Trade

Trading Type

Spot

Trade crypto freely

Alpha

Points

Get promising tokens in streamlined on-chain trading

Pre-Market

Trade new tokens before they are officially listed

Margin

Magnify your profit with leverage

Convert & Block Trading

0 Fees

Trade any size with no fees and no slippage

Leveraged Tokens

Get exposure to leveraged positions simply

Futures

Futures

Hundreds of contracts settled in USDT or BTC

Options

HOT

Trade European-style vanilla options

Unified Account

Maximize your capital efficiency

Demo Trading

Futures Kickoff

Get prepared for your futures trading

Futures Events

Participate in events to win generous rewards

Demo Trading

Use virtual funds to experience risk-free trading

Earn

Launch

CandyDrop

Collect candies to earn airdrops

Launchpool

Quick staking, earn potential new tokens

HODLer Airdrop

Hold GT and get massive airdrops for free

Launchpad

Be early to the next big token project

Alpha Points

NEW

Trade on-chain assets and enjoy airdrop rewards!

Futures Points

NEW

Earn futures points and claim airdrop rewards

Investment

Simple Earn

Earn interests with idle tokens

Auto-Invest

Auto-invest on a regular basis

Dual Investment

Buy low and sell high to take profits from price fluctuations

Soft Staking

Earn rewards with flexible staking

Crypto Loan

0 Fees

Pledge one crypto to borrow another

Lending Center

One-Stop Lending Hub

VIP Wealth Hub

Customized wealth management empowers your assets growth

Private Wealth Management

Customized asset management to grow your digital assets

Quant Fund

Top asset management team helps you profit without hassle

Staking

Stake cryptos to earn in PoS products

BTC Staking

HOT

Stake BTC and earn 10% APR

GUSD Minting

Use USDT/USDC to mint GUSD for treasury-level yields

More

Promotions

Activity Center

Join activities and win big cash prizes and exclusive merch

Referral

20 USDT

Earn 40% commission or up to 500 USDT rewards

Announcements

Announcements of new listings, activities, upgrades, etc

Gate Blog

Crypto industry articles

VIP Services

Huge fee discounts

Proof of Reserves

Gate promises 100% proof of reserves

- Trending TopicsView More

256.23K Popularity

49.21K Popularity

5.6K Popularity

7.39K Popularity

7.31K Popularity

- Hot Gate FunView More

- MC:$3.65KHolders:30.05%

- MC:$3.79KHolders:40.67%

- MC:$3.6KHolders:10.00%

- MC:$3.61KHolders:10.00%

- MC:$3.67KHolders:20.04%

- Pin

November 25 | BTC trend analysis

Core Insights

Current Price: $87,800 (as of November 25, 10:24 AM Beijing Time)

Short-term Outlook: Cautiously optimistic, there are rebound opportunities in the short term. The daily chart shows severe overselling (RSI 32), but the 4-hour chart is beginning to show positive signals. On-chain data indicates that short-term holders are capitulating, which typically marks the formation of a cyclical bottom. Social media sentiment has shifted from panic to cautious optimism, and institutional fund outflows have slowed, laying the groundwork for a potential rebound.

Key Support:

Key Resistance:

Technical Pattern Analysis

Multiple Time Frame Signals

BTC is currently at a critical turning point, with significant divergence in signals across multiple time frames. The 1-hour chart shows a neutral stance, with an RSI of 52, and the price fluctuating between the EMA moving averages. The 4-hour chart presents a mild bullish signal, with the MACD histogram turning positive and the price approaching the upper Bollinger Band. However, the daily chart remains weak, with the RSI deeply oversold at 32, and the MACD continuing to weaken.

Key price level breakthrough conditions

The technical analysis shows that a breakthrough of $88,800 will confirm a short-term rebound, targeting $89,500. If it falls below $87,000, it may accelerate the decline towards the strong support area near $85,000.

On-chain Data Pivot

capital flow characteristics

In the past 24 hours, on-chain activity for BTC shows positive signals. A net outflow of 1,889 BTC from exchanges indicates that investors are moving Bitcoin to cold wallets for long-term holding. The exchange reserves have decreased from 2.41 million BTC to 1.84 million BTC in 30 days, a drop of 24%, which creates potential support for the price due to this supply tightening.

Holder Behavior Analysis

Short-term holders are going through a capitulation process, with over 63,000 BTC transferred from long-term holders to new buyers. This pattern has historically appeared at cyclical bottoms. At the same time, large transactions (over $1 million) reached 29,000 this week, possibly marking the most active whale trading week of 2025, indicating that big capital is repositioning.

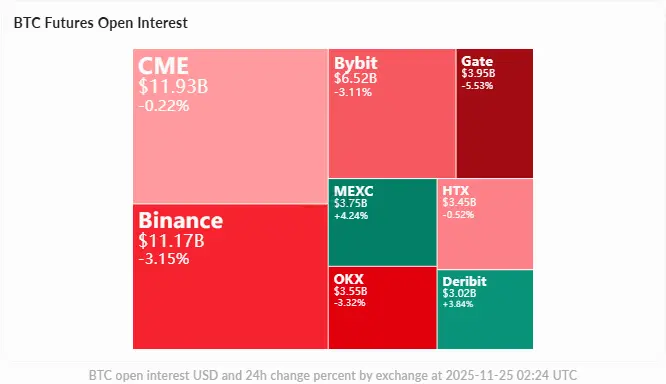

Derivatives Market Status

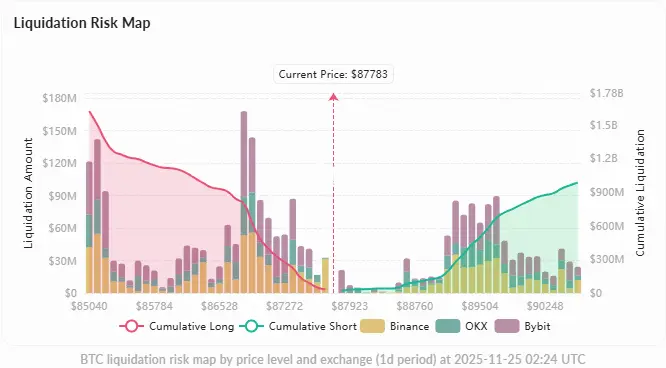

Position and Liquidation Risk

The total open interest is $59.7 billion, down 1.12% in the last 24 hours, indicating that leverage is decreasing. The funding rates have turned negative (Binance -0.0034%, Bybit -0.0047%), with shorts paying longs, providing support for price stability or an increase.

The liquidation risk chart shows an asymmetric distribution: around $85,040, there is a concentration of $1.6 billion in long liquidations, while above $90,620, there is only $983 million in short liquidations, suggesting a greater risk of a downward breakout. However, if the key support is maintained, the upward resistance is relatively small.

Impact of the Macroeconomic Environment

Recently, the BTC trend has been significantly influenced by macro factors, with a net outflow of $3.5 billion in ETFs in November, setting a historical record. However, this process of institutional deleveraging may be nearing its end, and market panic has reached its lowest level in nearly two years, often indicating a reversal opportunity.

The Federal Reserve's interest rate cut expectations (67% probability in December) and the upcoming economic data (retail sales, PPI) will provide important catalysts for short-term trends.

Overall Assessment

Considering the overall technical analysis, on-chain data, and market sentiment, BTC is currently in a key support zone and has conditions for a short-term rebound. The oversold state on the daily chart, combined with the continuous outflow of funds from exchanges, provides a basis for a fluctuating rebound in the $87,000-$89,000 range. Investors should closely monitor the effectiveness of the $87,000 support, and a breakout above $88,800 will confirm the short-term rebound trend.