# eTh

23.83M

小木论

1.23 Friday Bitcoin and Ethereum Afternoon Analysis

Currently, market volatility is limited, maintaining a weak trend, and it is still suitable to establish short positions. Recently, prices have been oscillating within the key level zone around 90,000, neither effectively breaking downward nor forming a significant rebound.

From a time cycle analysis, the past two days show a regular pattern of a rebound in the early session followed by a decline during the European and American trading hours. Considering today is Friday, unless there is a major fundamental change to break the current pattern

View OriginalCurrently, market volatility is limited, maintaining a weak trend, and it is still suitable to establish short positions. Recently, prices have been oscillating within the key level zone around 90,000, neither effectively breaking downward nor forming a significant rebound.

From a time cycle analysis, the past two days show a regular pattern of a rebound in the early session followed by a decline during the European and American trading hours. Considering today is Friday, unless there is a major fundamental change to break the current pattern

- Reward

- 6

- Comment

- Repost

- Share

1.23 Friday Bitcoin and Ethereum Midday Analysis

The four-hour chart indicates a clearer market structure. The market trend remains strictly confined within a consolidation range, with support and resistance levels clearly defined. Currently, the price is precisely touching the key resistance area at the upper boundary of the range, and the upward potential has been fully blocked. Caution is advised regarding the potential misleading nature of a rebound.

Bitcoin around 90200 watch near 88500

Ethereum around 2990 watch near 2900

#BTC #ETH #BNB

View OriginalThe four-hour chart indicates a clearer market structure. The market trend remains strictly confined within a consolidation range, with support and resistance levels clearly defined. Currently, the price is precisely touching the key resistance area at the upper boundary of the range, and the upward potential has been fully blocked. Caution is advised regarding the potential misleading nature of a rebound.

Bitcoin around 90200 watch near 88500

Ethereum around 2990 watch near 2900

#BTC #ETH #BNB

- Reward

- 6

- Comment

- Repost

- Share

1.24 Saturday Bitcoin and Ethereum Midday Analysis

In the short term, after continuous upward movement, the momentum has weakened, and the validity of the upper pressure zone has been further confirmed. It is expected that there will be no effective breakthrough in the short term. Market participation tends to be relatively light over the weekend, and the trend is likely to be dominated by oscillation and consolidation, so focus on short-term trades.

Bitcoin around 90200 watch near 89500

Ethereum around 2980 watch near 2920

#BTC #ETH #BNB

View OriginalIn the short term, after continuous upward movement, the momentum has weakened, and the validity of the upper pressure zone has been further confirmed. It is expected that there will be no effective breakthrough in the short term. Market participation tends to be relatively light over the weekend, and the trend is likely to be dominated by oscillation and consolidation, so focus on short-term trades.

Bitcoin around 90200 watch near 89500

Ethereum around 2980 watch near 2920

#BTC #ETH #BNB

- Reward

- 6

- Comment

- Repost

- Share

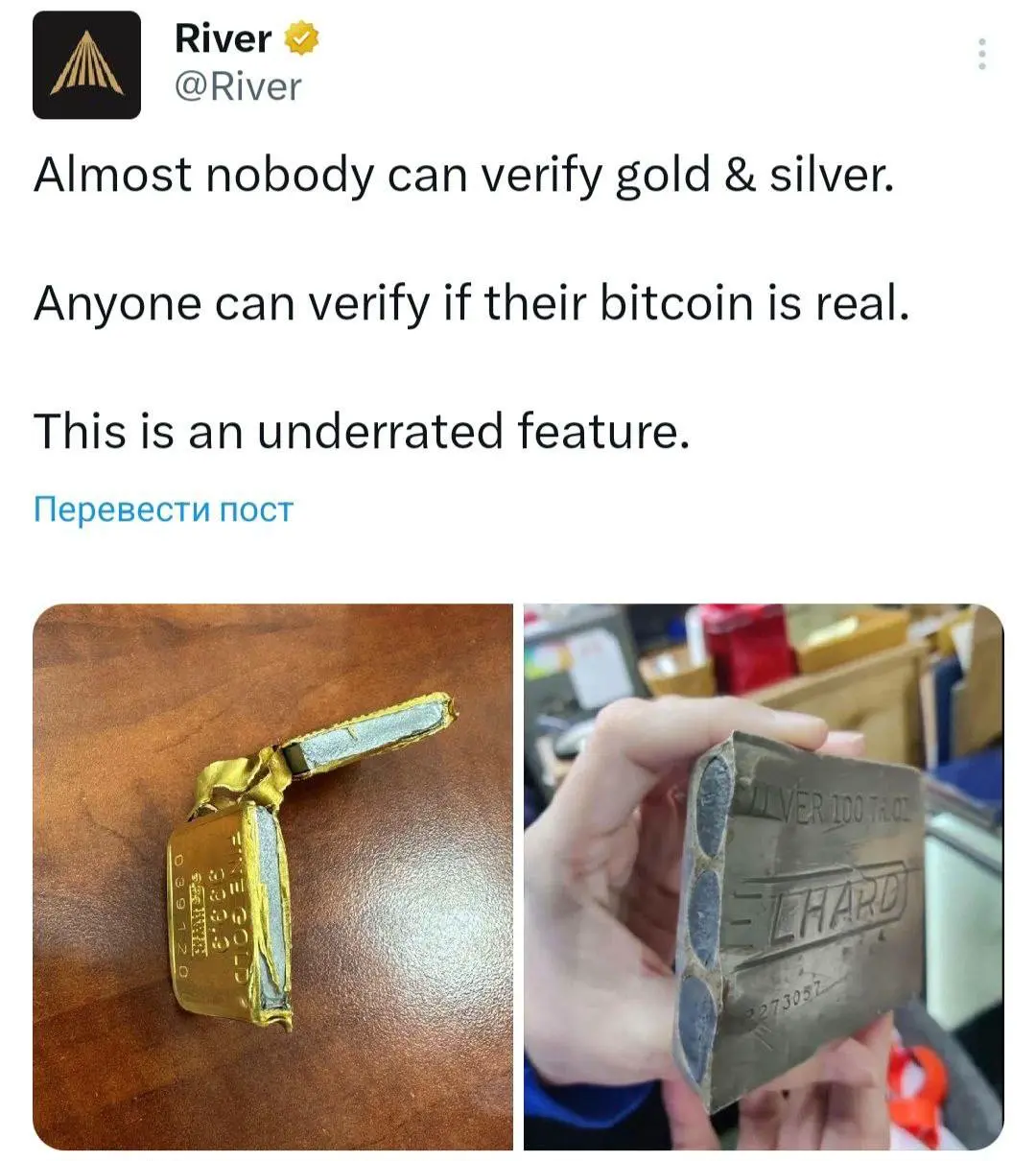

🔥 #CryptoMarketPullback 🔥

Crypto markets are taking a breather! After weeks of bullish momentum, Bitcoin, Ethereum, and major altcoins have pulled back from recent highs. But don’t panic—pullbacks are natural and healthy in any maturing market.

💡 Why This Happens:

1️⃣ Profit-Taking: Traders cash in after strong rallies.

2️⃣ Macro Uncertainty: Interest rates, inflation, and global events affect sentiment.

3️⃣ Leverage Cleanup: Over-leveraged positions get liquidated, making the market stronger.

4️⃣ Regulatory News: Even neutral updates can trigger short-term sell-offs.

📊 What It Means for I

Crypto markets are taking a breather! After weeks of bullish momentum, Bitcoin, Ethereum, and major altcoins have pulled back from recent highs. But don’t panic—pullbacks are natural and healthy in any maturing market.

💡 Why This Happens:

1️⃣ Profit-Taking: Traders cash in after strong rallies.

2️⃣ Macro Uncertainty: Interest rates, inflation, and global events affect sentiment.

3️⃣ Leverage Cleanup: Over-leveraged positions get liquidated, making the market stronger.

4️⃣ Regulatory News: Even neutral updates can trigger short-term sell-offs.

📊 What It Means for I

- Reward

- 3

- 2

- Repost

- Share

Vortex_King :

:

Buy To Earn 💎View More

🎊🌈#ETH$ETH :

The Heart of the Ethereum Project: Why Is It So Valuable?

Ethereum is the "World’s Computer," hosting thousands of applications. What makes it valuable is not just its price, but the smart contracts within it. In 2026, Ethereum stands out as:

- Center of Tokenization: The main platform where banks and companies digitize real-world assets (real estate, stocks).

- Deflationary Structure: ETH is burned with each transaction. This reduces supply over time, and with demand increasing, the price remains under natural upward pressure.

2. What Drives Ethereum?

ETH is known in the

The Heart of the Ethereum Project: Why Is It So Valuable?

Ethereum is the "World’s Computer," hosting thousands of applications. What makes it valuable is not just its price, but the smart contracts within it. In 2026, Ethereum stands out as:

- Center of Tokenization: The main platform where banks and companies digitize real-world assets (real estate, stocks).

- Deflationary Structure: ETH is burned with each transaction. This reduces supply over time, and with demand increasing, the price remains under natural upward pressure.

2. What Drives Ethereum?

ETH is known in the

- Reward

- 3

- 4

- Repost

- Share

Falcon_Official :

:

1000x VIbes 🤑View More

ZEC's Largest Short Position Partially Closes ETH Short

On January 24, a notable address known for its significant short position on ZEC executed a partial profit-taking on its ETH short position. According to BlockBeats On-chain Detection, the address reduced its ETH short by 1,055.93 ETH. Despite this reduction, the ETH short position remains substantial, valued at $118.7 million, with a current floating profit of approximately $11.04 million.

The address gained recognition for establishing a large short position on ZEC, initially shorting from $184. After incurring a floating loss of $21 mi

On January 24, a notable address known for its significant short position on ZEC executed a partial profit-taking on its ETH short position. According to BlockBeats On-chain Detection, the address reduced its ETH short by 1,055.93 ETH. Despite this reduction, the ETH short position remains substantial, valued at $118.7 million, with a current floating profit of approximately $11.04 million.

The address gained recognition for establishing a large short position on ZEC, initially shorting from $184. After incurring a floating loss of $21 mi

ETH-0,12%

- Reward

- 1

- 1

- Repost

- Share

Miwhu_ :

:

Happy New Year! 🤑- Reward

- 1

- 1

- Repost

- Share

deltapro :

:

BTC @ $89500, #ETH @ $2950 Index of fear and greed - 34

Alto season index - 29

Market capitalization - $3.1 trillion.

Thoughts on coins

📉 Short applicants:

—INJ

—FLOK

📈 Long candidates:

—TAC

—CLO

#DTCCMovesTowardTokenization The DTCC, which handles over $1.5 quadrillion in annual securities, is quietly rewriting the rules of global finance. Tokenization isn’t a gimmick—it’s structural disruption. Traditional settlements take T+2 days, locking trillions in liquidity and creating systemic risk. DTCC’s move to tokenize equities, bonds, and derivatives could cut settlement time to minutes, free trillions, and enable 24/7 global trading.

Here’s the truth most analysts won’t say: if DTCC succeeds, traditional finance as we know it changes. Institutions that ignore blockchain will be structur

Here’s the truth most analysts won’t say: if DTCC succeeds, traditional finance as we know it changes. Institutions that ignore blockchain will be structur

- Reward

- 2

- Comment

- Repost

- Share

🎯 #ETH Positive📈(

The market is witnessing institutional accumulation of ETH: Ethereum remains a key asset in the tokenization sector of )RWA(; increased investor interest is confirmed by activity from major wallets and the participation of BlackRock and Bitmine funds. Amid overall fear in the )25–34( index, ETH shows potential for recovery supported by institutional demand and Bitcoin market correction.

News and Institutional Factors )📈(:

Major Purchases and Institutional Drivers: The address “0xfb7” via FalconX bought 20,013 ETH )≈ $59 million(, reinforcing accumulation signals.

Applicati

View OriginalThe market is witnessing institutional accumulation of ETH: Ethereum remains a key asset in the tokenization sector of )RWA(; increased investor interest is confirmed by activity from major wallets and the participation of BlackRock and Bitmine funds. Amid overall fear in the )25–34( index, ETH shows potential for recovery supported by institutional demand and Bitcoin market correction.

News and Institutional Factors )📈(:

Major Purchases and Institutional Drivers: The address “0xfb7” via FalconX bought 20,013 ETH )≈ $59 million(, reinforcing accumulation signals.

Applicati

- Reward

- 3

- 4

- Repost

- Share

GateUser-cb8193b1 :

:

Bull run 🐂View More

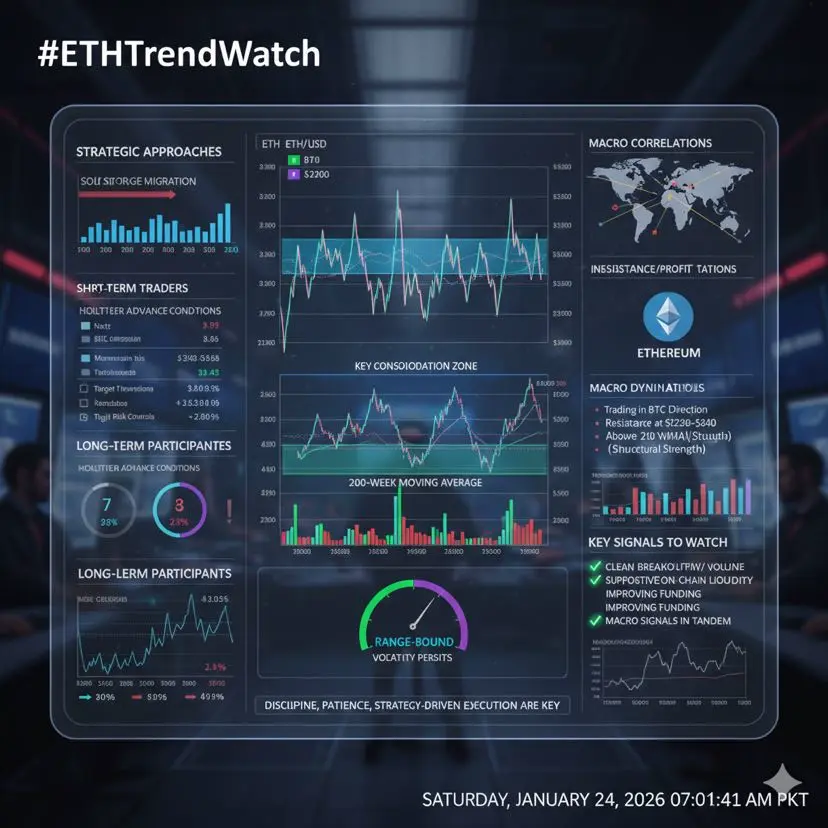

🔥 #ETHTrendWatch | Ethereum in Consolidation Mode

Ethereum (ETH) is currently navigating a range-bound consolidation, balancing technical structure with macro uncertainty. No panic—just calculated price discovery.

💹 Price Action Snapshot • Range: $2,970 – $3,200

• Choppy movement after recent highs

• Strong demand zone: $3,100–$3,200

• Key resistance: $3,250–$3,400 (profit-taking area)

📊 Technical Outlook • ETH holds above the 200-week MA → long-term strength intact

• A clean breakout above $3,400–$3,450 could unlock bullish momentum

• Accumulation at support, distribution near resistance

•

Ethereum (ETH) is currently navigating a range-bound consolidation, balancing technical structure with macro uncertainty. No panic—just calculated price discovery.

💹 Price Action Snapshot • Range: $2,970 – $3,200

• Choppy movement after recent highs

• Strong demand zone: $3,100–$3,200

• Key resistance: $3,250–$3,400 (profit-taking area)

📊 Technical Outlook • ETH holds above the 200-week MA → long-term strength intact

• A clean breakout above $3,400–$3,450 could unlock bullish momentum

• Accumulation at support, distribution near resistance

•

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

58.72K Popularity

34.61K Popularity

28.47K Popularity

11.96K Popularity

21.9K Popularity

15.72K Popularity

13.78K Popularity

81.07K Popularity

42.79K Popularity

24.75K Popularity

13.81K Popularity

2.51K Popularity

257.29K Popularity

24.09K Popularity

182.82K Popularity

News

View MoreRootData: EIGEN will unlock tokens worth approximately $12.91 million in one week

7 m

RootData: BEAT will unlock tokens worth approximately $6.02 million in one week.

7 m

Overview of popular cryptocurrencies on January 25, 2026, with the top three in popularity being: PENGUIN, FIGHT, ENSO

7 m

RootData: ZETA will unlock tokens worth approximately $3.19 million in one week

8 m

Brazil Central Bank: Banks and brokerages must hire independent third-party compliance certification to conduct cryptocurrency business

9 m

Pin