Post content & earn content mining yield

placeholder

GateUser-9a3f4236

- Reward

- like

- Comment

- Repost

- Share

Single liquidation exceeds $700 million, approaching 50 small targets. Is this big brother okay…

View Original

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

馬币火

Malaysian Ringgit

Created By@TIANDAO

Listing Progress

100.00%

MC:

$9.29K

Create My Token

Short-Term Holder Capitulation Signals Rising Selling Pressure in Bitcoin

Recent on-chain data shows a sharp increase in realized losses from Bitcoin short-term holders, indicating that coins acquired in recent months are being moved to exchanges at prices below their acquisition cost. This behavior typically reflects capitulation, where newer market participants exit positions under pressure from rapid price declines.

The current spike in short-term holder losses aligns with Bitcoin’s move toward the low-$80K region, suggesting that leveraged and late-cycle entries are being forced out as vol

Recent on-chain data shows a sharp increase in realized losses from Bitcoin short-term holders, indicating that coins acquired in recent months are being moved to exchanges at prices below their acquisition cost. This behavior typically reflects capitulation, where newer market participants exit positions under pressure from rapid price declines.

The current spike in short-term holder losses aligns with Bitcoin’s move toward the low-$80K region, suggesting that leveraged and late-cycle entries are being forced out as vol

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- 1

- Repost

- Share

Dannyw :

:

This wave of decline sees Bitcoin heading towards 76,000, possibly even lower. Ethereum is heading towards around 2,100. Anyway, now the rebound is just a shorting opportunity.#CryptoMarketPullback 🚨 Breaking: 🚨Over $400M in longs were liquidated in the past 4 hours.

- Reward

- 2

- 1

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊Gate Live 2026 Lunar New Year On-Chain Gala · Non-Stop Market Insights https://www.gate.com/campaigns/3937?ref_type=132

- Reward

- like

- Comment

- Repost

- Share

Built in silence. Claimed in $LOCKIN.

- Reward

- like

- Comment

- Repost

- Share

大神们,我这点位拿到多少?

View Original

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

Market is fucked. It’s time to accumulate based coins.$lifehacks

- Reward

- like

- Comment

- Repost

- Share

星星之火

星星之火

Created By@gatefunuser_936d

Listing Progress

100.00%

MC:

$3.28K

Create My Token

My Little pumpkin has arrived 🎃👶Life just got richer.Blessed. ✨🤍

- Reward

- like

- Comment

- Repost

- Share

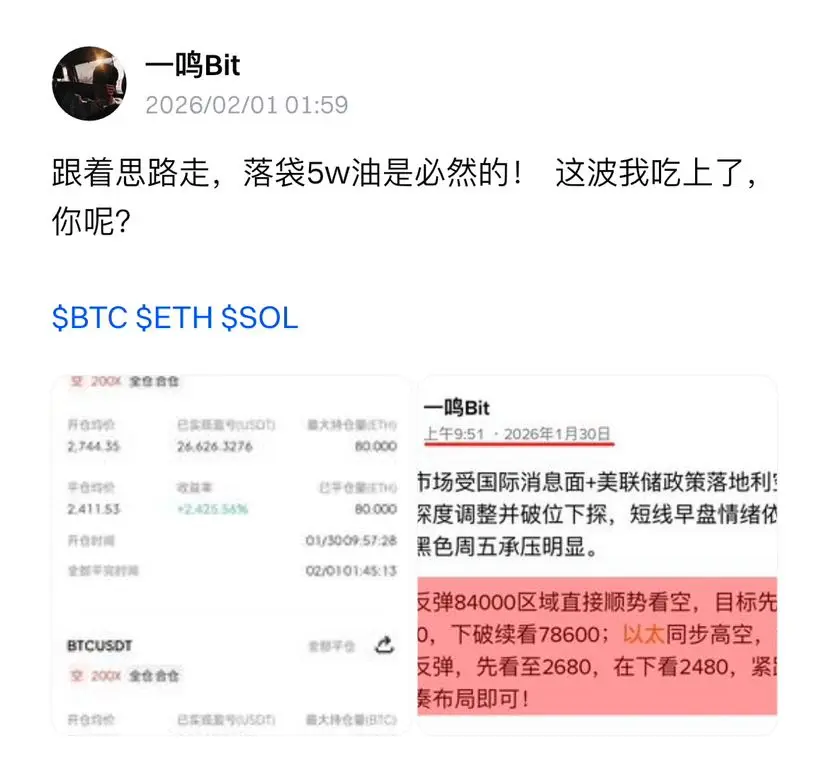

24 hours, $2.5 billion liquidation, 400,000 people out.

95% are long positions.

This is not about market direction,

it's leverage being liquidated by the market.

Kill off another segment, completely clear out

Technical rebound (for escaping)

View Original95% are long positions.

This is not about market direction,

it's leverage being liquidated by the market.

Kill off another segment, completely clear out

Technical rebound (for escaping)

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

X monetization coaches right now trying to explain to their audience why they got paused

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More13.85K Popularity

54.13K Popularity

363.52K Popularity

41.15K Popularity

61.84K Popularity

News

View MoreData: In the past 24 hours, the total liquidation across the network was $2.53 billion, with long positions liquidated at $2.415 billion and short positions at $115 million.

14 m

Data: Bitcoin price has fallen below $78,000, indicating a significant decline in the market. Investors are advised to exercise caution as the cryptocurrency experiences increased volatility. Stay tuned for further updates on market trends and analysis.

52 m

ETH Breaks Through 2400 USDT

1 h

"1011 Insider Whale" was fully liquidated on Hyperliquid, with a single liquidation exceeding $700 million

1 h

Data: 1,154,000 TRUMP tokens transferred from an anonymous address to Bitgo Custody, valued at approximately $4.88 million.

1 h

Pin