation. With such a large portion of tokens held by a few addresses, there's an increased risk of market volatility if these major holders decide to sell. Furthermore, the high concentration may impact the token's decentralization efforts and governance processes.

Despite these concerns, it's worth noting that about 20.29% of SUT tokens are distributed among numerous smaller holders, which could provide some level of market resilience. However, the overall picture suggests a need for increased token distribution to enhance market stability and reduce centralization risks in the SUT ecosystem.

Click to view the current SUT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x987d...c5dd2d | 90000.00K | 44.78% |

| 2 | 0x0000...00dead | 50000.00K | 24.88% |

| 3 | 0xaaa4...89cc2c | 13233.51K | 6.58% |

| 4 | 0x03fd...136597 | 5000.00K | 2.48% |

| 5 | 0x1b32...21a133 | 2004.50K | 0.99% |

| - | Others | 40705.82K | 20.29% |

II. Key Factors Affecting SUT's Future Price

Supply Mechanism

- Maximum Supply: The maximum supply of SuperTrust (SUT) is capped at 238,403,732 tokens.

- Circulating Supply: As of September 12, 2025, the circulating supply is 2,024,492.29 SUT.

- Current Impact: The limited circulating supply relative to the maximum supply may create scarcity, potentially influencing price dynamics.

Institutional and Whale Dynamics

- Corporate Adoption: SuperTrust has its own platform at supertrust.club, indicating potential for corporate and user adoption.

Macroeconomic Environment

- Inflation Hedging Properties: As a cryptocurrency, SUT may be viewed as a potential hedge against inflation, similar to other digital assets.

Technological Development and Ecosystem Building

- Platform: SUT operates on the Polygon platform, leveraging its ecosystem and technological infrastructure.

- Ecosystem Applications: SuperTrust has its own website and platform, suggesting the development of ecosystem applications and services.

III. SUT Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $7.29 - $9.59

- Neutral prediction: $9.59 - $10.65

- Optimistic prediction: $10.65 - $12.25 (requires favorable market conditions)

2027-2028 Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2027: $8.84 - $12.53

- 2028: $9.60 - $17.43

- Key catalysts: Increased adoption, technological advancements, market sentiment

2030 Long-term Outlook

- Base scenario: $17.21 - $19.77 (assuming steady market growth)

- Optimistic scenario: $19.77 - $22.54 (assuming strong market performance)

- Transformative scenario: Above $22.54 (under extremely favorable conditions)

- 2030-12-31: SUT $17.21 (79% increase from 2025)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 10.65156 | 9.596 | 7.29296 | 0 |

| 2026 | 12.24977 | 10.12378 | 5.66932 | 5 |

| 2027 | 12.52919 | 11.18678 | 8.83755 | 16 |

| 2028 | 17.43124 | 11.85798 | 9.60497 | 23 |

| 2029 | 19.77022 | 14.64461 | 13.61949 | 52 |

| 2030 | 22.54172 | 17.20742 | 9.292 | 79 |

IV. Professional Investment Strategies and Risk Management for SUT

SUT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Value investors with a long-term perspective

- Operational suggestions:

- Accumulate SUT tokens during market dips

- Regularly review project developments and adjust positions accordingly

- Store tokens in secure hardware wallets for long-term holding

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear stop-loss and take-profit levels

- Monitor trading volume for confirmation of price movements

SUT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Portfolio diversification: Balance SUT with other crypto assets

- Use of stop-loss orders: Limit potential losses on exchanges

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate web3 wallet

- Cold storage solution: Offline storage for large holdings

- Security precautions: Use two-factor authentication, regular security audits

V. Potential Risks and Challenges for SUT

SUT Market Risks

- Volatility: High price fluctuations common in the crypto market

- Liquidity: Limited trading pairs may affect ease of buying/selling

- Competition: Other projects in the advertising and landscape sharing space

SUT Regulatory Risks

- Uncertain regulations: Potential for new laws affecting token usage

- Cross-border compliance: Challenges in adhering to various jurisdictions

- Tax implications: Evolving tax treatment of crypto assets

SUT Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability challenges: Ability to handle increased network load

- Technological obsolescence: Risk of being outpaced by newer solutions

VI. Conclusion and Action Recommendations

SUT Investment Value Assessment

SUT presents an innovative approach to global advertising and landscape sharing platforms. While it offers potential long-term value in these growing markets, investors should be aware of short-term volatility and regulatory uncertainties.

SUT Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about the project ✅ Experienced investors: Consider a balanced approach with regular portfolio rebalancing ✅ Institutional investors: Conduct thorough due diligence and consider OTC options for large acquisitions

SUT Trading Participation Methods

- Spot trading: Available on Gate.com for direct token purchases

- Staking: Explore staking options if offered by the project

- DeFi integration: Monitor for potential DeFi opportunities involving SUT tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for Synthetix in 2030?

Based on current market trends, Synthetix is projected to reach $1.108134 by 2030, representing a 55.94% increase from current prices.

What is the Sol stock price forecast for 2025?

Based on current market trends, the Sol stock price forecast for 2025 is expected to range between $1.307 and $1.914528, with a recent prediction indicating $1.368035.

Will hamster coin prices increase in the future?

Yes, hamster coin prices are projected to increase significantly. Forecasts suggest the price could reach $0.0₈3116 by 2030, representing a substantial gain from current levels.

What is the best token price prediction in 2025?

Based on current trends, BlockchainFX (BFX) is predicted to have the best token price in 2025. It's already generating daily revenue as a crypto super app, making it a top investment choice.

แชร์

เนื้อหา