K线数字密码9

Live broadcast room on December 1st at noon: Institutional trading model long position strategy:

More trading strategies. For Android phones, you can click on the subscription dynamic strategy directly to subscribe. For Apple phones, you need to subscribe by trying this official link: https://www.gate.com/zh/profile/K线数字密码

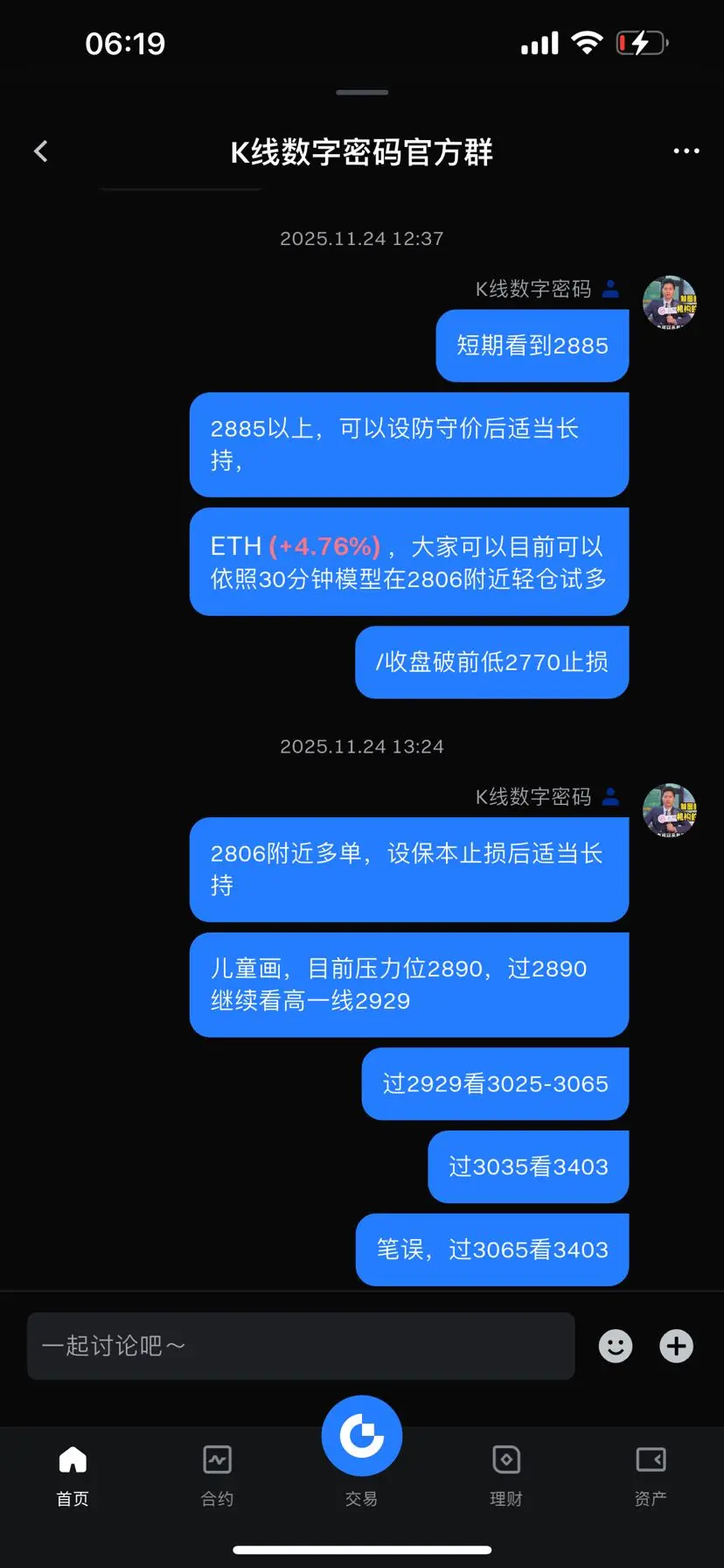

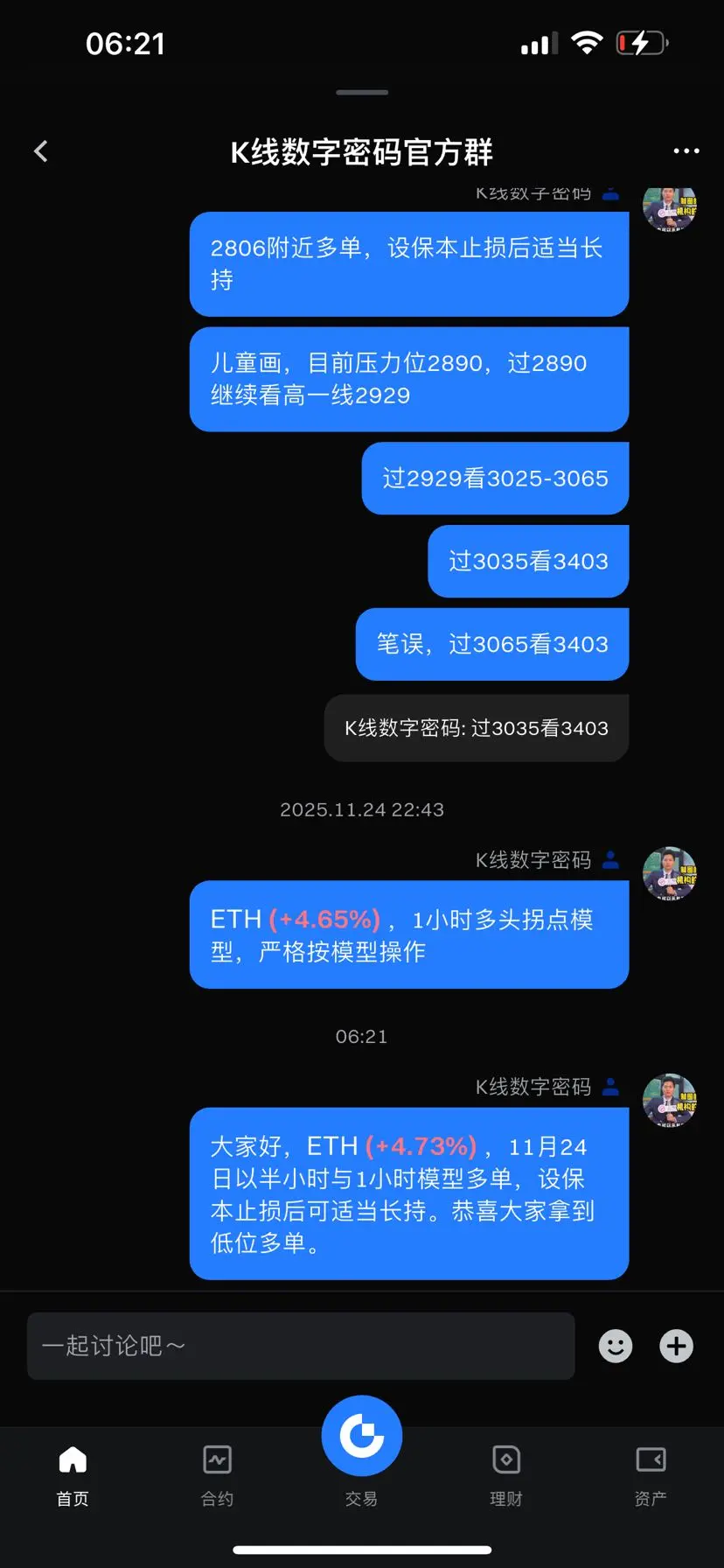

ETH long position, general entry point:

First opening point: 2765±10 (Manage your funds well, and you are responsible for your own profits and losses.)

Stop-loss price: 2729

Take profit price: For intraday or small wave trades, follow up on take profit yourself.

Position: Li

More trading strategies. For Android phones, you can click on the subscription dynamic strategy directly to subscribe. For Apple phones, you need to subscribe by trying this official link: https://www.gate.com/zh/profile/K线数字密码

ETH long position, general entry point:

First opening point: 2765±10 (Manage your funds well, and you are responsible for your own profits and losses.)

Stop-loss price: 2729

Take profit price: For intraday or small wave trades, follow up on take profit yourself.

Position: Li

ETH-7.11%