Trade

Trading Type

Spot

Trade crypto freely

Alpha

Points

Get promising tokens in streamlined on-chain trading

Pre-Market

Trade new tokens before they are officially listed

Margin

Magnify your profit with leverage

Convert & Block Trading

0 Fees

Trade any size with no fees and no slippage

Leveraged Tokens

Get exposure to leveraged positions simply

Futures

Futures

Hundreds of contracts settled in USDT or BTC

Options

HOT

Trade European-style vanilla options

Unified Account

Maximize your capital efficiency

Demo Trading

Futures Kickoff

Get prepared for your futures trading

Futures Events

Participate in events to win generous rewards

Demo Trading

Use virtual funds to experience risk-free trading

Earn

Launch

CandyDrop

Collect candies to earn airdrops

Launchpool

Quick staking, earn potential new tokens

HODLer Airdrop

Hold GT and get massive airdrops for free

Launchpad

Be early to the next big token project

Alpha Points

NEW

Trade on-chain assets and enjoy airdrop rewards!

Futures Points

NEW

Earn futures points and claim airdrop rewards

Investment

Simple Earn

Earn interests with idle tokens

Auto-Invest

Auto-invest on a regular basis

Dual Investment

Buy low and sell high to take profits from price fluctuations

Soft Staking

Earn rewards with flexible staking

Crypto Loan

0 Fees

Pledge one crypto to borrow another

Lending Center

One-Stop Lending Hub

VIP Wealth Hub

Customized wealth management empowers your assets growth

Private Wealth Management

Customized asset management to grow your digital assets

Quant Fund

Top asset management team helps you profit without hassle

Staking

Stake cryptos to earn in PoS products

BTC Staking

HOT

Stake BTC and earn 10% APR

GUSD Minting

Use USDT/USDC to mint GUSD for treasury-level yields

More

Promotions

Activity Center

Join activities and win big cash prizes and exclusive merch

Referral

20 USDT

Earn 40% commission or up to 500 USDT rewards

Announcements

Announcements of new listings, activities, upgrades, etc

Gate Blog

Crypto industry articles

VIP Services

Huge fee discounts

Proof of Reserves

Gate promises 100% proof of reserves

- Trending TopicsView More

250.38K Popularity

42.04K Popularity

3.73K Popularity

6.61K Popularity

6.21K Popularity

- Hot Gate FunView More

- MC:$3.71KHolders:20.00%

- MC:$3.86KHolders:21.01%

- MC:$4.07KHolders:22.86%

- MC:$3.66KHolders:10.00%

- MC:$3.65KHolders:10.00%

- Pin

November 20 | BTC Trend Analysis

Core Insights

Current Price: $91,804 ( as of November 20, 09:10 Beijing Time )

Short-term Outlook: Neutral to cautiously optimistic

Key Support:

Key Resistance:

Technical Analysis

multi-timeframe evaluation

The short-term technical analysis shows that the MACD histogram on the 1-hour and 4-hour levels has turned positive, indicating a weakening of bearish momentum. The daily chart is severely oversold, creating conditions for a rebound, but the price remains below all major moving averages.

Derivatives Data

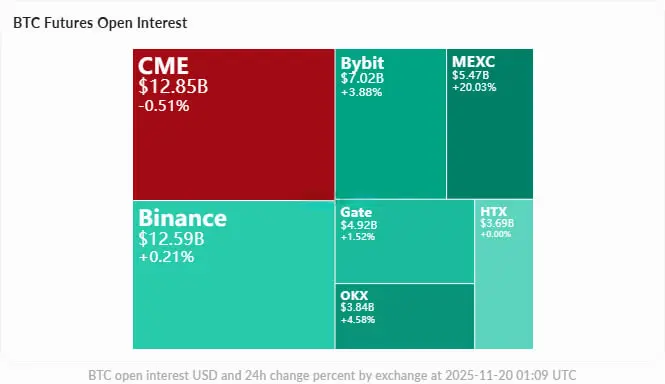

The total market open interest is $6.711 billion, with a 24-hour increase of 2.52%. The funding rate remains slightly positive at ( Binance 0.0034%, Bybit/OKX 0.01%), indicating a relatively balanced long and short position, with no extreme sentiment.

On-chain Analysis

Exchange liquidity

The continued net outflow indicates that long-term holders are accumulating, reducing the selling pressure on exchanges. The exchange's BTC reserves have fallen to 2.37 million coins, a multi-month low.

Whale Movement

This week, whale trading activity reached a new high in 2025, with over 102,900 large transactions exceeding 100,000 USD. Key findings:

Market Sentiment

( social media sentiment

The sentiment in the Twitter/X community is relatively cautious, with major viewpoints diverging:

) ETF trends impact

Severe outflow for Bitcoin spot ETF in the US:

Risk Assessment

Upside Catalyst:

Downside Risk:

Trading Strategy Reference

Rebound Trading: Current position long, target $96,384, stop loss $88,870, risk-reward ratio 1.22 Risk Control: If it falls below the strong support of $88,870, be wary of further declines to the $83,000-$84,000 range.

Probability Assessment: Short-term rebound probability 60%, further decline probability 30%, sideways consolidation 10%

Summary

BTC is currently in a key support area, with technical oversold conditions combined with on-chain accumulation signals creating conditions for a rebound. Whether it can stabilize above $92,400 and launch an attack towards $96,400 in the short term will largely depend on changes in macro sentiment and ETF fund flows. It is recommended to pay attention to U.S. employment data and speeches from Federal Reserve officials as important references for judging the next direction.