Post content & earn content mining yield

placeholder

LaidDown

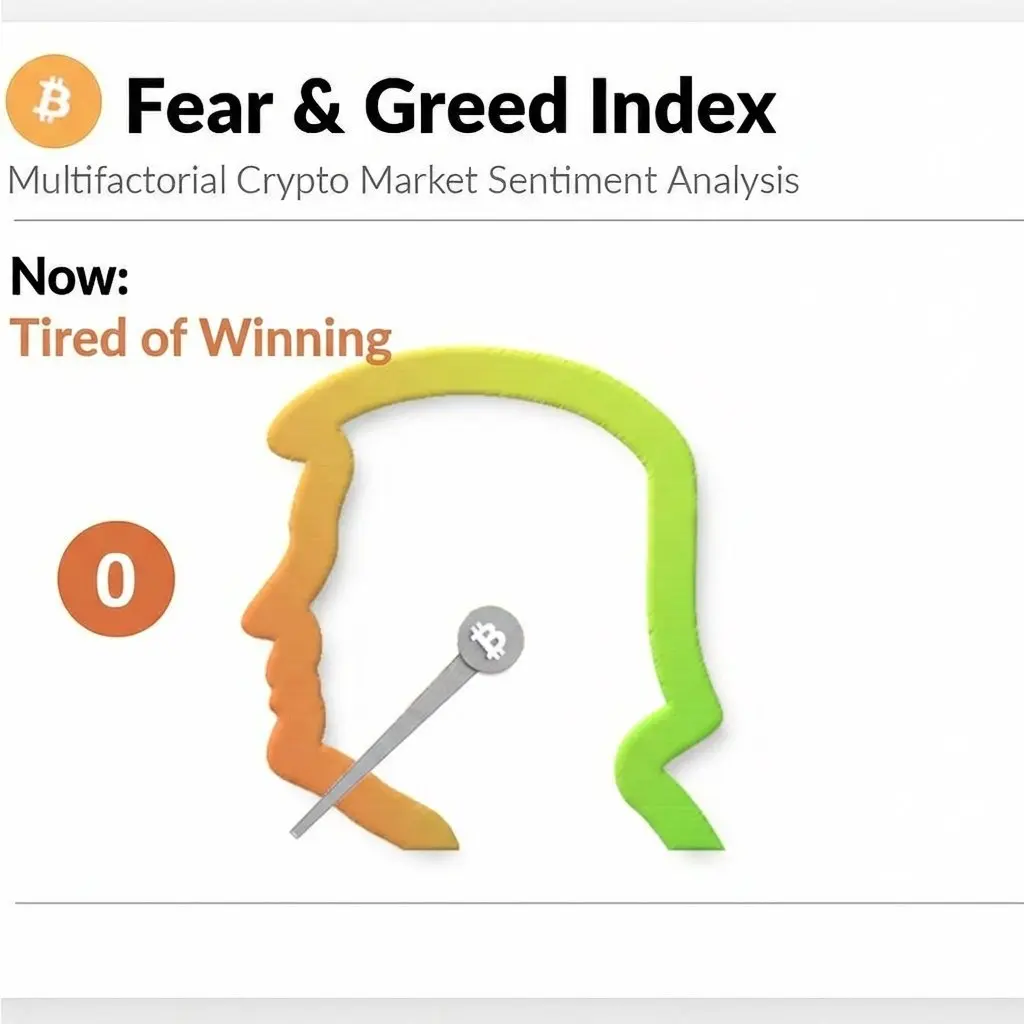

Crypto bro fear and green index

- Reward

- like

- Comment

- Repost

- Share

#DoubleRewardsWithGUSD

Gate Launchpool – Minting, Staking & Yield Opportunities 🚀

Gate is currently offering an exciting opportunity for crypto enthusiasts to mint at 4.4% APR and stake in Launchpool with up to 441.65% APR. Here’s what’s happening and why it matters:

1️⃣ Minting at 4.4% APR

What it means: Users can lock their stablecoins or supported assets to mint new tokens while earning a steady 4.4% APR.

Why it’s interesting: In today’s market, a guaranteed APR—even in a lower range—provides capital preservation with passive returns, which is especially attractive during volatility.

2️⃣

Gate Launchpool – Minting, Staking & Yield Opportunities 🚀

Gate is currently offering an exciting opportunity for crypto enthusiasts to mint at 4.4% APR and stake in Launchpool with up to 441.65% APR. Here’s what’s happening and why it matters:

1️⃣ Minting at 4.4% APR

What it means: Users can lock their stablecoins or supported assets to mint new tokens while earning a steady 4.4% APR.

Why it’s interesting: In today’s market, a guaranteed APR—even in a lower range—provides capital preservation with passive returns, which is especially attractive during volatility.

2️⃣

- Reward

- 1

- 3

- Repost

- Share

HighAmbition :

:

Buy To Earn 💎View More

- Reward

- like

- Comment

- Repost

- Share

多买点

多买点

Created By@ChineseMemeHeartTransmitter

Listing Progress

0.00%

MC:

$3.37K

Create My Token

- Reward

- 1

- Comment

- Repost

- Share

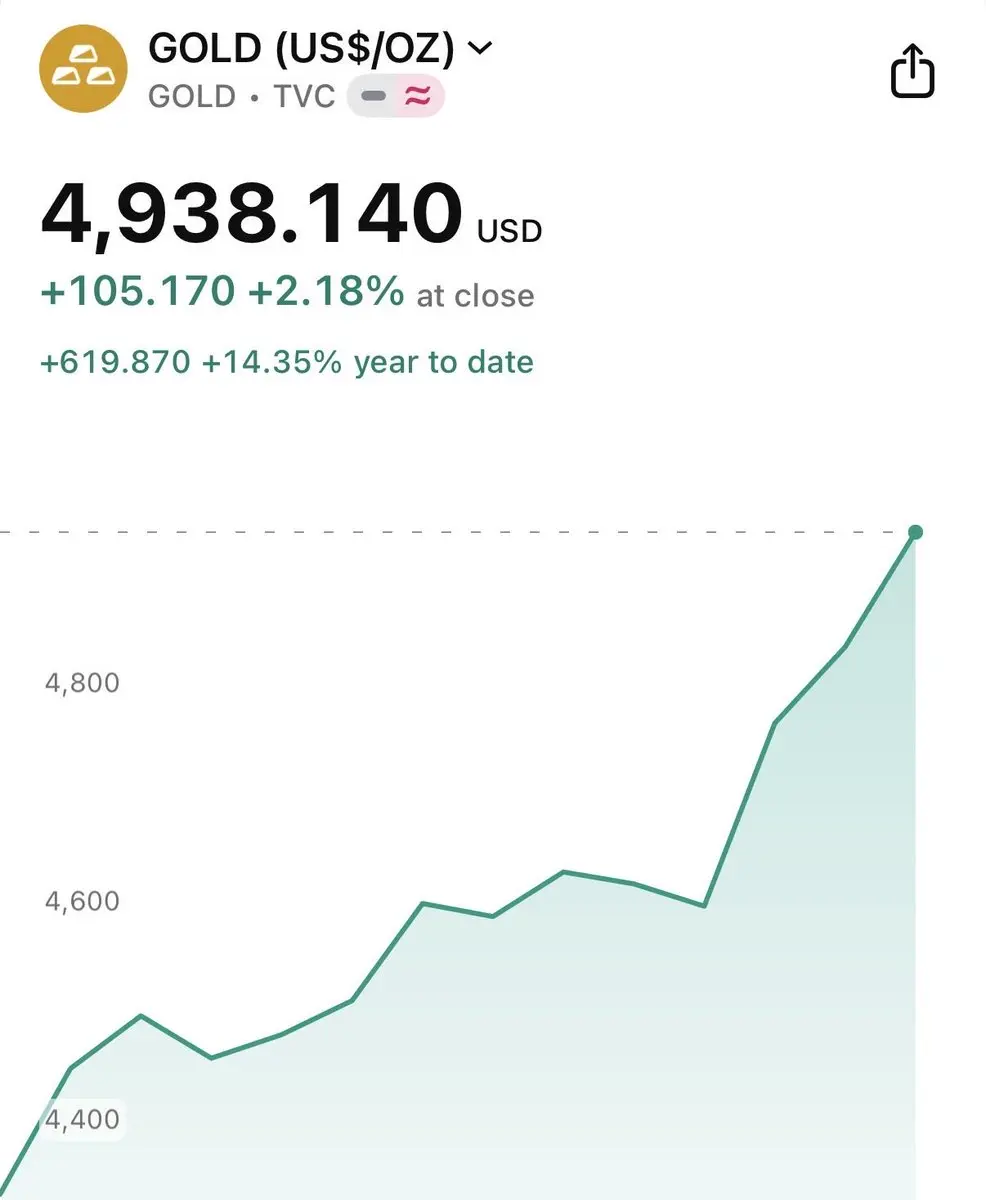

#GoldandSilverHitNewHighs

#GoldandSilverHitNewHighs

As of January 22, 2026, global precious metals markets are capturing renewed attention as gold and silver surge to fresh multi-year highs, reinforcing their status as critical safe-haven assets in an increasingly uncertain macroeconomic environment. Amid heightened volatility across equities, rising bond yields, and persistent geopolitical and policy-driven risks, investors are once again turning toward tangible stores of value. Gold’s upward momentum reflects sustained institutional demand, central bank accumulation, and growing concern ove

#GoldandSilverHitNewHighs

As of January 22, 2026, global precious metals markets are capturing renewed attention as gold and silver surge to fresh multi-year highs, reinforcing their status as critical safe-haven assets in an increasingly uncertain macroeconomic environment. Amid heightened volatility across equities, rising bond yields, and persistent geopolitical and policy-driven risks, investors are once again turning toward tangible stores of value. Gold’s upward momentum reflects sustained institutional demand, central bank accumulation, and growing concern ove

- Reward

- 1

- 1

- Repost

- Share

DragonFlyOfficial :

:

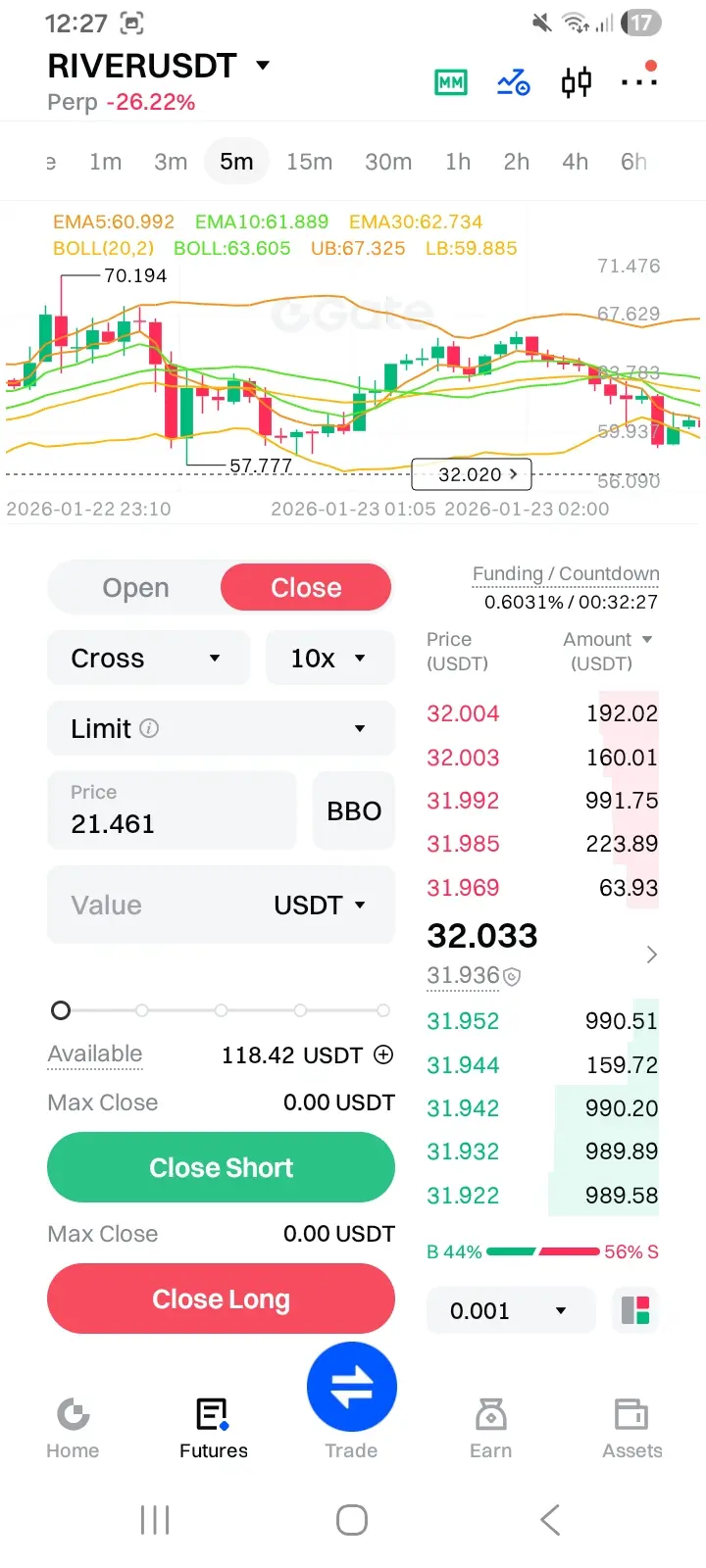

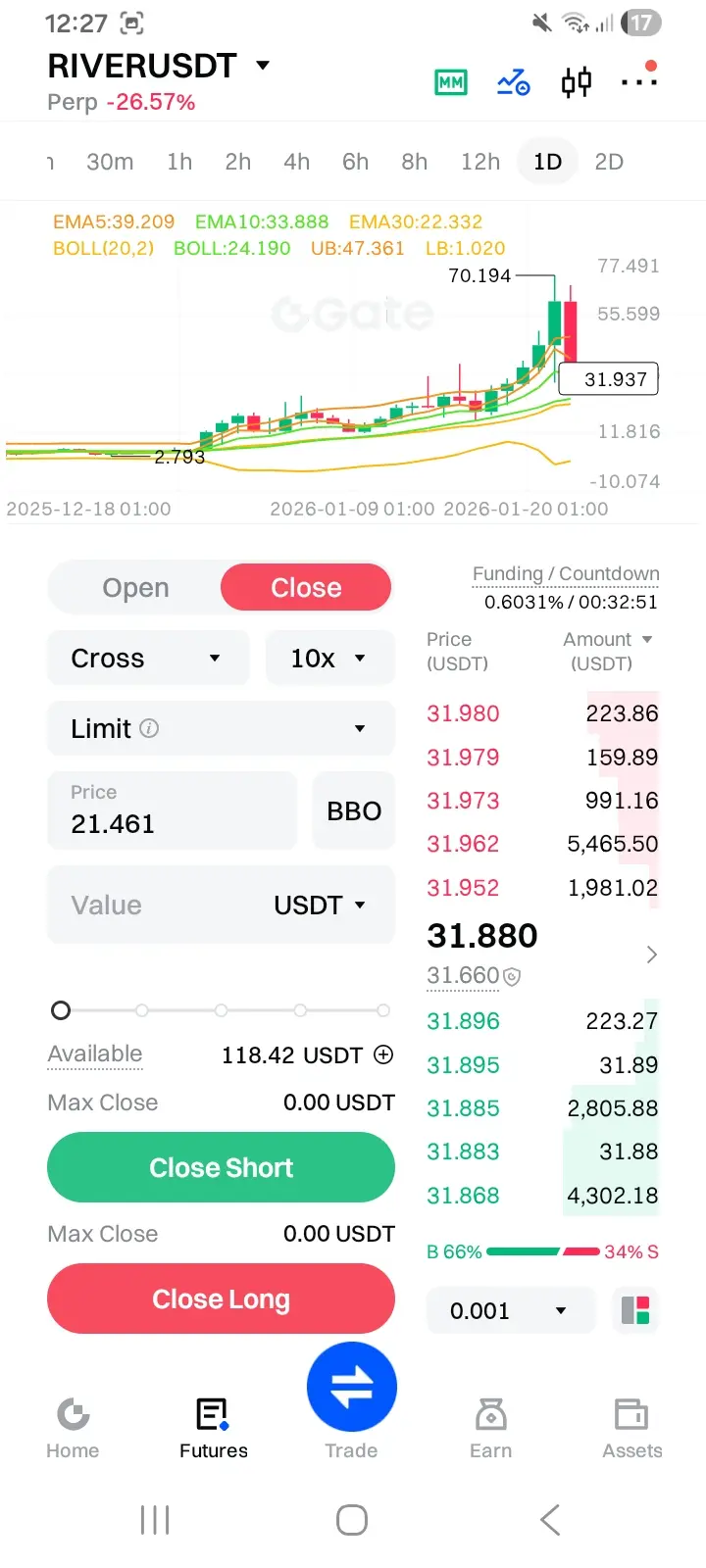

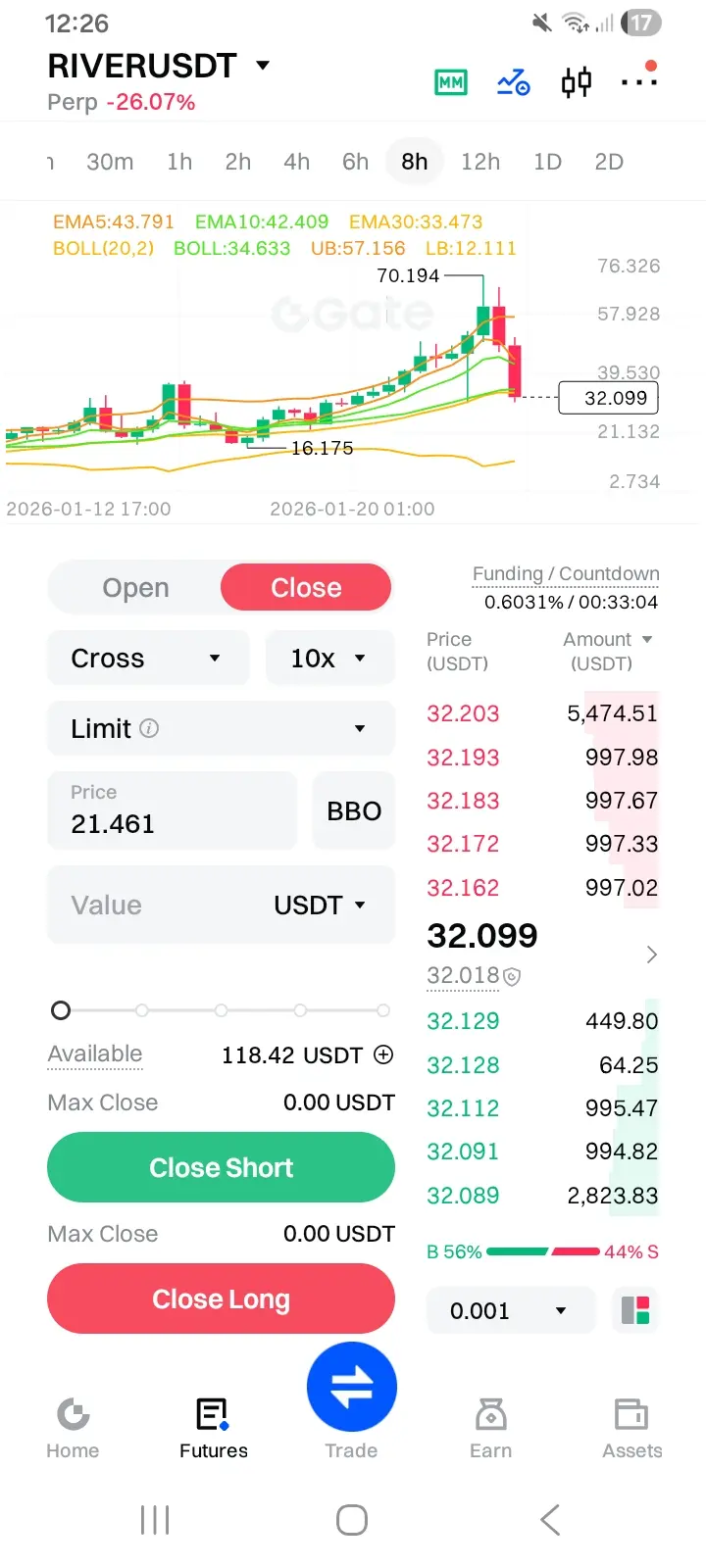

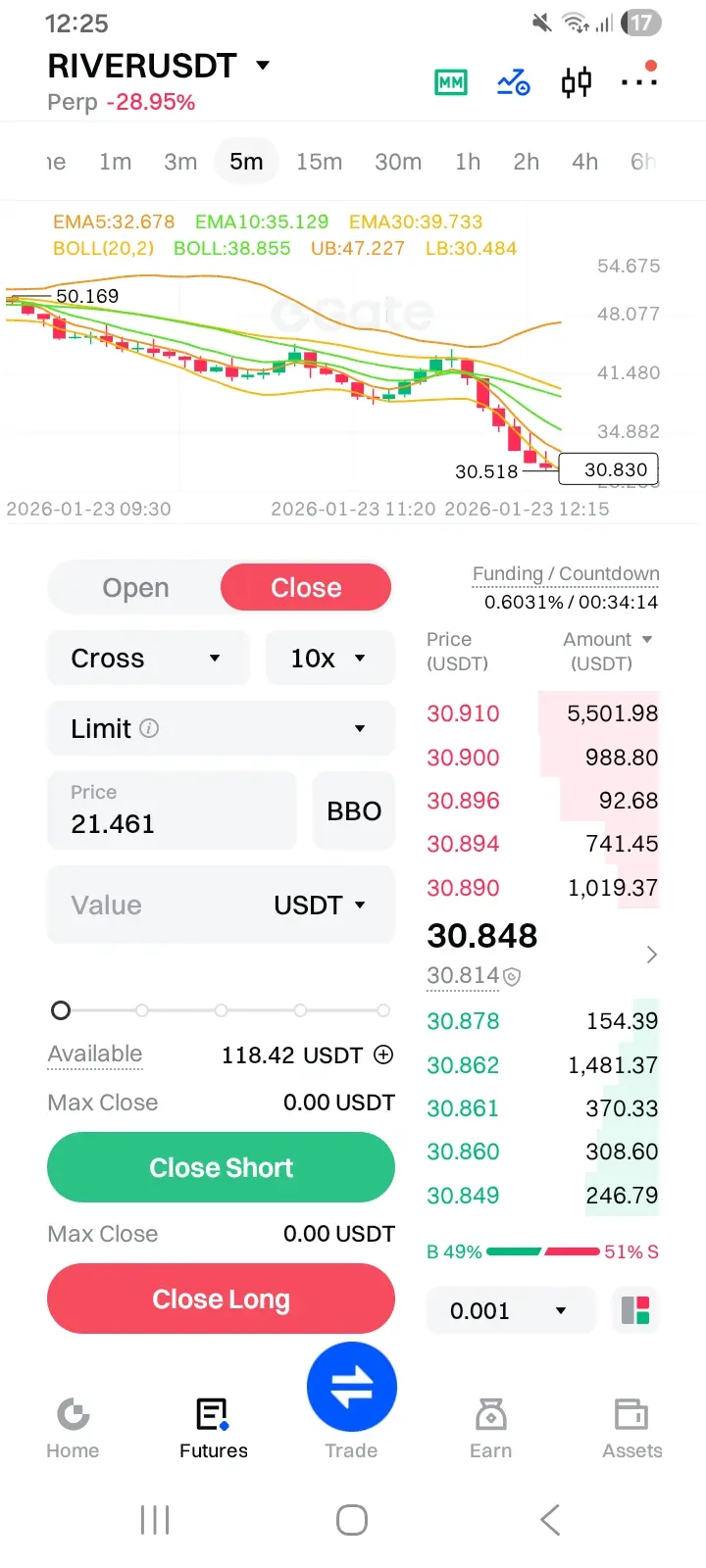

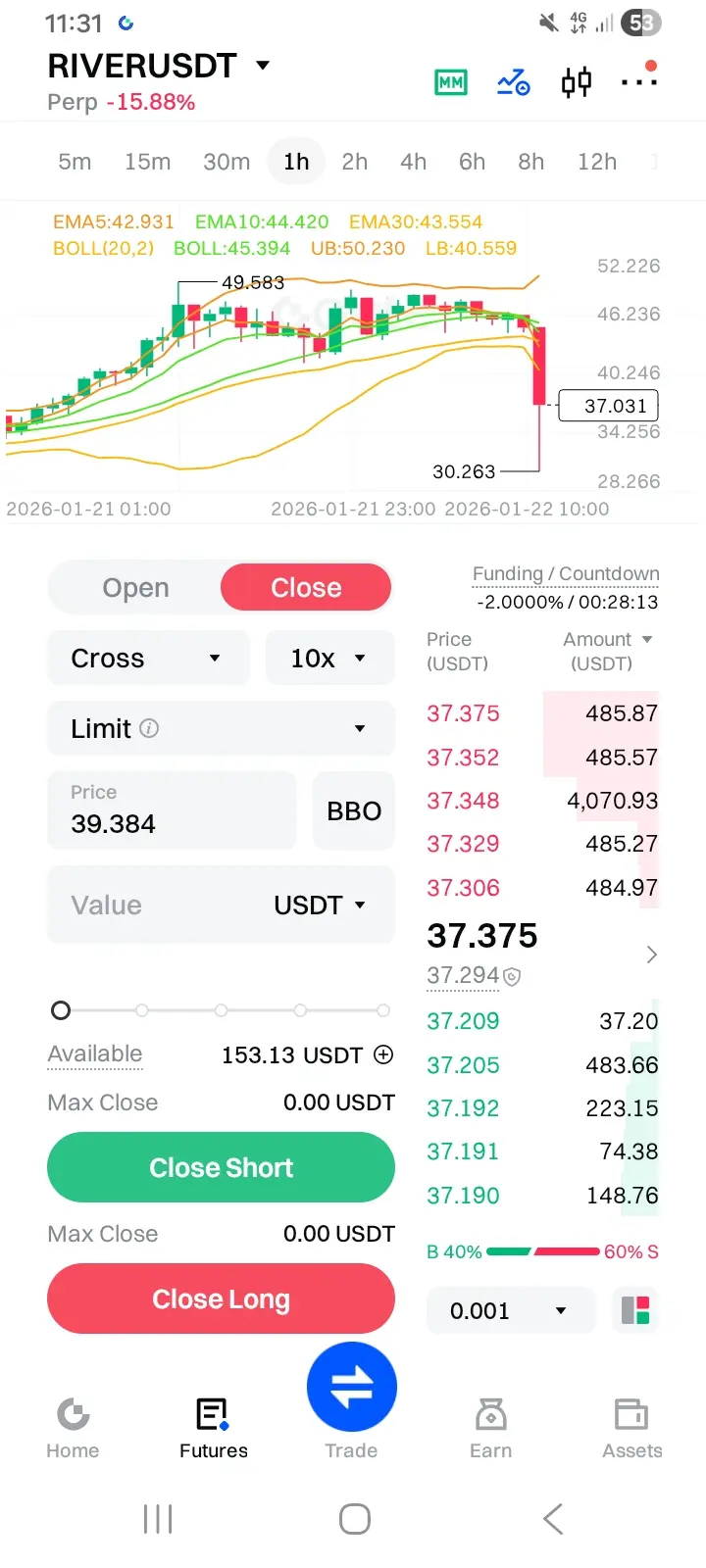

Buy To Earn 💎#RIVER pump and dump. thank you market makers! I have been following and documenting this all the way up and down. Probably worth short selling on pullbacks...

- Reward

- like

- Comment

- Repost

- Share

View Original

- Reward

- like

- Comment

- Repost

- Share

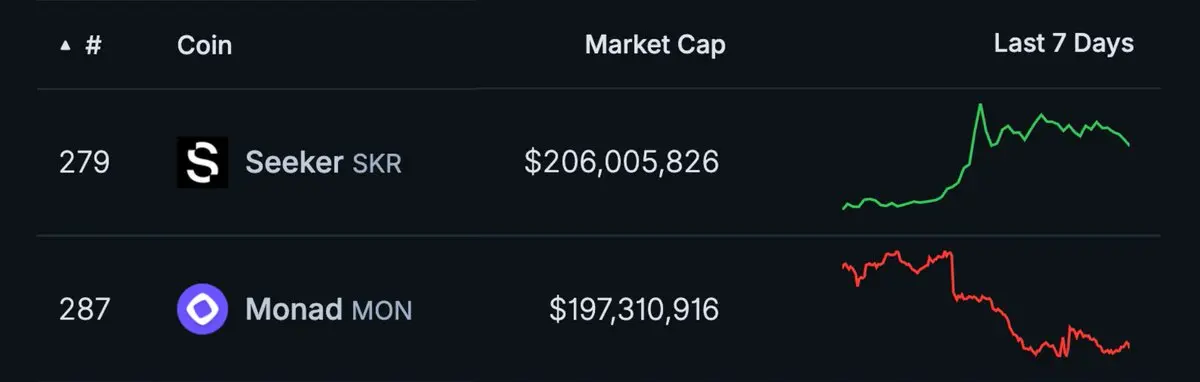

#PrivacyCoinsDiverge

This Is a Structural Shift, Not a Temporary Trade

When I look at the crypto market in early 2026, one thing stands out clearly:

while Bitcoin and Ethereum are struggling under regulatory pressure and macro uncertainty, privacy-focused assets are quietly holding their ground — and in many cases, outperforming.

This doesn’t look like a random altcoin pump.

It looks like a market response to the world outside crypto.

Privacy coins are no longer “legacy leftovers” from an older era.

They are becoming tools for a new environment — one defined by surveillance, compliance, and c

This Is a Structural Shift, Not a Temporary Trade

When I look at the crypto market in early 2026, one thing stands out clearly:

while Bitcoin and Ethereum are struggling under regulatory pressure and macro uncertainty, privacy-focused assets are quietly holding their ground — and in many cases, outperforming.

This doesn’t look like a random altcoin pump.

It looks like a market response to the world outside crypto.

Privacy coins are no longer “legacy leftovers” from an older era.

They are becoming tools for a new environment — one defined by surveillance, compliance, and c

- Reward

- 6

- 8

- Repost

- Share

GateUser-e640aaac :

:

HODL Tight 💪View More

MARKET IS SOON SHOW BIG PUMP AND AS IT WE LEARNED FROM PAST THAT MARKET SOON TOUCHED ITS NEW ALL TIME AGAIN SO WHAT YOU GUYS WAITING

- Reward

- like

- Comment

- Repost

- Share

Turkish Banking Giant Garanti BBVA Extends Partnership with Ripple, Aims for Enhanced Cross - - #cryptocurrency #bitcoin #altcoins

BTC-0,98%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- 4

- Repost

- Share

IfYouDon'tHaveMoney,GoLongOn :

:

It's the same, I'm still at the top empty, the funding rate is messing with me.View More

[Market Prediction]🔹 Warning: If Bitcoin loses $88,000, it could trigger $638 million in cascading long liquidations

- Reward

- 1

- 1

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊For many people, home ownership remains a distant goal—often perceived as something reserved for a select few.

The reason is structural.

Once the decision to purchase a home is made, individuals are confronted with systemic barriers:

→ High upfront capital requirements

→ Lengthy and restrictive approval processes

→ Long-term mortgage obligations

→ And total ownership costs that significantly exceed initial valuations

Combined with infrastructure limitations, inflexible rental systems, and limited access to fair financing, these challenges discourage participation and reinforce exclusion from o

The reason is structural.

Once the decision to purchase a home is made, individuals are confronted with systemic barriers:

→ High upfront capital requirements

→ Lengthy and restrictive approval processes

→ Long-term mortgage obligations

→ And total ownership costs that significantly exceed initial valuations

Combined with infrastructure limitations, inflexible rental systems, and limited access to fair financing, these challenges discourage participation and reinforce exclusion from o

- Reward

- like

- Comment

- Repost

- Share

MYJB

蚂蚁金币

Created By@MunanYiBufan

Listing Progress

100.00%

MC:

$8.6K

Create My Token

#GateTradFi1gGoldGiveaway

📢📢📢📢📢📢📢Did you hear? 📢📢📢📢📢 Gate TradFi is giving away gold every 10 minutes. Trade on TradFi and get a chance to win gold every 10 minutes; you have a chance to win 1,152 grams of gold daily.

📢📢📢📢📢📢📢Did you hear? 📢📢📢📢📢 Gate TradFi is giving away gold every 10 minutes. Trade on TradFi and get a chance to win gold every 10 minutes; you have a chance to win 1,152 grams of gold daily.

- Reward

- 9

- 8

- Repost

- Share

AngelEye :

:

Happy New Year! 🤑View More

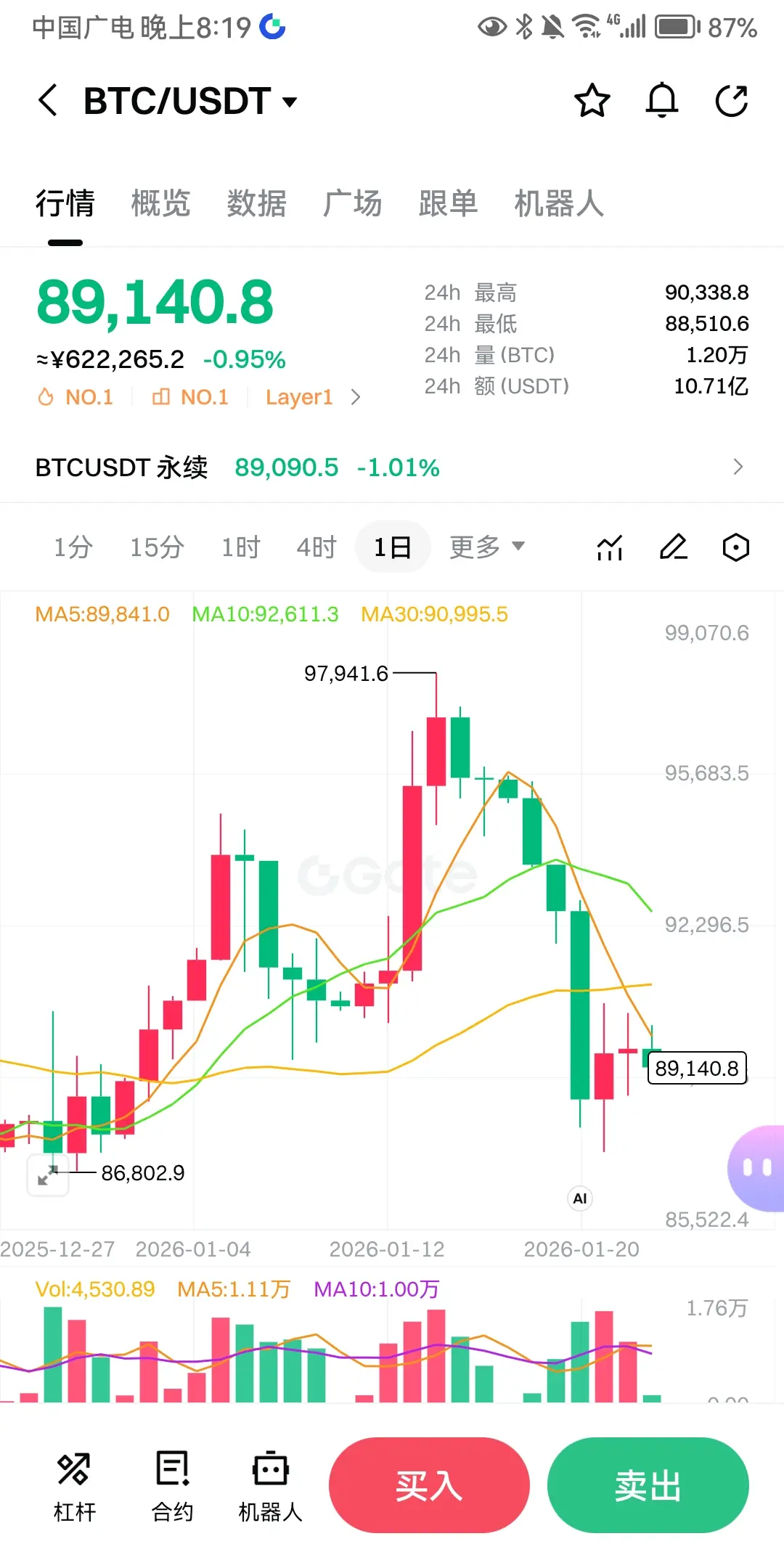

Here is the core market analysis and causes of BTC on January 22, 2026 (yesterday), with data sourced from public market statistics:

Core Price and Volatility

- Opened at $89,455, high of $90,360, low of $87,209, close at $89,560, with slight intra-day fluctuations, a deep dip at one point, and ultimately nearly flat, with the $90,000 level repeatedly contested.

- During the day, it briefly fell below $88k, reaching a recent low, then quickly rebounded amid macro easing news (cancellation of EU tariff threats), showing a V-shaped recovery but failing to break through the $91k resistance zone.

Core Price and Volatility

- Opened at $89,455, high of $90,360, low of $87,209, close at $89,560, with slight intra-day fluctuations, a deep dip at one point, and ultimately nearly flat, with the $90,000 level repeatedly contested.

- During the day, it briefly fell below $88k, reaching a recent low, then quickly rebounded amid macro easing news (cancellation of EU tariff threats), showing a V-shaped recovery but failing to break through the $91k resistance zone.

BTC-0,98%

- Reward

- like

- Comment

- Repost

- Share

🔹 Warning: If Bitcoin loses $88,000, it could trigger $638 million in cascading long liquidations

- Reward

- like

- Comment

- Repost

- Share

Once the rebound comes back, I will withdraw funds to buy a Ferrari, and I will never trade cryptocurrencies again😭

View Original

- Reward

- like

- Comment

- Repost

- Share

#TrumpWithdrawsEUTariffThreats

As of January 22, 2026, global markets are reacting to a notable shift in trade rhetoric as former U.S. President Donald Trump has stepped back from previously signaled tariff threats against the European Union, easing fears of an imminent transatlantic trade confrontation. The move has been interpreted by investors and policymakers as a de-escalation signal at a time when global markets are already navigating heightened volatility, slowing growth expectations, and sensitive geopolitical dynamics. Trade tensions between the U.S. and EU have historically carried

As of January 22, 2026, global markets are reacting to a notable shift in trade rhetoric as former U.S. President Donald Trump has stepped back from previously signaled tariff threats against the European Union, easing fears of an imminent transatlantic trade confrontation. The move has been interpreted by investors and policymakers as a de-escalation signal at a time when global markets are already navigating heightened volatility, slowing growth expectations, and sensitive geopolitical dynamics. Trade tensions between the U.S. and EU have historically carried

- Reward

- 2

- 2

- Repost

- Share

CryptoVortex :

:

Buy To Earn 💎View More

Bank of Japan intervenes in the exchange rate

Gold and silver then experience a pullback

So, from the price reaction, it can actually be seen

Carry trade funds are the main bullish force for gold and silver

View OriginalGold and silver then experience a pullback

So, from the price reaction, it can actually be seen

Carry trade funds are the main bullish force for gold and silver

- Reward

- like

- Comment

- Repost

- Share

🚀 #Chainlink Takes Over #أطلس to Protect DeFi Users

Chainlink has taken over Atlas to stop unfair trading practices in DeFi and to help protocols like Aave and Compound retain more of their funds.

The system has already processed transactions worth $460 million and has returned over $10 million to users.

#Link

$LINK

Chainlink has taken over Atlas to stop unfair trading practices in DeFi and to help protocols like Aave and Compound retain more of their funds.

The system has already processed transactions worth $460 million and has returned over $10 million to users.

#Link

$LINK

LINK-1,11%

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More25.06K Popularity

7.64K Popularity

3.62K Popularity

1.93K Popularity

2.85K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$3.38KHolders:10.00%

- MC:$0.1Holders:10.00%

- MC:$3.39KHolders:10.00%

- MC:$3.38KHolders:10.00%

News

View MoreAnalyst: The key support level for Bitcoin is at $87,400

4 m

Data: 1340.06 PAXG transferred from an anonymous address, worth approximately $6.62 million

6 m

11 Wall Street analysts predict that Strategy's stock target price could exceed $440 within the year

7 m

A certain whale bought 566.8 XAUT from CEX in the past 2 days, worth nearly $2.8 million.

12 m

OpenEden, FalconX, and Monarq jointly launch the tokenized yield investment portfolio PRISM

21 m

Pin