**RRPGAw**

İngilizce topluluğun günlük bülteni

=====

Yayın tarihi: 2025-08-01

Genel piyasa duygusu

=====

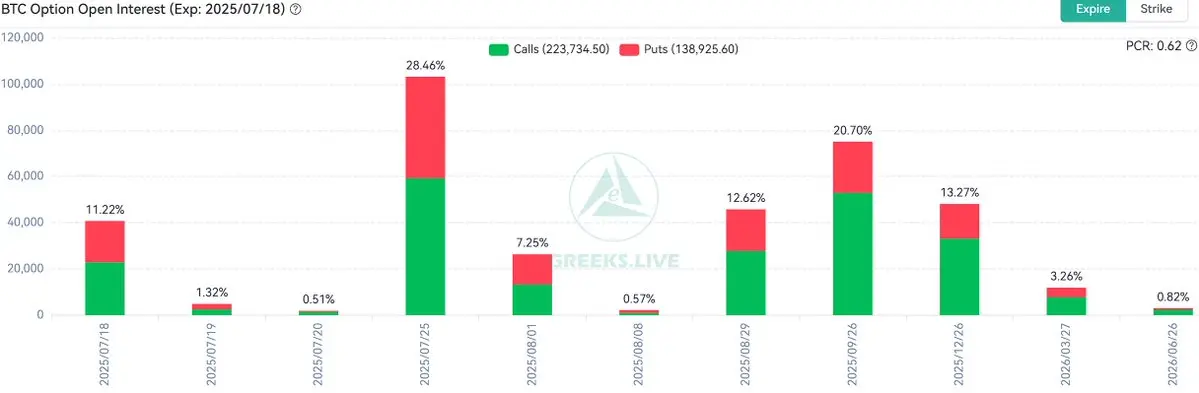

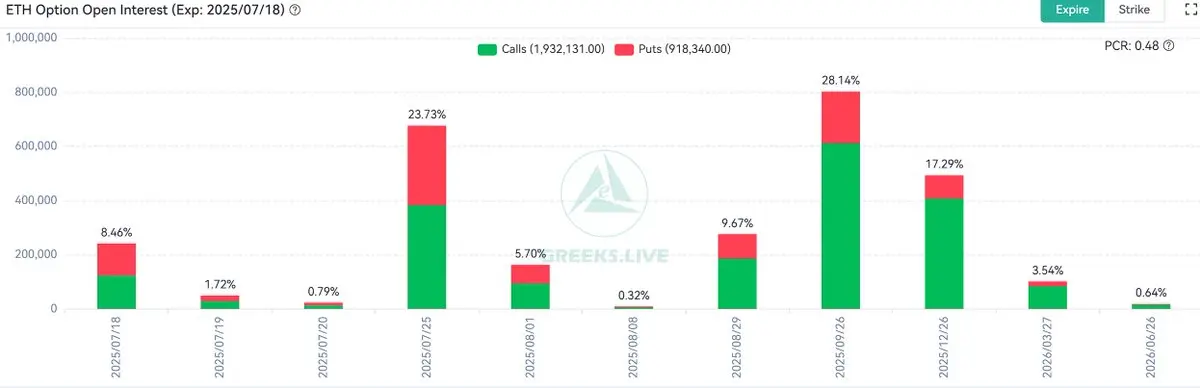

Gruplar genel olarak düşüşe işaret eden karmaşık duygular sergiliyor, ancak bazı insanlar yine de genel eğilim konusunda yükseliş inancını sürdürüyor. Ana gözlem noktaları arasında direnç seviyesi 115, düşüş opsiyonu kullanım fiyatı 113 ve 110, aşırı aşağı yönlü hedef 97 bulunmaktadır.

Volatilite ticareti baskı altında - Seçenek stratejileri test ediliyor

=====

• Satış opsiyonu pozisyonu büyük baskı altında, bir trader 115 direnç seviyesinin aşılmasının ardından 113 put opsiyonunu 110 kullanım fiyatın

View Original=====

Yayın tarihi: 2025-08-01

Genel piyasa duygusu

=====

Gruplar genel olarak düşüşe işaret eden karmaşık duygular sergiliyor, ancak bazı insanlar yine de genel eğilim konusunda yükseliş inancını sürdürüyor. Ana gözlem noktaları arasında direnç seviyesi 115, düşüş opsiyonu kullanım fiyatı 113 ve 110, aşırı aşağı yönlü hedef 97 bulunmaktadır.

Volatilite ticareti baskı altında - Seçenek stratejileri test ediliyor

=====

• Satış opsiyonu pozisyonu büyük baskı altında, bir trader 115 direnç seviyesinin aşılmasının ardından 113 put opsiyonunu 110 kullanım fiyatın